Accommodations accounted for about 20% of total online travel transactions in 2016 and have the potential to reach 100 billion yuan according to China Housing Sharing Development Report 2017.

The number of users sharing accommodations was only 35 million in China in 2016 according to the report. Total transactions of China’s accommodation sharing market reached 24.3 billion yuan with over 2 million users providing such services.

The top online platforms for short-term accommodations in China include Tujia.com, Mayi.com, Xiaozhu.com, and Airbnb. Tujia and Mayi have the highest brand awareness in China (over 70%), followed by Xiaozhu and Airbnb (40%-70%) according to iResearch data.

Search engines, social ads, and web portals are the top channels for China online users to become aware of short-term accommodation platforms.

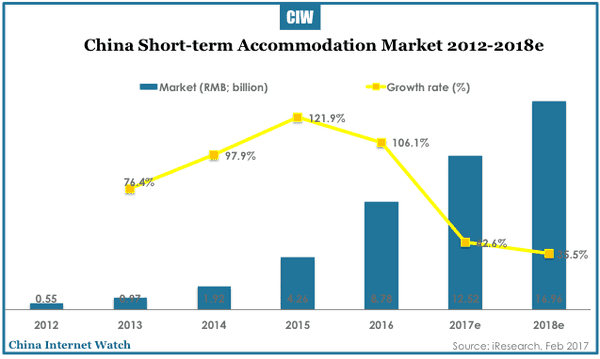

Short-term accommodation market in China reached 8.78 billion yuan in 2016 with a growth rate of 106.1%; it’s estimated to grow by 42.6% and 35.5% to reach 12.52 billion yuan and 16.96 billion yuan in 2017 and 2018 respectively.

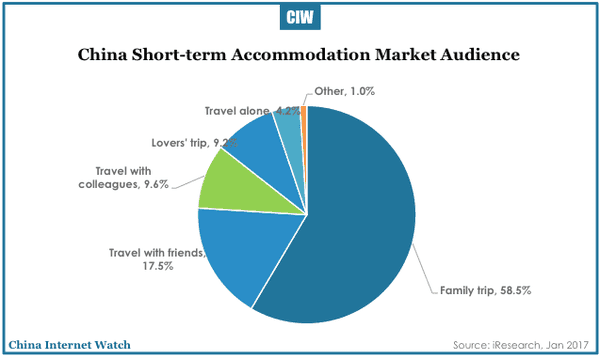

Close to 60% users in China booked short-term accommodations for family trips. Traveling with friends (17.5%) is the second largest user group.

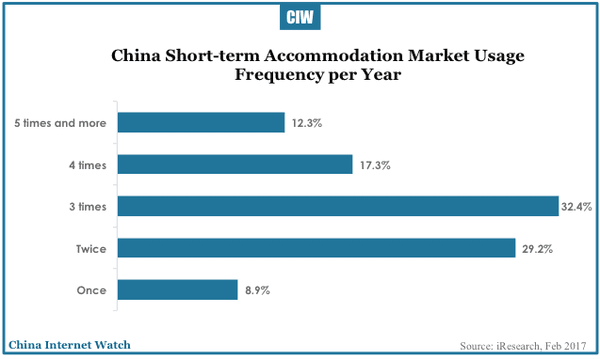

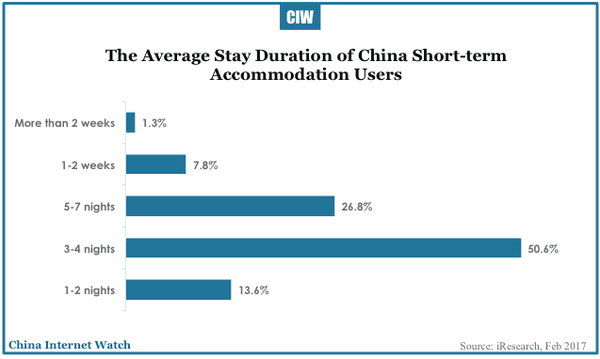

Over 60% users book short-term accommodations 2-3 times per year. And, over half (50.6%) stayed an average duration of 3-4 nights.

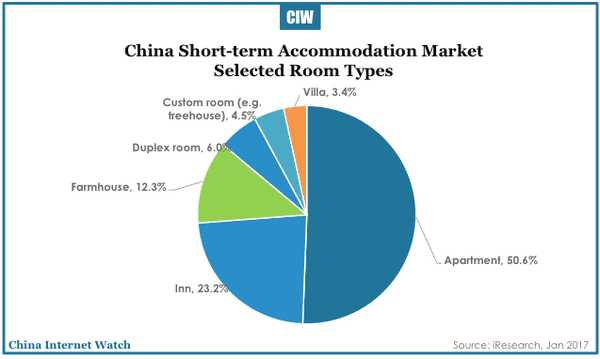

Apartments are the most selected room type (50.6%) for short-term accommodation market in China in 2016, followed by inns (23.2%) and farmhouses (12.3%).

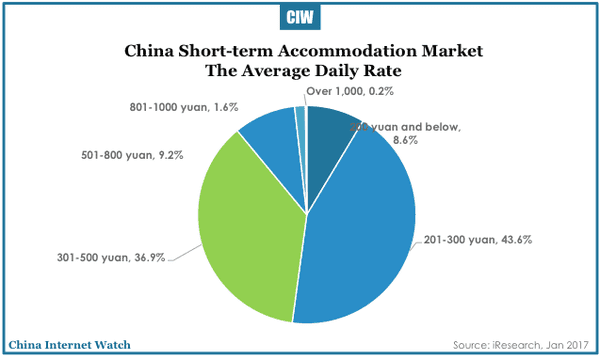

43.6% charged an average daily rate of between 200 and 300 yuan, which is about the price of economic hotels in China. 36.9% between 301 and 500 yuan.

