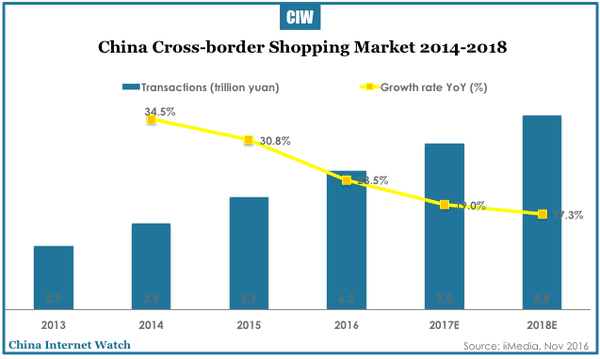

The total transactions of China cross-border e-commerce market reached 6.3 trillion yuan (US$920 billion) in 2016, including retail and B2B according to a Chinese research company iiMedia. And, it’s expected to reach 8.8 trillion yuan (US$1.28 trillion) in 2018.

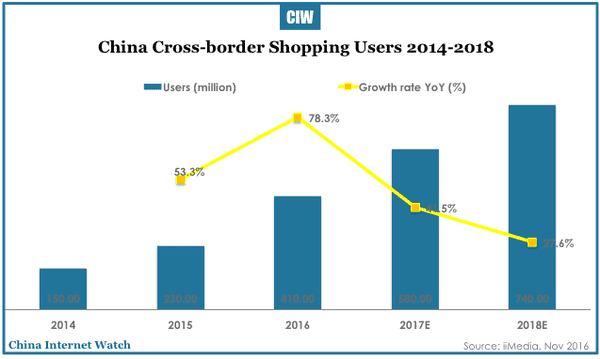

The total number of cross-border shoppers in China exceeded 410 million in 2016 and is expected to reach 740 million in 2018. The growth was 78.3% in 2016 and will slow down to 27.6% in 2018.

The total transactions of China cross-border e-commerce market reached 6.3 trillion yuan (US$920 billion) in 2016 from 5.1 trillion yuan in 2015, including retail and B2B. It’s estimated to reach 7.5 trillion yuan in 2017 and 8.8 trillion yuan in 2018.

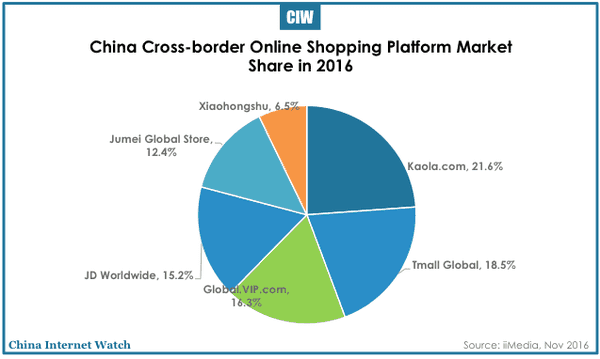

In China cross-border retail e-commerce import market, Kaola.com (Netease) led in 2016 with 21.6% market share by total sales value, followed by Tmall (18.5%), Vipshop (16.3%), JD Worldwide (15.2%), Jumei (12.4%), and Xiaohongshu (6.5%).

73.6% cross-border online shoppers in China are female; 30.9% have monthly income of between 5,001 and 8,000 yuan; 84% are between 19 and 40 years-old; 45.2% live in the east (Jiangsu, Zhejiang, Shanghai, etc). Tier-1 and tier-2 cities accounted for 77.4% all cross-border online shoppers in 2016.

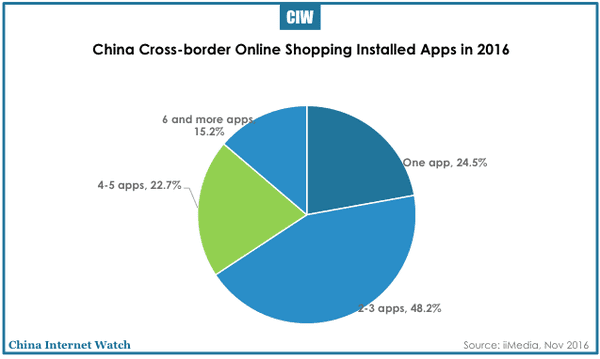

46.2% chose mobile as primary devices for cross-border online shopping. 48.2% installed 2 to 3 cross-border online shopping apps.

