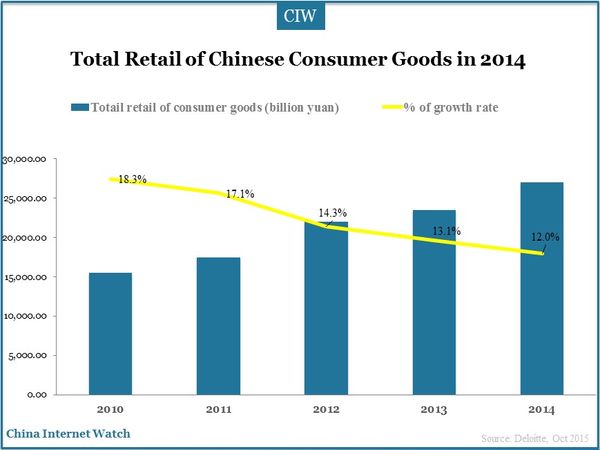

Total retail sales of China consumer goods were 26.24 trillion yuan (US$4.11 trillion) in 2014, an increase of 12% compared to the previous year. The growth rate of the Chinese retail market has dropped for five consecutive years. More than two-tenths of responding retailers have reduced opening new stores and the average number of employees fell by 0.8% and 1.2% respectively in 2013 and 2014 according to Deloitte.

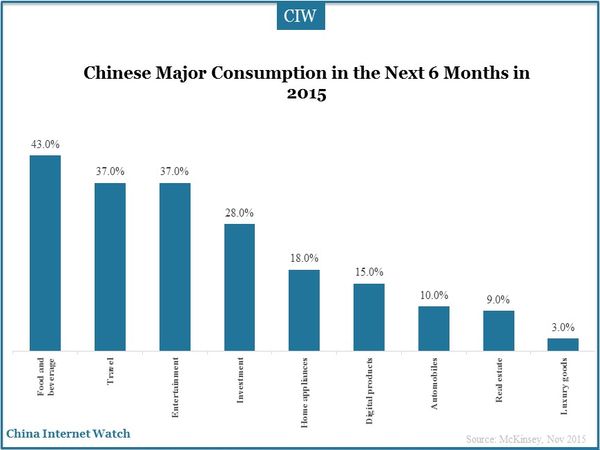

Consumption in education, travel, culture, entertainment and others gradually occupied more share on consumers’ expenditure in the past few years. In the next 6 months, customers tend to spend more on food and beverage, travel, entertainment, investment, investment, home appliances and so on.

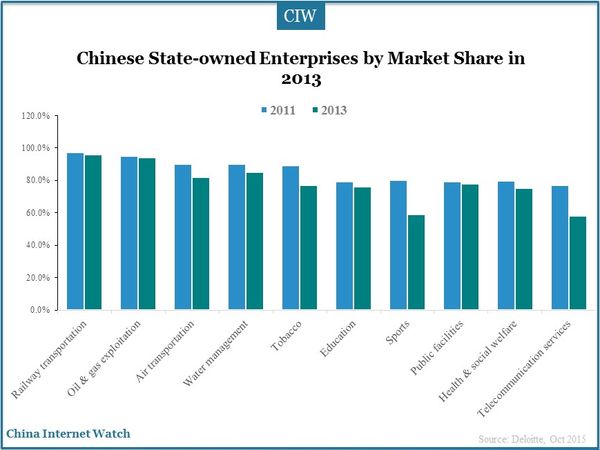

State-owned enterprises managed China’s industry in most aspects with overwhelming advantages. In recent several years, state-owned enterprises have given up much control to promote more dynamic market.

The growth rate of Chinese consumer goods market has declined following the slowing macroeconomy and residents’ income. Total retail sales of Chinese consumer goods were 26.24 trillion yuan (US$4.11 trillion) in 2014, an increase of 12% compared to the previous year. About 23% companies didn’t open any new stores in 2014 according to Deloitte.

