China’s cross-border shoppers reached 18 million and generated revenues of 140 billion yuan (US$21.75 billion) in 2014 according to China Electronic Commerce Research Center and China General Administration of Customs.

Transaction values of the cross-border market in China are expected to exceed 1 trillion yuan (US$0.16 trillion) in 2018 according to China Electronic Commerce Research Center with 36 million cross-border shoppers in 2018 according to Nielsen. It will account for 16% e-commerce market.

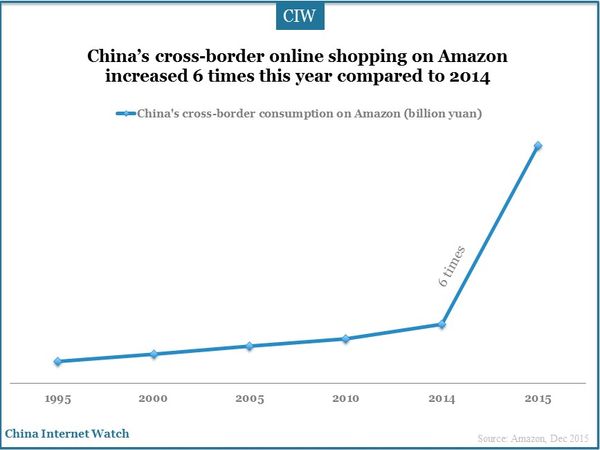

Amazon, as the largest global e-commerce company, is undoubtedly benefiting from the expansion and growing popularity of onine cross-border shopping market. The total expenditure of China’s consumers at Amazon Global sites increased by more than six times this year compared to 2014, and spends at Amazon overseas sites have been equivalent to the sum of the past 20 years counting only from January to October 2015.

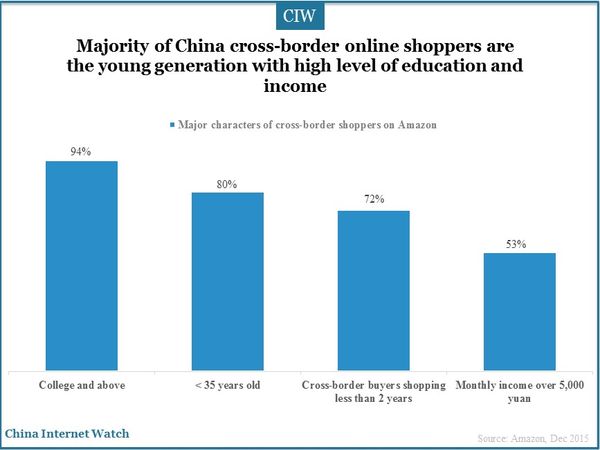

80% cross-border consumers on Amazon were under the age of 35 according to Amazon. Over 90% users have Bachelor’s Degree or above. In addition, over half cross-border shoppers gained a monthly income of more than 5,000 yuan.

Cross-border shoppers in tier-3 and tier-4 cities grew faster than tier-1 and tier-2 cities during Black Friday becoming the fastest growing regions. However, the average consumption per shopper on Black Friday was less than 699 yuan (US$108.59) in 2015 according to Alipay.

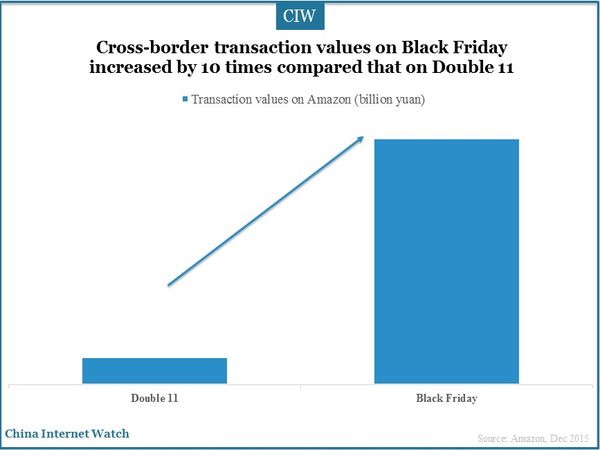

Although on Double 11 Tmall sold out 2,605 cross-border products from 41 countries only in the first 10 minutes and surpassed last year’s cross-border transactions within 105 seconds, cross-border orders on Amazon were much fewer.

However, Amazon China launched its Black Friday promotion from November 18th lasting till December 5 2015, which was longer period than other e-commerce websites in China. Sales values on Black Friday were 10 times as much as its Double 11 ones this year.

The number of online cross-border shoppers on Black Friday 2015 increased by 7 times compared to last year according to Alipay. Sales in only half a day on Black Friday surpassed total one week’s sales during Black Friday in 2014. And page views on Amazon reached a record high on Black Friday with the number of new users as much as four times more than 2014.

Bags, shoes, and personal-care products have been the most popular categories of China’s cross-border shoppers on Amazon since 2014 while shoppers liked beauty makeups best on Taobao.

Beijing cross-border shoppers preferred air purifiers, vacuum cleaners, water purifiers and masks. Shanghai shoppers liked to buy infant formula. Hangzhou buyers liked Cartier products and Nanjing consumers preferred cross-border beauty products.

Price (84%) and quality (81%) were top two factors for China’s cross-border consumers, followed by logistics (57%). Very long delivery time would damage the enthusiasm of cross-border shoppers. Male users are most concerned about commodity prices while the female users during Black Friday are most concerned about whether the goods are authentic.

In recent years, the gradual improvement of cross-border e-commerce policies on customs, bonded warehouse, or a host of other policies has encouraged the cross-border business in China. Besides, online shopping platforms and cross-border shopping platforms have developed to a certain scale.

Also read: China Retail V.S. Online Shopping 2015