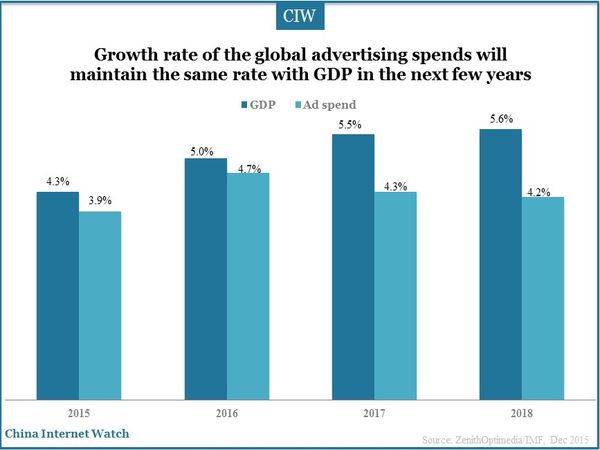

Global advertising spends will reach US$579 billion with an increase by 4.7% by the end of 2016 according to ZenithOptimedia. The global advertising market has maintained a steady growth of 4% to 5% since 2011.

Growth rate of the global advertising spends will maintain the same of about 4% to 5% in the next few years.

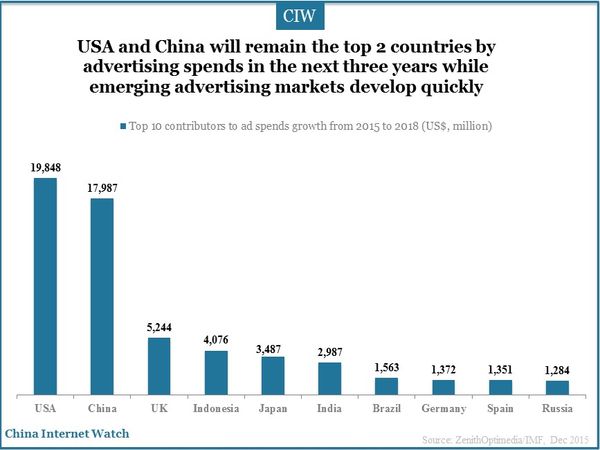

USA and China will remain the top 2 contributors to the total global advertising spends in the next three years while emerging advertising markets develop quickly. The global advertising market will grow by US$77 billion from 2015 to 2018. The United States will account for 26%, followed by China (24%), UK (7%), and Indonesia (5%).

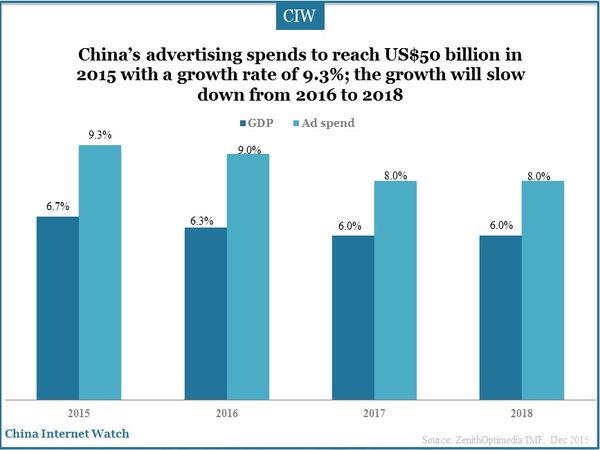

China will be one of the main driving forces of global advertising spends. China’s advertising spends were expected to reach US$50 billion in 2015 with a growth rate of 9.3%. The growth will slow down from 2016 to 2018 while is still much higher than the average global growth rate. By 2015, China’s GDP would reach US$11 trillion among which advertising spends were US$50 billion accounting for 5%.

