During 2016, the online tourism market in China maintained steady growth over the year prior, growing much more quickly than GDP growth while increasing its overall penetration into the tourism industry as a whole.

Overall, online booking of hotels and plane tickets maintained leading positions within online tourism sales, and individual travel bookings dominated the industry (as opposed to group tours). The trend towards individual, independent travel is beginning to dramatically affect the market, mostly in ways which are beneficial to the online travel booking industry.

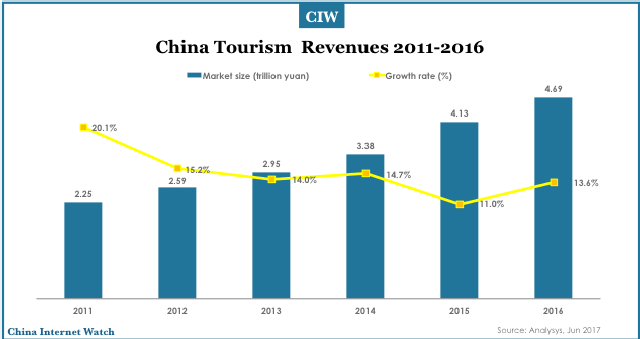

Tourism industry revenue trends

The tourism industry in China has maintained a growth rate far above GDP growth for several years, growing at over 10% year-on-year every year for the past five years. In 2016, the total market reached 4.69 trillion yuan (US$ 703 billion), having grown by 13.6% from 2015.

This growth rate is also slightly higher than 2015, when growth over 2014 was 11.0%. Tourism accounted for 6.3% of China’s GDP in 2016, also a slight increase over 2015 (6.0%).

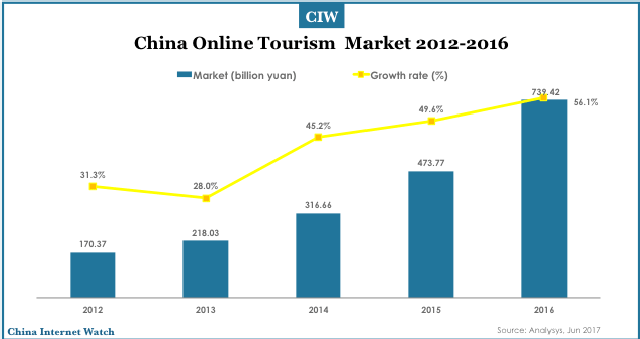

Meanwhile, the online tourism market is growing much more rapidly than the tourism market overall; in 2016, online tourism revenue reached 739.42 billion yuan (US$110.85 billion), representing 56.1% growth over 2015. As a result, online tourism has increased its market share from 11.5% of the market in 2015 to 15.8% in 2016 (up from 6.6% in 2012).

Online tourism market overview

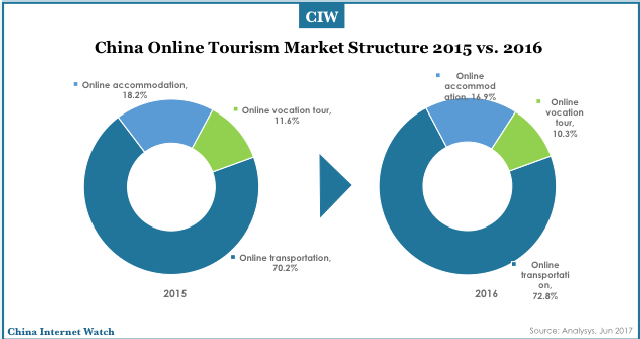

From 2015 to 2016, there were minor changes in the structure of the online tourism market in China. In 2016, as before, online booking of transportation (plane, high-speed rail, conventional rail) dominated the market, with total revenue of 538.5 billion yuan (US$80.7 billion), followed by accommodation booking with 125.1 billion yuan (US$18.8 billion).

Group tours and tour packages made up the remainder; market share shifted in favor of transportation, which rose from 70.2% to 72.8% of the market, taking equally from accommodation and tours, which both slid from 2015 by about 1.3%.

