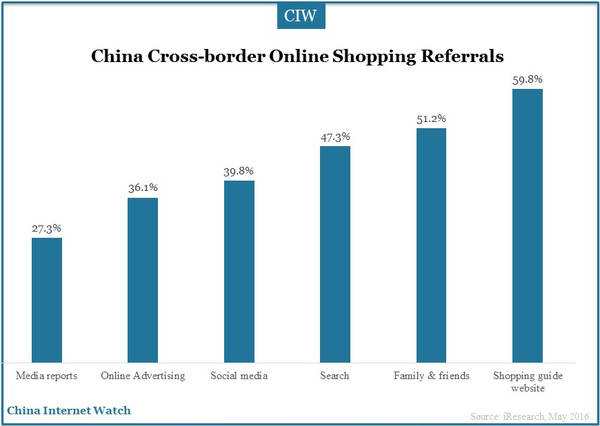

Shopping guide websites are the top referral of China cross-border online shoppers (59.8%), followed by family & friends (51.2%) and search (47.3%) according to iReseach.

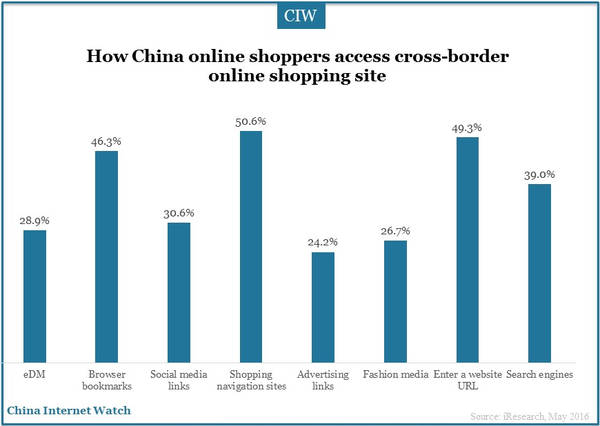

50.6% China online shoppers access cross-border online shopping sites via shopping navigation sites; 49.3% by entering a website URL, 46.3% via browser bookmarks.

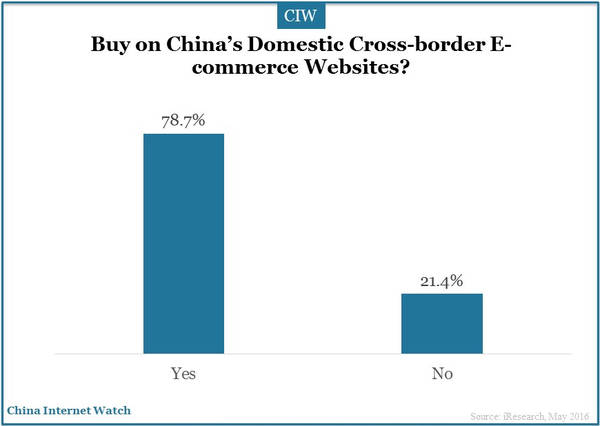

Nearly 80% online shoppers purchase on domestic cross-border e-commerce websites such as Tmall Global and JD Worldwide.

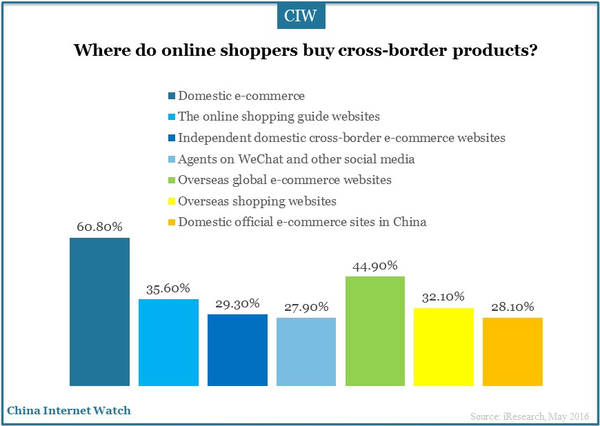

60.8% online shoppers buy cross-border products through domestic e-commerce channels while 40.9% online shoppers through overseas global e-commerce websites.

