Offline merchants hoped to get more consumers and profits by accessing to the O2O platforms in China in 2015. Tier-3 and tier-4 cities have been a new expanding regions for the O2O platforms. Meituan maintained a prominent position in the less developed cities.

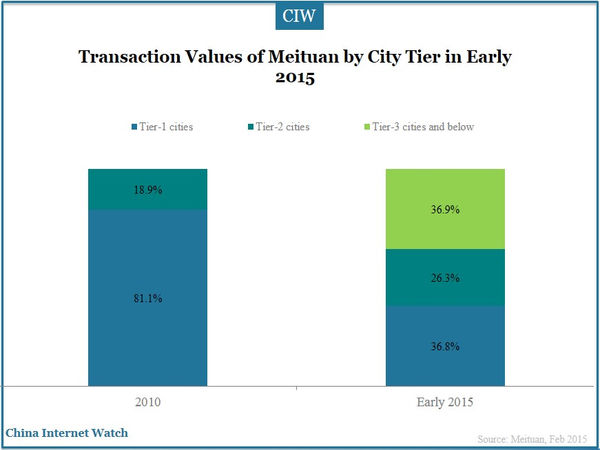

China O2O companies were busy expanding to tier-3 and tier-4 cities in 2015 as more consumers accessed to the service according to Tencent. For example, 36.8% of total transaction values of Meituan came from tier-3 and tier-4 cities in early 2015 and over 80% once came from tier-1 cities in 2010.

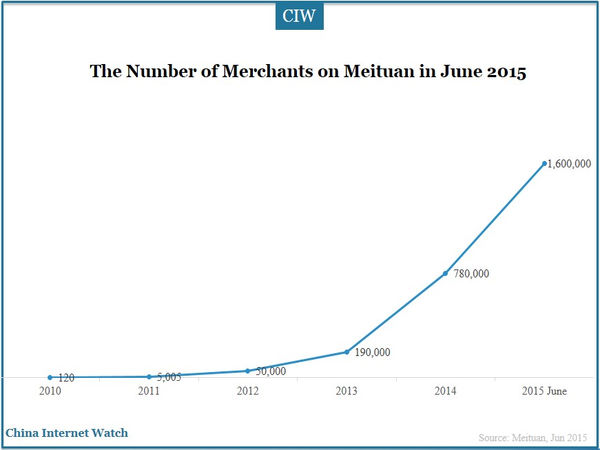

China O2O market entered a white-hot competition period in 2015 and companies tried hard to win consumers. The number of merchants on Meituan was only 780,000 in 2014 and the number increased to 1,600,000 in 2015.

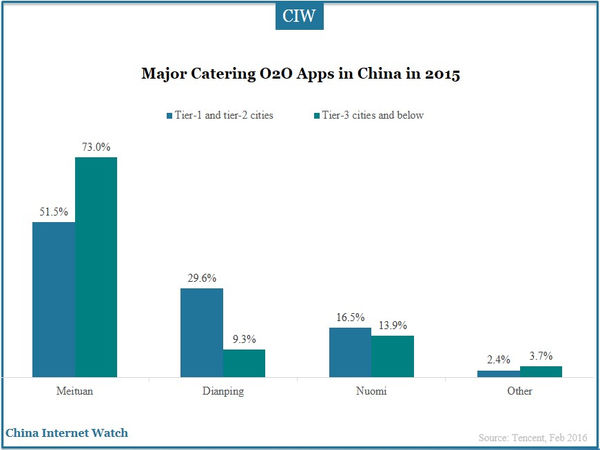

Major catering O2O apps were Meituan, Dianping, and Nuomi in China in 2015. Penetration of Meituan in tier-3 and tier-4 cities was far higher than that of other catering O2O apps.