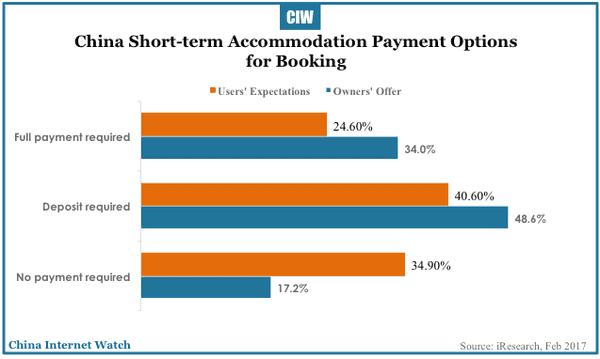

Unlike hotel bookings on Ctrip or eLong in China (most require no payment for bookings), over one-third of short-term accommodations require full payment for booking and 40.6% charge deposits. Users are currently not comfortable with this; over one-third of users expect no payment at all for booking rooms.

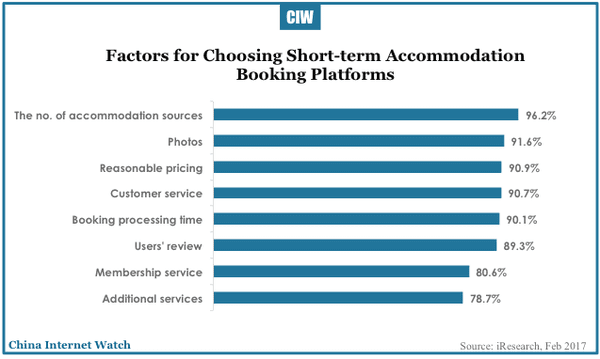

Having more rooms for selection is the top factor for Chinese users to choose a specific short-term accommodation platform; photos, reasonable pricing, and customer service are also important factors.

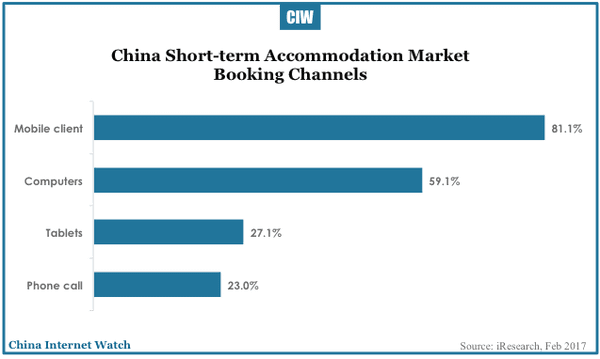

Mobile clients are the top channel for online bookings of short-term accommodations.

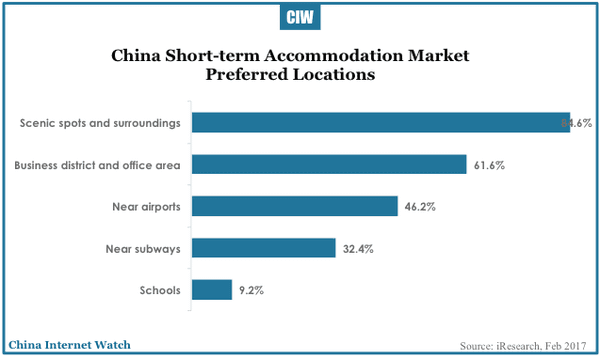

84.6% short-term accommodation users prefer to book their stay around scenic spots; 61.6% in business districts; 46.2% near airports; and, 32.4% near subways.

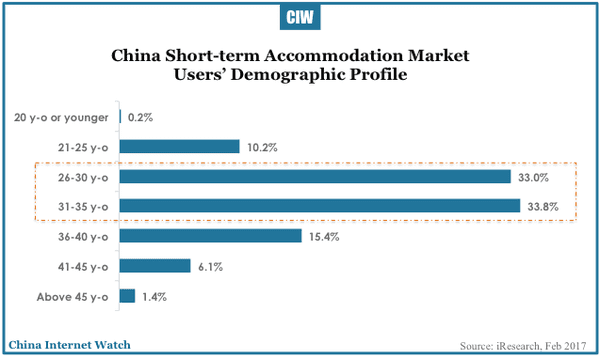

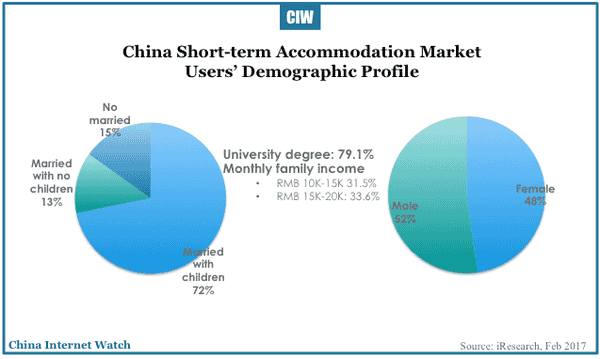

Over 60% short-term accommodation users in China are between 26 and 35 years-old. Near 80% have a degree; and, over one-third have a monthly family income of between 15K to 20K yuan.

Also read: An Overview of China’s Local “Airbnb” (Xiaozhu, Tujia, Zhubaijia…)