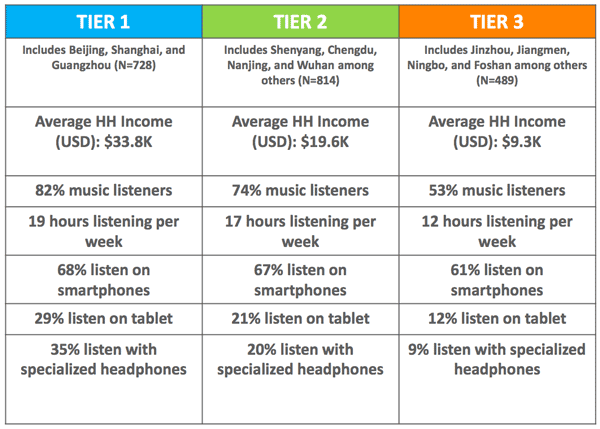

Music consumption behaviors across China vary by income levels and understanding the differences between different city tiers is critical to marketers according to the Nielsen Music 360 report.

72% of the general population in China listens to music for an average of 16 hours per week. The population with the highest average household incomes are the most engaged music listeners, spending more time and more money on music than the rest of the population according to Nielsen.

Tier 1 Chinese consumers, from Beijing, Shanghai and Guangzhou, are 15% more likely to be music listeners than the general population. They spend more time listening to music – 19 hours a week on average – and more of their discretionary income on music. They were also the most likely to listen to English language music, particularly jazz, pop and rock.

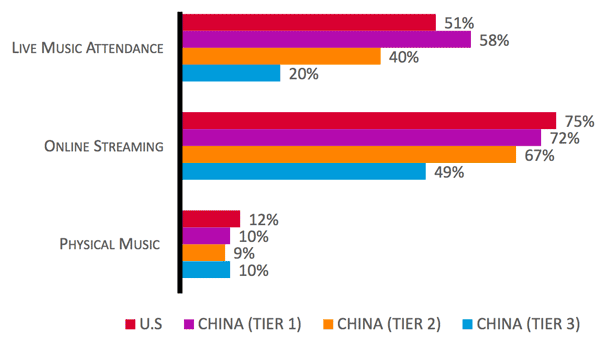

57% of tier 1 respondents attend live music events, compared with 51% of the U.S. general population. And, 71% of tier 1 listeners in China listen to an online streaming service in a typical week, in line with 75% of U.S. music listeners.

74% of China’s tier-2 consumers are music listeners and are on par with the national average for listening hours per week.

Tier 3 consumers spend the least amount of time listening to music and allocate the least amount of their total entertainment spending on music; they are nearly as likely to listen on a smartphone as more affluent consumers.

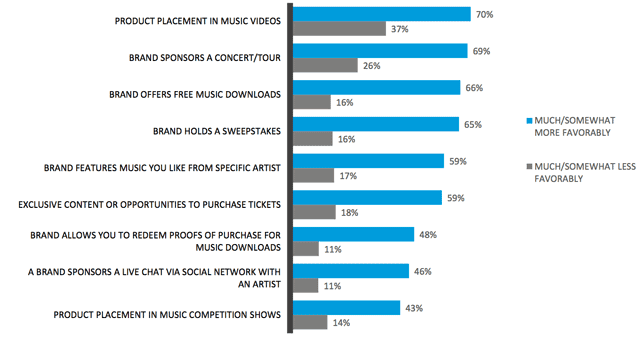

Nielsen suggests that involvement in music-based sponsorships could be a solid way to reach Chinese consumers. Not only are they highly engaged with music, but they are generally favorable when a brand is involved, with the highest net favorability going to promotions that offer free music downloads or sweepstakes.

Also read: 7 Habits of China Online Shoppers