As Chinese tourists spending increased in 2016, their total overseas shopping spending decreased by 17% according to consulting firm Oliver Wyman.

The average spend per Chinese tourist on shopping was 6,705 yuan in 2016, lower than the previous year’s 8,050 yuan. However, counting the hotel and sightseeing spend, the overall consumption for holidays is on a rising trend last year (20,317 yuan; up 3.5%).

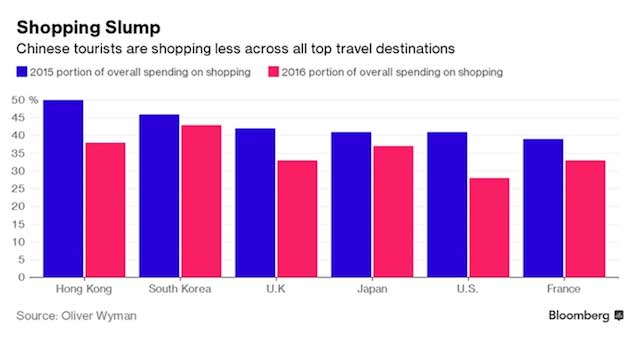

Shopping, the second most popular reason for outbound tourism in China in 2015, has fallen to the third. And, its proportion of the total tourism spends dropped to 33% in 2016 from 41% in 2015.

Japan’s largest duty-free shop Laox said Chinese tourists contributed 33% less revenue in 2016. One key reason for the decrease in outbound tourism on shopping is the rising and growing popularity of cross-border retail e-commerce platforms in China including Tmall Global, JD, Amazon, Kaola, and etc.

Shopping guide websites are the top referral of China cross-border online shoppers (59.8%), followed by family & friends (51.2%) and search (47.3%) according to iReseach. See more cross-border online shopping insights here and here.

Another trend of outbound tourism in China is that the number of individual travelers decreased while the proportion of family travelers with children increased by 12% in 2016. Couple travelers also increased to 59% from 46%.

China retail industry development report 2016-2017