The top 3 cross-border online shopping categories are makeup & skin care (45.7%), mother & baby products (39.3%), and health supplements (38.6%).

The U.S. is the most popular source for cross-border online shopping, accounts for 53.9%, followed by Japan (45.7%) and Korea (35.3%).

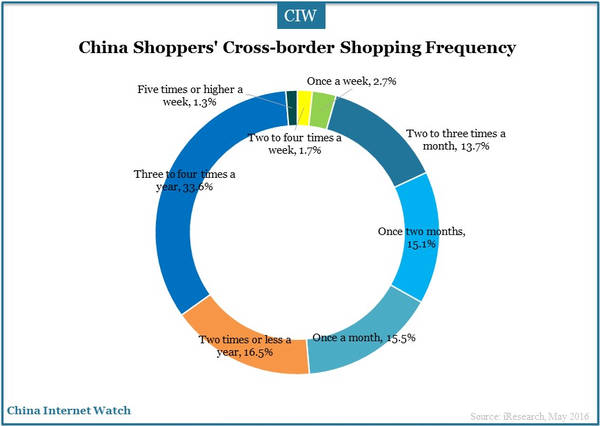

33% Chinese online shoppers shop cross-border three to fourth times a year.

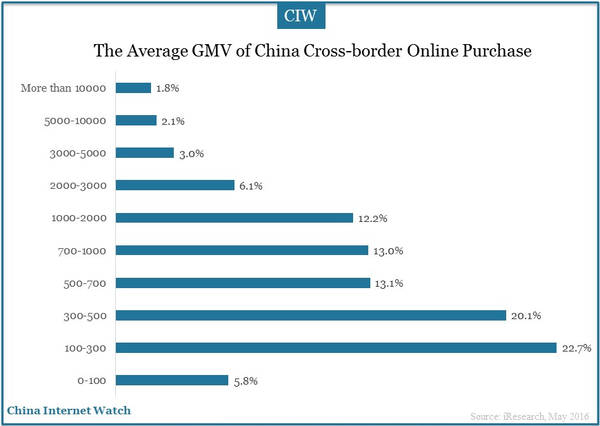

The average GMV of 42.8% China’s cross-border online shopping is between 100 and 500 yuan.

About 58% Chinese online shoppers’ average monthly spend on cross-border online shopping is over 1,000 yuan (USD 299).

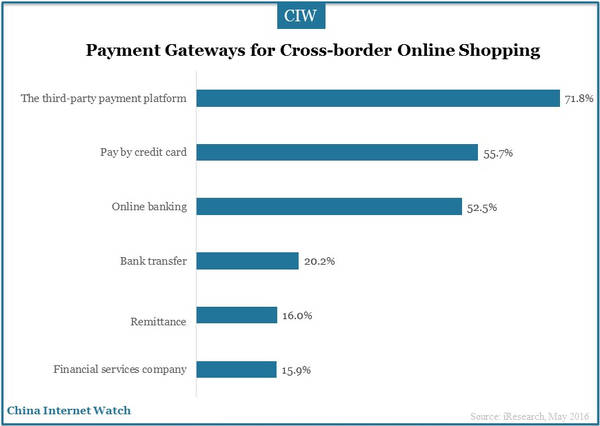

71.8% online shoppers prefer using the third-party payment platforms to pay.

