JingDong (JD) held an annual sale on 18th June to celebrate its anniversary in China. Other eTailers as Alibaba’s Tmall follow to compete with JD. Data below shows the sales of electronic products during 1-18 June 2017.

Related: 618: China’s major mid-year shopping festival

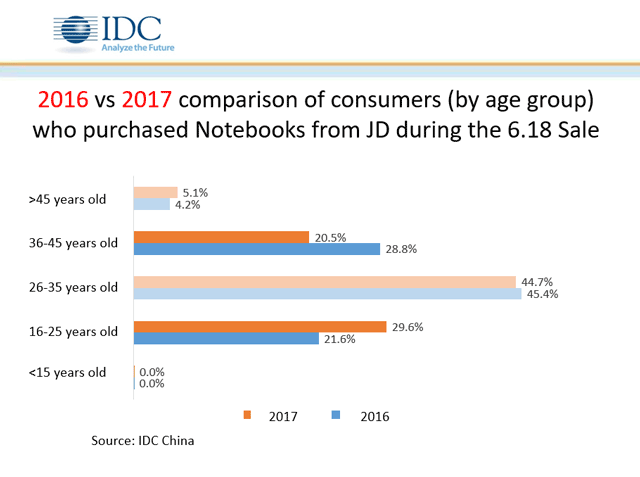

The growth of 16-25 age group. This age group made up 29.6% of the purchasing of notebooks. Compared to 21.6% last year, young consumers promoted an increasing demand for notebooks, especially for≤20mm notebooks and gaming notebooks. In the 36-45 age group, the decline from 28.8% last year goes down to 20.5% this year. Young customers get higher demand for these products. There is still space to come up with the older age group.

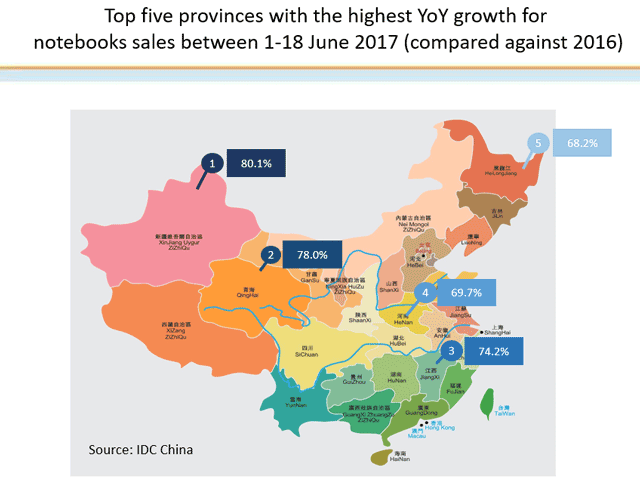

Tapering growth in developed provinces. The developed provinces such as Guangdong, Beijing, Shanghai, Zhejiang, Fujian got lower growth rates for notebooks than the average of whole China. Xinjiang, Qinghai, Jiangxi, Henan, and Harbin grow as the top 5 highest rates. Similar to the sales of desktops, PC market shows a stabilized state in the more developed cities.

AI powering personalized options/choices. eTailers are providing more personalized recommendations for consumers by the technology of big data and artificial intelligence. JD introduced an online virtual assistant to recommend relevant items to consumers based on their purchase history.