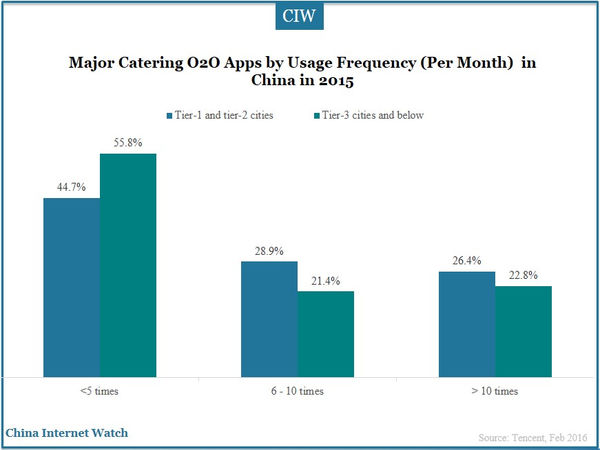

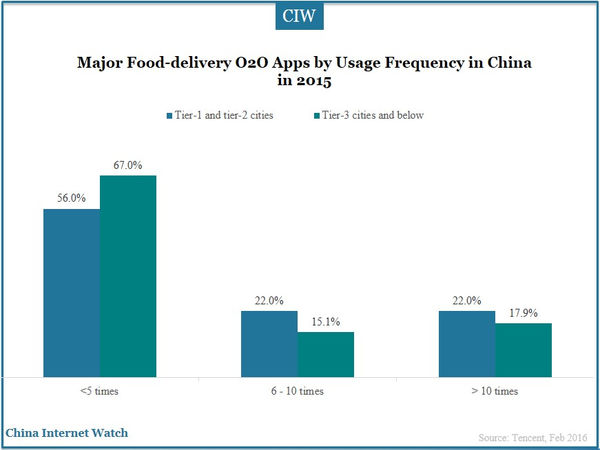

About 50% users would use catering apps less than five times per month according to Tencent and the usage frequency of tier-1 and tier-2 city users was higher than that of tier-3 and below city users in 2015.

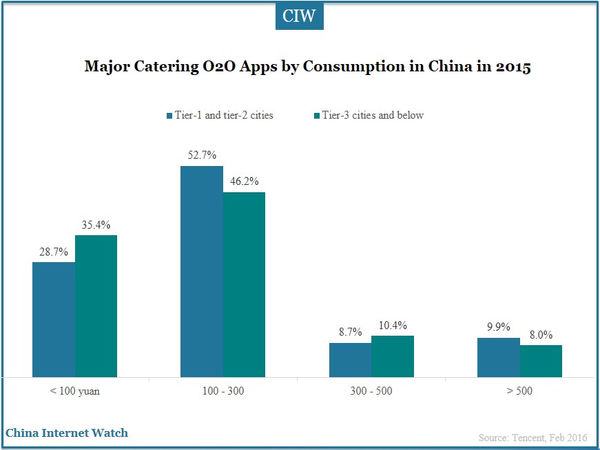

About half users spent 100 yuan to 300 yuan each time. 35.4% tier-3 and below city users spent less than 100 yuan and 28.7% tier-1 and tier-2 city users spent less than 100 yuan when catering with O2O apps. However, 10.4% tier-3 and tier-4 city users spent 300 yuan to 500 yuan higher than 8.7% of tier-1 and tier-2 city users.

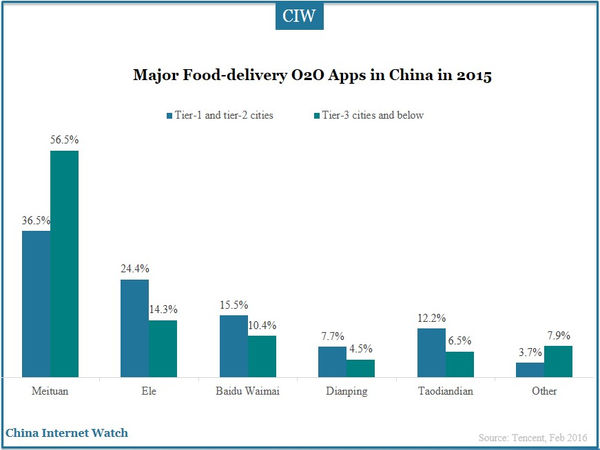

Competition among food-delivery O2O market also was fierce in 2015. Meituan played a more prominent role in tier-3 and tier-4 cities and the penetration rate surpassed others with a large gap. Penetration rate of food-delivery O2O apps didn’t have much gap in tier-1 and tier-2 cities.

The monthly usage of food-delivery apps came more frequently in advanced cities than less developed cities in China in 2015. The overall usage frequency of food-delivery O2O apps was fewer than the catering O2O apps.