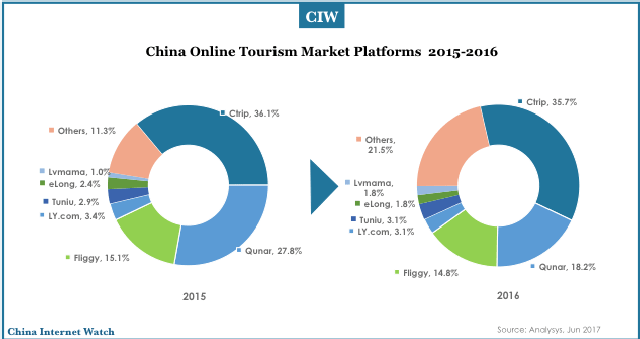

Within the online tourism market, there were three major players and a host of minor ones. The major players, Ctrip, Qunar, and Fliggy, collectively dominated the market in 2016, with 68.7% of market share. Ctrip maintained a commanding lead, holding 35.7% of the market (263.6 billion yuan or US$39.5 billion), a slight decline over the year prior in terms of market share.

Qunar, however, slid dramatically after being bought out by Ctrip; in 2015 it accounted for 27.8% of the online tourism market, but dropped to only 18.2% in 2016. Minor players stepped into the gap in a big way, moving on the backs of a market shift in favor of O2O and featuring several new players which combine tourism sales with Tripadvisor-like crowd-sourced advice and reviews.

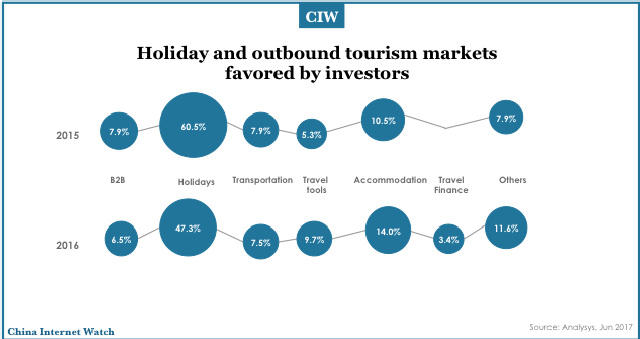

Online tourism investment overview

When it comes to investors, holiday and accommodation booking are still the two sectors which attract the most attention and capital. With Chinese tourism spending continuing to rise and holiday booking markets still in their infancy, there is significant room for online providers to make an impact and earn a return on investment in this sector.

Within the holiday booking industry, international travel continues to be a growth market and a driving force. While overall investment share declined significantly from 2015, holiday booking is still an under-served market and will continue to attract attention and financing going forward.

In addition, investment into travel finance is noteworthy; a new and much-watched market, with investment only appearing in 2016, it is driven by Chinese consumers’ increasing willingness to amortize major expenses beyond a home.

Online tourism markets: Sector breakdowns and analysis

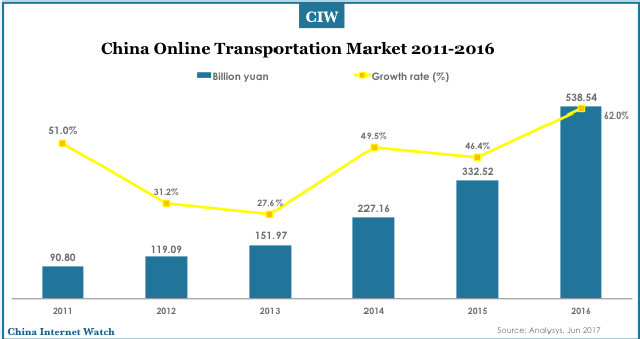

Online transportation market

Of all sectors, transportation booking has the highest online market penetration rate, with online booking accounting for 54.6% of sector revenue. As consumers in China come to prefer independent travel over group tours, online booking has become the preferred way of buying train or plane tickets because of its convenience and economy. In 2016, the online transportation market grew by 62.0% to reach 538.5 billion yuan (US$80.7 billion).

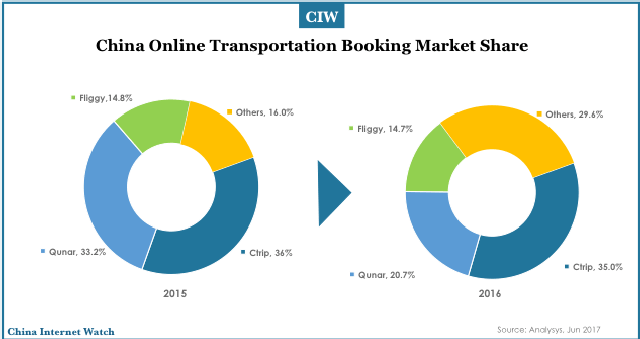

The market share breakdown within the online transportation market mirrors the breakdown within the online tourism market as a whole, with the same three major players accounting for 69.4% of the market in 2016.