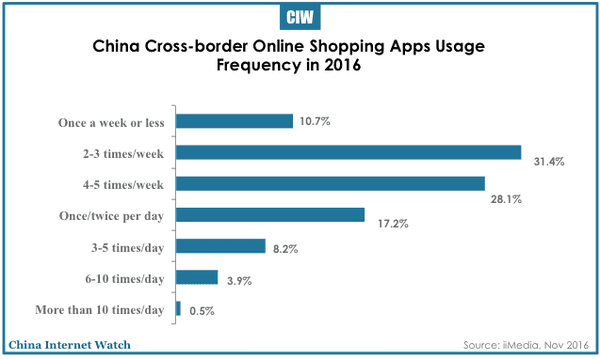

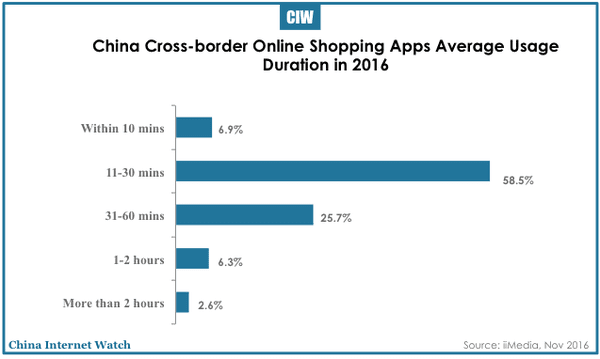

Near one third (31.4%) of users open cross-border shopping apps 2-3 times per week; 58.5% spend 11 to 30 minutes every time.

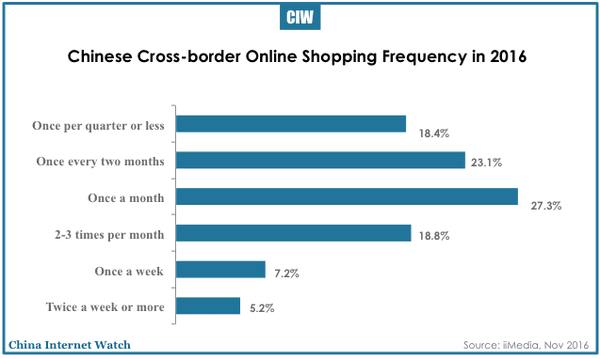

27.3% users on average shop cross-border products once a month; 58.5% at least once a month.

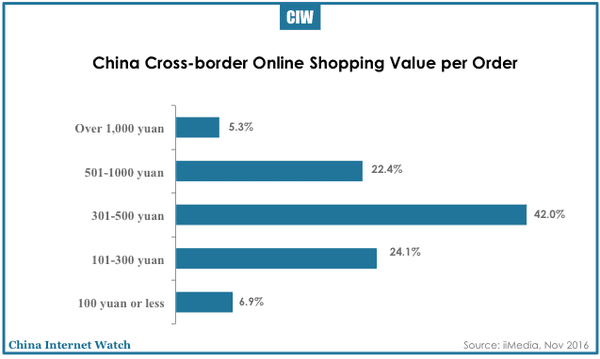

42% spend between 301 and 500 yuan per order.

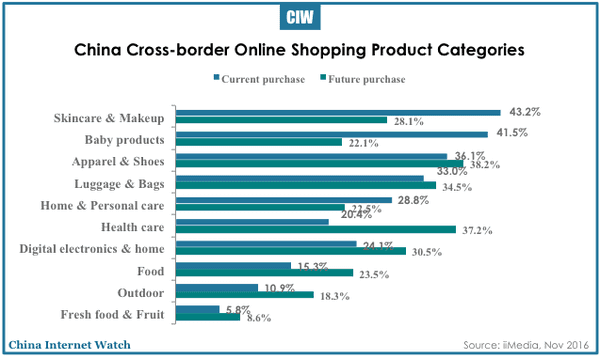

The top product category for cross-border online shopping is skincare and makeup (43.2%), followed by baby products (41.5%) and apparel & shoes (36.1%). Only 20.4% bought cross-border health care products online; but, 37.2% expressed intention to buy in this product category in the future.