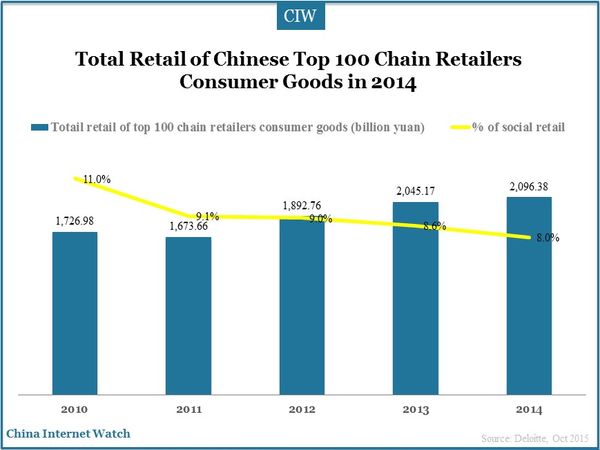

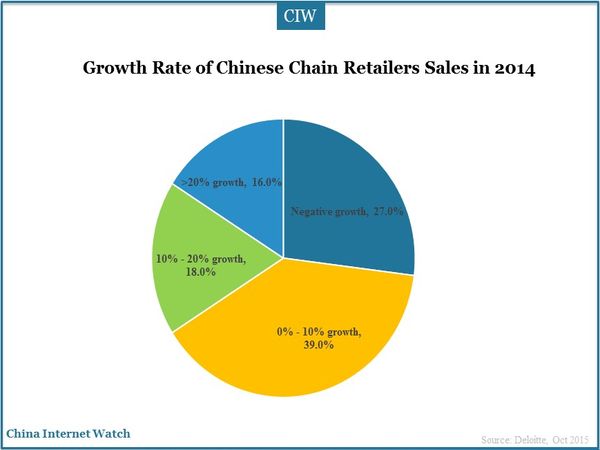

Bricks-and-mortar retailing has become fragmented under the booming of China’s online shopping market. The growth rate of China’s top 100 chain retailers slowed down. 27% companies surveyed maintained negative growth in 2014.

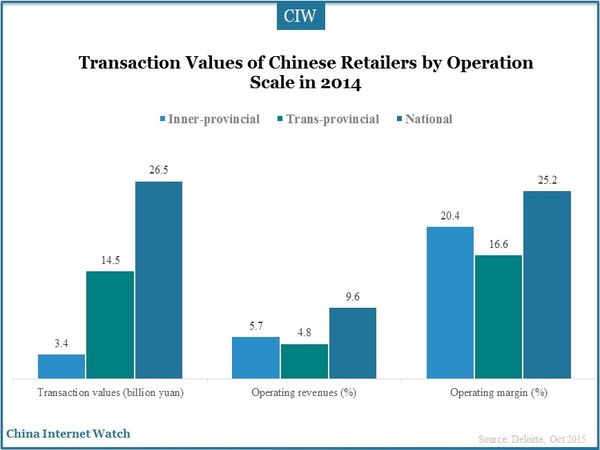

The larger companies are, the more transactions companies may have. Chinese companies with national-wide operating scale gained an average revenue of 26.5 billion yuan (US$4.16 billion) and an increase of 9.6% in operating revenues compared to the previous year.

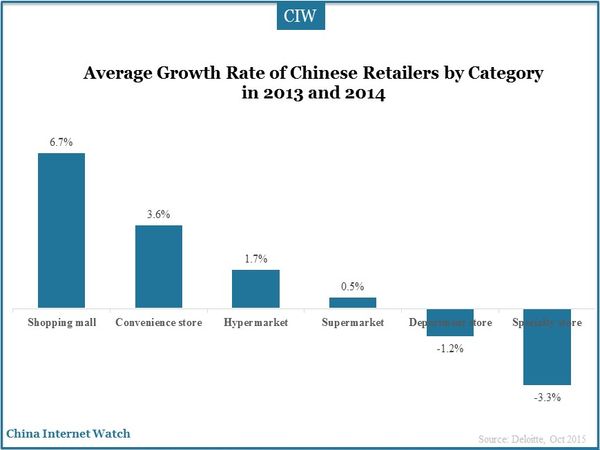

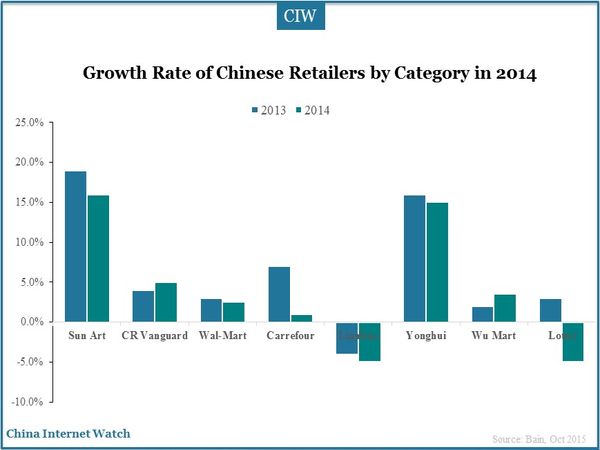

Shopping malls, convenience stores, and hypermarkets maintained growth in operating revenues in 2013 and 2014 compared to supermarkets, department stores, and specialty stores. Major retailers dropped in sales such as Sun Art, Carrefour, Lianhua, Yonghui, and Lotus.

