92% Chinese use smartphones ‘all the time’ according to WBR Digital. 70% Hong Kong consumers have bought something as a result of receiving a marketing e-mail.

China’s consumers use smartphones very often, compared to other countries. 100% respondents owned at least one smartphone and 92% use smartphones for a long time according to the research of WBR Digital.

Marketers have long been trying to get a complete view of their consumers to better align their marketing efforts. With the advent of the digital age which has now evolved into what is now known as the Internet of Things, marketers are increasingly finding themselves grappling to truly understand consumer preferences and behavior when it comes to channels, devices and content according to WBR Digital.

Consumer Behavior by Device

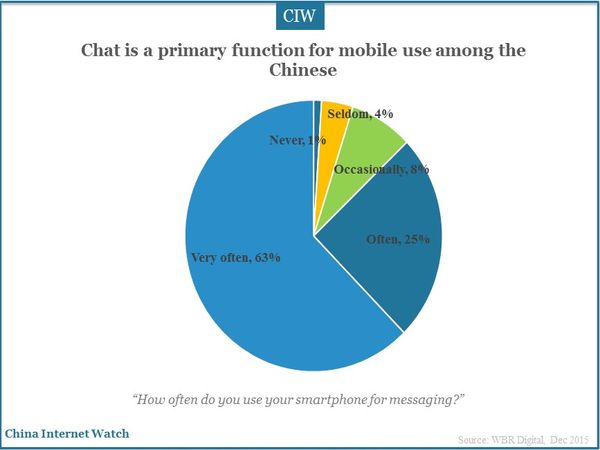

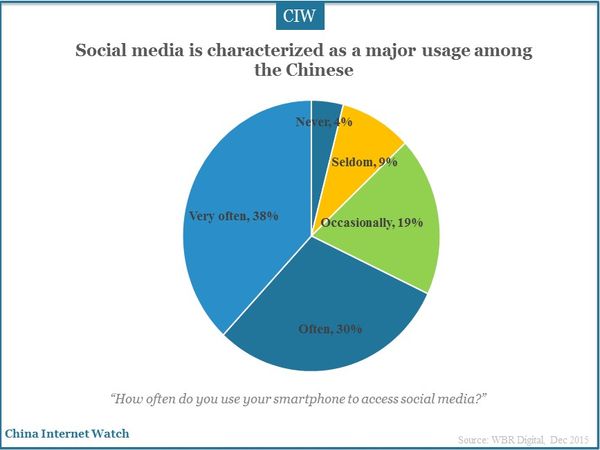

Messaging and social media are among the primary functions for mobile use among the Chinese. Monthly active users (MAUs) of QQ are 850 million as of September 2015, MAUs of WeChat is 650 million, and MAUs of Weibo is 222 million.

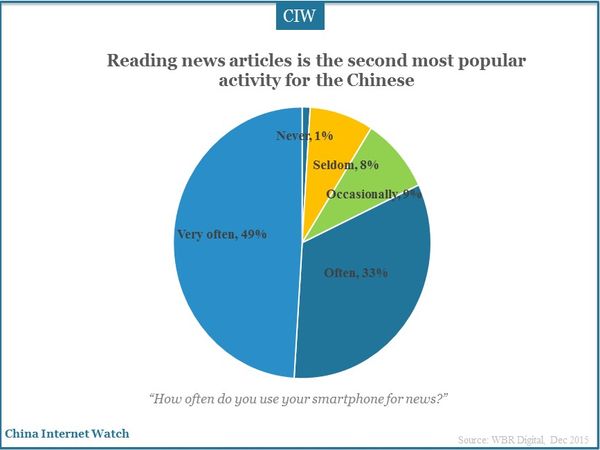

The second most popular activity for the Chinese is reading news articles. Therefore, although advertising on newspaper and magazine declines 34.5% and 18.5% respectively in the first three-quarters in 2015 compared to the same period in 2014, mobile news apps are very prevalent among the Chinese especially the post-90s and post-80s.

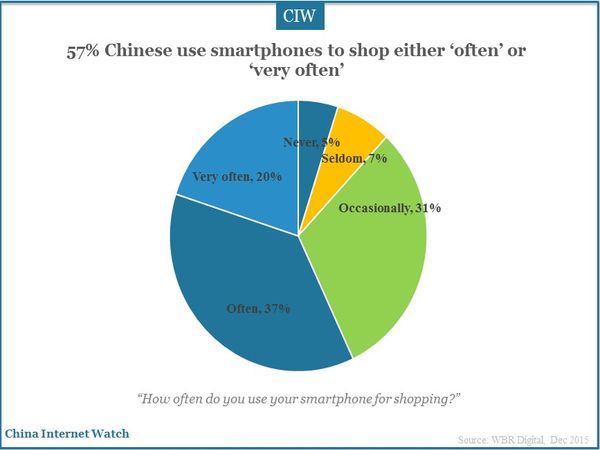

57% Chinese use smartphones to shop either ‘often’ or ‘very often’ while values they have created are immense. Overall transaction sales of Tmall on Double 11 this year reached 122.937 billion yuan (US$19.34 billion). Retail sales through tablets, smartphones and other mobile devices in China are expected to increase by 85.1% annually to US$333.99 billion in 2015, accounting for 49.7% of China’s retail e-commerce sales according to eMarketer.