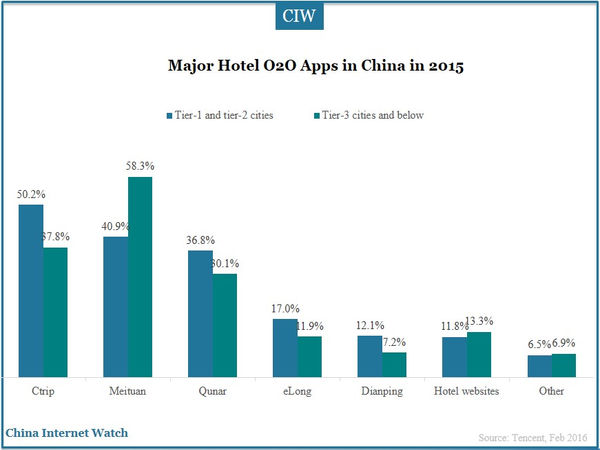

Ctrip was more active in tier-1 and tier-2 cities and Meituan was more active in tier-3 and tier-4 cities when booking hotels online.

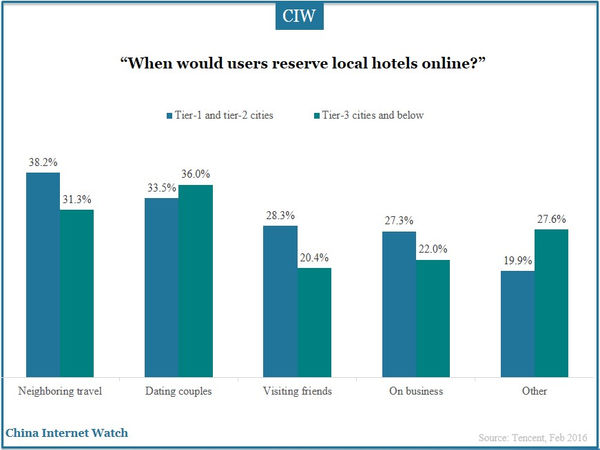

36.0% couples in tier-3 and tier-4 cities would reserve hotels online for dating and 38.2% users in tier-1 and tier-2 cities would book hotels for neighboring travel.

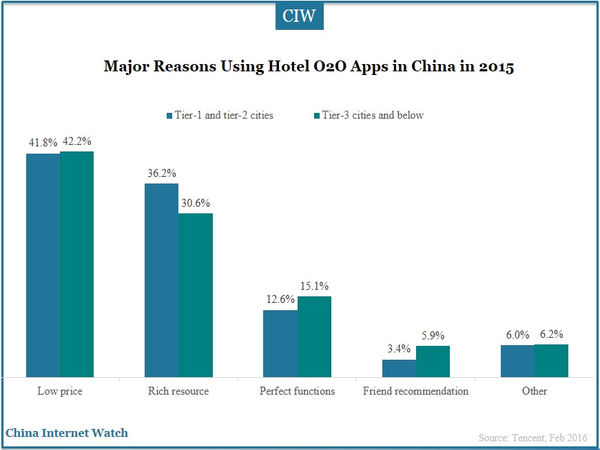

Low price, rich hotel resource, and perfect function of hotel O2O apps was the major reasons for users to reserve hotels online in China in 2015.

The increasing travel needs boosted the intense competition of hotel O2O apps. The top seven travel apps were Ctrip, Qunar, Meituan, Alitrip, Tuniu, CY, and eLong.

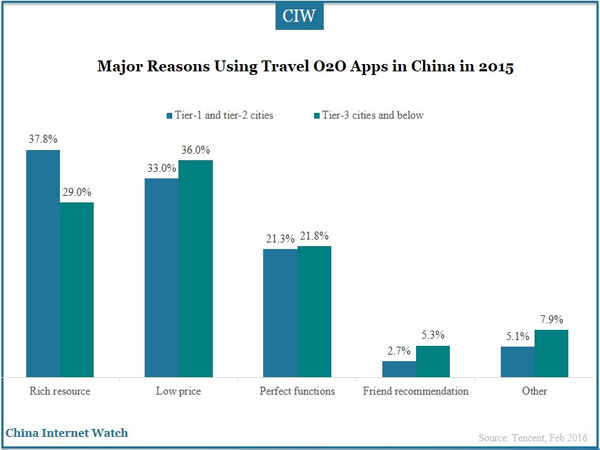

Rich resource was more important towards tier-1 and tier-2 city users than the less developed city users. Tier-3 and above city users concerned more on low price than other city users.

