China’s online travel market reached 122.23 billion yuan (US$19.07 billion) with an increase of 18.0% QoQ and 45.9% YoY in the third quarter of 2015 according to iResearch. The OTA market in China reached 5.96 billion yuan (US$0.93 billion) in Q3 2015 with an increase of 48.8% compared to the same period last year, led by Ctrip and eLong.

Related: China Online Travel Booking Users Overview Q3 2015

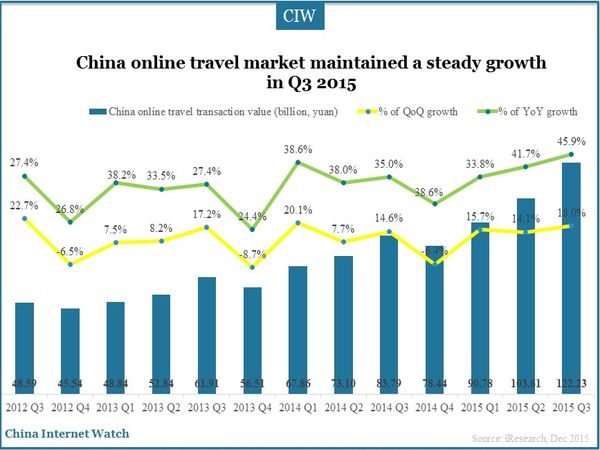

China’s online travel market reached 122.23 billion yuan (US$19.07 billion) in the third quarter this year with an increase of 18.0% compared to the previous quarter of this year and 45.9% compared to the same quarter last year according to iResearch.

The growth mainly resulted from the increasing subdivision travel products such as parent-child travel, cruise travel, free and easy travel and so on. The maturing online travel market and peak travel season from September to November also drove the growth.

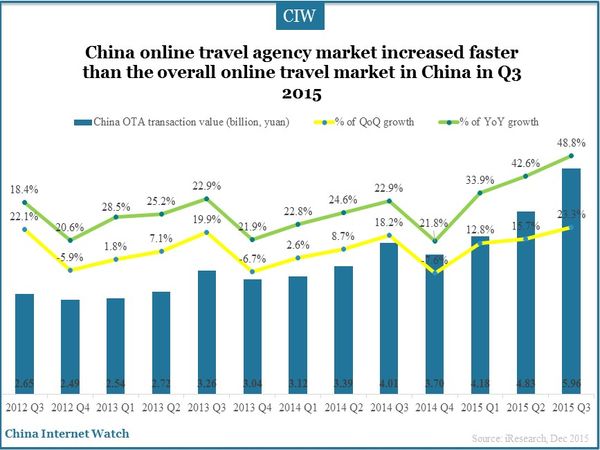

China OTA market reached 5.96 billion yuan (US$0.93 billion) in Q3 2015 with an increase of 48.8% compared to the same period last year. OTA ticket revenues grew by 41.7% YoY in the third quarter of 2015 compared to 31.0% in Q2 2015.

Hotel revenues of China’s OTA market grew 55.7% YoY in the third quarter this year compared to 51.1% in the previous quarter. Business holiday travel revenues increased 58.4% YoY in the third quarter this year.

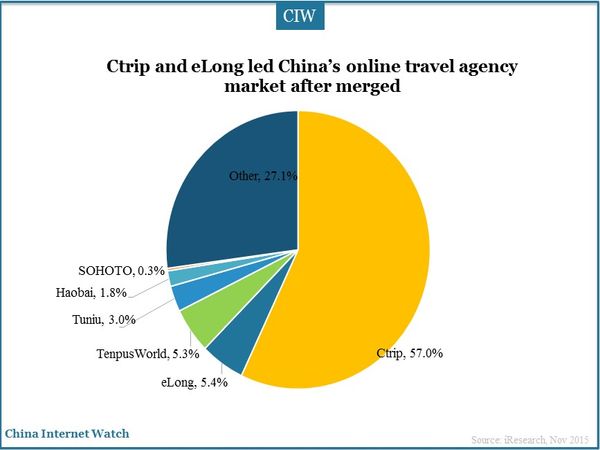

China’s OTA market remained stable in Q3 2015. After the merger, Ctrip shared hotel resources with eLong and promoted the outbound train ticket booking service that they accounted for 62.4% of China’s OTA market.

Net revenues in the third quarter of 2015 of Tuniu increased by 127.5% year-over-year to US$469.4 million. The total number of trips from organized tours (excluding local tours) increased by 142.1% year-over-year and the total number of trips from self-guided tours increased by 181.8% year-over-year on Tuniu in the third quarter of 2015.

Also read: China Short-term Accommodation Market Overview 2015