Advertising spend can reflect changes in the economic structure of China. Real estate ad spends decreased by 26.2% year on year and fell down to 28.6% in the first three-quarters this year compared to the same period last year according to CTR.

Related: China social media trend 2015

Following Chinese government’s promotion of “internet plus” strategy, online advertising market in China reached a growth rate of 94.7% as of 30 September this year. Taobao invested 1.3 times more in advertising from January to September 2015 compared to the same period last year, Suning 1.1 times, and Vipshop even 10 times.

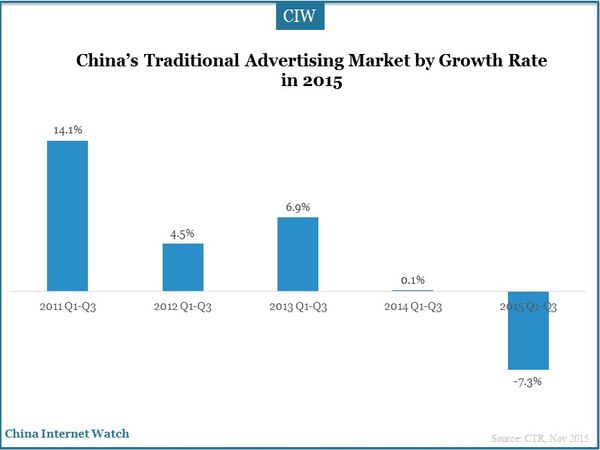

China’s traditional advertising spends have declined in recent years by and large while it declined 7.3% as of 30 September this year out of expectation. The traditional advertising market in the third quarter decreased 10.1% compared to the previous quarter which reached a record low.

