Online retail sales in China’s rural areas in H1 2017 achieved 537.62 billion yuan (US$79.9 billion), including 328.64 billion yuan (US$48.8 billion) for service retail sales and 208.98 billion yuan(US$31.1 billion ) for physical goods retail sales.

Rural e-commerce of China in H1 2017 presents the following characteristics:

1. Rural retail continues to maintain rapid growth. Online retail sales in rural areas grew 38.1% YoY in H1 2017, which is 4.9 percent higher than the city.

The proportion of rural retail sales in the whole country accounted for 17.3%. Rural e-commerce shows to maintain an accelerated growth in the quarterly trend, for online retail sales grew by 39.2% in Q2, 2.4 percent higher than Q1.

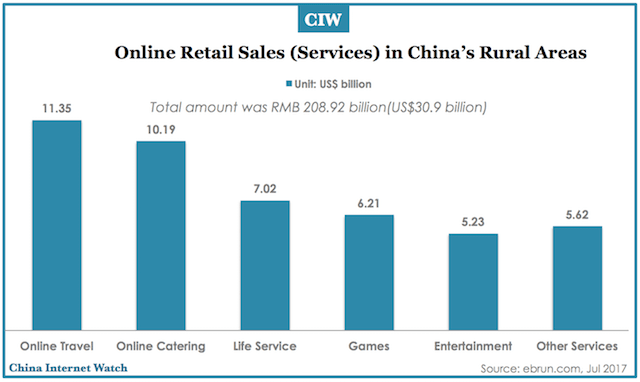

2. Rural online travel and catering are growing rapidly, which contributes to the high-speed growth of service type retail sales.

Service type online retail sales grew up to 44.4% YoY, 10.1 percent higher than physical type online retail sales, for which is 34.3%. Service type takes 38.9% of the whole online retail sales, 1.7 percent higher than last year.

Service type sales lead rural online retail sales reached 16.5 percentage points. In the service industry, online travel, entertainment, online catering are leading the development of service type e-commerce, with retail sales of 84.19, 8.17, 68.95 billion yuan(US$12.55B, US$1.22B, US$10.27B) and growth of 61.6%, 58.3%, 56.6% respectively, of which online travel grows as 23.4 percentage points higher than the whole country, significantly more than the national level of development.

Online travel and catering led rural online retail sales to 8.2 and 6.4 percentage points, becoming the largest contribution to the growth among all 19 industries.

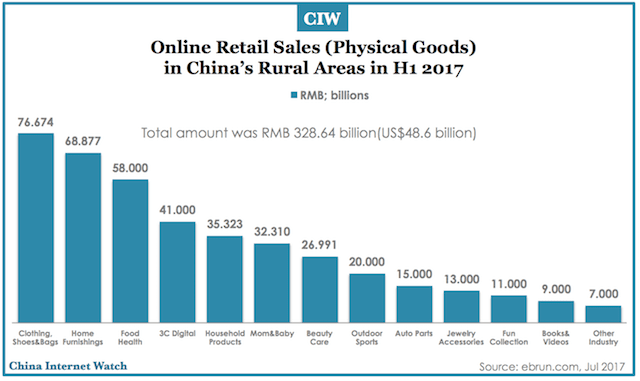

3. Food health leads the development of rural physical goods type e-commerce, and remarkable results have been achieved in agricultural and their processed products.

Food health industry which covers most of the agricultural and the processed products reached an amount of retail sales of 42.08 billion yuan (US$6.26 billion) in H1 2017, with a high-speed growth of 62.0%, that is 20.2 percentage points higher than the industry’s average increasing speed in the country and 27.7 percentage points higher than the growth of the physical goods type online retail sales.

It led the rural online retail sales to a growth of 4.1%, which contributes the most to the physical goods type industry. Industries of beauty care, books&videos and outdoor sports maintain growth over 50%, their growth rates achieved 105.2%, 54.5% and 53.3% YoY, which are 83.5, 65.5, 36.3 percentage points higher than their industries of the country.

Food health rates as the fourth of the growing speed, following by mom&baby and 3C digital which kept a growth rate of over 40%.

4. Midwest and northeast rural e-commerce maintain high-speed growth trend, and the eastern area is showing obvious advantages as always. The retail sales achieved 341.86, 107.95, 75.96, 11.84 billion yuan(US$50.86B, US$16.06B, US$11.3B, US$1.76B) for the eastern, middle, western and northeastern areas of China in H1 2017, with growths of 30.6%, 46.4%, 63.1%, 60.8% YoY.