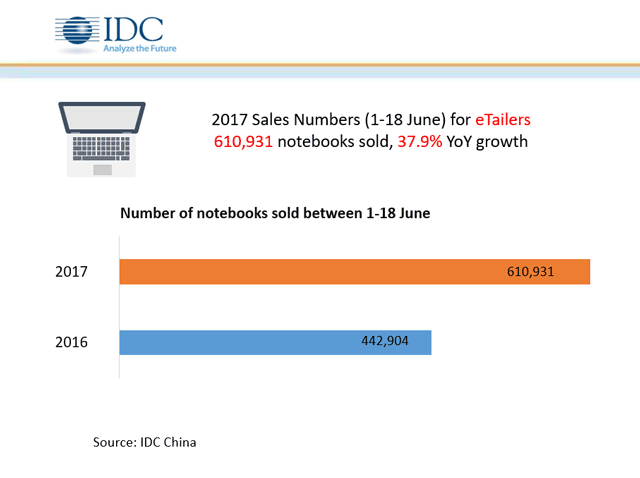

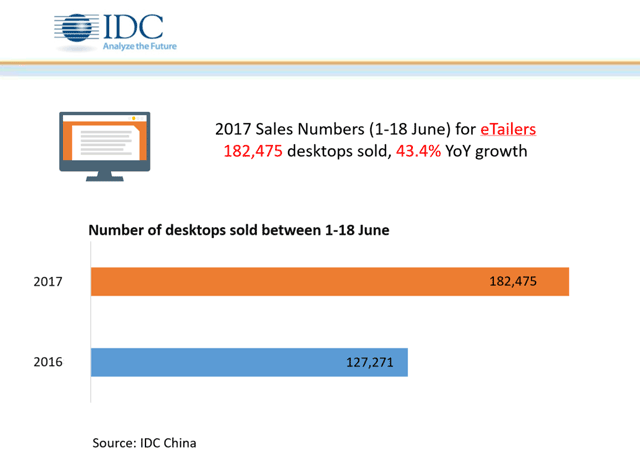

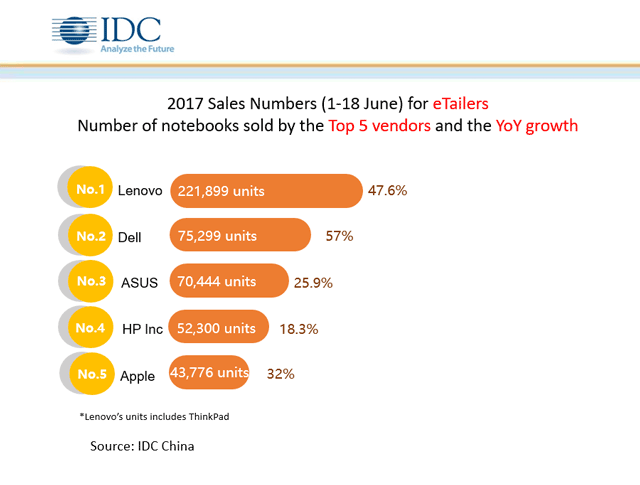

For all eTailers, 610,931 units of notebooks were sold with an increase of 37.9% compared to the same period last year. 182,475 units of desktops (excluding DIY) were sold with a YoY increase of 43.4%. For JD alone, the numbers are 38% for notebooks and 44.2% desktops (excluding DIY). JD made up 83.8% on notebooks and 94% on desktops of the overall eTailer sales numbers.

