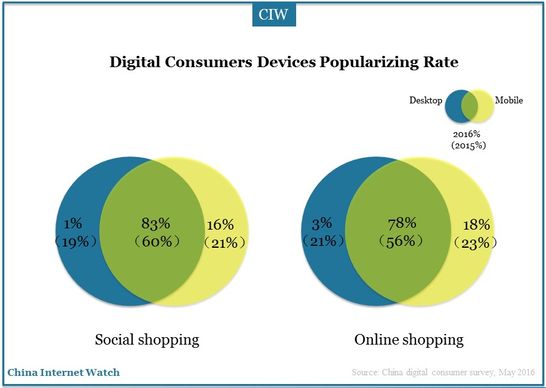

In 2016, 83% Chinese users use multi devices for social shopping, 78% for online shopping according to McKinsey Digital Consumer Survey.

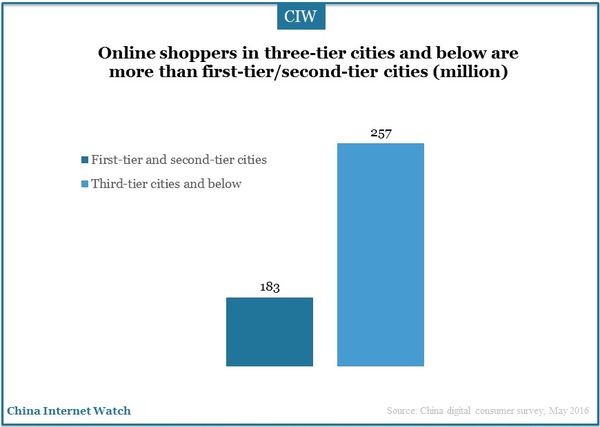

E-commerce retail sales account for over 50% of China’s total product value in lower tier cities; online shoppers growth rate is 61%, higher than that of the first-tier and second-tier cities.

The number of online shoppers in third-tier cities and below reached 257 million.

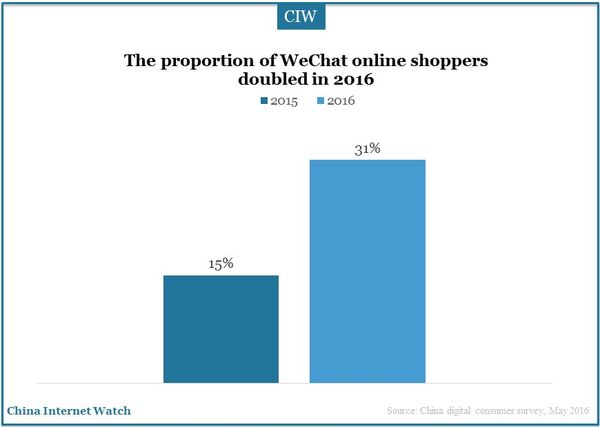

The proportion of WeChat online shoppers doubled in 2016 with 31%.

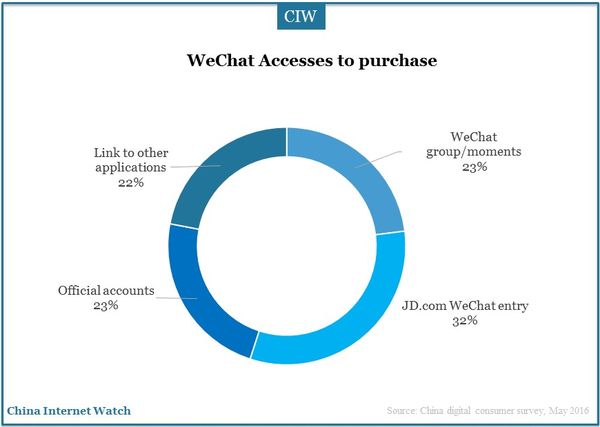

Users who shop on JD.com via WeChat account for 32%, slightly more than that of other shoppers on WeChat.

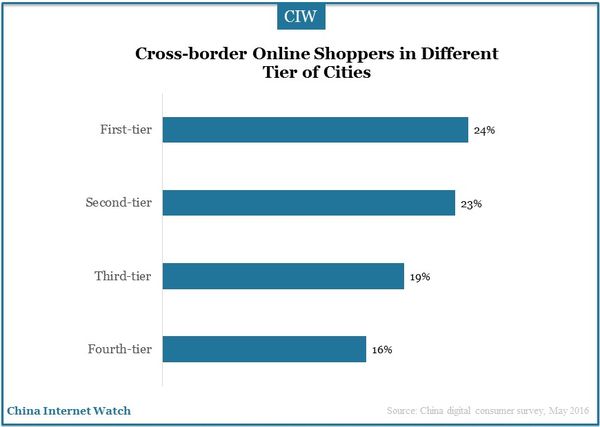

Cross-boarder online shoppers in the first-tier and second-tier cities are more than shoppers from the third-tier and fourth-tier cities.

