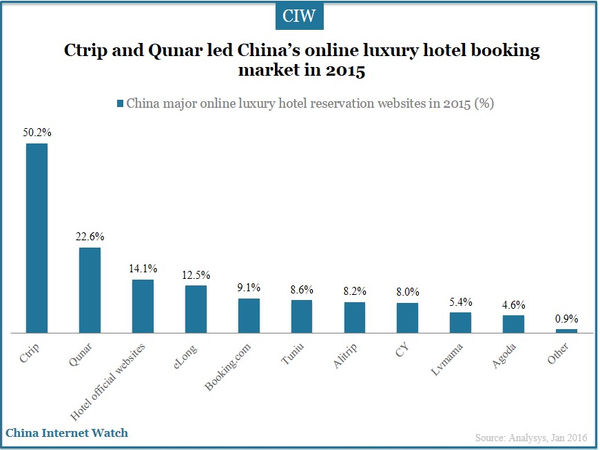

China major luxury hotels were located in relatively advanced regions. Male users accounted for 60.5% and users with monthly income of 5,000 yuan (US$762.8) to 10,000 yuan (US$1525.6) accounted for the bulk. Ctrip and Qunar led China’s online luxury hotel booking market according to Analysys.

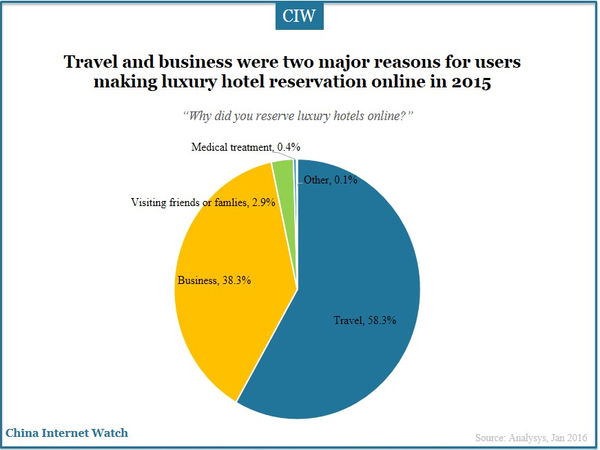

Travel and business were two major reasons for online luxury hotel users reserving luxury hotels online in 2015 accounting for 96.6% in total. China’s online travel market reached 122.23 billion yuan (US$19.07 billion) with an increase of 18.0% QoQ and 45.9% YoY in the third quarter of 2015.

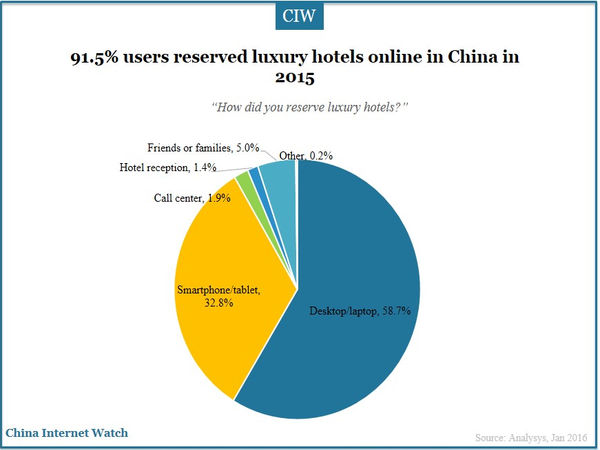

Online reservation has become the major method for luxury hotel users. 91.5% users reserved luxury hotels online in China and 32.8% reserved through mobile devices in 2015. Most luxury hotel users reserved in advance while 1.4% still reserved at hotel receptions.

Ctrip and Qunar which led China’s luxury hotel online booking market accounted for 50.2% and 22.6% of market share in 2015. 14.1% users reserved hotel on hotel official websites.

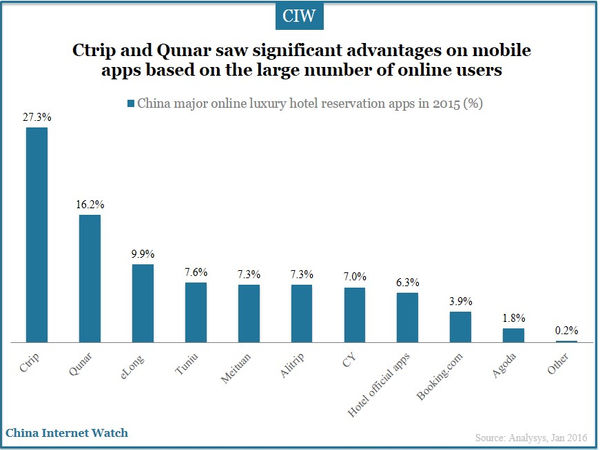

Mobile app users were influenced by PC end users and the mobile user experience. Ctrip and Qunar saw significant advantages on mobile app users based on their large number of online users in 2015.