As with the overall market, Qunar has seen a dramatic fall in market share from 2015 to 2016, dropping by a whopping 12.5% to 20.5% following its purchase by Ctrip. Ctrip has maintained a commanding lead as the largest player in the market, especially with the addition of Qunar.

Minor players have stepped into the market in a big way, with sites such as Tuniu (which formerly focused on group tours and holiday packages) introducing transportation booking platforms.

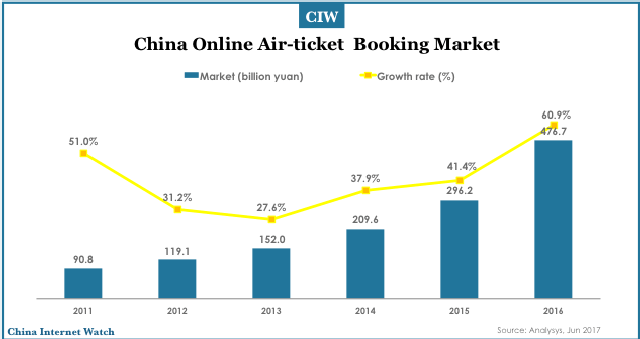

The most important component of online transportation booking, China’s online plane ticket booking market has grown in lock-step with (indeed, been the primary driving factor behind) growth in the online transportation booking market.

In total, plane tickets account for 88.5% of online transportation booking revenue, and 68.1% of all plane ticket revenue comes from online bookings. From 2015 to 2016, this market has grown by 60.9% to 476.7 billion yuan ($US 71.5 billion). By comparison, train and bus tickets are a small portion of the online transportation booking market, and online booking’s penetration into these areas is quite low.

Online accommodation market

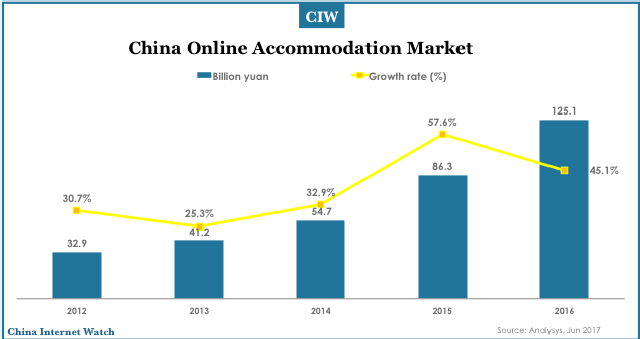

The market for online accommodation booking in China is the second largest component of the online tourism industry, with a value in 2016 of 125.1 billion yuan (US$18.75 billion), and accounting for 32.6% of the accommodation booking sector within China. This market is also growing far more quickly than the tourism market in China, but u

This market is also growing far more quickly than the tourism market in China, but unlike the online transportation booking sector, its year-on-year growth fell markedly from 2015 to 2016, from 57.6% in 2015 to 45.1% in 2016.

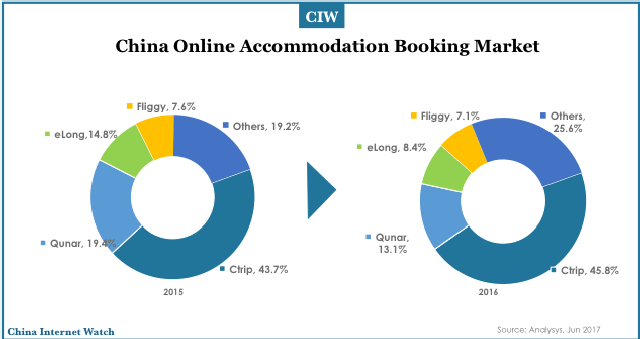

The four major players within the online accommodation booking market in China are Ctrip, Qunar, Fliggy, and eLong, which collectively account for 74.4% of the market. Qunar, as mentioned above, was acquired by Ctrip in 2016, as was eLong, meaning that that one holding company collectively controls 67.3% of the market for online accommodation booking.

Market share for both Qunar and eLong has fallen significantly from 2015 following their acquisition by Ctrip. Their market share has been eroded in part by the entry of Meituan (A Groupon analog) into the hotel booking market in a big way in recent months.

