E-commerce enterprises in China have taken an increasing role spearheading cross-border commerce in goods and services between China and other nations. As consumers within the country have become more affluent, some enterprises have begun importing increasing amounts of high-quality consumer goods from abroad while others provide platforms for importers to sell goods B2C and C2C.

The following is an overview of the state of the cross-border e-commerce sector in the first half of 2017.

Cross-border e-commerce market overview

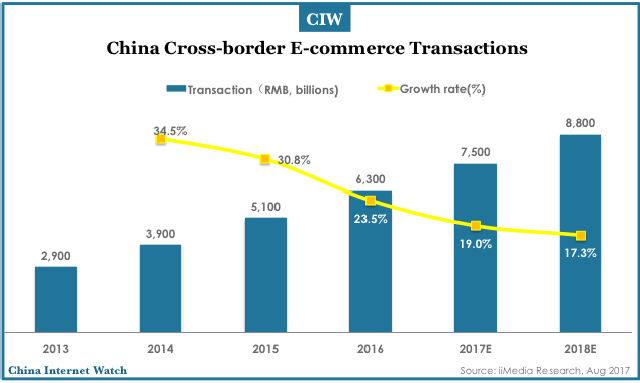

From 2013 to the present the value of cross-border transactions conducted using e-commerce platforms has more than doubled, from 2.9 trillion yuan (US$ 434.7 billion) to 6.3 trillion yuan (US$944.5 billion) in 2016, and is expected to surpass the US$1 trillion mark in 2017. In 2016, year-on-year growth was 23.5%, a figure expected to fall slightly to 19.0% in 2017.

Following improvements in logistics and international supply chains, consumers are becoming “sea scourers” (haitao, researching and purchasing imported goods online) as a way to meet their needs, leading to rapid growth in the number of Chinese consumers purchasing imported goods online.

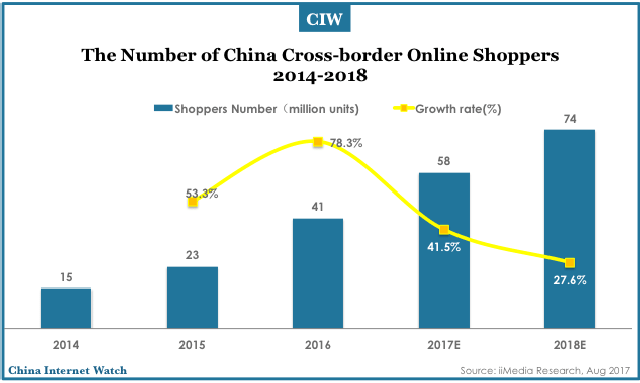

In 2016, 41 million Chinese consumers purchased imported goods online, an increase of 78.3% from the year prior, and it is expected that this figure will grow by a further 41.5% in 2017, to 58 million.

For comparison, there is a total of 765 million discrete accounts on all e-commerce platforms in China, meaning that 7.6% of consumers will make an international purchase in 2017. This also implies that while growth rates will taper off over time, the market is far from saturated relative to the size of the overall e-commerce market.

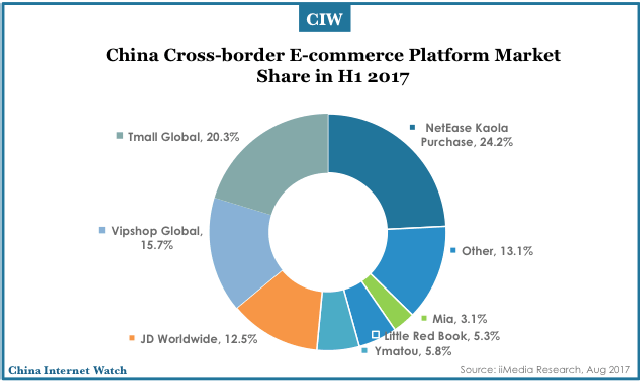

The e-commerce market for imported goods is dominated by four companies, NetEase Kaola, Tmall Global, VIPShop Global, and JD Worldwide, of which Tmall Global and JD Worldwide are offshoots of larger e-commerce platforms, Taobao and JD.com.

These four collectively account for 72.7% of the market. JD Worldwide and other companies which are able to rely on a larger e-commerce platform and strong supply chain will be able to leverage these advantages to occupy a strong market position.

