China’s mobile internet users reached 657 million and smartphone users 601 million in Q2 2015 according to iiMedia. Smartphone penetration in China is expected to reach 38.6% by the end of 2015 and mobile apps is becoming an important part of Chinese life.

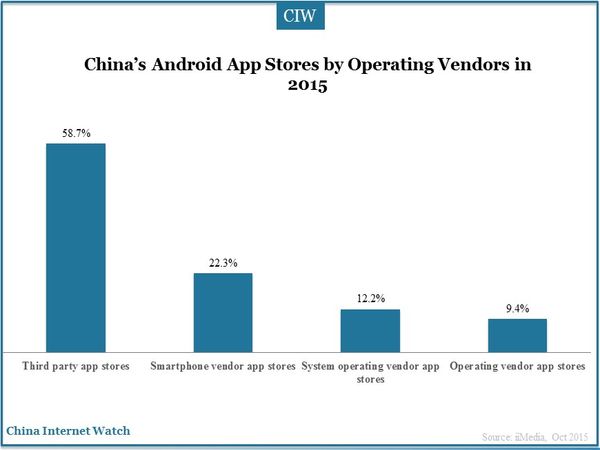

Nearly 58.7% of the Chinese Android smartphone users downloaded apps from third-party app stores. Other important download channels are app stores of smartphone vendors, app stores of system operating vendors and app stores of operating vendors. Only a small amount of users will download apps from websites. Users of iOS usually download from App Stores.

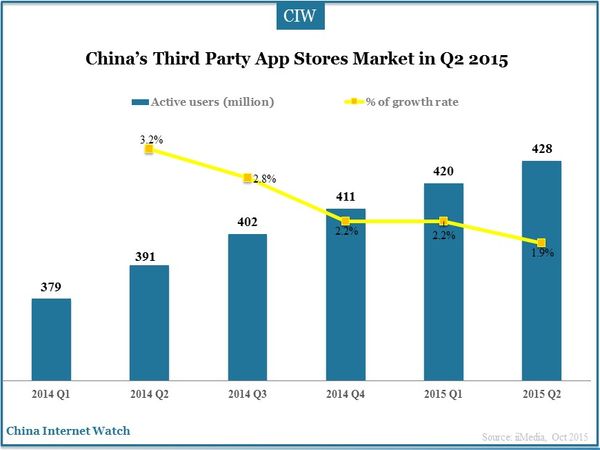

Active users of third-party mobile app stores in Q2 2015 increased to 428 million, with growth of 1.9% compared with the previous quarter. Users of third-party app stores kept a steady growth momentum although the growth rate slows down.

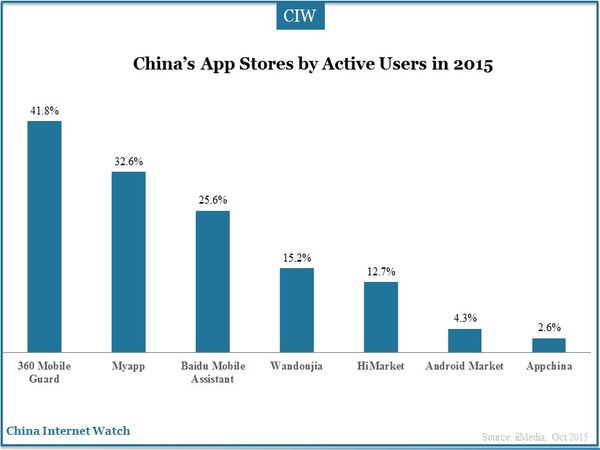

360 Mobile Guard ranks first in terms of total number of active users, followed by Myapp and Baidu Mobile Assistant. Xiaomi app store is also popular, especially among MIUI and Xiaomi users. Stores with high profile, variety of apps and security insurance are key factors to attract more users.

