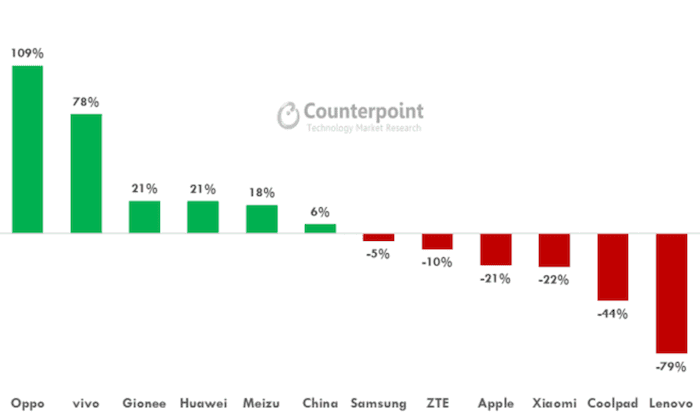

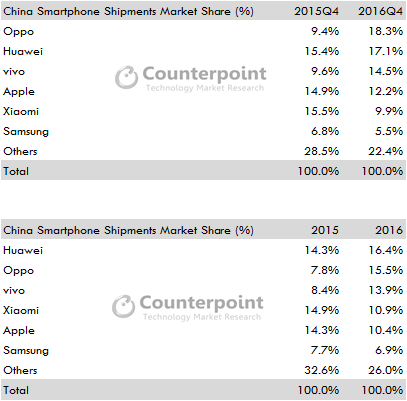

China smartphone shipments were up 9% in Q4 2016 and 12% in 2016 according to Counterpoint. Huawei, Oppo, and Vivo (HOV) emerged as clear winners in 2016.

Oppo, Huawei, vivo, Meizu, and Gionee captured a combined 58% of the total Chinese smartphone market in 2016. Demand for rest of the brands declined, especially Xiaomi and Apple.

Oppo and Vivo were the fastest growing brand and since June 2016 owing to strong omnipresent distribution channels from tier-1 to tier-4 cities across China. Xiaomi slipped to the fourth spot during the year as the demand for its smartphones declined 22% annually.

Best-Selling Smartphone Models Share in 2016

| Ranking | Best-Selling Models in 2016 | % Market Share |

| 1 | OPPO R9 | 4% |

| 2 | Apple iPhone 6S | 2% |

| 3 | Huawei HONOR Joy 5S | 2% |

| 4 | OPPO A33 | 2% |

| 5 | MI Redmi Note 3 | 2% |

| 6 | LeEco Le2 | 2% |

| 7 | vivo Y51 | 2% |

| 8 | Apple iPhone 6S Plus | 1% |

| 9 | vivo X7 | 1% |

| 10 | Huawei Mate8 | 1% |

| 11 | OPPO R9 Plus | 1% |

| 12 | Huawei P9 | 1% |

| 13 | MI Redmi 3S | 1% |

| 14 | MI Redmi 3 | 1% |

| 15 | OPPO A59 | 1% |

| 16 | Apple iPhone 7 | 1% |

| 17 | MI 5 | 1% |

| 18 | OPPO A37 | 1% |

| 19 | Meizu Blue Note 3 | 1% |

| 20 | Apple iPhone 7 Plus | 1% |

Oppo R9 rose to the best-selling smartphone in China in 2016 breaking Apple’s iPhone dominance streak as the best-seller for the first time since 2012.

Android accounted for 80.7% of urban China smartphone sales in Q4 2016, an increase of 9.3 percentage points year-over-year according to Kantar. iOS made up 19.1% of smartphone sales, down from 27.1% in the same period a year earlier. iPhone 7 remained the top-selling model in the Chinese market in the last quarter of 2016 at 6.8%.

Related: China Smartphone Usage Insights 2016