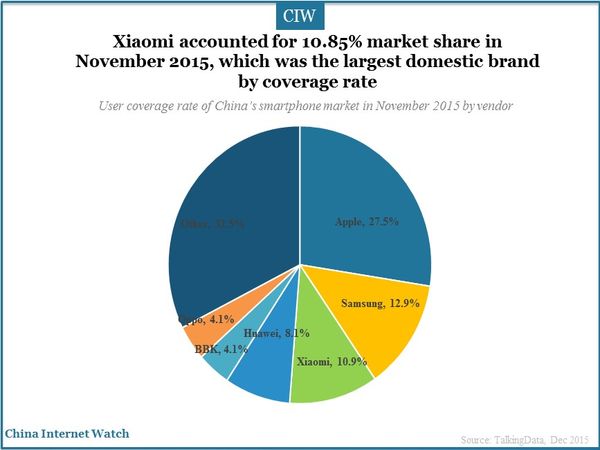

Xiaomi accounted for 10.85% of China’s smartphone market in November 2015, which was the largest domestic brand by total user coverage rate.

However, Apple’s iPhone 6S still ranked first in market share by total user coverage rate, followed by Samsung. Huawei followed Xiaomi ranked the fourth.

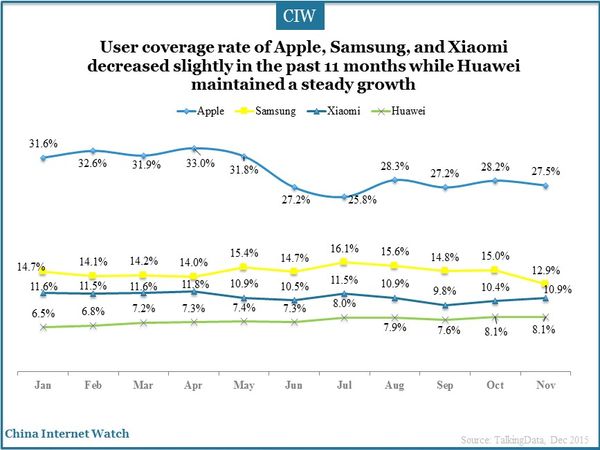

User coverage rate of Apple, Samsung, and Xiaomi decreased slightly in the past 11 months while Huawei maintained a steady growth. The year 2015 has witnessed strong growth of Huawei smartphones.

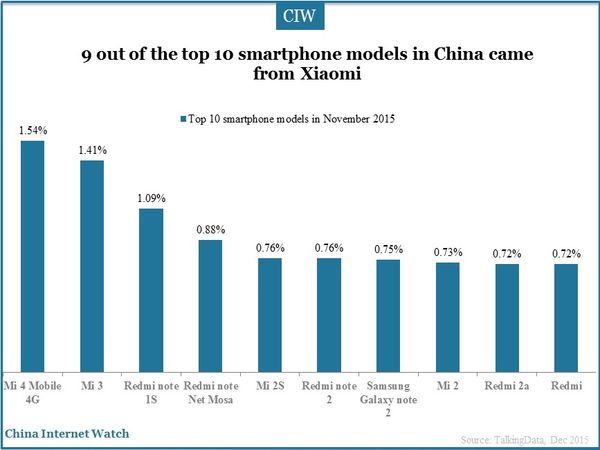

Although public attention and company competitiveness of Xiaomi were lower than Apple and Samsung, Xiaomi was obviously strong in product promotions. 9 out of the top 10 smartphone models in China came from Xiaomi and the remaining one was Samsung Galaxy Note 2.

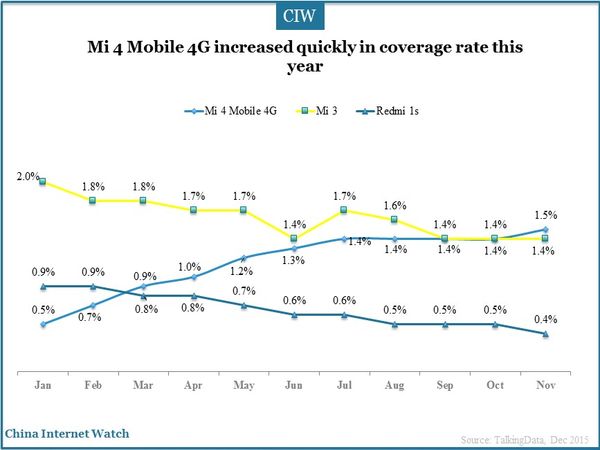

Mi 3 was launched in October 2013. Redmi 1S was launched in May 2014 and Mi 4 was promoted in July 2014. Mi 4 Mobile 4G sales grew quickly in coverage rate this year. Influenced by Mi 3 and Xiaomi Note which was launched early this year, Mi 3 and Redmi 3S decreased in users coverage rate.