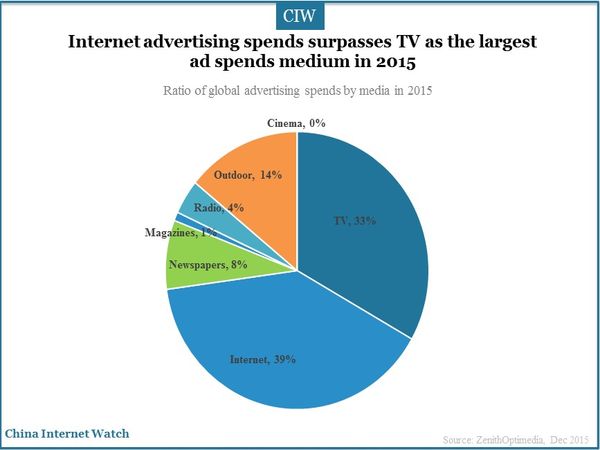

China’s online ad spends have been rapidly growing over the past five years and it accounted for 36% of total ad spend in 2015. Total online ad spends would reach US$20 billion exceeding the estimated US$16 billion in TV ad spends in 2015. The growth rate of TV advertising will be less than 1% in the next three years predicted by ZenithOptimedia.

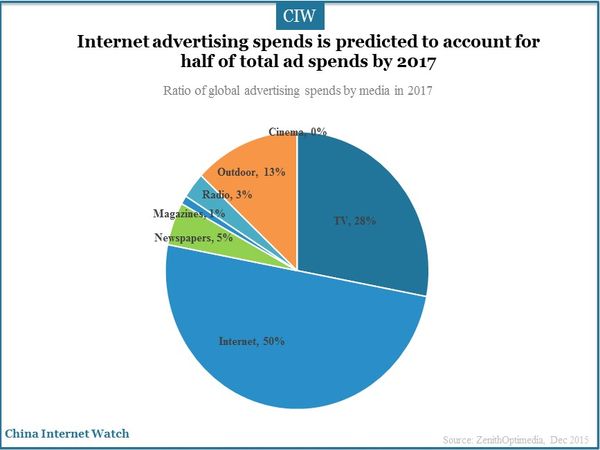

Online advertising spends in China is predicted to account for half of total ad spends by 2017 and TV will still be a major contributor which account for 28%.

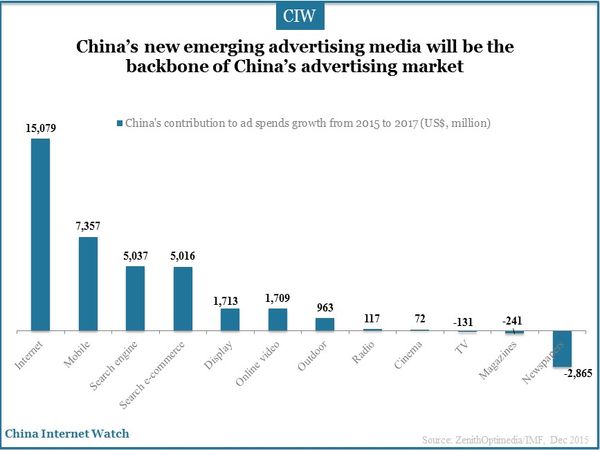

Mobile advertising as China’s new emerging advertising media will be the backbone of China’s advertising market. Mobile advertising increased by 118% in 2015 compared with the previous year and will account for 31% of total digital ad spends by 2017. Online video and search e-commerce will increase quickly in the next few years according to ZenithOptimedia.

Online video advertising, the fastest-growing category of internet advertising spends, is expected to increase at an annual growth rate of 35% by 2017. More and more advertisers have regarded online video advertising as the first choice for reaching consumers, especially in some industries with high TV ad spends or high penetration of online video.

Search e-commerce will increase with an average annual growth rate of 33% by 2017, which is primarily driven by the continuous innovation of large online retailers such as Alibaba and Jingdong. Taobao and Tmall gained revenues of 122.937 billion yuan (US$19.34 billion) on Double 11 2015, and 70% from the mobile devices. With the development of China’s e-commerce platforms, e-commerce search spends will grow rapidly.

Ad spend on print media will continue to drop to 21% on newspaper and 12% on magazines in 2017.

Also read: China Overall Advertising Insights Q3 2015