China’s mobile internet maintained a solid development in the third quarter this year, and the basic pattern of China’s mobile internet remained unchanged compared to the first half-year of 2015 according to TrustData.

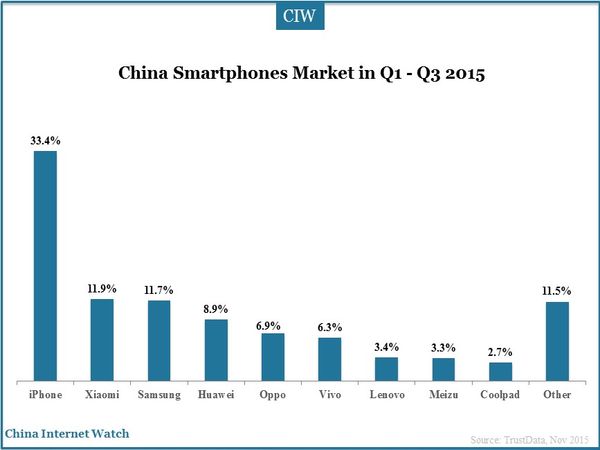

Apple still took the first position in China’s smartphone market with a penetration rate of 33.4%. Xiaomi overcame Samsung as the second-largest smartphone brand and the largest smartphone vendor in China.

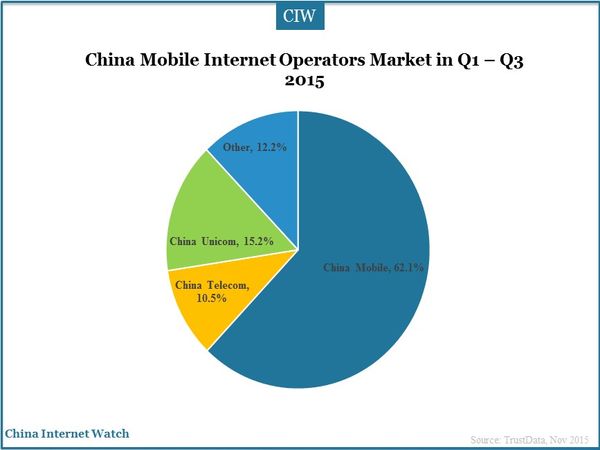

After China’s three telecommunication companies went through swaps of senior executives in this quarter, China Mobile declined in the market by 1.1 percentage points lower compared to the first two-quarters this year while China Unicom and China Telecom increased to various degrees.

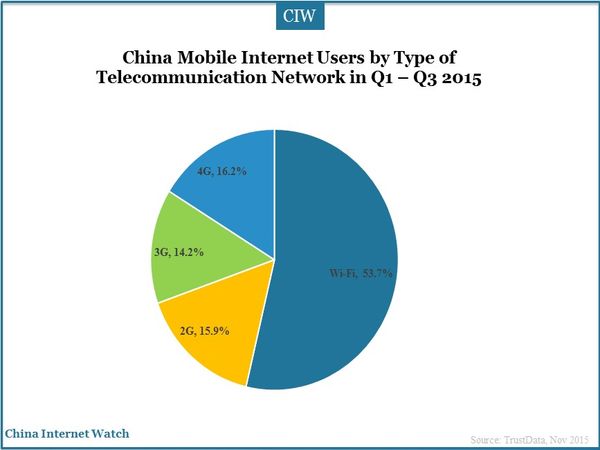

Users accessing the internet through 4G network exceeded 3G and 2G in Q3 2015 in China representing a penetration rate of 16.2%. Over half of mobile phone users were the most likely to access the internet by Wi-Fi. Public places offering free Wi-Fi really helped to attract customers, especially for restaurants, hotels, KTV, and so on.

