With the increasing utility and availability of mobile payment methods, store-based O2O commerce has experienced steady growth, with total sales of US$91.1 billion in 2016, a figure which is projected to reach US$143.6 billion in 2019.

Online-to-offline (O2O) commerce has long been more prevalent in China than in the developed world, leading to China becoming the largest and most developed O2O market in the world.

With consumers having largely bypassed credit and debit cards in a rush to mobile payment apps, O2O maintains a strong position and strong prospects for growth within China’s consumer markets. Still, the industry is witnessing disruption and structural shifts in response to changing buying habits.

AS STORE-BASED O2O COMMERCE IN CHINA MAINTAINS STEADY GROWTH…

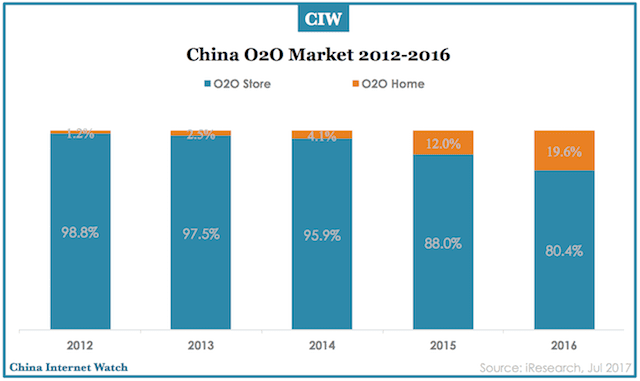

Because of its early start and ability to fill an important niche within e-commerce, store-based O2O commerce has long held a leading position in the O2O space within China.

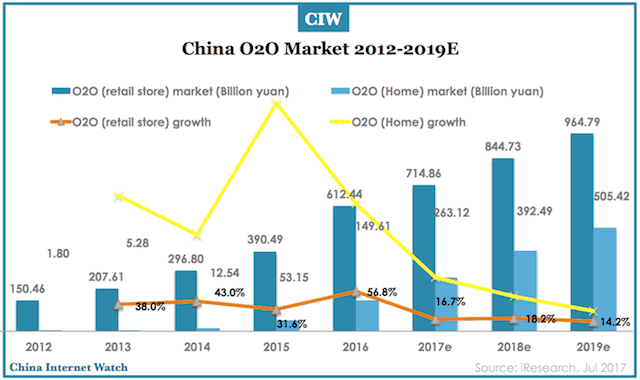

With the increasing utility and availability of mobile payment methods, store-based O2O commerce has experienced steady growth, with total sales of 612.4 billion yuan (US$91.1 billion) in 2016, a figure which is projected to reach 964.8 billion yuan (US$143.6 billion) in 2019.

… HOME-BASED O2O COMMERCE FILLS A NICHE…

Meanwhile, home-based O2O, which includes sectors such as food delivery, online provision of home services, at-home spa and health services, and home delivery of groceries and goods, has begun to catch up rapidly. With shifts in preferences and a willingness to pay a premium to bring goods and services to their door, consumers have rapidly embraced the home-based O2O model.

From a low starting point, home-based O2O commerce came to take up 19.6% of the O2O market in 2016, a whopping 149.6 billion yuan (US$ 22.3 billion), and is expected to grow to more than a third of the market by 2019, with expected sales of 505.4 billion yuan (US$75.2 billion) that year.

… WHILE LAGGING IN SOME AREAS

At present, the home-based O2O market is greatly dominated by two services: delivery of prepared foods, and online education; in 2012 education accounted for 46% of the O2O market, with delivery in second at 27.4%.

By 2016, their positions reversed, with food delivery holding 54.9% of the market and education only 20.5%. Meanwhile, other fields like home repair, at-home health services, grocery delivery, and laundry services have grown less rapidly and still have some distance to go to make up ground on the major players.