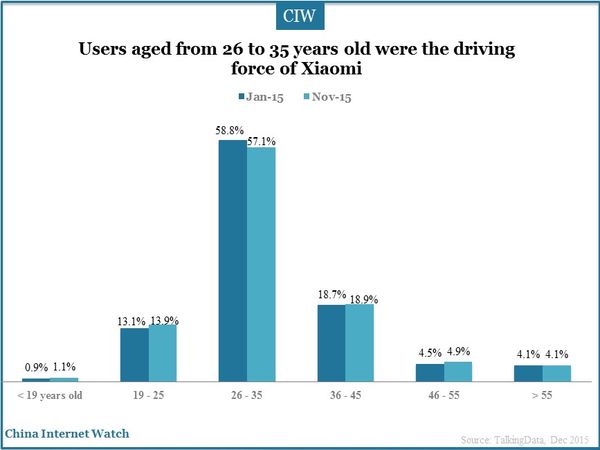

Users aged from 26 to 35 years old were the driving force of Xiaomi smartphones according to data of January and November of TalkingData. Users aged from 19 to 25 years old and from 36 to 45 years old were also an important component of Xiaomi smartphone users.

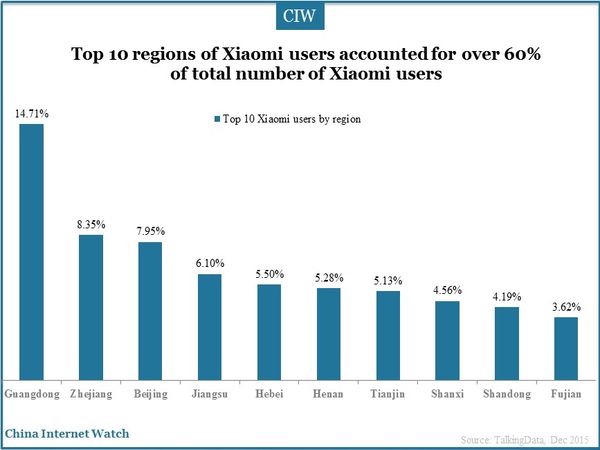

Top 10 regions of Xiaomi users accounted for over 60% of total number of Xiaomi users in November 2015. The top 10 regions were mainly located in eastern coastal and central China.

