Comparing to regular online shopping in China, cross-border shopping frequency is lower with a higher average order value. About one-third of Chinese cross-border online shoppers purchased overseas goods only 3 to 5 times in 2014. However, about a quarter of the respondents spent 1,000 (US$157.17) to 3,000 yuan (US$471.51) on each order and 11% spent over 5,000 yuan (US$785.84) according to Nielsen.

Nearly 88% of the second-tier city consumers will buy cross-border goods online according to Nielsen. Although penetration rate of cross-border online shoppers in second-tier cities is lower than that of first-tier cities, the average spend and shopping frequencies are quite close.

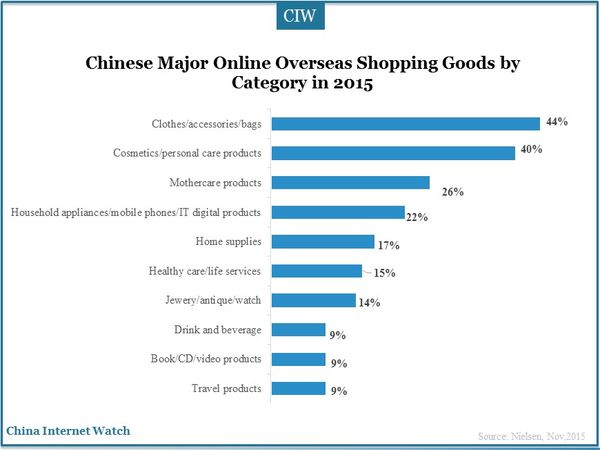

Clothes (44%), cosmetics and personal care products (40%), and mothercare products are top three categories consumers want to buy most online in 2015. Cross-border online shopping users prefer to buy skin care products from Korea or France, clothes and bags from Italy or Hong Kong, health care products from Australia, and mothercare products from New Zealand.

Young people with high education and high income lead Chinese cross-border online shopping market, especially among men between 26 to 35 years old and women 26 to 40 years old. The majority of online overseas shopping families gain average income of over 11,000 yuan (US$1,728.85).

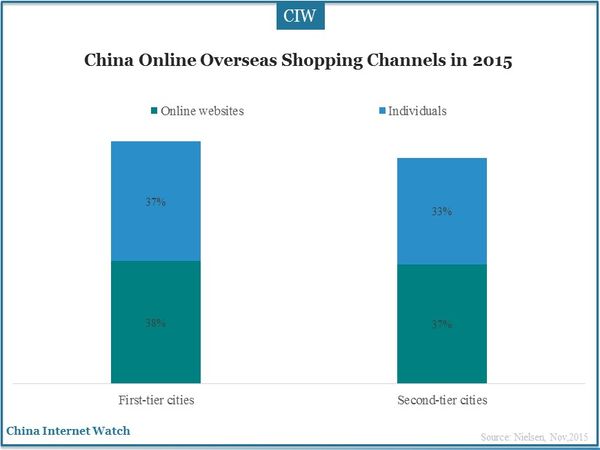

Whether goods are authentic has a big impact on choices of shopping channels. Due to the presence of flexibility and effectiveness, 33% overseas shoppers will buy from the individual agents on Taobao and other platforms who could directly help buy goods overseas. 29% will buy from online overseas shopping websites. The relatively assured quality and profitable price of individual overseas shopping better meet consumers demand.

With high penetration of smartphones and the rapid development of mobile apps, about 71% consumers will buy overseas products on mobile devices and 56% use smartphones and computers at the same time. However, shoppers on the PC end make up 85% of total consumers.

About 88% consumers in second-tier cities will buy overseas goods online. Purchasing channels of foreign goods in second-tier cities are not as rich as in first-tier cities, so consumers are more likely to shop online. Second-tier cities have a more potential market compared to first-tier cities.

Since 2014, online overseas purchasing market has maintained a steady growth. By 2020, the number of China internet users is expected to reach 80% of the total population, and 70% of them would shop online. China cross-border e-business in China is estimated to reach 6.5 trillion yuan (US$1.02 trillion) in 2016 according to China Ministry of Commerce, and about 60% consumers tend to buy overseas goods online during Double 11 according to Nielsen. With ever increasing shopping consciousness of consumers and improving market, Chinese online overseas shopping market is determined to have a brighter future.

Also read: China E-Payment Insights 2015