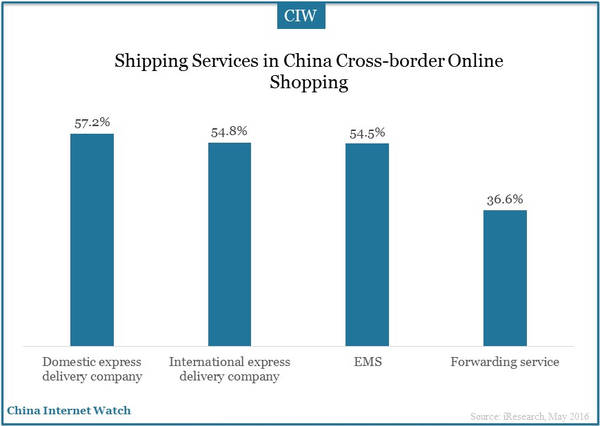

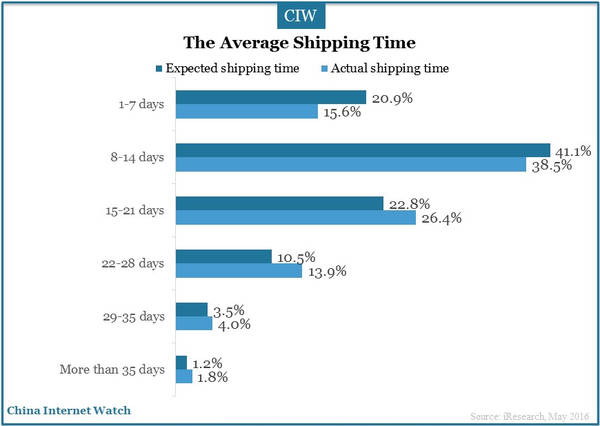

62% Chinese cross-border online shoppers expect to receive the products within 2 weeks; but, about 54% orders were delivered within 2 weeks.

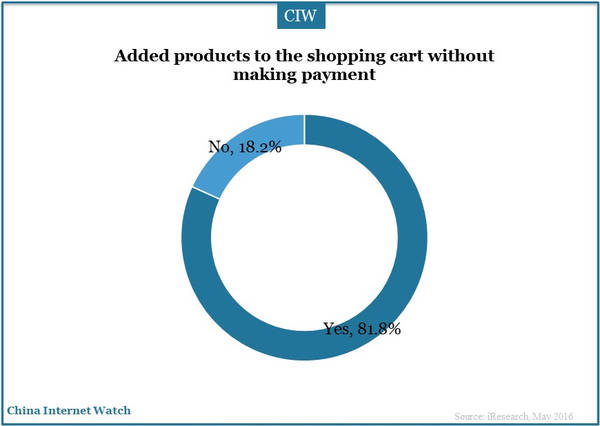

81.8% online shoppers added products to their shopping carts and made no payment.

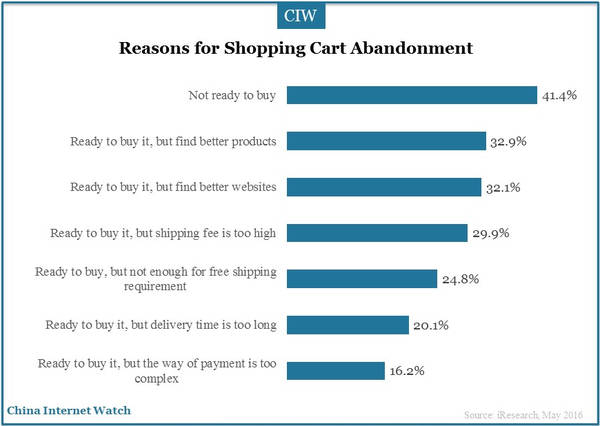

41.4% online shoppers in the end did not make payment because they were not ready for the final buying decision; or, some were ready to buy, but found better products later (32.9%).

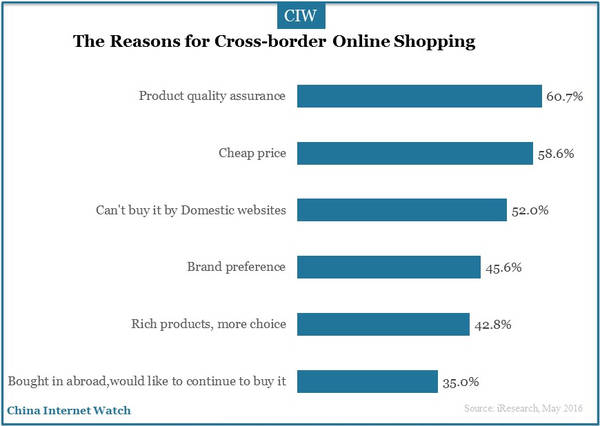

Product quality is the top reason for Chinese cross-border online shopping, followed by cheap price (58.6%).

