For the first time in history, digital ad spends surpassed TV in 2016 and accounted for half of total media budget according to “This Year, Next Year: China Media Forecasts” by GroupM. It also forecasted that the digital spend would be increased to 57.2% of the total ad spend in China in 2017, and TV commercials dropped by 5.2%.

As the penetration of smartphone keeps going up, Kantar Worldpanel believes that mobile as a medium will become the first choice to catch the consumers’ eyeballs very soon. CTR Advertiser Survey in 2017 also indicated that the mobile budget allocation increased dramatically from 7% in 2015 to 23% in 2017 thus narrowing the gap with TV rapidly.

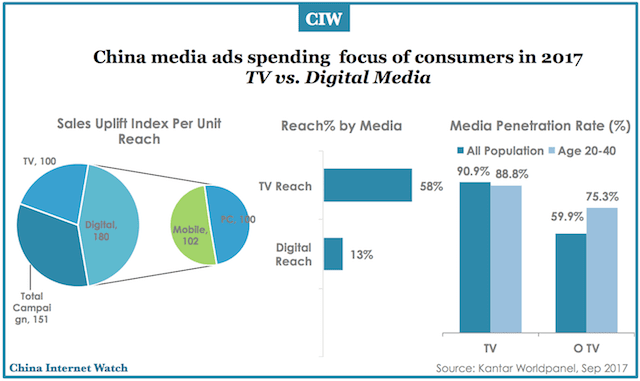

If the advertisers did not invest in digital media, they would miss a full 13% of the consumers based on the case studies of Kantar Worldpanel from 2015 to 2017. But if they dropped TV altogether, they would have missed as much as 58% of the consumers.

Even for the brands targeting young consumers, halo effect can still be strong resulting from the multi-media investment. The advertisers can reach 75.3% of the young target audience (aged 20-40) by using pre-roll of online video, but they can cover 88.8% of the same target by using traditional TV, 13.5% higher than online video.

The starting point is connecting the consumers’ ad exposure across media with their total channel purchase behavior, then evaluate and quantify the sales impact from media investment, so that the advertisers can optimize the media mix based on the quality of sales conversion.

For example, if an advertiser has invested 10 million yuan for a campaign, Kantar Worldpanel can effectively quantify the brand sales benefited solely from its investment on top of baseline sales. After quantifying the brand sales uplift, Kantar Worldpanel can further differentiate the return on investment by different media type including TV and digital. Kantar Worldpanel then can conclude how the advertiser should optimize the media budget allocation according to different media efficiency level in driving sales. Furthermore, with the in-depth understanding of those consumers, we can bring consumer insights into the brand sales uplift analysis to understand which consumer groups were influenced more by the campaign.

The next questions can be what the optimal times of exposure for driving sales, whether program sponsorship works, what role social media should play, and so on. Please contact us for the answers.

The article was originally published on Kantar.com.