China online luxury hotel subscribers paid more attention to true hotel information and the number of available hotels when purchasing on online platforms in 2015. Authentic reviews and ratings were also among the influential factors.

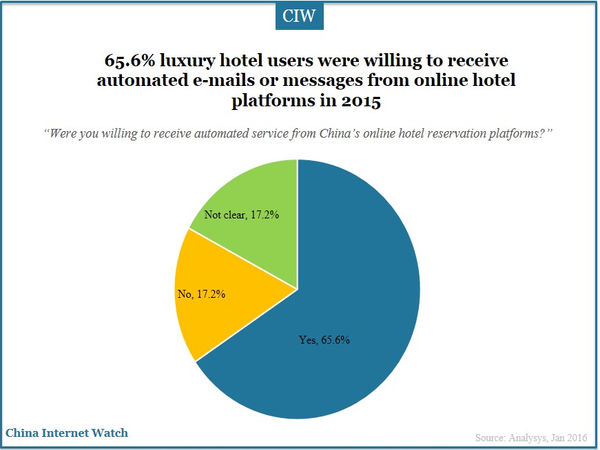

China online luxury hotel users were more friendly towards automated information from hotels. 65.6% luxury hotel users were willing to receive automated e-mails or messages in 2015 and only 17.2% were not willing.

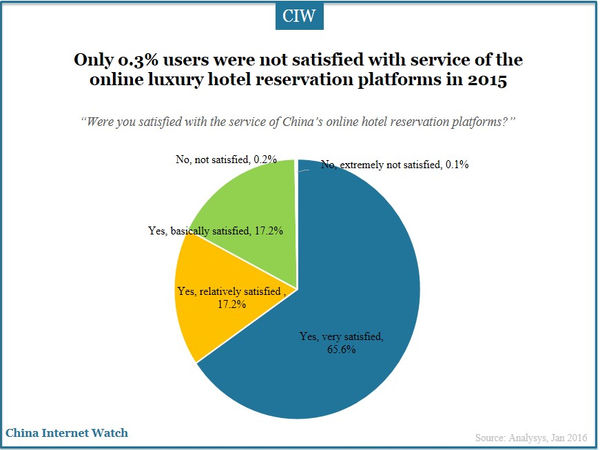

Online luxury hotel users were more satisfied with online hotel reservation platforms compared with general hotel users in China. Only 0.3% users were not pleased with service of the online luxury hotel reservation platforms in 2015.

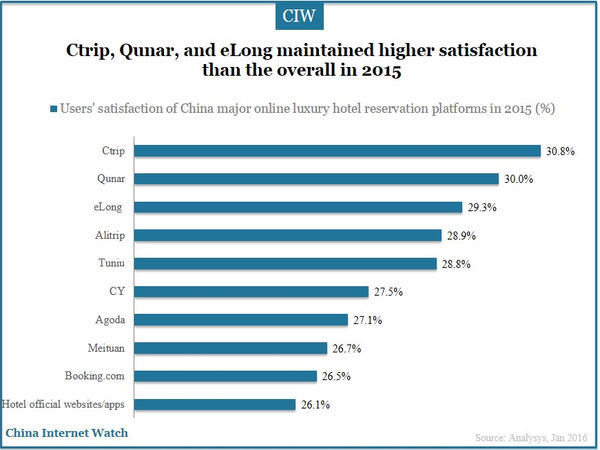

The overall satisfaction of China online luxury hotel reservation platform was 29.2% in 2015. Ctrip, Qunar, and eLong maintained higher satisfaction than the overall in 2015.