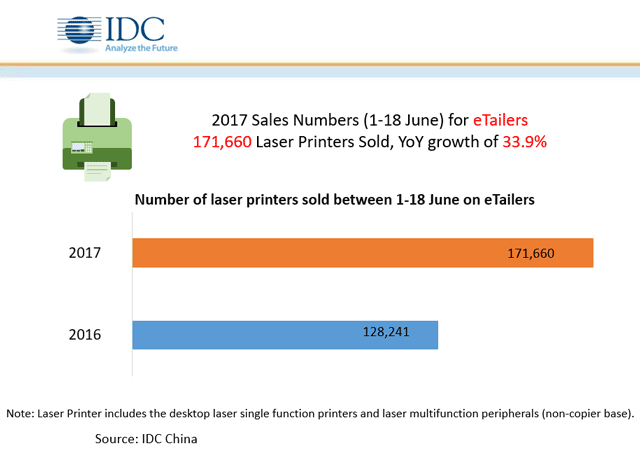

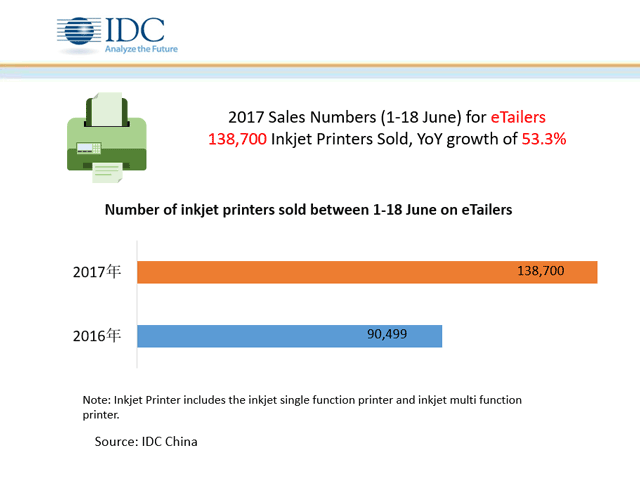

Printers (including single function printers, laser multifunction peripherals (non-copier base), inkjet single function printer and inkjet multi-function printer) made a 41.9% YoY growth during which JD made up 70.1% of the whole market. The laser printer grew 33.9% YoY and the inkjet printer grew 53.3% YoY.

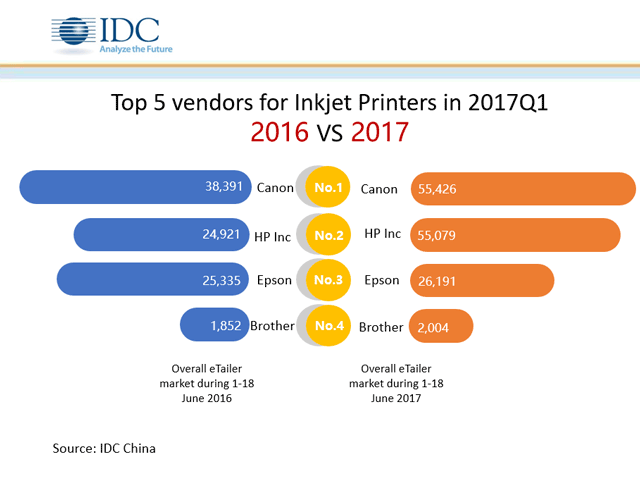

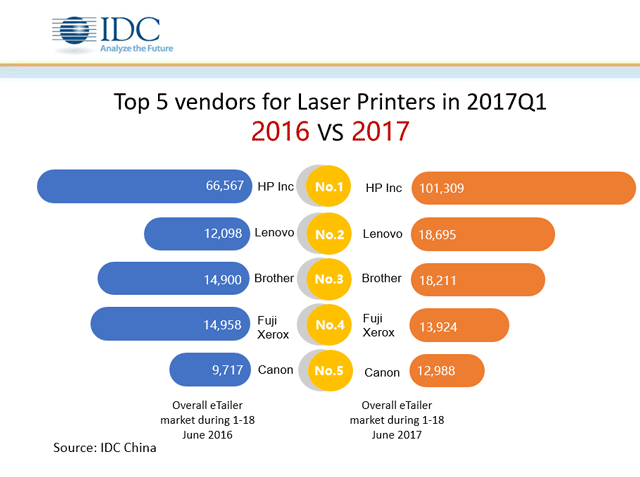

For inkjet printers, Canon continued to top the eTailer market, and HPInc and Epson took the second and third position as last year. For laser printers, HPInc had a market share of 59% which maintained its top position.

Top vendors continue to be the same as last year for notebooks. And the top vendor is still Lenovo (including ThinkPad).

In Q1 2017, based on IDC’s data, notebooks in the “>US$730” price band increased by 110.5% YoY and made up 48.1% of the overall notebook market. Consumers got higher demand for better designs and specifications such as ≤20mm notebooks and gaming notebook. Students’ demands for completing their homework and working adults for external discussions are increasing which also pushes the notebook market.

How to satisfy Chinese consumers’ demand in digital retail era