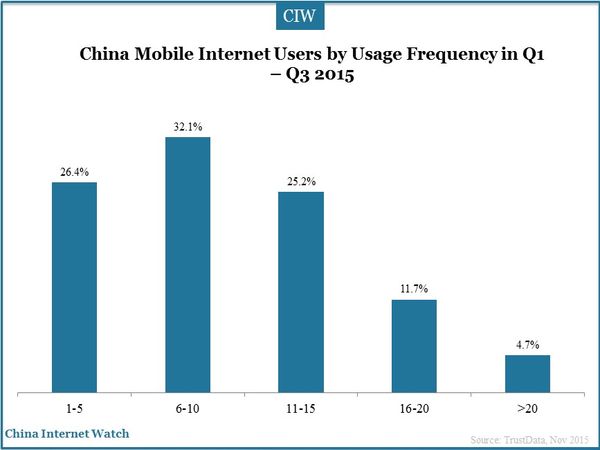

More Chinese were willing to spend time on mobile apps that 16.4% opened more than 16 apps every day compared to 12.4% in the first half this year.

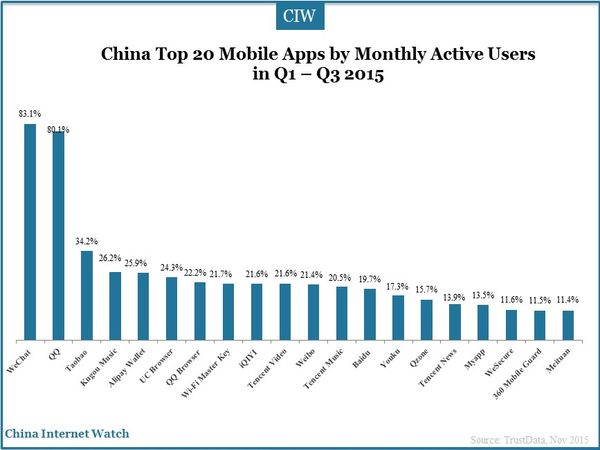

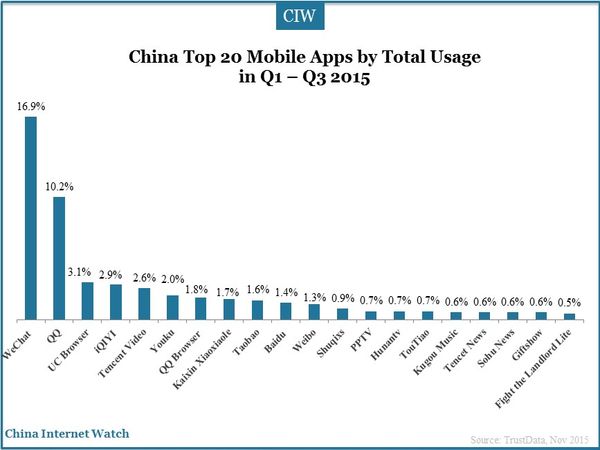

Among the top 20 mobile apps by monthly average users, nine apps were from Tencent. WeChat exceeded QQ in monthly active users among the top 20 mobile apps as of September this year.

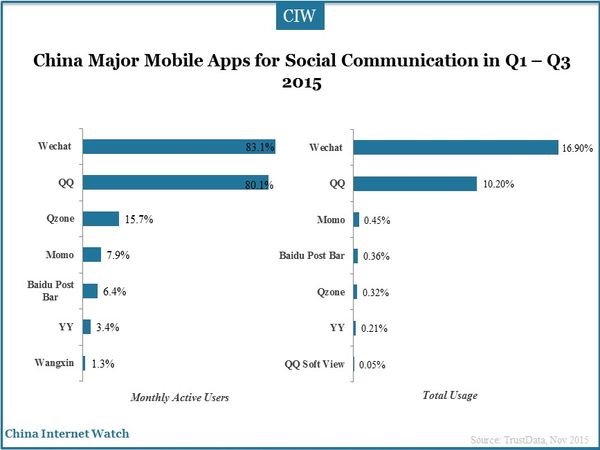

WeChat and QQ undoubtedly led China’s social communication platforms. Baidu Post Bar, as a place gathering like-minded people, also gained millions of advocates.