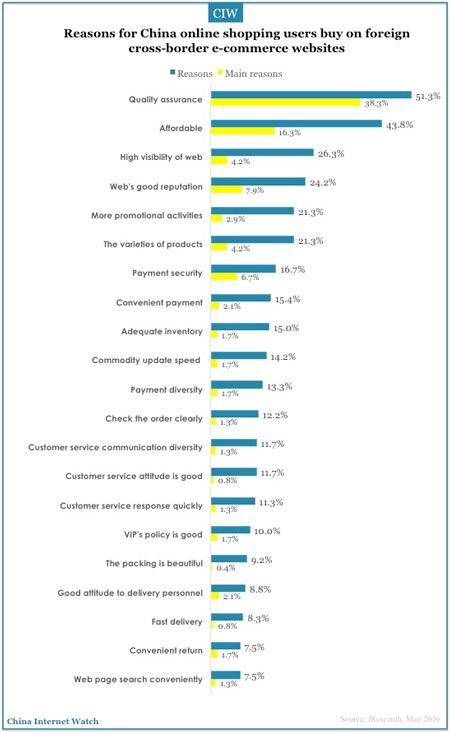

The reason for Chinese consumers to choose an overseas website for online shopping lie on quality assurance (51.3%), affordable price (41.8%), etc; and, 38.3% shoppers consider the quality assurance the main reason to shop on foreign websites.

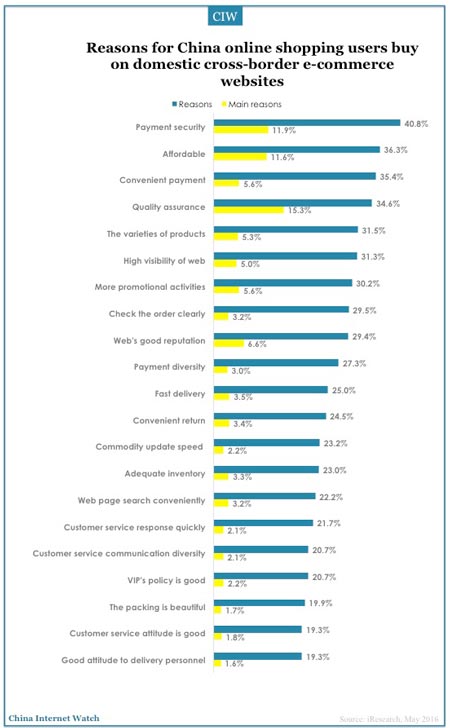

For online shoppers who choose domestic websites for cross-border online shopping, payment security (40.8%), affordable price (36.3%), and convenient payment (35.4%) are top 3 influencing reasons; but quality assurance ((15.3%)) remains the top of main reasons, followed by payment security (11.9%).

91% Chinese cross-border online shoppers would continue cross-border online shopping in the future.

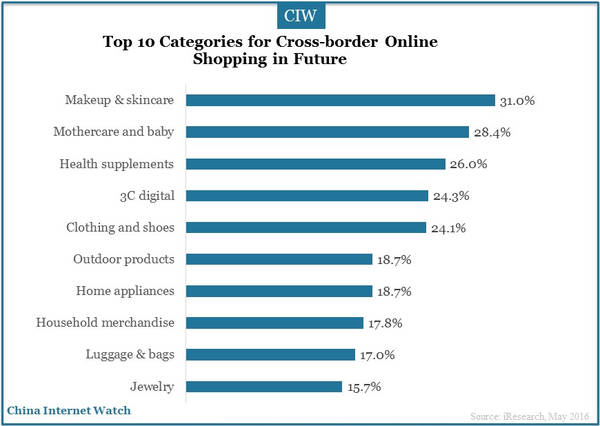

n the future, makeup & skincare (31.0%) will be popular products in the cross-border online shopping market, followed by mother & baby products (28.4%) and health supplements (26.%).

E-marketer estimated that China’s each online shoppers will spend an average of $473.26 on foreign goods. By 2020, the cross-border consumers will account for 50.7% of total digital consumers, up from 20% in 2014.

Read more: China cross-border consumers to account for over half of total digital consumers by 2020