The People’s Bank of China recently released the payment business statistics for 2016. The country handled a total number of 125.111 billion non-cash payment transactions with the amount of 3,687.24 trillion yuan.

The mobile payment maintained a rapid growth momentum in China in 2016; online payment was also growing steadily; but, the phone payment business was down by 6.61%.

China’s mobile payment business saw 25.71 billion transactions in 2016, an increase of 85.82% and a total amount of 157.55 trillion yuan. But, the online payment business in China still remained the main force of non-cash payments in 2016 with a total of 461.78 billion transactions, an increase of 26.96%. The online payment reached 2,084.95 trillion yuan in China.

In 2016, China’s non-bank payment institutions accumulated a total of 163.302 billion transactions in 2016, up by 99.53%. The growth rate of the total amount was more than 100% to 99.27 trillion yuan.

As of the end of 2016, China’s banks had issued 6.125 billion bank cards, an increase of 12.54% YoY. On average, every user holds 4.47 cards, up 11.83%; and, every user has only 0.31 credit card. China’s bank card transactions totaled 115.474 billion in 2017, an increase of 35.49%; the daily average transactions totaled 316 million and 2.03 trillion yuan.

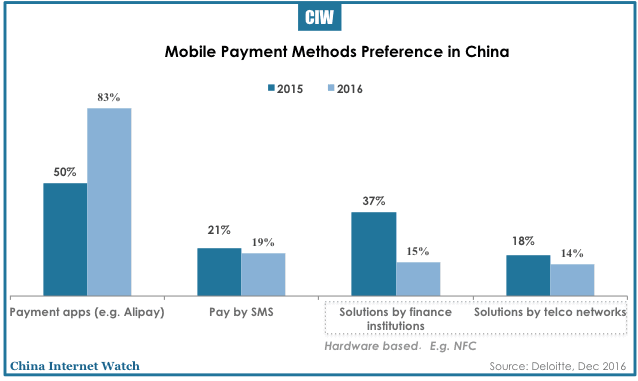

Top mobile payment scenarios in China: restaurants, taxi, fast food »