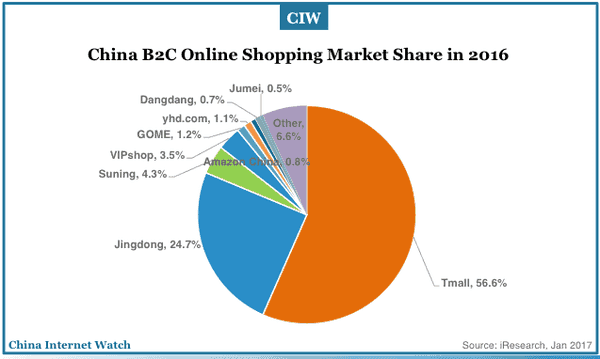

The total transactions of China’s online shopping market totaled 4.7 trillion yuan (US$680 bn) in 2016 with an increase of 23.9%; and, it’s estimated to reach 7.3 trillion yuan (US$1.06 trillion) in 2019. Tmall dominates China’s B2C online shopping market with over 56% market share.

B2C online shopping market will grow to over 60% in 2019 from 55.3% in 2016 while C2C continues to shrink.

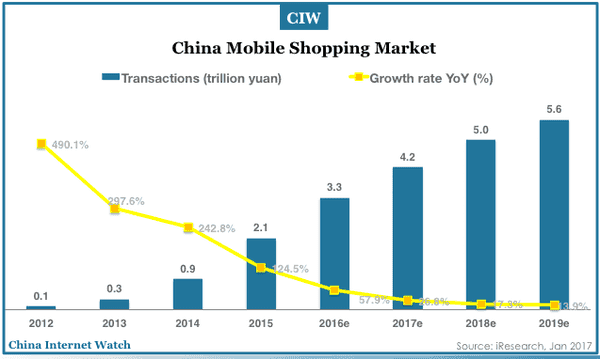

Mobile shopping begins to dominate China’s online shopping market and will grow to 5.6 trillion yuan; 76.9% of total online shopping transactions in 2019.

Tmall continued to lead China’s B2C online shopping market with 56.6% market share, followed by Jingdong (24.7%) and Suning (4.3%).

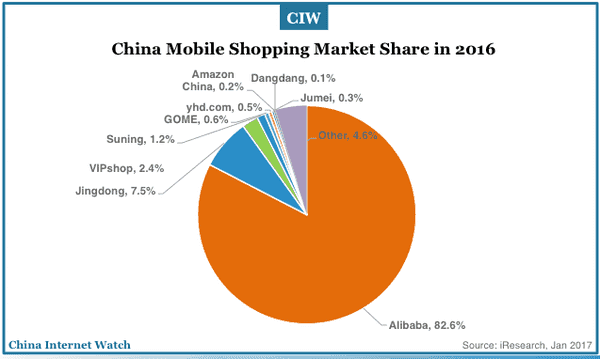

Mobile MAUs on Alibaba’s China retail marketplaces reached 493 million in December 2016 while annual active buyers on its China retail marketplaces reached 443 million, an increase of 4 million. It has 82.6% market share in China’s mobile shopping market according to iResearch.

Jingdong annual active customer accounts increased by 46% to 226.6 million in 2016 from 155.0 million in 2015. Net revenues for 2016 were RMB260.2 billion (US$37.5 billion), an increase of 44% from 2015.

Also read: China’s cross-border online shoppers to exceed 200 million by 2020