Online banking in China has suffered badly at the hands of online and mobile payment providers over the past few years. In the second quarter of this year, transaction volumes fell for the first time ever.

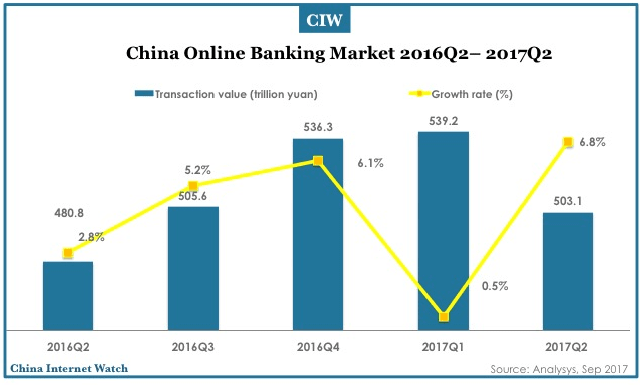

After several quarters of lackluster growth, the total value of online banking transactions in China dropped by 6.8% in Q2 2017 to 503.1 trillion yuan (US$76.34 trillion).

Despite banks’ introduction of new services to their online platforms, they have proven unable to compete with the flexibility and utility of online and mobile payment services and have steadily lost market share. One bright spot for banks has been business services, which have grown steadily despite the intrusion of third-party payment providers.

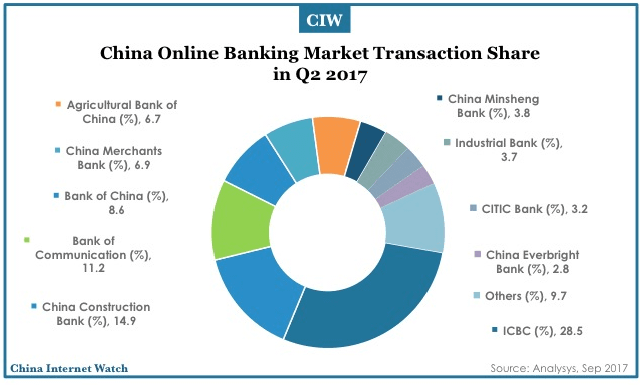

Within this market, ICBC remains the market leader, accounting for 28.5% of all transactions by value, followed by CCB at 14.9% and Bank of Communications at 11.2%. ICBC is a leader in business services and has innovated in the retail banking sector with the introduction of an AI customer service interface to maintain its lead even as the market as a whole suffers.