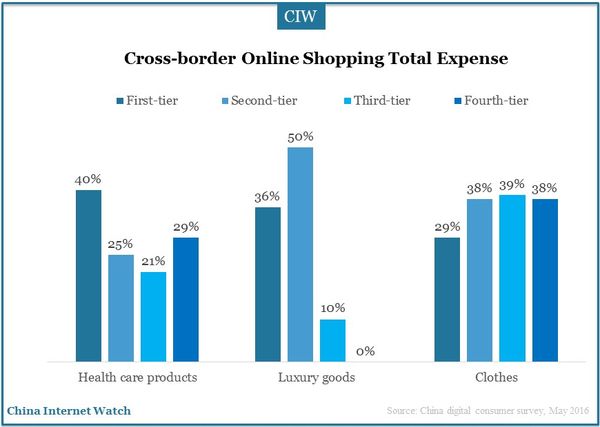

Shoppers from the first-tier cities spend 40% of their total expenditure on health care products, while shoppers from the second-tier cities tend to spend 50% of total expenditure on luxury goods.

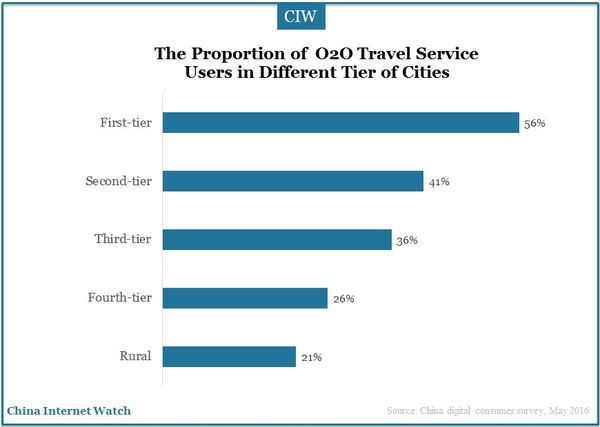

Over half users in China’s first tier cities use O2O travel service.

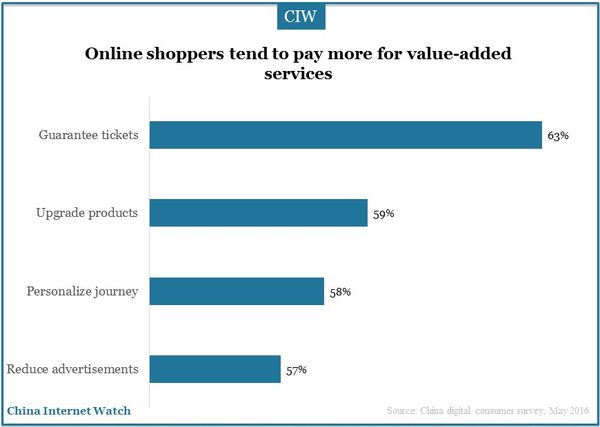

63% China online shoppers are willing to pay more for guarantee tickets.

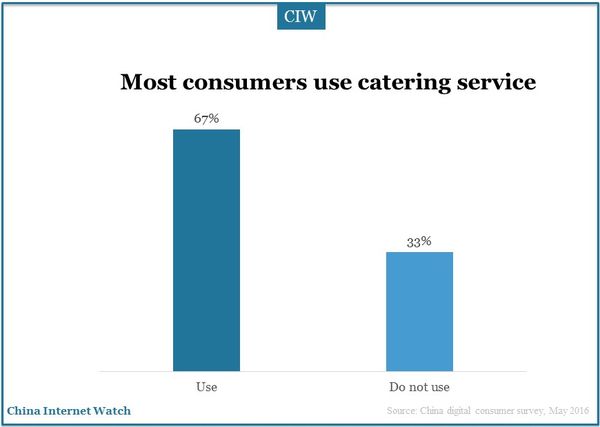

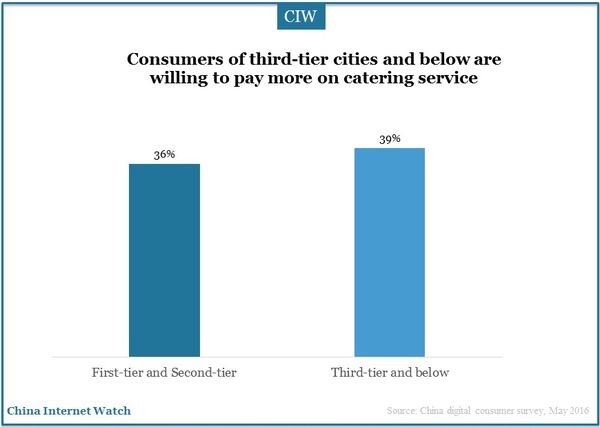

67% consumers use catering service. More Chinese consumers from third-tier cities and below are willing to pay more on catering service.