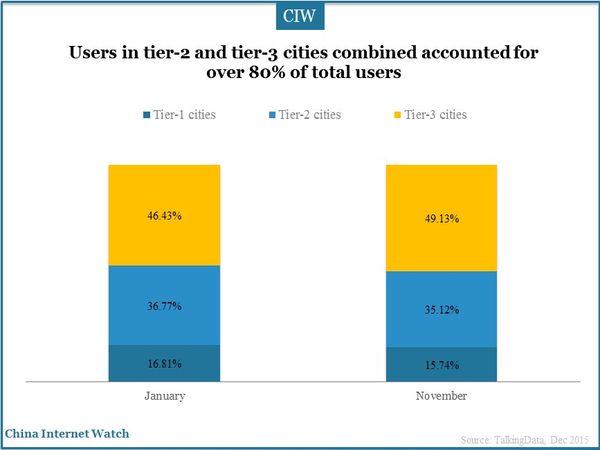

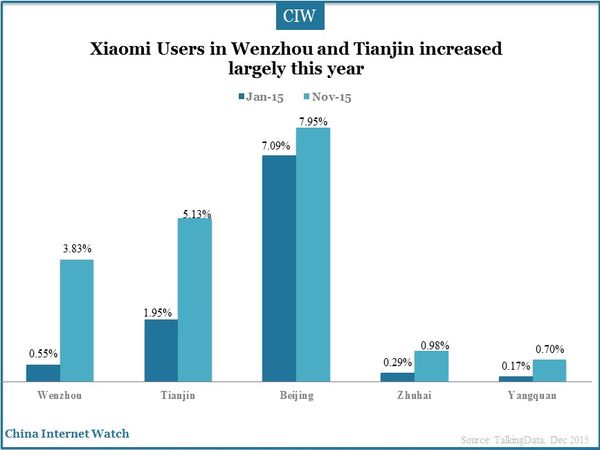

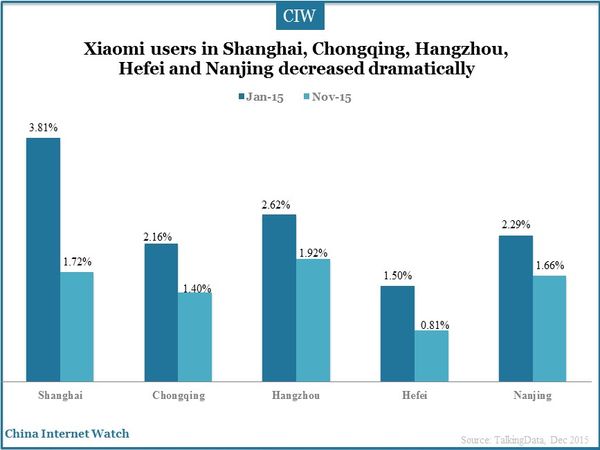

Users in tier-2 and tier-3 cities combined accounted for over 80% of total users. Mi 3 and Mi 4 with higher prices had larger penetration rate in tier-1 cities than Redmi 1S. Xiaomi Users in Wenzhou and Tianjin increased largely this year and users in Shanghai, Chongqing, Hangzhou, Hefei and Nanjing decreased dramatically.

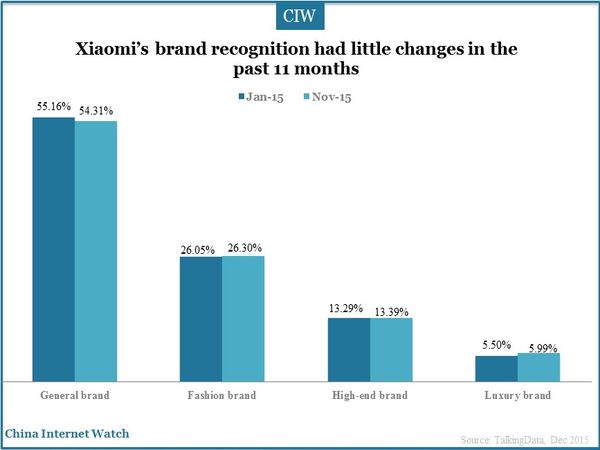

Xiaomi’s brand recognition had few changes in the past 11 months. Xiaomi at first targeted the young generation aged from 25 to 35 years old with low price and high performance. However, Xiaomi also launched phones over 2,000 yuan (US$308.73) targeting middle and high-income consumers.

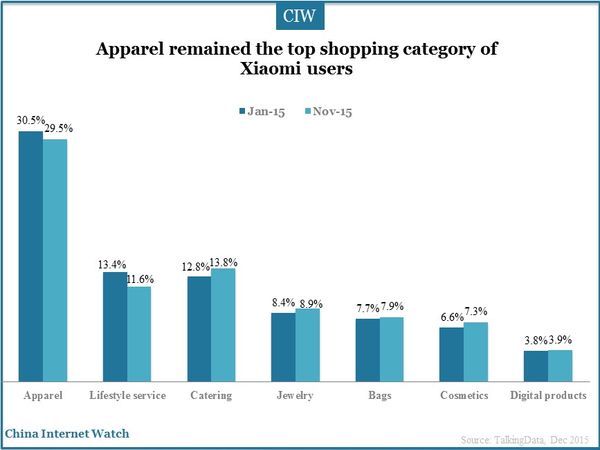

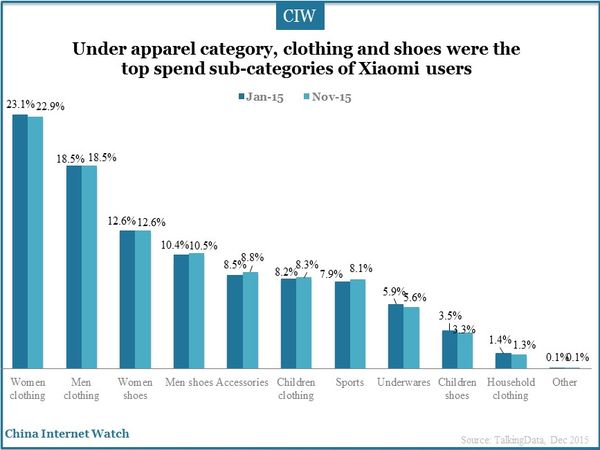

Apparel remained the top shopping category of Xiaomi users although the ratio was 3 percentage points lower in November compared to January 2015. And under apparel category, clothing and shoes were the top spends sub-categories of Xiaomi users.