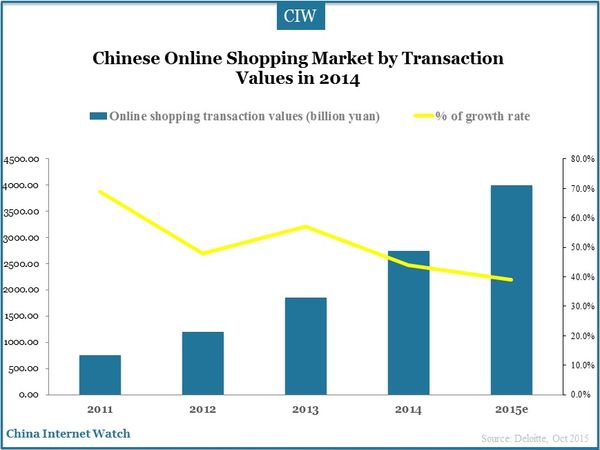

Although the offline market in China didn’t see any significant improvement, the online shopping market maintained a steady momentum of growth in the recent several years. Overall transaction values of online shopping market reached 2.81 trillion yuan (US$0.44 trillion) in 2014, representing a growth of 48.7% compared with the same period the previous year and 10.7 percentage points slower compared with the growth rate in 2013. Overall online retailing sales accounted for 10.71% of the whole retailing market in China.

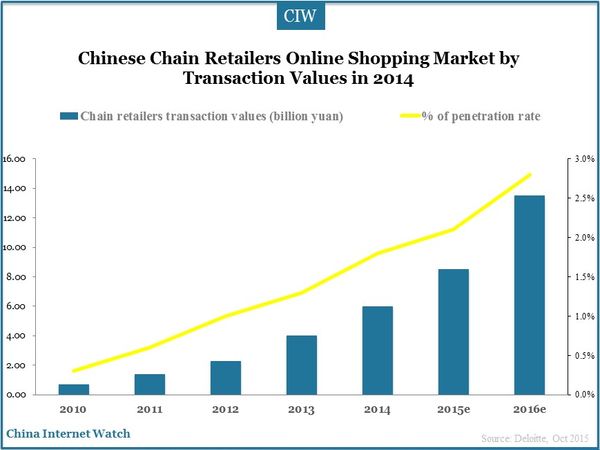

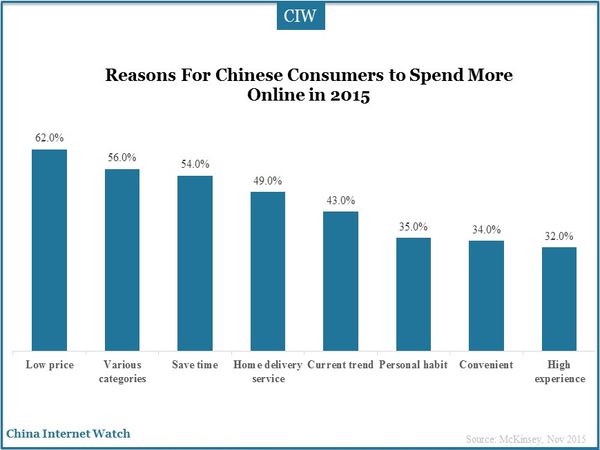

Many large offline retailers developed online shopping platforms in 2014 that the transaction values of O2O market in 2014 exceeded 300 billion yuan (US$47.07 billion) and was expected to reach 465.54 billion yuan (US$73.04 billion) in 2015. Lower price and good deals remained an important driver of online shoppers while product variety also saw more importance. Overall transactions of chain retailers’ online shopping market totaled 6.1 billion yuan in 2014.

