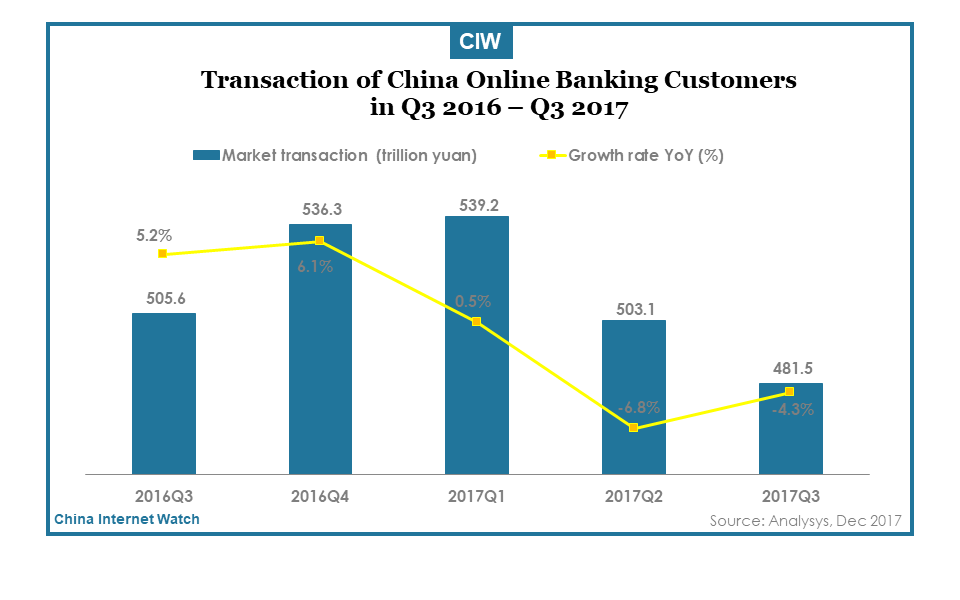

According to recently published report by Analysys, “China Online Banking Quarterly Forecast Report for 2017 Q3”, the total online banking transactions amounted to 48.15 billion, reflecting a 4.3% decrease when compared to the same quarter previous year.

The decrease includes a decline in personal online banking. Corporate banking activities have been comparatively active, with corporates doing bank transfers, salary disbursements, tax payments and other transactions, thus leading to a steady growth within the corporate online banking sector.

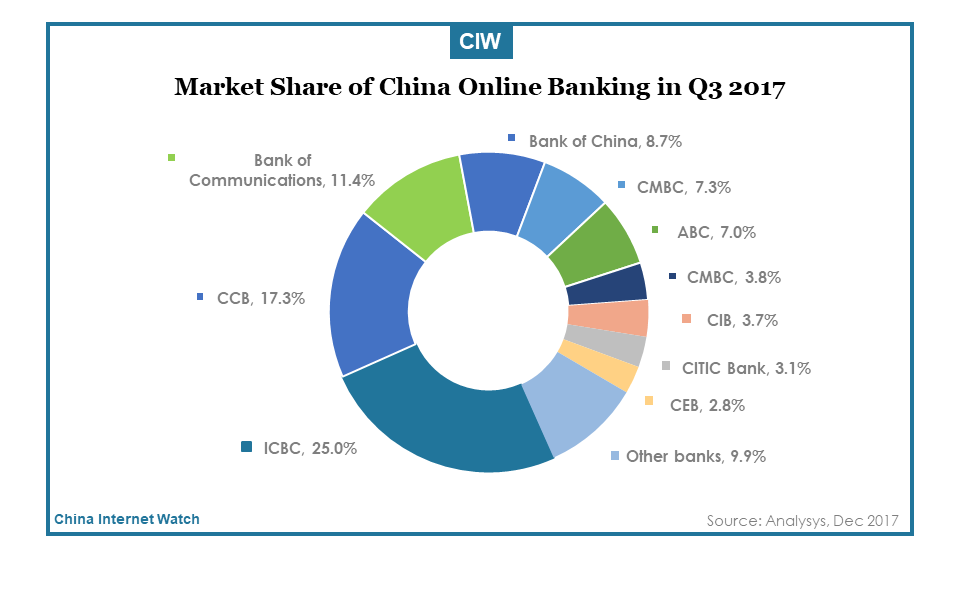

For Q3 of 2017, ICBC, China Construction Bank, Bank of Communications and Bank of China are the respective top 4 performing banks in the market, occupying a total of 62.4% of the market share. CMBC ranks 5th placing with 7.3% of market share.

From the perspective of product innovation, SPD Bank has especially come up with an online cloud system, an integrated platform called “e企行” to resolve the pain points faced by small and medium-sized businesses during its growth phase. The online platform provides access via both PC and mobile apps, providing a low-cost, efficient and smart user experience for businesses.

On the other hand, CGB has released a new generation of verification tool for internet banking – Bluetooth Key token which can be accessed via USB on PC and also connect to mobile phones via Bluetooth. The initiative by CGB satisfies the needs of the customers for a safe yet fuss-free way for verification.

Whereas from the angle of marketing activities, the focus of marketing activities is to boost activities, hence the marketing campaign will be attractive as long as customers qualify for lucky draws or other benefits when they perform a specific online banking transaction.