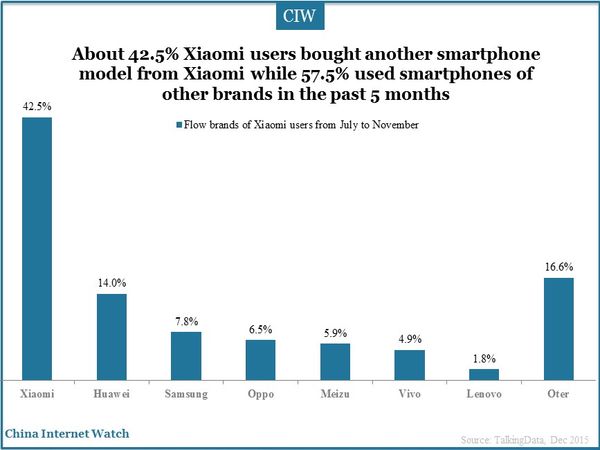

About 42.5% were loyal customers of Xiaomi who bought another smartphone models from Xiaomi. However, other 57.5% bought other smartphone brands. Owing to the overlapping part of targeted customers, 14.0% of these bought Huawei products.

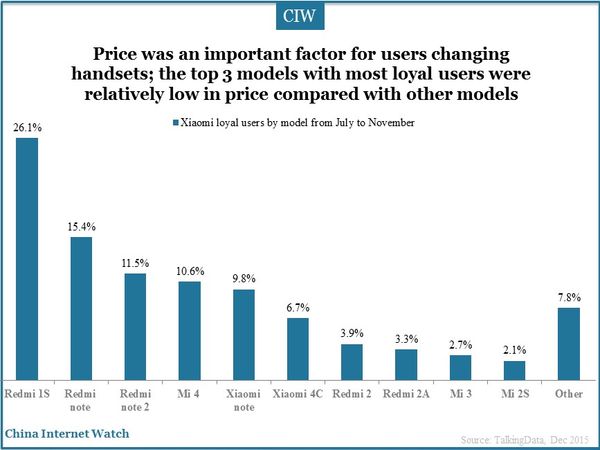

Pricing was an important factor for users changing handsets according to the top 11 Xiaomi models of most loyal users. The top 3 models with most loyal users were relatively low in price compared with other models. Mi 4 and Xiaomi 4C also gained many loyal users.

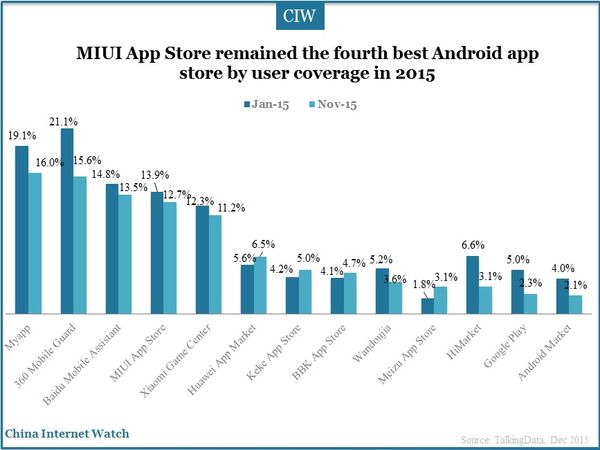

MIUI App Store remained the fourth best Android app store by user coverage in 2015 relying on a large number Xiaomi users, higher than Huawei, BBK, Maizu and other.

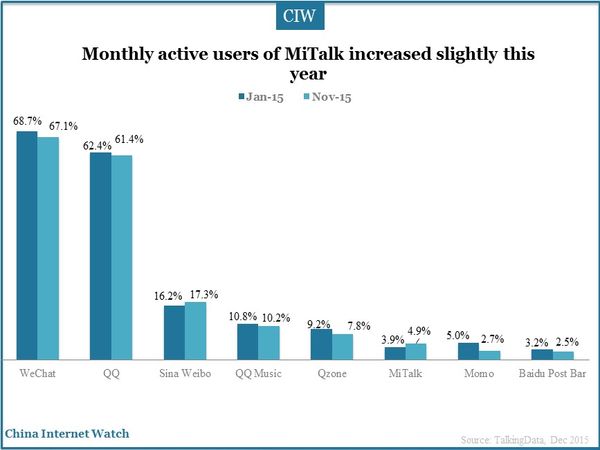

Compared with WeChat, Weibo and other main social platforms, the number of monthly active users of MiTalk was much less while it increased slightly in penetration rate in the past 11 months this year.

Besides smartphones, Xiaomi was also devoted in other smart devices including TV, smart bracelet, tablet, router, camera, water purifier and etc.