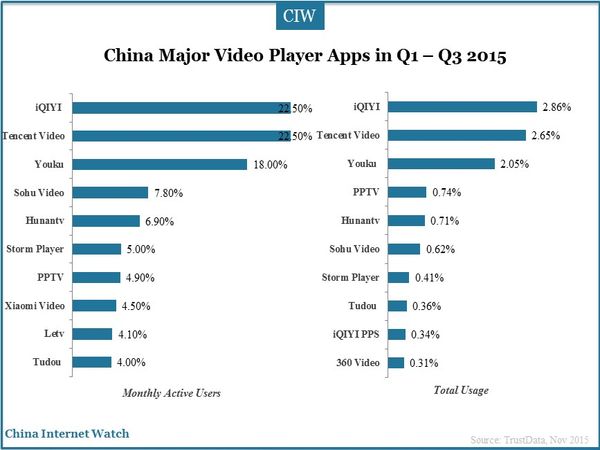

Depending on hot IP dramas and variety shows iQIYI pulled up to Tencent Video and tied for first place in monthly active users in this quarter while users spend more time on iQIYI compared to Tencent Video.

Major mobile video market maintained the same in the first four apps while Nokia X Video player ranked the fifth by monthly active users much out of expectation.

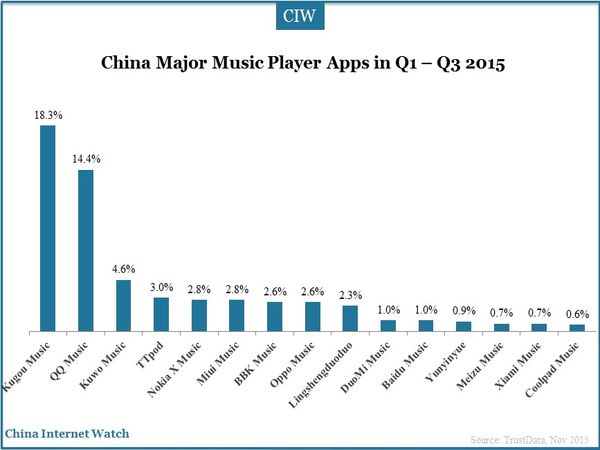

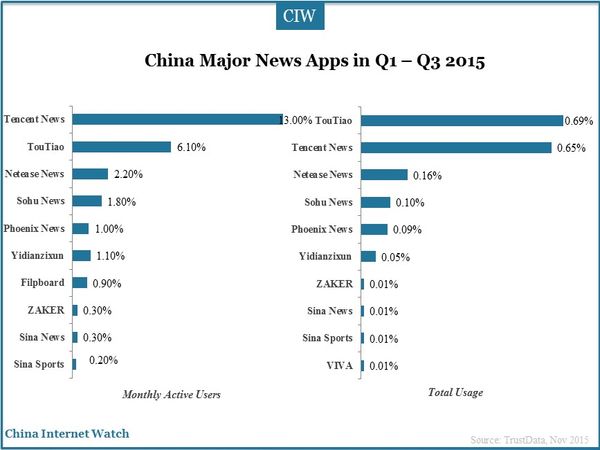

Similar with mobile video market, mobile news market had a relatively big change from the fifth to tenth music apps by monthly active users. The overall usage time of news apps increased compared to the last two-quarters.