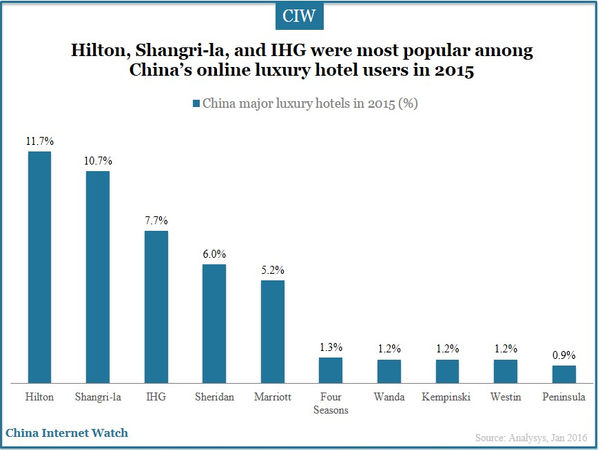

The number of overseas luxury hotels were more compared with domestic like hotels among popular luxury hotels in China. Hilton, Shangri-la, and IHG were most popular among China’s online luxury hotel users in 2015.

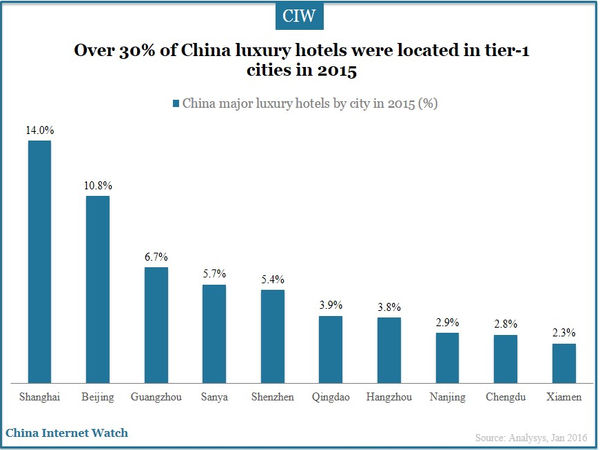

China major luxury hotels were located in relatively advanced provinces and cities. Location of luxury hotels was affected by regional economic level. Shanghai, Beijing, Guangdong and other advanced cities owned more luxury hotels.

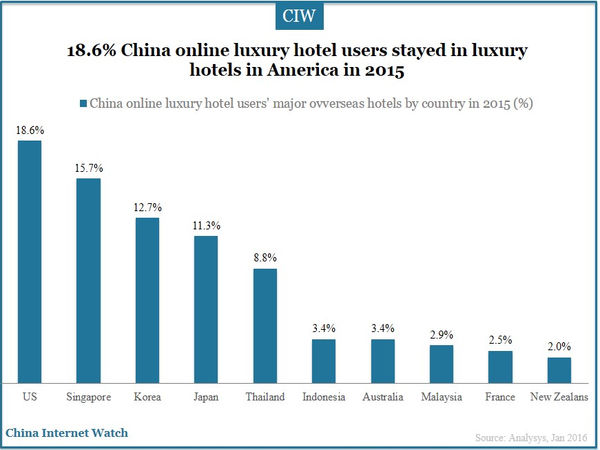

Among China online luxury hotel users in 2015, 18.6% reserved hotels in America, 15.7% reserved hotels in Singapore, and 12.7% reserved hotels in Korea. Destination countries were basically the same with popular outbound travel countries.

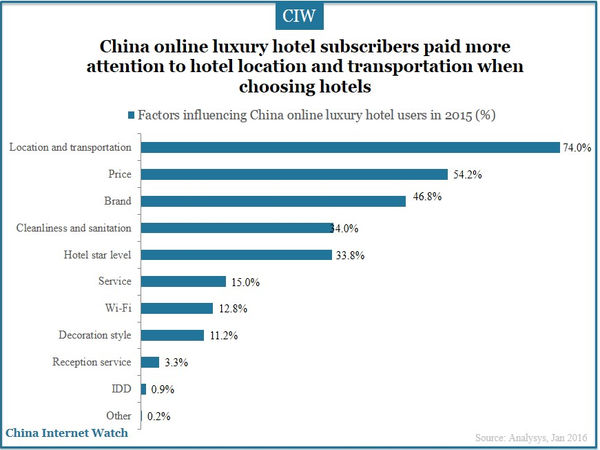

China online luxury hotel subscribers paid more attention to hotel location and transportation facilities when choosing hotels online. Wi-Fi has become a necessity to attract China’s hotel users.