Understanding China’s “sea scourers”

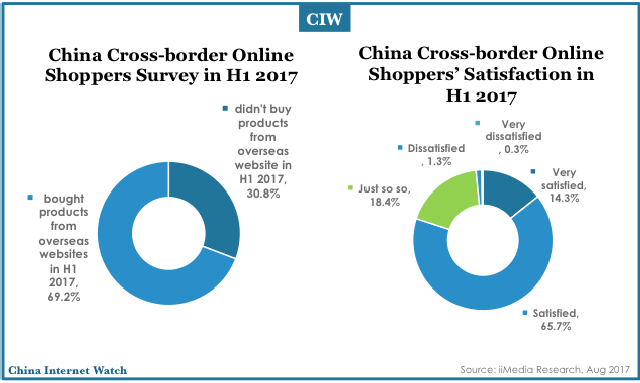

Survey data shows that nearly 70% cross-border online shoppers have bought imported goods in the first half of 2017, of whom just 1.6% were dissatisfied or very dissatisfied, while 80% were satisfied or very satisfied.

Economic development within China has allowed cross-border e-commerce platforms to continually develop their product selection, while technological improvements have contributed towards a better shopping experience, such that consumers are generally satisfied with their options and the quality of the goods and customer service they receive.

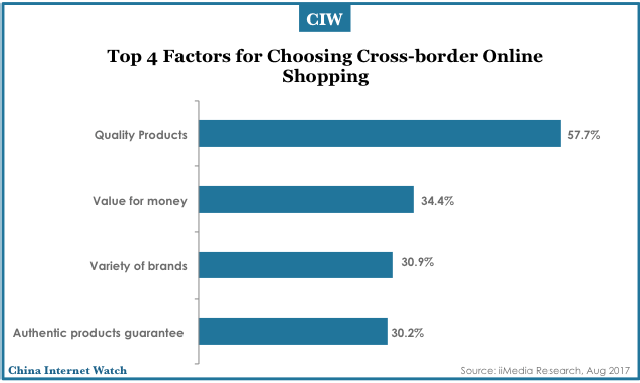

“Sea scourers” are motivated to buy imported goods by several factors, the most important of which are a search for quality and authenticity, a belief that imported goods are a better value for the money, and the variety of brands available online from international sources.

In a market such as China, where e-commerce is not always reliable and counterfeit goods are commonplace, it’s only natural that the most common concern driving consumers to buy imports is product quality.

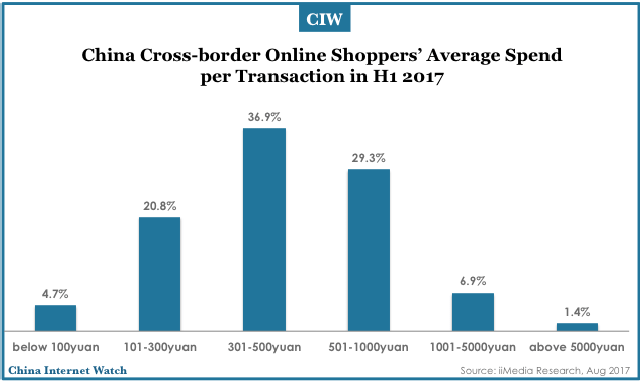

In addition, clear patterns emerged from the survey data regarding spending; 66.2% of transactions were in the range of 300-1000 yuan (US$45-150), indicating that average spending among “sea scourers” is higher than among ordinary e-commerce users, but that the majority of them are not buying high-priced luxury goods. This reinforces the data above; most “sea scourers” are motivated by a search for quality and authentic goods which is harder to find in domestic products.

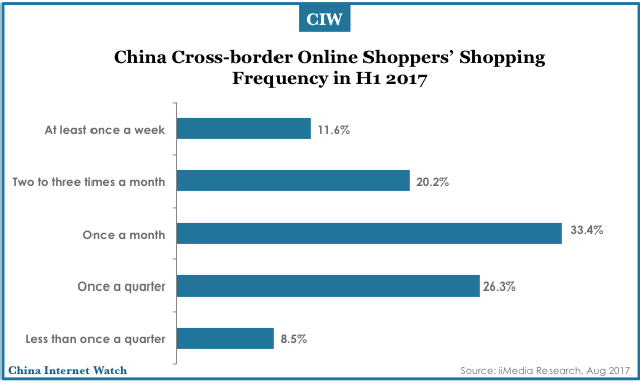

A large majority of consumers (65.2%) say they buy imported goods online at least once a month, with a significant fraction saying they purchase goods weekly, suggesting that buying imported goods has become routine and an important part of the consumption habits of many households.