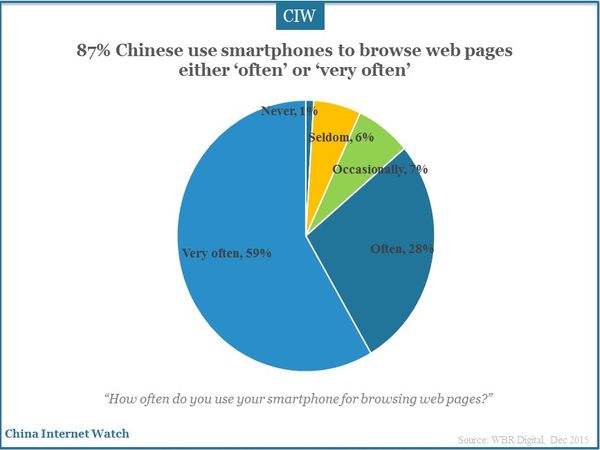

Accurate customer data are a cornerstone of effective modern marketing campaigns according to WBR Digital. As high as 87% Chinese use smartphones to browse web pages either ‘often’ or ‘very often’ which will be a powerful tool to target consumers.

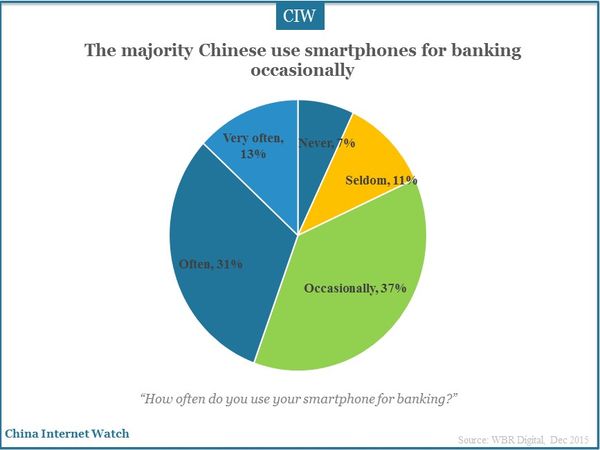

Major Chinese use smartphones for banking occasionally only 44% use smartphones for online shopping often or very often.

73% Chinese still like to read e-mails on the desktop, 26% prefer on tablet and 56% on mobile. 64% Chinese have purchased goods as a result of promotional content they received e-mails. 65% have purchased goods when they received content from SMS; 55% have purchased from the in-app messages; 53% have purchased during the social chat, and 41% have purchased from social media messages.

Most occasionally, recommendations from friends, families, fashion bloggers or others can better attract China’s consumers thus social media as a platform for sharing should be put much time and efforts in. 66% Chinese use social chat apps such as WeChat and Line to share messages, 52% will repost on social media or networks to share, 36% will share on SMS, and 34% share on DMs.

Content Preferences Targeted Content Strategy

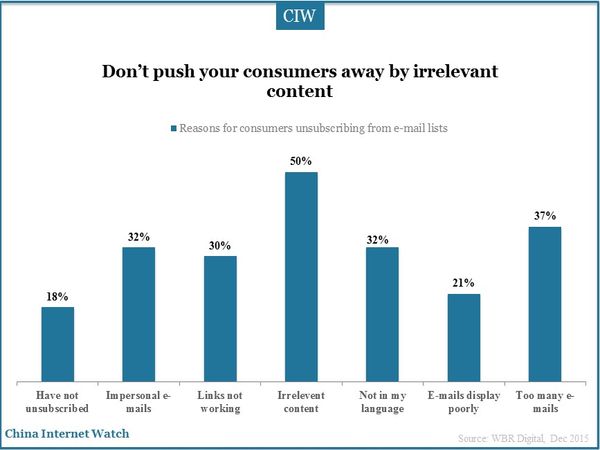

Ultimately, an engaged and receptive audience is anchored by content relevancy and accurate targeting. Failure to provide this will be most likely result in damage to consumers’ concern. Thus, advertisers should deliver e-mails more personal and relevant.

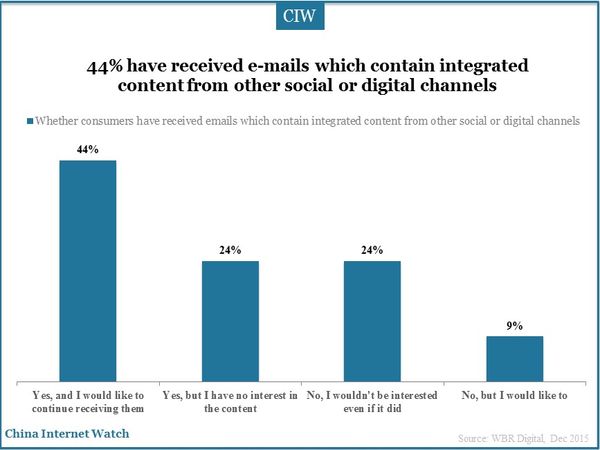

A lot of integrated content e-mails are distributed via various channels in China while 24% who have received integrated content have no interest in it and 24% haven’t received and won’t like to receive at all. 44% consumers are interested in the integrated content and are willing to receive continuously.