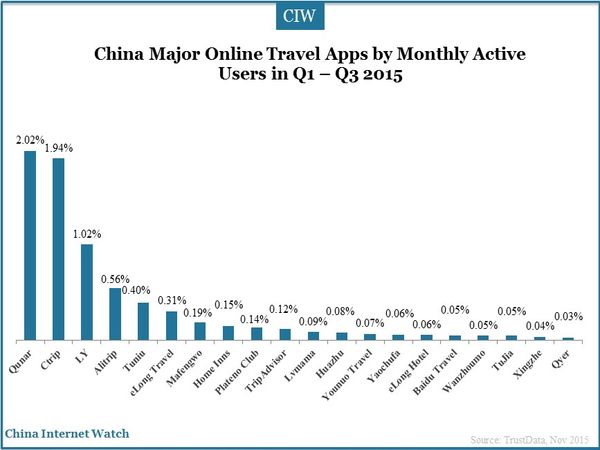

A stable pattern of China’s mobile travel market was basically formed that Qunar, Ctrip and LY shared the market. The total number of China’s tourists was estimated to exceed 4.1 billion person trips in 2015 and reached a total revenue of 3840 trillion yuan (US$617.40 billion) according to China Tourism Academy, among which online travel platforms and mobile apps benefited a lot in ticket booking, hotel reservation and travel products.

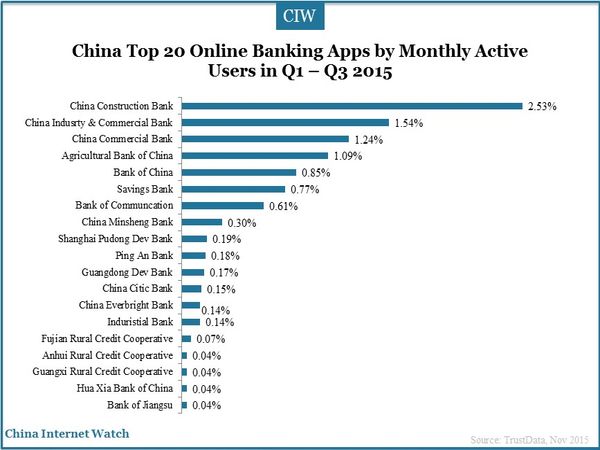

Influenced by the rush of Alipay, Huabei, JD Baitiao and other online payment and internet financing products, banks in China released relevant profitable policies to enhance transactions and active users. Top 20 online banking apps showed small changes in this quarter.

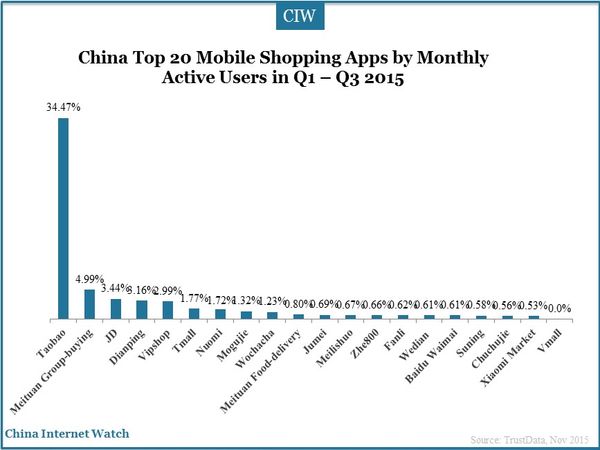

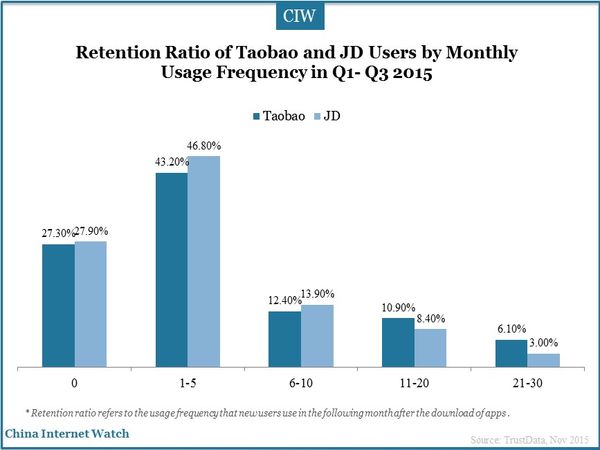

Taobao’s dominance maintained relying on 386 million of annual active buyers and 346 million of mobile active buyers. Meituan Group-buying, Jingdong, and Dianping followed while after emerging between Meituan and Dianping their market share might increase in the next quarter.

