While China’s more affluent consumers increasingly favor independent travel, the online holiday and group tour booking market is still showing rapid growth, likely driven by continued expansion of the middle class in China.

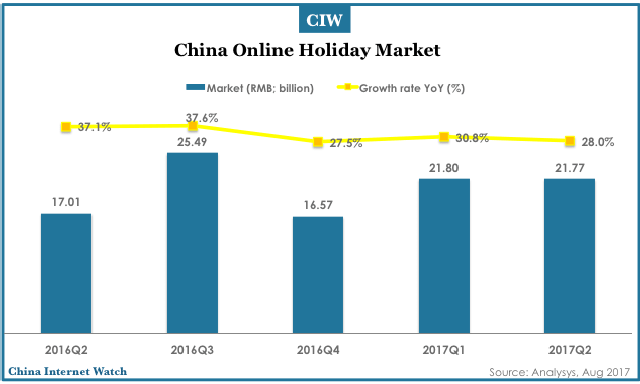

In the second quarter of 2017, China’s online holiday booking market grew to 21.77 billion yuan (US$3.26 billion), equating to year-on-year growth of 28%.

While this figure is slightly lower than that for Q1 2017, this is common as the second quarter in China lacks any long public holidays and opportunities for travel are more limited; traditionally, the first and third quarters are peak season for group tour bookings.

During 2017, the National Tourism Administration has taken measures to combat group tours with unrealistically low prices, believing that these are likely to be low-quality and rely on forcing tourists to engage in activities and shopping for added fees in order to recoup costs.

This policy has come as part of a comprehensive effort to revamp and improve the quality of group tours in China and make high-quality travel more accessible to the burgeoning middle-class, as well as to restrain monopolistic practices and anti-competitive pricing.

Travel e-commerce platforms including Tuniu and Ctrip have responded with their own efforts to increase quality and standardize customer experiences. Ctrip released a new “diamond standard” rating system and released a new high-end line of tours.

Lvmama’s “Happy Donkeyback Travel” line also received an upgrade, wherein the platform began enforcing a “no forced shopping, no hidden costs” program and worked to make sure tour operators weren’t receiving kickbacks and commissions from local sites and retailers.

In addition, market trends towards independent travel are forcing tour providers to move in the direction of greater personalization and more authentic experiences for tourists. Themed tours are becoming more common, including food and minority culture tours.

Capital is continuing to flood the market, with startup “Travel Book” completing A round financing for more than 10 million yuan (US$1.5 million). Travel Book is a building a travel planner and tour guide platform which will help travelers put together optimized itineraries and daily plans for travel on tours and independent trips.

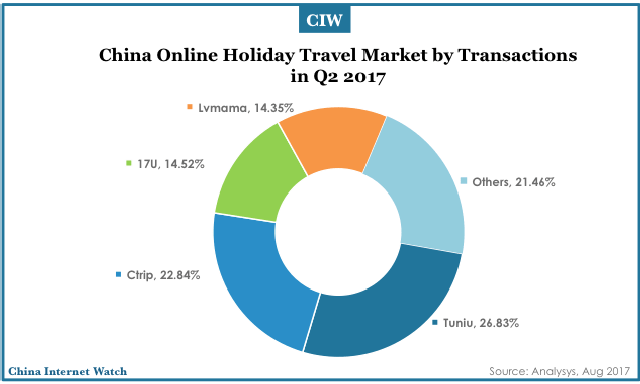

Regarding market share in the second quarter, Tuniu (with 26.83%) and Ctrip (with 22.84%) remain the top two players in the market, sharing half of the market between them. Tuniu has been able to strengthen its supply chain and improve member services, and has earned customer approbation with its strong customer service and professional tour guides.

It’s innovative review system allows customers to compare hotels, sites, and experiences from inside and outside packaged tours to better choose tour packages for themselves. Ctrip is leveraging its acquisition of Qunar to build a better e-commerce platform for tours, and totaled 4.92 billion yuan (US$ 737.6 million) in tour revenue in Q2.

Below the top two, LY.com and Lvmama maintained market shares of 14.52% and 14.35%, respectively. They, too, worked to improve quality and standardization, with Lvmama in particular trying to build a set of personalized and highly diverse tour packages for its customers.

Analysys analysts believe that online holiday market will continue to expand and customer habits continue to develop, as resort packages are being accepted by a wider range of markets.

Given the demand for personalization, enterprises are working to optimize operational efficiency, and continuously drive product and service segmentation and personalized upgrades. Enterprises are moving from business development towards a deeper cultivation of their customer bases, pointing towards a healthy trend of development within the overall market.