Analysts believe that increasing consumer affluence coupled with the quality of the goods available from overseas markets will continue to drive e-commerce users abroad to fulfill their daily needs.

Preferred nations of origin

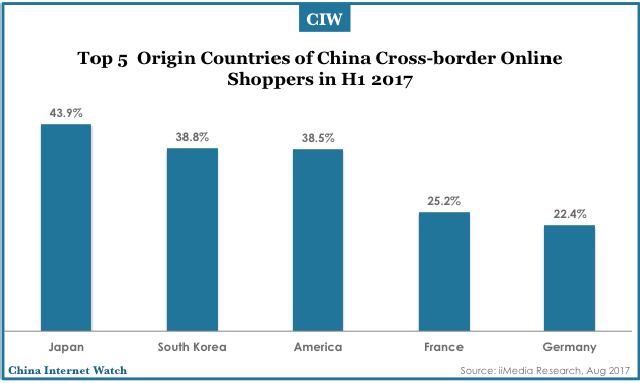

In cross-border e-commerce, developed economies dominate as exporters. Japan, South Korea, the United States, France, and Germany were the biggest suppliers of goods to cross-border shoppers. 43.9% of China cross-border online shoppers reported having purchased Japanese-sourced goods, predominantly in the cosmetic, skincare, and nutrition industries.

South Korea and the United States were in second and third place; consumers primarily purchased skincare products, foodstuffs, and fashion from South Korea and nutrition, fashion, and infant-related products from the US. France and Germany were both sources of infant-related and nutrition products, while France also provided cosmetics and Germany, skincare products.

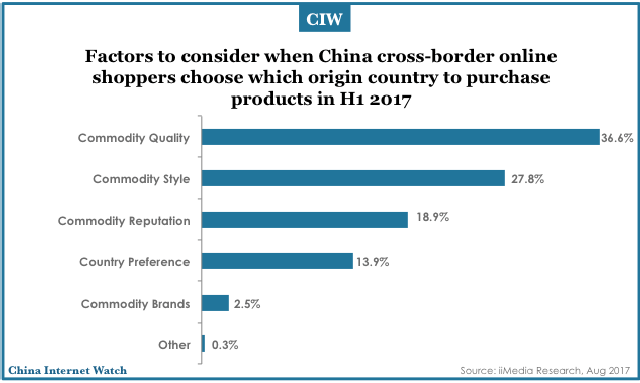

Survey responses showed that quality is not just a consideration for consumers in choosing to buy from abroad, but also in choosing from where to buy. 36.6% of “sea scourers” reported choosing products from a given country of origin based on product quality, a significant margin over those who chose based on style (27.8%) or reputation (18.9%).

… and e-commerce platforms

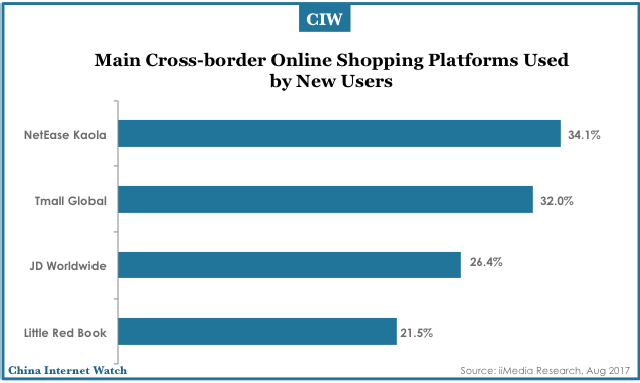

Meanwhile, among new “sea scourers”, NetEase Kaola, Tmall Global, JD Worldwide, and Little Red Book dominate as preferred cross-border e-commerce platforms.

