China online FMCG has grown by 47% in a 12-month period ended in June 2016 according to Kantar Worldpanel.

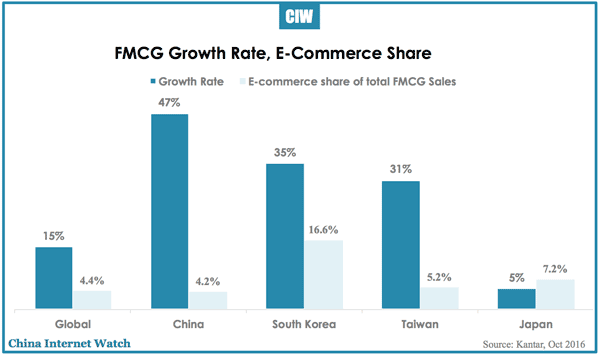

E-commerce share of total FMCG sales reached 4.4% globally and 4.2% in China with 47% growth rate. In 2025, online FMCG will grow to become a US$36 billion business with a market share of 15% according to Kantar.

In China, 50% of FMCG’s online sales is beauty, which had an increase of 8.1% in sales after one year.

Chinese urban consumers’ spending in fast moving consumer goods (FMCG) in the third quarter of this year grew by 3.6% from a year ago, according to Kantar Worldpanel. It is lower than 4.6% in second quarter, but still the second fastest growth since the second quarter of 2015.

Lower tier cities still grew faster than higher tier cities, especially county level cities (4.7%) and counties (4.2%). The combined share of international retailers dropped to 11.6% in third quarter from 12.1% in a year ago. Walmart, the leading international retailer in China, is embracing the omni-channel strategy by increasing its shareholding of JD to 10.8% in mid-October and the opening of a global purchase flagship store on JD.com. Walmart’s offline share declined 0.1 of one percentage point to 4.7% in third quarter 2016 compared to the same time last year due to strong competition from local leaders Sun-Art Group and Yonghui.