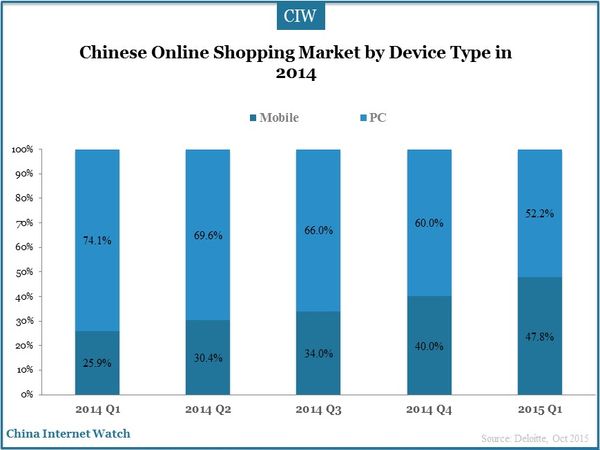

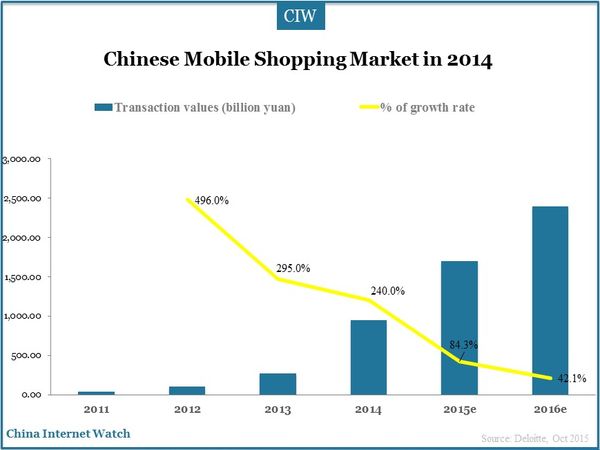

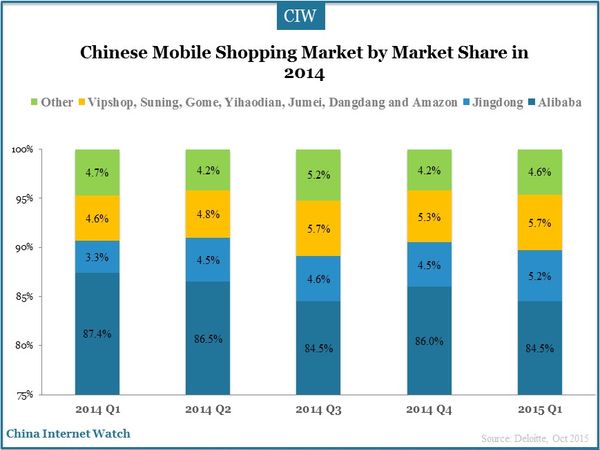

Chinese mobile shopping market reached 928.5 billion yuan (US$145.67 billion) in 2012, reflecting an increase of 240% compared the previous year. In the first quarter of 2015, the mobile shopping market reached 362.34 billion yuan (US$56.85 billion) accounting for 47.8% of the overall internet shopping market and was expected to exceed 50% in 2015.