Online holiday and tour markets

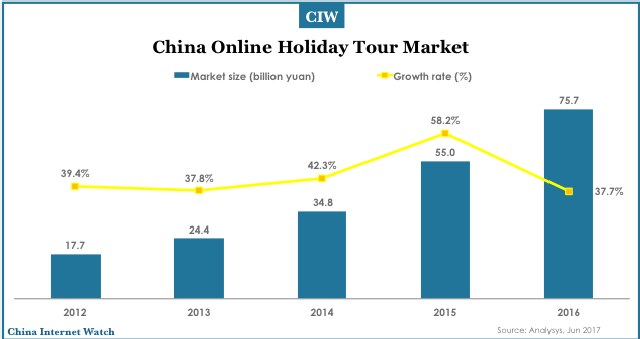

The online holiday and tour booking market is simultaneously the smallest sector of the online tourism industry and the one in which online platforms have the least penetration, accounting for only 10.3% of the online tourism industry and 17.5% of holiday and tour booking.

Its comparatively small market penetration is one of the reasons that it has attracted significant attention and capital from investors in recent years, but in 2016 the sector saw markedly smaller growth (37.7%) compared to 2015 (58.2%), reaching a total revenue of 75.7 billion yuan (US$11.3 billion).

Analysis sees long-term, slow growth in the online side of the industry as it slowly increases market penetration relative to offline providers, but the industry as a whole may be falling out of favor with consumers who are increasingly interested in independent travel.

Analysts concluded that the industry may be entering a period of “deep plowing and careful cultivation” (a Chinese idiom roughly meaning “retrenchment”) in which more strategically-minded participants restructure their operations to suit changing consumer preferences and many participants are weeded out entirely.

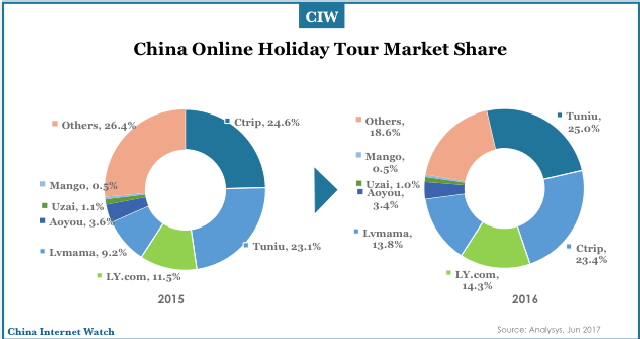

As with the other sectors, the online holiday booking market is dominated by several major players (with a total market share of 76.5%), but excepting Ctrip none of the players are the same as in the other sectors, due to the wildly different conditions and requirements faced by the industry. Compared to 2015, market consolidation has increased; market share for the largest four players in 2015 was 68.4%.

Given the conditions faced by the market, market entrants increasingly focus on upscale tours rather than the economy group tours which were the mainstay of the industry, and the major participants are restructuring their operations accordingly.

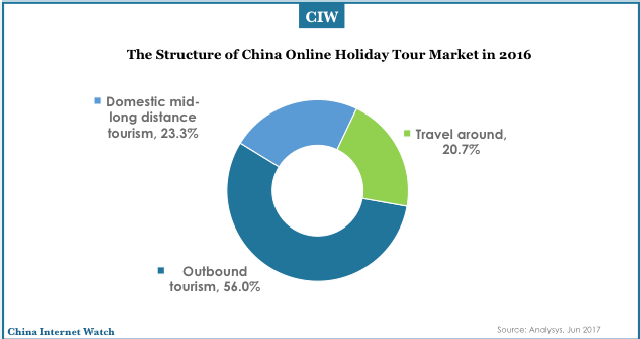

One bright spot within the online pre-packaged tour/holiday booking industry remains international tourism, which accounts for 56.0% of the market. Outbound tourism has been immune to many of the headwinds faced by the market for domestic group tours, buoyed by issues related to language, safety, and tourist visa access for Chinese traveling abroad.

However, the growth rate has slowed even for the international group travel market; Analsys analysts suggest that, as Chinese consumers become wealthier and more experienced internationally, and as foreign countries become more adapted to and comfortable with Chinese tourists, the same preference for independent travel which has already manifested itself for travel within China will come to do so for international travel as well.