Chinese urban consumers’ spending in fast moving consumer goods (FMCG) in the third quarter of 2017 grew by 3.6% from a year ago, indicating a clear recovery.

Kantar Worldpanel reports the Chinese urban consumers’ spending in fast moving consumer goods (FMCG) in Q3 2017 grew by 3.6% on 12-month basis, indicating a clear recovery for the industry.

Offline channel grew by 2.2%, which is slower than the total trade. However, modern trade (including hypermarkets, supermarkets, and convenience stores) did report higher growth at 2.9%, suggesting consumers are returning to brick and mortar stores as they create better shopping experiences through technology innovation.

Four key cities (Beijing, Shanghai, Guangzhou, and Chengdu) and provincial capitals grew slightly faster, up 3.7%. Across all regions, the West and South markets reported a more upbeat trend, up by 6.0% and 4.2% respectively.

Sales rebound in offline

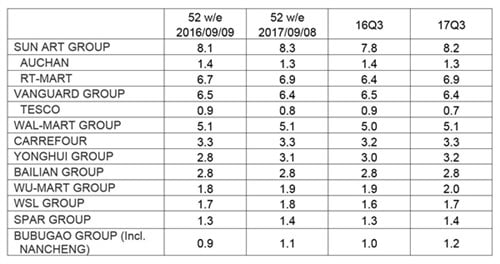

Leading Grocery Share of Modern Trade – National Urban China (%)

Local retailers continued to outgrow their global counterparts during Q3. The Sun Art group lifted its share by 0.4 percentage point over the same period last year, driven by successfully growing the size of shopper’s baskets. Yonghui and BuBuGao kept growing by opening more new stores. Within the first half of 2017, Yonghui opened 64 stores and BuBuGao opened 22 stores. It largely helps to strengthen their position, and both of them gained 0.2 percentage point share during this quarter.

Amongst international retailers, Walmart and Carrefour started to see meaningful share recovery. Although they are still closing non-performing stores, they are proactively reformatting their existing stores to be more competitive and appealing to shoppers.

They are introducing new stores which are 30% to 50% smaller than the old ones to make their merchandises more accessible while reducing the sales area for durable goods. In June, Carrefour opened its first Easy Carrefour store in Wuxi and this is the first time the retailer introduced the smaller format store outside its home base in Shanghai. More recently it launched its own digital wallet “Carrefour Pay” together with Union Pay to facilitate more mobile payments in store.

Apart from that, in order to seek growth in the new retail era, most of the top 10 retailers adopted a more aggressive O2O (Offline and Online) strategy, by providing an integrated shopping experience with multi-channel offers.

For example, Yonghui works with JD.com’s platform to deliver its fresh produce and essential grocery items to consumers within one hour. They also introduced their own APP Yonghui Life in selected cities to expose to consumers directly.

More Chinese E-commerce players moving offline

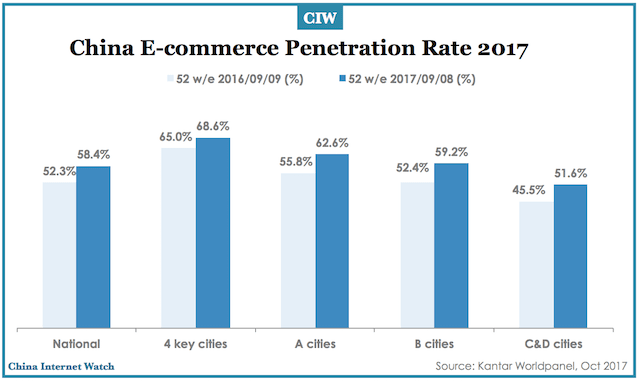

Kantar Worldpanel reported a robust 24.3% growth in FMCG spend through E-commerce channel in this quarter. Now e-commerce accounts for 7.4% of FMCG spend in the latest 52 weeks ending September 8, which is 1.7 points higher than the same period last year.

China’s Online Retail Trends of Devices Sales in Q3 2017

This article was originally published on Kantar.com.