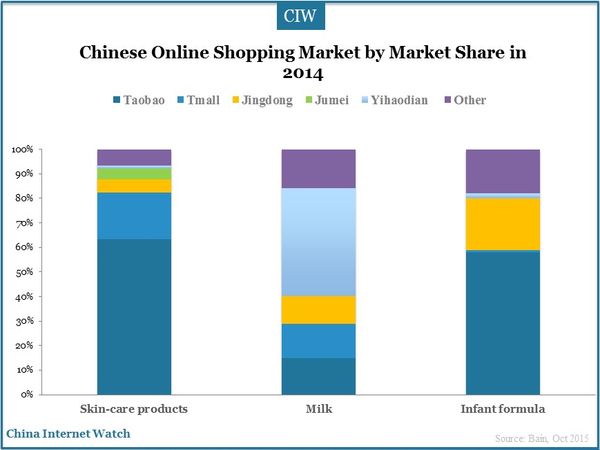

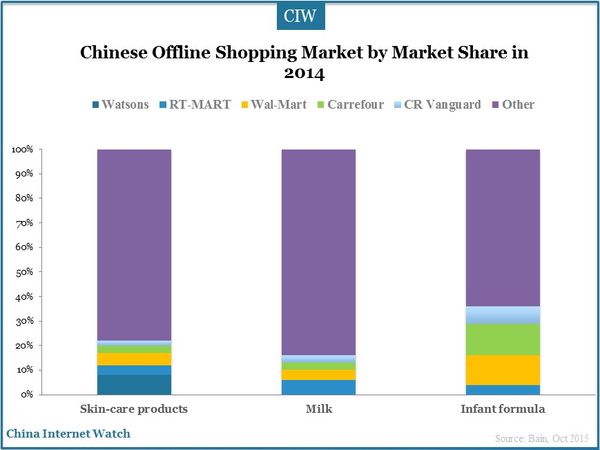

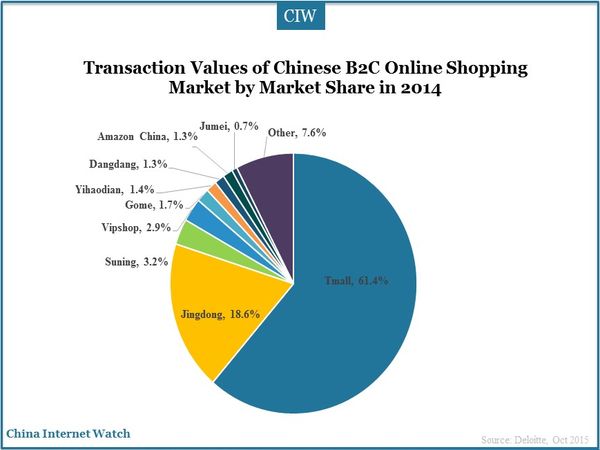

Skin-care products, milk and infant formula sold best online. Tmall, Taobao Jingdong, Jumei, Vipshop and others were major shopping platforms while when purchasing those products offline users were more likely to buy in Watsons, RT-MART, War-Mart, Carrefour and CR Vanguard.

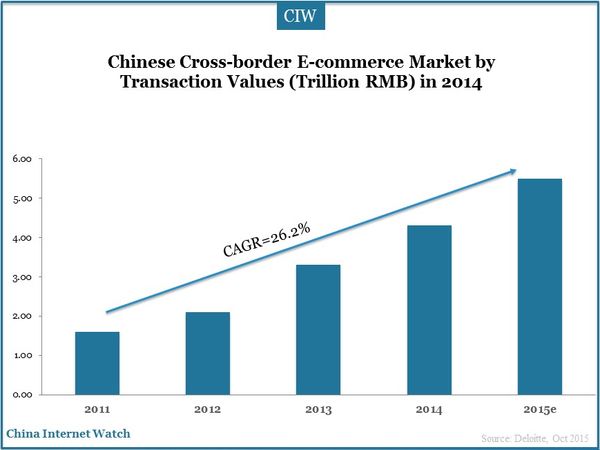

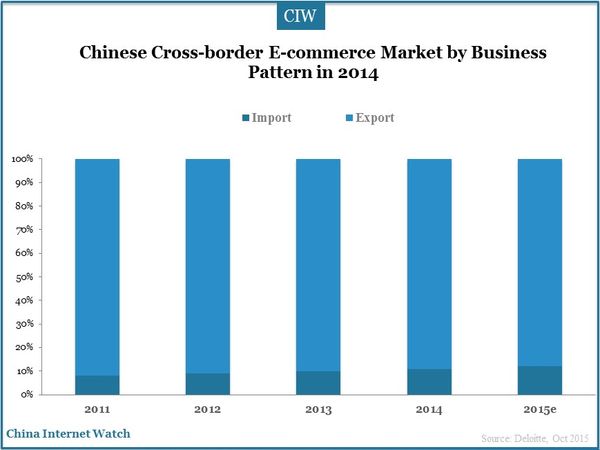

Chinese cross-border e-commerce market saw much potential that the transaction values reached 4.2 trillion yuan (US$0.66 trillion) in 2014 with YoY growth of 33.3% and realized a 26.2% CAGR (compound annual growth rate) over the past five years. However, China was still new to cross-border e-commerce concluded by the relatively low import transaction values.

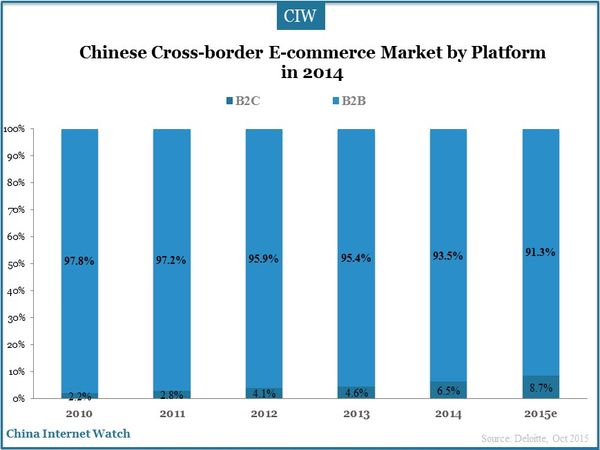

As high as 93.5% transactions were dealt on B2B platforms in 2014 in China and 6.5% on B2C platforms. However, with speedy development of logistics and overseas online shopping market, B2C market would increase in online transactions in the future. Tmall, Jingdong, Suning, Gome, Vipshop and Yihaoian were major B2C online shopping platforms.

Also read: 22% Online Shopping Spend Are Newly Created Demand