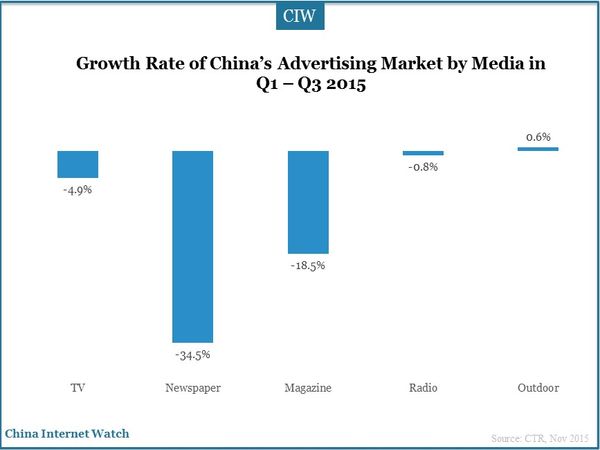

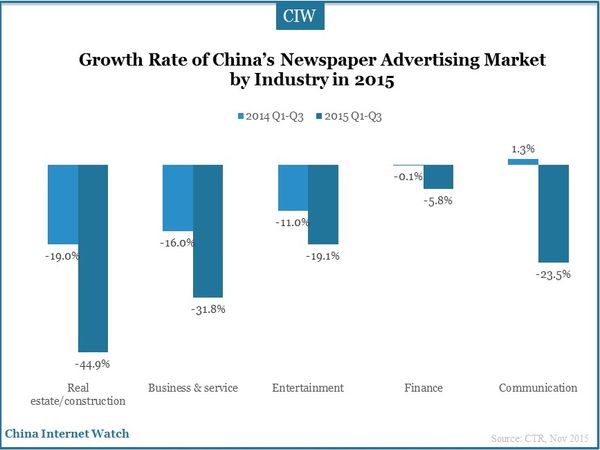

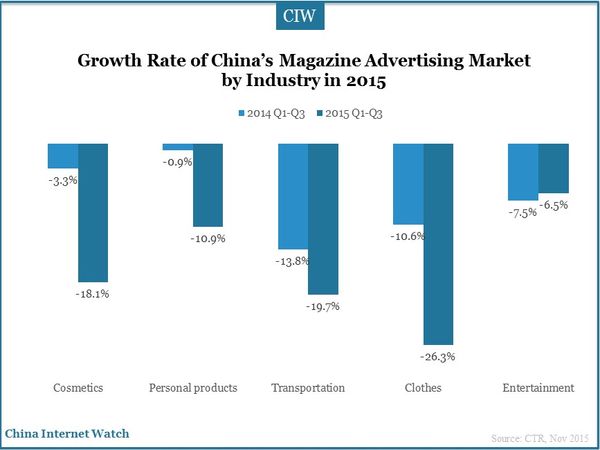

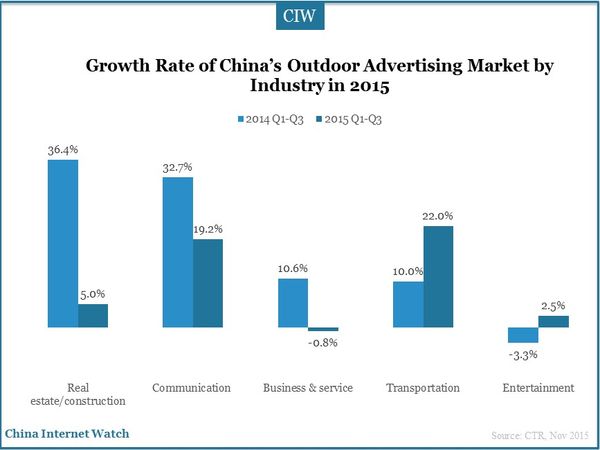

Print media newspaper and magazines advertising spends in this industry also decreased sharply with a growth rate of -34.5% and -18.5% respectively as of Q3 2015 compared to the same period last year. Advertising spend on TV and radio also declined while only the outdoor increased by 0.6%.

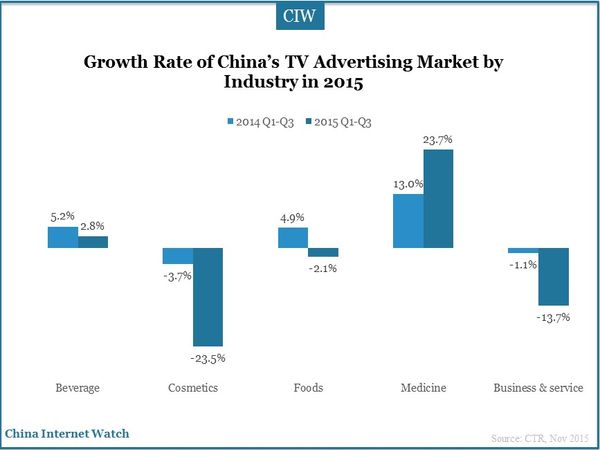

Beverage, cosmetics, foods, medicine, and business and service focused on TV advertising in the first three-quarter this year. However, the overall spends on TV advertising declined compared to the same period last year. Cosmetics decreased by 23.5% and business and service dropped by 13.7%. Medicine increased by 23.7% on TV advertising revenues.

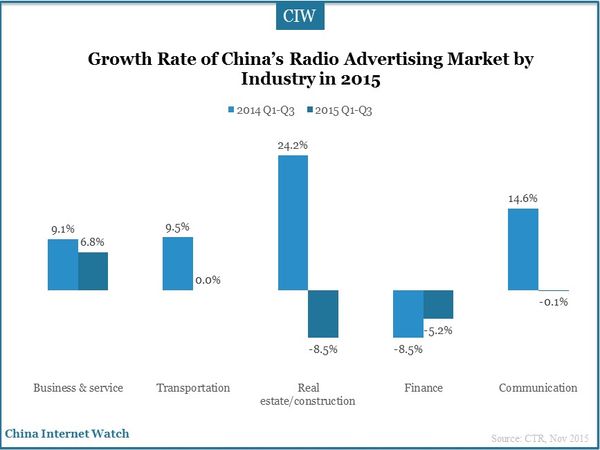

Similarly with TV advertising, the overall radio advertising market also declined, among which real estate industry spend decreased by 8.5% in the first three-quarters of 2015 compared to spends in the same period last year.

Newspaper and magazine advertising has suffered a great hit. Even among the top 5 advertising sectors, advertising spends decreased to a large extent this year compared to the same period last year.

Compared to the large advertising revenues on the outdoor last year, the real estate industry was more prudent with only 5% increase in advertising in the first three-quarters this year. In general, the outdoor advertising market maintained a relatively good momentum this year.

