2012 is the trouble times of Chinese advertising. Whether the food security crisis aroused by the toxicant capsules, Diaoyu Island incident or the hit of the Voice of China, we could see the influence of media.

The Overview Statistics of China Advertising 2012

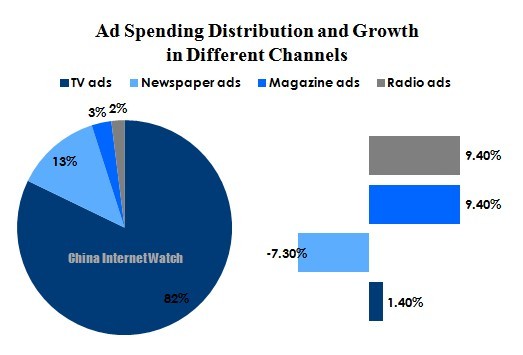

In 2012, the advertising market was more than 652.8 billion yuan (USD 104.7 billion), where we didn’t see much grow compared with that in 2011 (649.3 billion yuan, about USD 104.15 billion). TV ads accounted for more than 80%, keeping its safe lead, but only increased by 1.4% under the restrictions of resources and policies. Both of magazine and radio ads up by 9.4%. Suffering the shock of the Internet, ads on newspapers down by 7.3%.

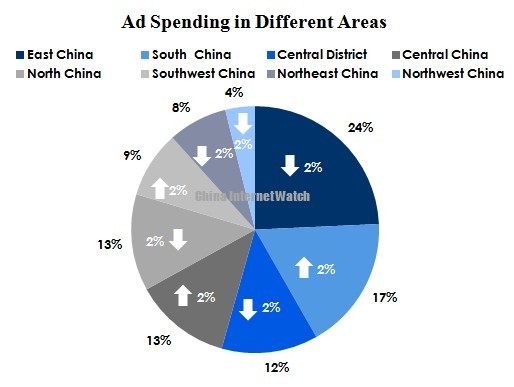

The north and northeast areas in China suffered relatively obvious decrease in ad spend, which were 7% and 9%. The ad spend in south, central and southwest areas saw increasing growth of 13%, 10% and 2% respectively.

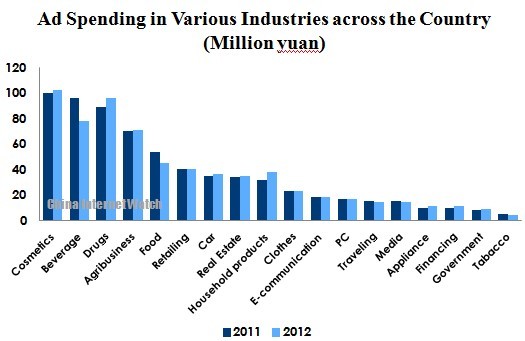

The top 5 industries with the highest advertising spending were still cosmetics, beverage, pharmaceutical, agribusiness and food. It was worth mentioning that the ad spend in food & beverage category grew by 20% and 18% respectively compared with that of last year. Though intervened by the political environment, the spending ratio of auto industry didn’t change a lot.

Most of the top 10 advertisers were from FMCG. P&G kept its lead but still lowered the ad spend by 30%. Environmental factors in pharmaceutical industry had marked influenced on Hayao Group, whose advertising spending declined for 29%.

Three Fascinating Stories in 2012

1.Sino-Japanese Crisis’

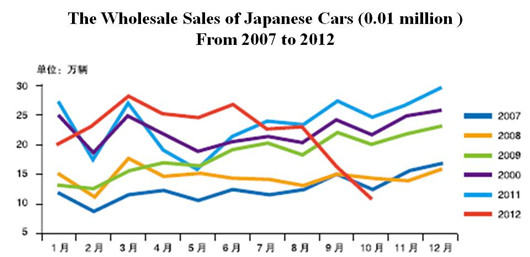

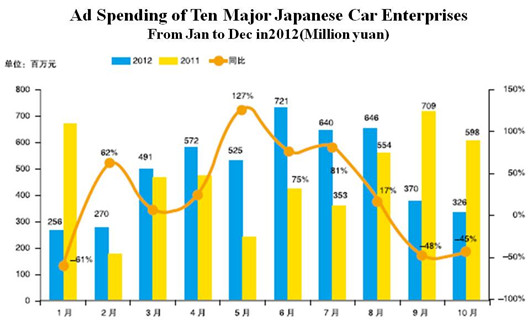

In Sep 2012, Diaoyu incident inevitably influenced the operation of Japanese manufactures. The spontaneous anti-Japanese demonstrations, Japanese car industry suffered tough declines in sales. According to statistics from Sina, the sales of Toyota, Nissan, Honda, Suzuki and Mazda decreased for 61.1%, 44%, 54.2%, 32.6% and 27.6% respectively.

The poor sales performance directly influenced the ads spending of Japanese car industry. Also, the media intermitting the ads of Japanese products was the explanation of the decline. Things were quite normal in July and August but dropped dramatically in September.

In contrast, other car brands experienced rapid growth. The ad spending growth of Land Rover exceeded 1800% in October and so it did with Germany Volkswagen. Chinese-made cars, represented by BYD, also increased the ad spending since August.

Until then, the after-effects still exist. According to statistics, Japanese car export to China declined to 82%, and Toyota even halted production in China.

Japanese car industry was not alone. Japanese electronic products industry had been similarly battered. The advertising spending of Canon, Nikon, Sony and or so had been decreasing since August and Canon’s spending even dropped for 99%.

2. The Voice of China, The Hit Last Summer

What is the most popular TV programs in 2012? Certainly the Voice of China is. Marketers won’t ignore this kind of public carnival. Instead, they started an advertising war on this platform. The very evidence is that the 15-second ad price soared 500,000 yuan (USD80,200) from 150,000 yuan at the beginning and still more advertisers wanted to join in.

But does being part of this carnival guarantee the ad impacts? Maybe the answer is no. Take those embedded ads as an example. During the final section of the Voice of China, there were 461 pieces of embedded ads in total, covering 86 brands. Most of them appeared in the mouth of the host or acknowledgement in the end. With too direct expression and too much similarity and too much intensity and audience’s selective retention, few ads could be memorized.

3.The Fight Between JDB and Wong Lo Kat

JDB and Wong Lo Kat used to be brothers and both of them sell herbal tea. They separated and started a war ever since the brand lawsuit.

JDB was quite active in this competition. Except for entitling several variety shows such as the Voice of China, JDB took good advantage of offline and online media to promote its brand. Take its cooperation with the Voice of China as an example. JDB not only provided tons of money for this program, but also took part in the pre-planning and after-publicity to ensure the consistency between the brand and the program. With the success of the Voice of China, JDB also harvested great performance in sales.

Summary and Prospect

In summary, the growth of Chinese advertising market was slowing down 2012, especially in those industries influenced by the government policies. The online media has great potential in the long run, but TV media are still the first choice of most advertisers. Chinese domestic brand is improving the sense of brand promotion and marketing strategy to be more influential in the market.

Data source: Nielsen