Retail sales in China’s skincare and cosmetics products market will grow at an average annual rate of 12.8% from 2016 to 2019, much higher than the global average of 6.0%, and will top RMB 287 billion (USD 44 billion) in 2019 according to Euromonitor International.

The proportion of young women who have the habit of making up (88%) is higher than that of mature women (83%) according to an HKTDC survey. 27% of the respondents said they would “make up every day”, the majority (59%) said they “only make up when the occasion requires” and 14% said they “do not wear any makeup”. And, the higher the monthly household income of respondents, the more likely they are to wear makeup every day according to the same survey.

Participants in the focus group discussions contended that usually three basic items are needed for putting on “light makeup”, while over 10 cosmetics products are required for putting on “full makeup”. Meanwhile, the types of cosmetics used also change according to different seasons and fashion trends.

Respondents said they use on average 4.7 different cosmetic products on average, with the most frequently used items being BB/CC cream (57%), makeup remover (46%), sunscreen/sunblock (44%), lipstick (37%) and foundation (34%). The proportion of young respondents using products such as BB/CC cream, makeup remover and sunscreen/sunblock is considerably higher than that of the more mature respondents.

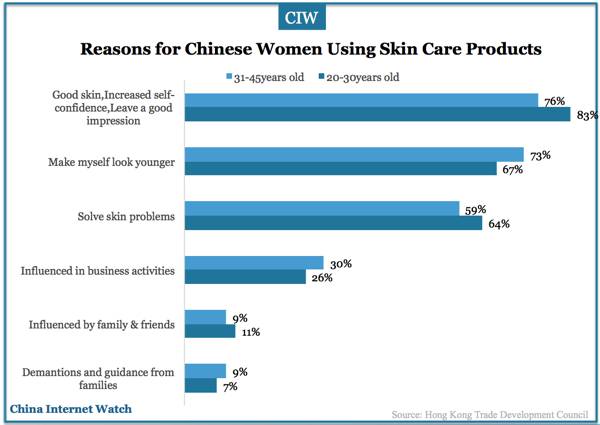

The main reason for Chinese women wearing makeup is “to make oneself look prettier and boost confidence” according to the HKTDC survey. The higher the monthly household income, the higher the proportion of respondents who believe that putting on makeup can “express one’s personal image and taste” as well as “show respect for others”.

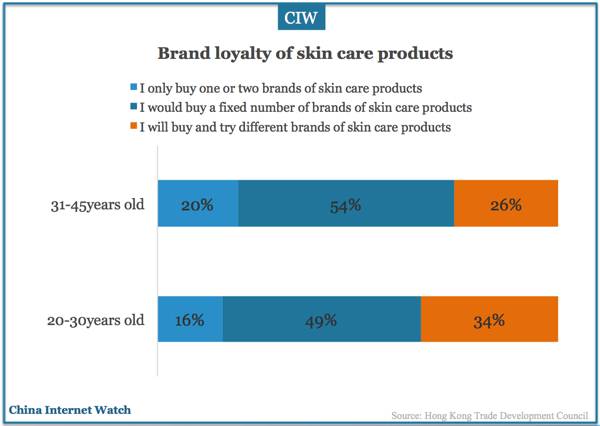

When it comes to buying and using cosmetics products, 52% of the respondents would stick to several specific brands. Among the young respondents, 34% said they would buy and try different brands of cosmetics, while the more mature respondents (28%) are less eager to try new brands.

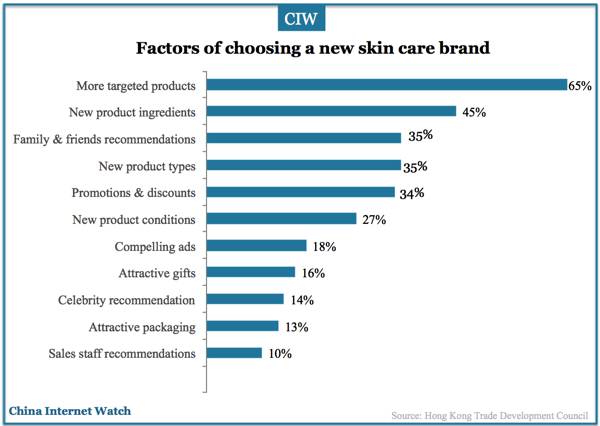

Overall, respondents’ cosmetics brand loyalty is quite high. In light of this, when a new brand enters the mainland market, it has to offer innovative products or novel makeup themes before it can attract the attention of consumers.

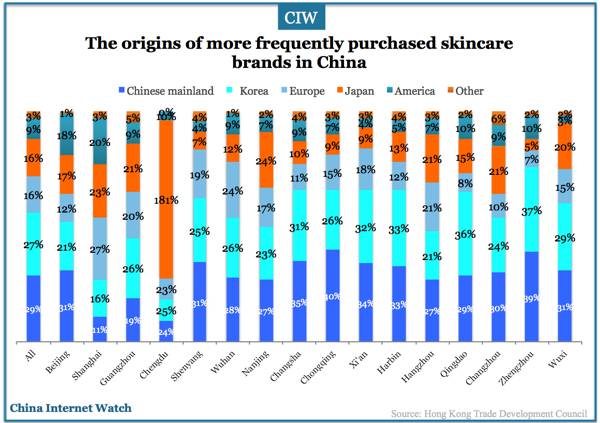

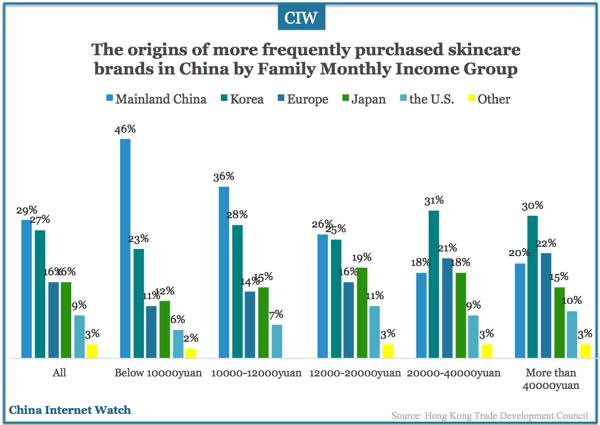

The price of imported cosmetics brands is higher than that of mainland brands. Hence, the purchasing power of a consumer affects her product choice to a certain extent.

Also read: 88% China Tier-2 Consumers Buy Overseas Online in 2015