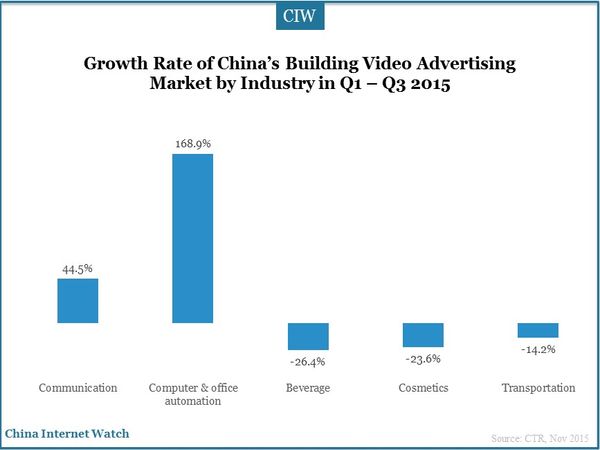

Building video advertising, which mainly referred to the advertising on large LCD screens outside the building and on the TV inside the elevators, increased by 15.2% in revenues this year compared to the same period last year. Beverage, cosmetics and transportation industry declined in advertising spend while telecommunication and computer increased dramatically.

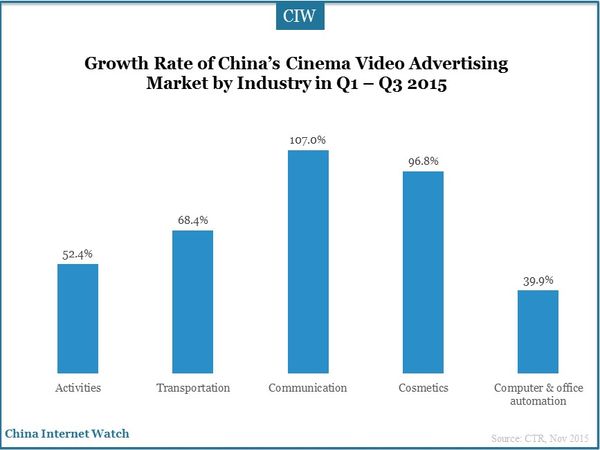

Chinese tended to spend more money on entertainment thus cinema video advertising gained the attention of the entrepreneurs. The overall cinema video advertising market grew by 56.2% among which the telecommunication industry increased by 107% YoY in the first three-quarters this year.

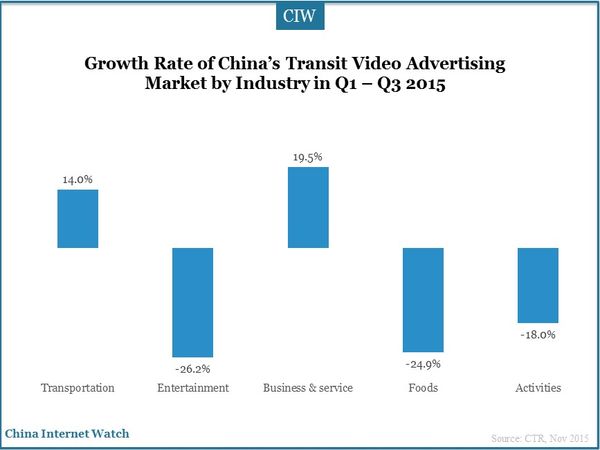

Video advertising on buses, trains, subways and such increased by 8.9% as of 30 September this year. With transit advertising costs increasing, some sectors reduced spend such as as entertainment, foods and events. In contrast, business and service sector sspent 19.5% more on transit video advertising in the first three-quarters this year.

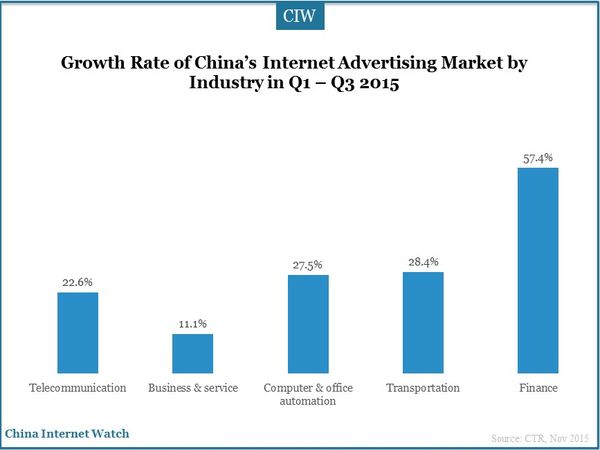

Online advertising market gained a wide-range blossom with a growth rate of 94.7%. Finance industry with a growth rate of 57.4% YoY was the fifth-largest online advertising sector and the telecommunications was the largest. Jingdong, Taobao, Mogujie, Suning, Kaola and other e-commerce companies have invested heavily on online advertising.

Also read: China Advertising Insights 2015