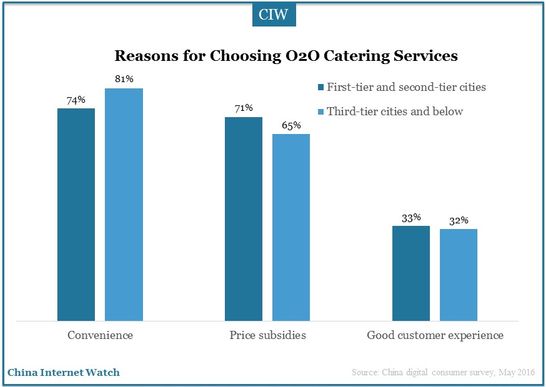

Convenience and price subsidies are main reasons for customers to choose O2O catering services.

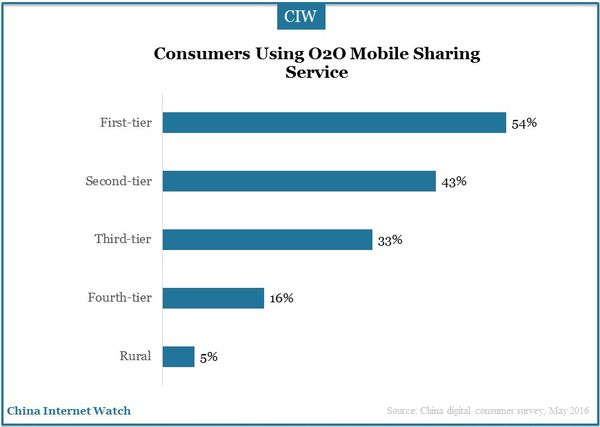

54% Chinese consumers from the first-tier cities are likely to use O2O mobile sharing service, followed by users from the second-tier cities (43%).

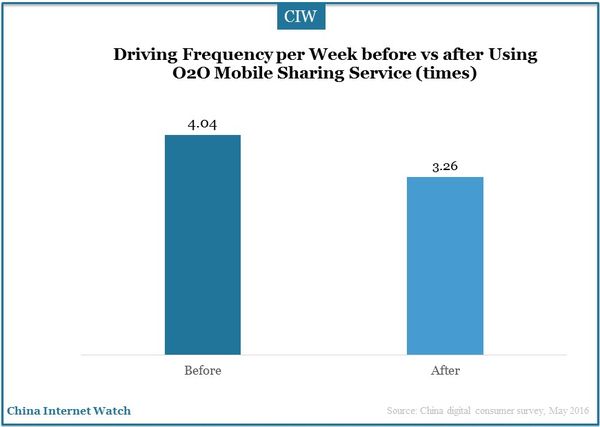

After using O2O mobile sharing service, Chinese consumers drive less per week is down to 3.26 times compared with 4.04 times before.

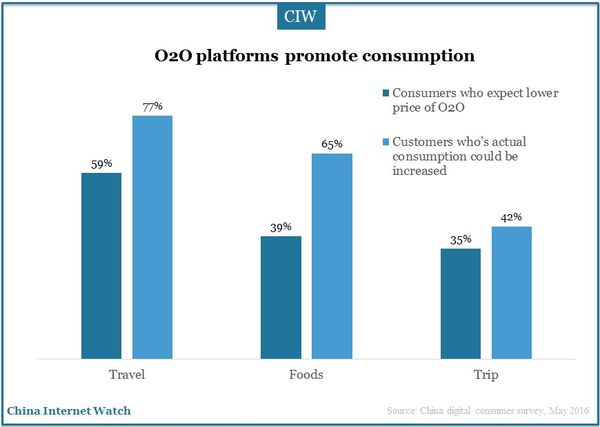

77% Chinese consumers’ actual consumption on travel services could be increased in the future, followed by foods (65%). Consumers who expect lower prices while using travel service on O2O platforms account for 59%.

The third-tier cities and below own a huge room of O2O market. China O2O companies were busy expanding to tier-3 and tier-4 cities in 2015.

Also read: Chinese online shoppers insights 2016