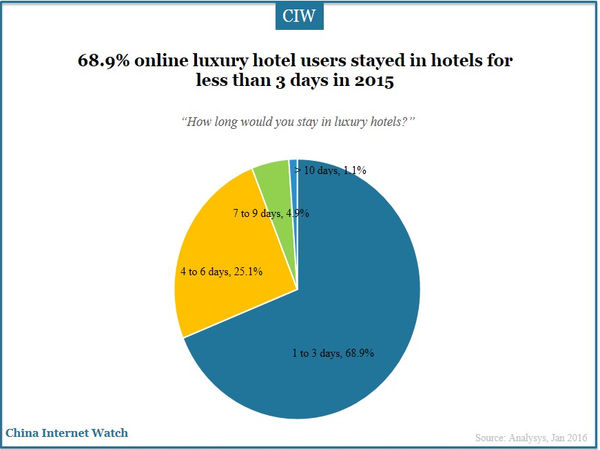

68.9% of online luxury hotel users stayed in hotels for less than 3 days in 2015, 28.9% four to six days, and 4.9% seven to nine days. Only 1.1% users lived over 10 days.

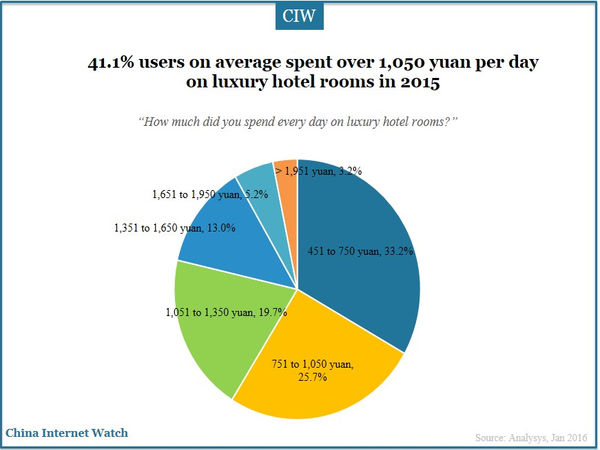

41.1% of users spent over 1,050 yuan (US$160.2) per day on average on luxury hotel rooms in 2015. Users spending less than 1,050 yuan on hotel room every day accounted for the majority.

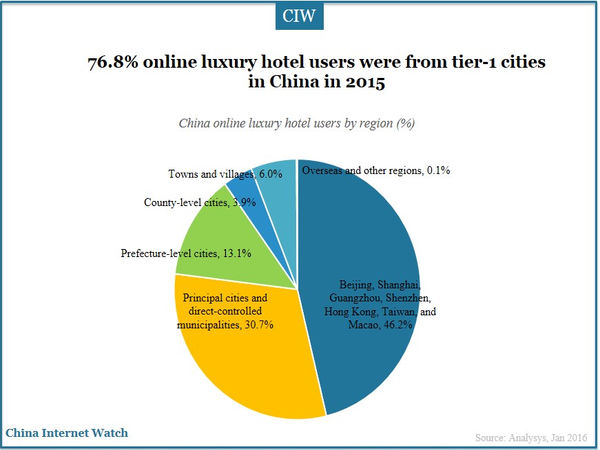

76.8% of online luxury hotel users came from tier-1 cities in China in 2015. Users from Beijing, Shanghai, Guangzhou, Shenzhen, Hong Kong, Macao, and Taiwan accounted for 46.2% in total and users from principal cities and direct municipalities accounted for 30.7%.

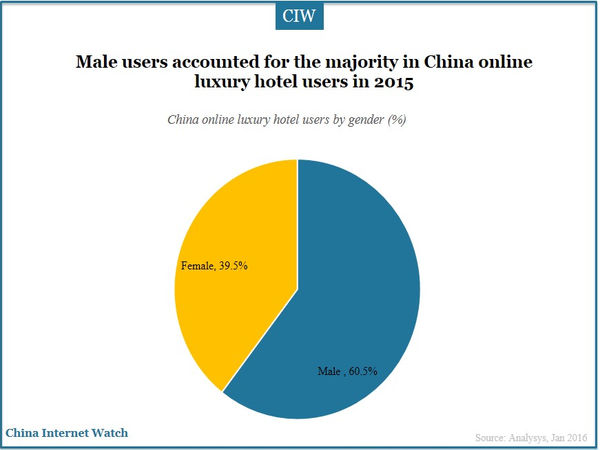

Male users accounted for 60.5% of China online luxury hotel users in 2015 and the female accounted for 39.5%.