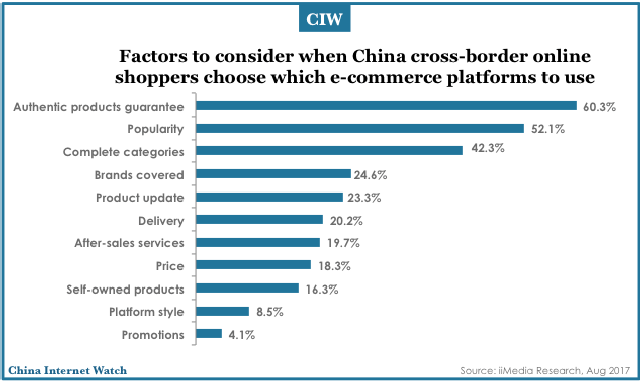

Cross-border online shoppers chose among competing e-commerce platforms based primarily on three factors: guarantees of product authenticity, platform popularity, and variety and completeness of choices offered.

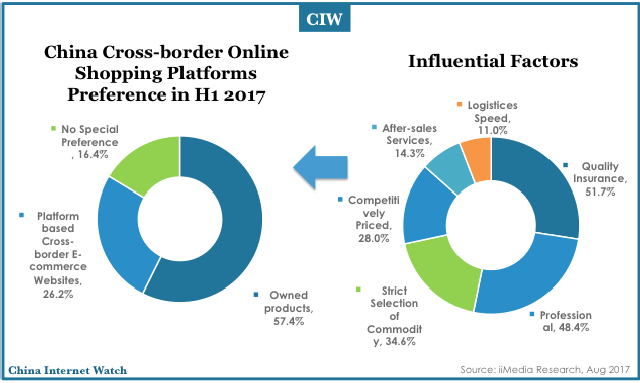

The majority choose e-commerce sites which control the import and sale of all products on the site, with 57.4% preferring such sites, while just 26.2% prefer sites which offer a platform to independent sellers. Those who responded in favor of centralized sites cite quality assurance, professional operations, and stringent selection of products as their primary reasons for preferring them.

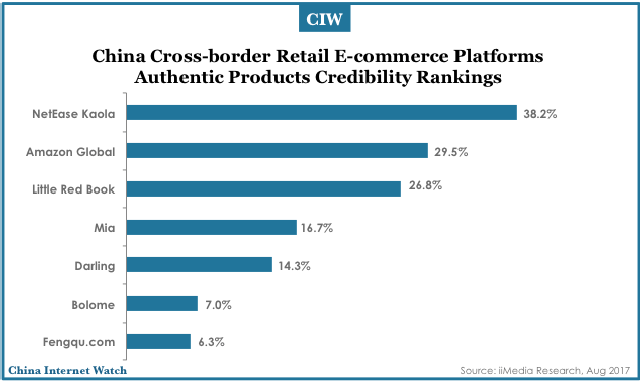

In keeping with the above, consumers found NetEase Kaola, Amazon Global, and Little Red Book to be the most credible platforms when looking to buy authentic, name-brand products from abroad.

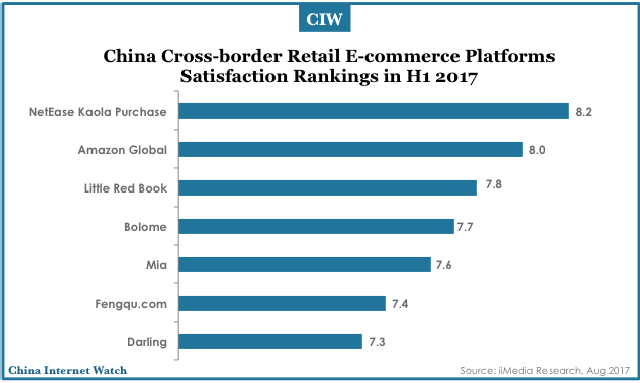

Additionally, these three sites had the highest satisfaction rating among surveyed consumers, with average ratings of 8.2/10, 8.0/10, and 7.8/10 respectively, suggesting that centralized commercial platforms have a leg up among consumers who are accustomed to a “Wild West” environment in e-commerce in China.

By exercising more control over procurement and ensuring the authenticity of goods purchased on their sites, they are able to offer a measure of security that the individual seller-dominated Tmall Global and similar platforms cannot.

Read part 2 here.