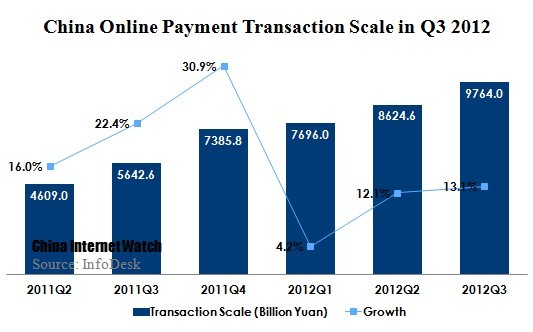

According to EnfoDesk, the total transaction of China online payment market reached 976.4 billion Yuan (USD156.4 bilion) in the third quarter. The QoQ growth was 13.1% and the YoY growth was 73%.

Influenced by National Day holidays and other business trips, online payment transaction for travel booking experienced obvious increase. And some emerging markets like retailing, cross-border trading also kept mushrooming.

Here are 3 trends in third-party online payment industry:

- Quick payment services develop rapidly. Following the steps of Alipay and Unionpay, payment enterprises like Tenpay, 99Bill and Chinapnr accelerate their development into quick payment services.

- Increased innovation in mobile payment. In Q3, Alipay established some mobile payment products based on the application of QR code and LBS. Tenpay cooperated with weixin to release Micro-life Payment Services, which may be a helpful strategic step for the process of O2O.

- Most payment enterprises expand into their offline POS region. Take Chinapnr as an example. It has founded branches for POS services in more than 30 cities, speeding up its overall arrangement to compete in the POS services market via agencies.