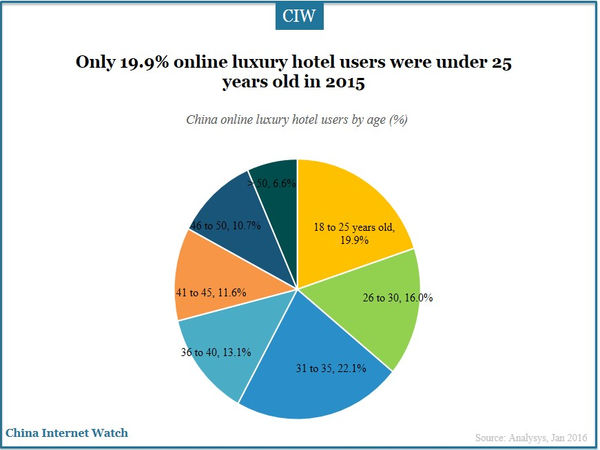

Users aged 31 to 35 years old were the driving force of online luxury hotel users in 2015. Only 19.9% online luxury hotel users were under 25 years old in 2015.

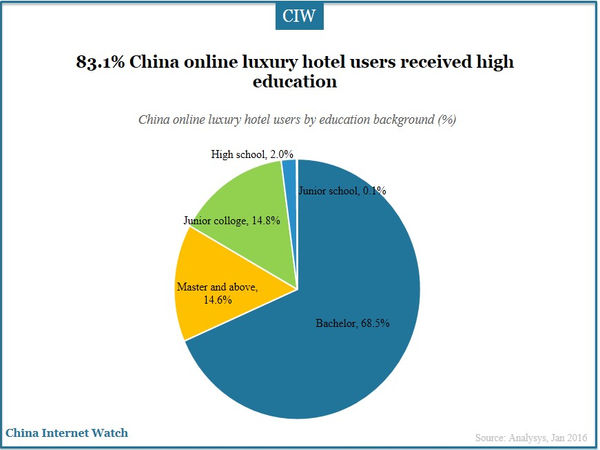

In generally, China online luxury hotel users had received high education. 68.5% had college background and 14.6% had master and above educational background.

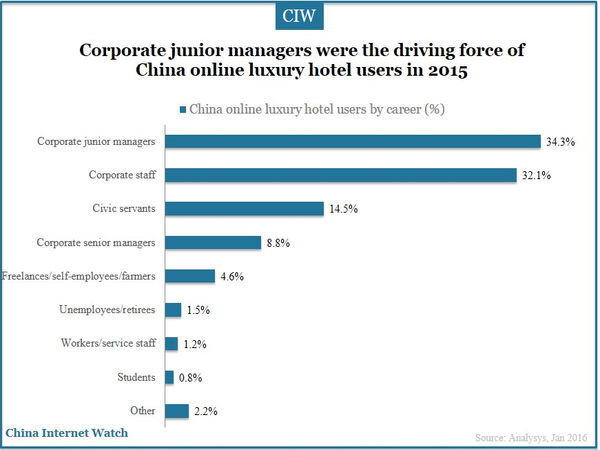

Corporate junior managers (34.3%) were the major users of online luxury hotels in 2015, followed by corporate staff (32.1%) and civil servants (14.5%).

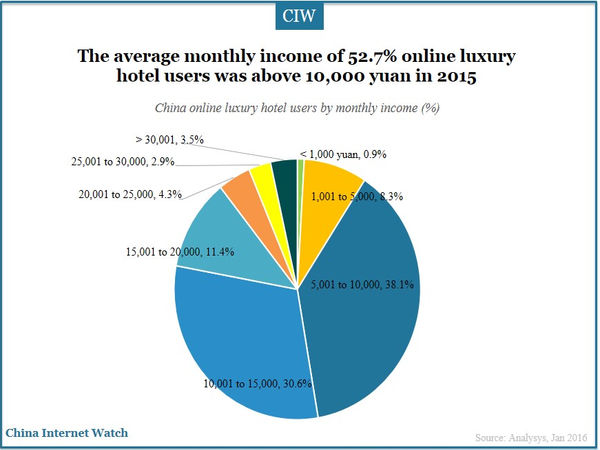

The average monthly income of 52.7% online luxury hotel users was above 10,000 yuan in 2015. Users with monthly income of 5,000 yuan to 10,000 yuan accounted for the bulk.

Also read: China Short-term Accommodation Market Overview 2015