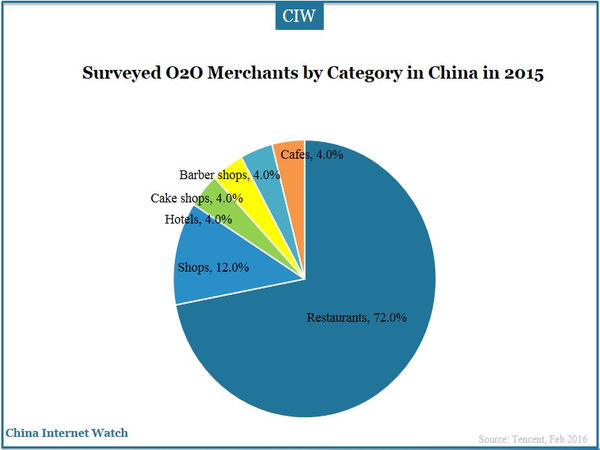

Catering O2O market developed into a mature stage in 2015. 72.0% merchants surveyed engaged in the catering industry in China in 2015.

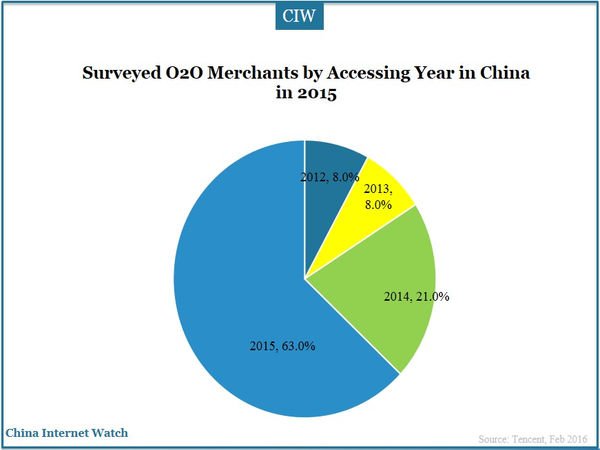

The recent two year had witnessed the fast development of the O2O market. 63.0% merchants accessed to the O2O market in 2015 and 21.0% accessed in 2014.

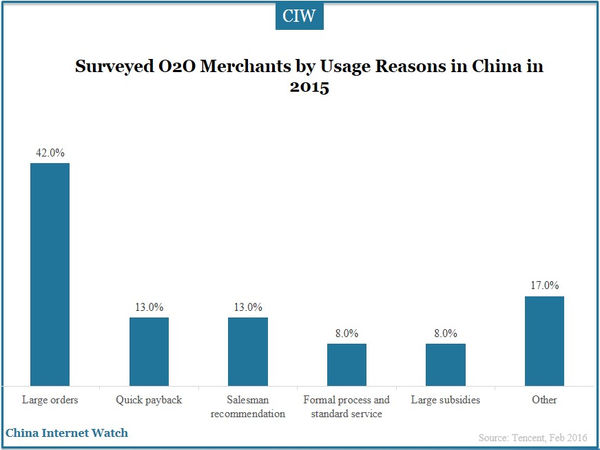

42.0% of offline merchants surveyed accessed to the O2O platforms because of the large orders online and 13.0% because of the quick payback speed. Promotion of salesman was also an important reason for the merchants to access to the O2O platforms.

By accessing to the O2O platforms, offline merchants hoped to get an increase in turnover, profit, and brand public praise.

About 50% of merchants surveyed believed their turnover increased by 10% to 30% after accessing to the O2O platforms and 32.0% believed their turnover increased by 30% to 50%.

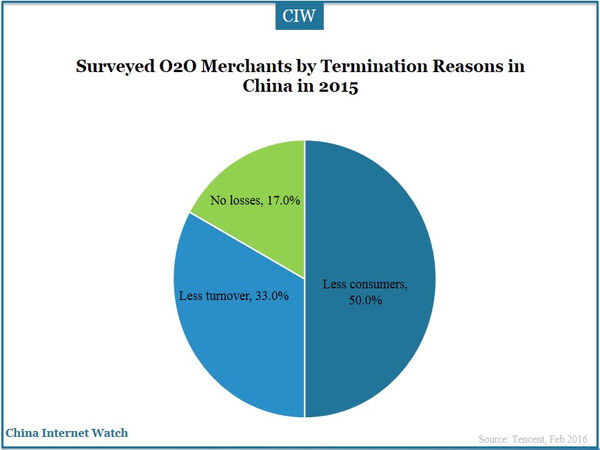

Some merchants terminated their cooperation with the O2O platforms. 50.0% terminated because of the loss of consumers and 33.0% because of the decrease of turnover.

The current cooperation mode of merchants and O2O platforms is subsidy plus discount which is expected to upgrade to maintain and draw more merchants and users. The O2O platforms could bring in more traffic and consumers for merchants while how to manage the merchants is still a severe challenge for O2O platforms.

Also read: China B2B Market Insights 2016