Email is the most mature marketing channel, therefore, it is no surprise that marketers across the region are feeling better of personalizing their messaging. 82% China’s consumers have received personalizes e-mails, 79% have received personalized content on SMS, 68% on the social chat, 64% on social media, and 62% on apps.

Consumers in China still prefer e-mail (63%) as one of the most important ways to transmit information about brands or companies. 47% also like to get in touch with brands or companies through social chat apps. Only 43% always want to contact through SMS, 38% through app notifications, and 29% through social media or networks.

Markers targeting China should manage multiple channels to provide proper prices. 54% China’s consumers have received conflicting or contradictory promotions or content on SMS or e-mail, 49% once received conflicting messages on social chat, 48% on apps, and 40% received on social media.

Apart from conflicting promotion content, 71% China’s consumers have received irrelevant content on e-mail, 68% on SMS, 63% on social chat, 57% on social media, and 55% on apps.

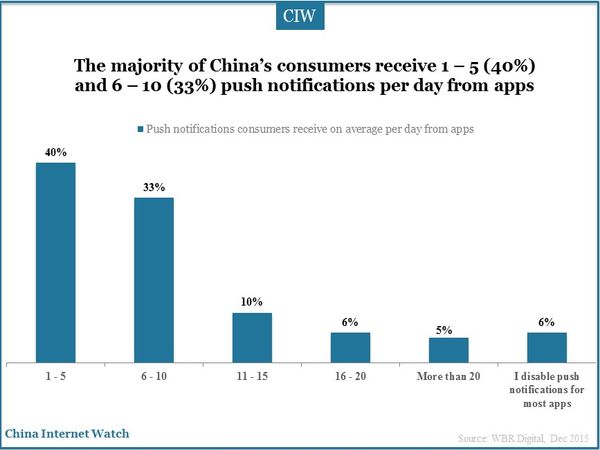

The majority of China’s consumers receive 1 – 5 (40%) and 6 – 10 (33%) push notifications per day from apps on mobile or tablet. Only 6% consumers in China disable push notifications for most apps.

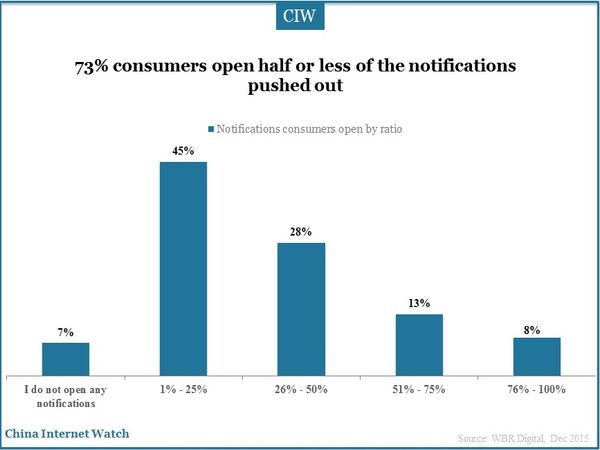

73% consumers open half or less of the notifications pushed out compared to 21% of opening 50% or more. Only 7% don’t open any notifications.

Communication Preferences Channel Hopping

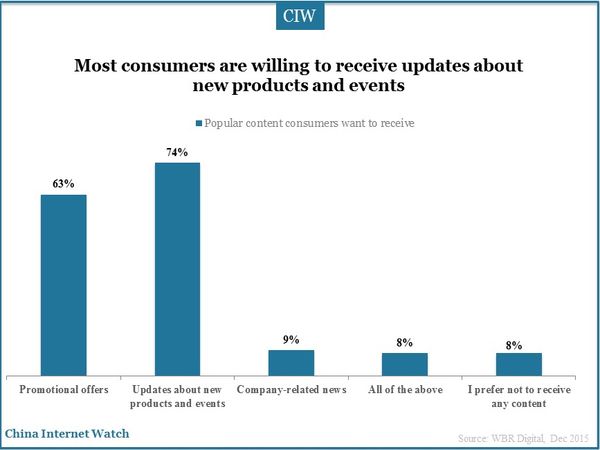

Most consumers are willing to receive promotional offers and updates on new products and events on mobile, digital and social platforms. Only 8% prefer not to receive any content. Thus, marketers have to understand what consumers really like before sending e-mails.

Location-based offers have enormous potential for retailers to capitalize on their physical presence to provide targeted and relevant offers directly to the consumer. However, only 68% like to receive location-based offers and promotions via e-mail or EMS. Only 47% consumer are willing to receive on social media.

Also read: China Retail V.S. Online Shopping 2015