The Economist Intelligence Unit (“EIU”) expects private consumption in China will grow in real terms by 5.5% a year on average in 2016-30 – boosting its share of the overall economy to nearly 50%.

The incremental growth EIU expect in private consumption in China over the next 15 years is more than current level of consumer expenditure in the EU.

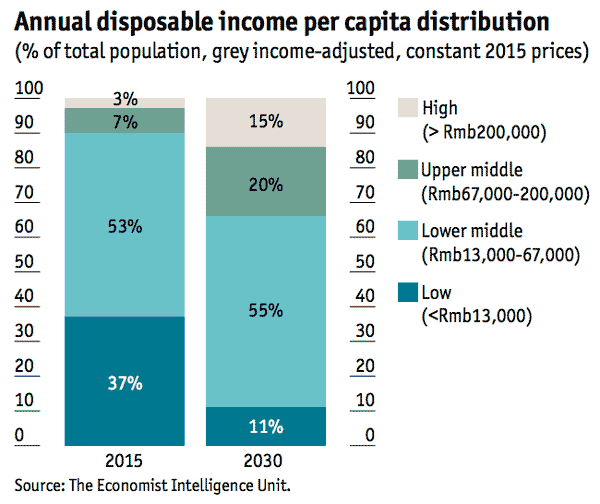

EIU expects nearly 35% of China’s population, or around 480 million consumers, to meet their definitions of upper middle-income and high-income by 2030. That represents a sharp increase on the 10% (132m) at present. The emergence of this large population, with a personal disposable income of at least US$10,000, will alter the consumer landscape in China.

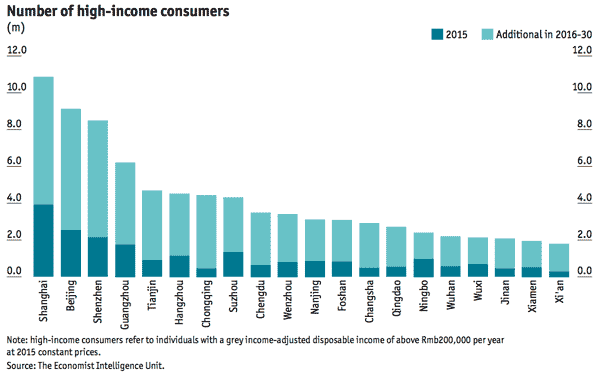

Income will become more dispersed, rather than concentrated in first-tier cities on the eastern

coast. Major interior cities, such as Changsha, Chengdu, Chongqing and Wuhan are set to see sizeable

leaps, with each having at least 2 million high-income consumers by 2030.

Nevertheless, smaller cities and those undergoing industrial restructuring risk being left behind, suggesting that high levels of income inequality will persist.

Rising discretionary income will drive changes in consumer tastes and preferences. Around 30% of the spending by the average Chinese consumer is still allocated to food, compared with only 15% in South Korea. As income levels rise, consumers will look to upgrade consumption habits and switch to more expensive and premium brands.

Chinese spending on health, as well as leisure and education, is likely to experience strong growth in the coming years, as average disposable income levels pass the key thresholds at which spending in these areas has taken off in other countries according to EIU.

There is also strong potential for growth in expenditure on transport and communications, with Chinese spending in this category currently below that of Malaysia when incomes in that country were at the same level.