In the midwest and northeast rural areas, the total online retail sales amount is 195.76 billion yuan(US$29.13 billion), and the growth rate is as high as 53.3%, which is 22.7 percent higher than the east rural area and covers as 36.4% of all rural online retail sales, 3.6 percentage points higher than last year.

For service type online retail sales, the amount of midwest and northeast areas achieves 92.5 billion yuan(US$13.76 billion), with a growth rate of 71.2%, which is 31 percentage points higher than the physical goods type and covers as 47.3% of all online retail sales, 4.9 percentage points higher than last year.

The retail sales achieved 341.86, 107.95, 75.96, 11.84 billion yuan(US$50.86B, US$16.06B, US$11.3B, US$1.76B) for the eastern, middle, western and northeastern areas of China in H1 2017, with growths of 30.6%, 46.4%, 63.1%, 60.8% YoY. In the Midwest and northeast rural areas, the total online retail sales amount is 195.76 billion yuan(US$29.13 billion), and the growth rate is as high as 53.3%, which is 22.7 percent higher than the east rural area and covers as 36.4% of all rural online retail sales, 3.6 percentage points higher than last year.

From the industry distribution, leading by agricultural and the processed products, travel and catering e-commerce, the development of different rural areas shows their own characteristics. Food health contributes the most to the growth of online retail sales in northeast, western and middle areas, with rates of 25.7%, 23.2%, and 11.5%.

Clothing, shoes & bags led online retail sales development with a growth rate of 16% in the eastern rural area. Online travel contributes the most to the service type industry in western, middle and eastern areas with growth rates of 36.5%, 24.7%, and 15.8% respectively.

Online catering rates the fourth with over 10% of the rate. Besides, beauty care, 3C digital of the eastern rural area, mom&baby, 3C digital of the middle rural area, home furnishings, clothing, shoes&bags of the western rural areas and clothing, shoes & bags and outdoor sports are all making great contributions to their online retail sales growth.

5. The 618 campaign promotes obvious improvement in rural areas, but there is still a big gap compared with the city.

During the 618 period from 1st June to 18th June, the rural online retail sales kept a high-speed development trend with a rate of 62.7%, which is 24.2 percentage points higher than May, but still 8.3 percentage points lower than the city.

It shows that during the shopping campaign in rural areas, the pressure of logistics warehousing response and centralized large-scale customer service, the ability of similar products and brand supply and competition and large data precision marketing, and related personnel training and so on are to be improved.

During 618 period, a number of online retail sales in the western rural area reached a top growth rate of 91.5%, and the growth rates for the northeast, middle and eastern areas are 78.4%, 69.3%, and 56.7%. Food health of midwest and northeast areas, clothing, shoes&bags of eastern areas contributed the most to their online retail sales of all industries.

6. E-commerce accesses to the rural comprehensive demonstration counties and becomes the leading vanguard of the development of rural e-commerce, e-commerce shows the obvious effect to the rural poverty alleviation.

In H1 2017, 496 rural comprehensive demonstration counties with e-commerce achieved online retail sales of 169.94 billion yuan(US$25.29 billion), with a growth rate of 45.4% YoY and 7.3 percentage points higher than the average growth rate.

Demonstration counties with less than a quarter of the number of the counties contributed about one third of the rural online retail sales. 93.2% of the demonstration counties locate at Midwest areas and 52.6% are state level poverty stricken counties.

The online retail sales of physical goods type and service type of demonstration counties in H1 are 98 billion yuan(US$14.58 billion) and 71.94 billion yuan(US$10.71 billion), with growth rates of 41.5% and 51.0% YoY. During 618 campaign, the retail sales grew 87% YoY with 24.3 percentage points higher than the rural areas, which shows that their ability of products and brand competition and marketing are obviously improving.

832 state level poverty stricken counties achieved online retail sales of 53.28 billion yuan (US$7.93 billion) in the first half of 2017, with a growth rate of 60.1% which is 22.1 percentage points higher than the rural average.

261 of the demonstration counties achieved a sales of 34.34 billion yuan(US$5.11 billion), with 67.7% YoY and the average sales amount is 130 million yuan(US$19.35 million), 2.2 times that of the average online retail sales of the state level poverty stricken counties, which is 60 million yuan (US$8.93 million).