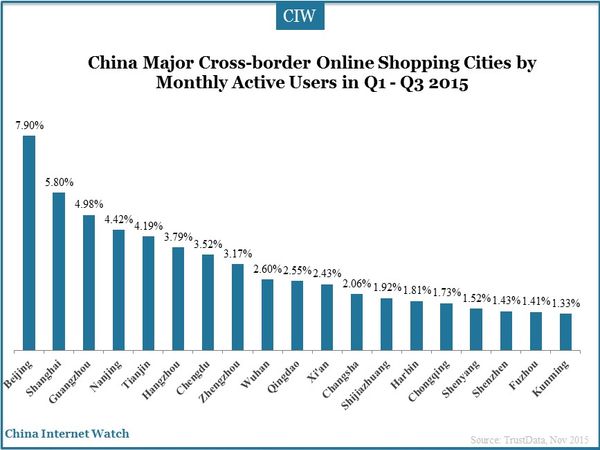

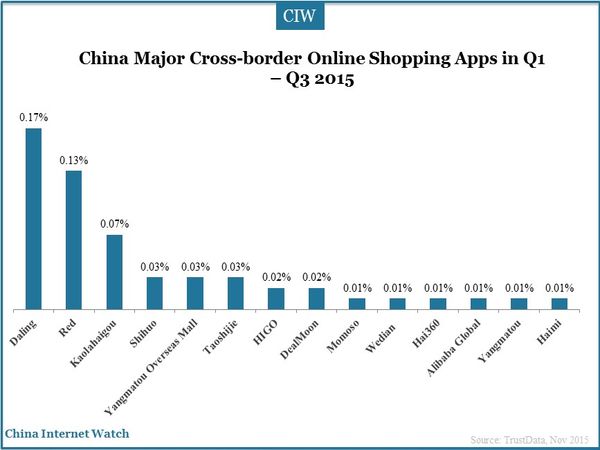

About 35% China’s online shoppers purchased cross-border products this year, and cross-border online shoppers mainly gathered in Beijing, Shanghai, Guangzhou… which was a function of city development level and citizens revenues. Although cross-border online shopping tended to be normalized by uplift of logistics, consumers’ rights and interests couldn’t be safeguarded timely and properly owing to long distance. The uppermost three cross-border apps were Daling, Red, and Kaolahaigou by monthly active users.

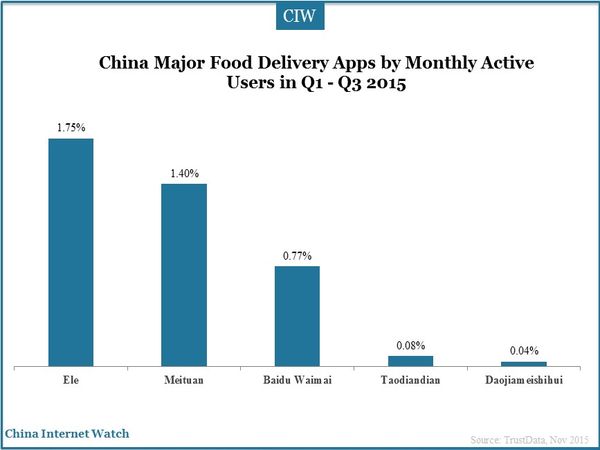

Meituan, Dianping, and Nuomi ran China’s mobile group-buying market in this quarter, and Ele, Meituan, and Baidu Waimai competed for the first position in the food-delivery market. After large input of allowance to attract users in regardless of prime cost, the food-delivery market would go depressed or prosperous still under mists.