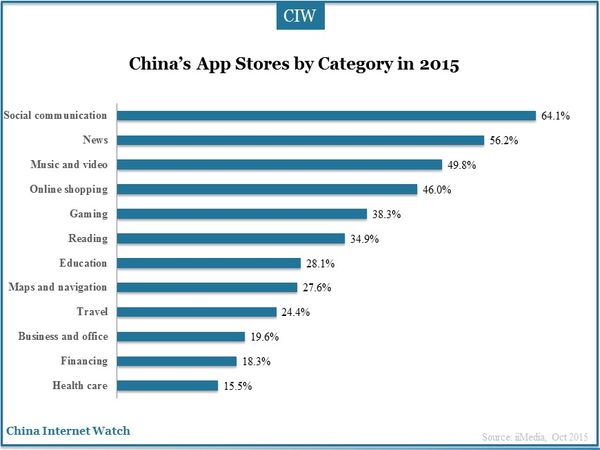

In terms of popularity of various types of mobile apps in China, the Chinese smartphone users prefer instant messaging and social communication apps, followed by news apps and music apps.

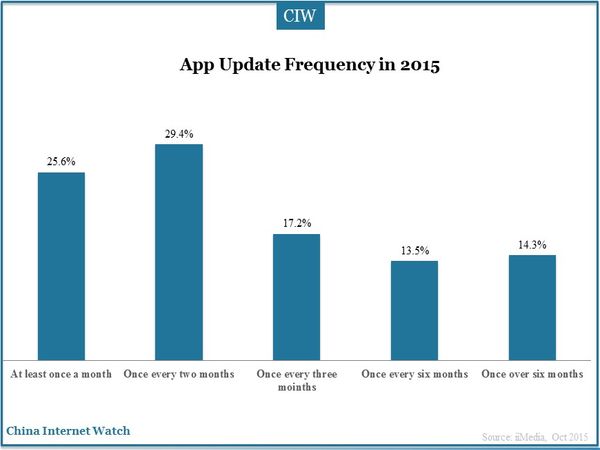

App update frequency by developers could reflect the number of active users and the competitiveness. About 14.3% apps are updated once longer than six months which means users aren’t a lot and may not be further maintained.

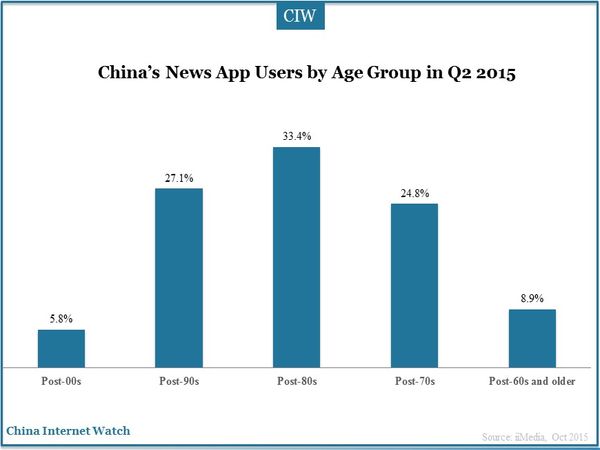

Tencent News, TouTiao, Netease News and Sohu News are major channels for Chinese to get news information. The post-90s, post-80s and post-70s are the majority of mobile app readers.

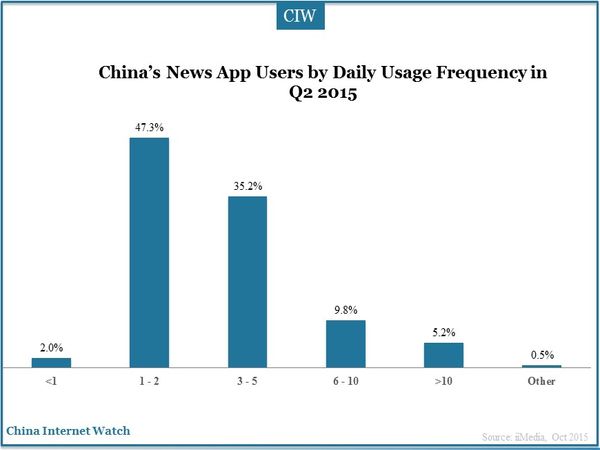

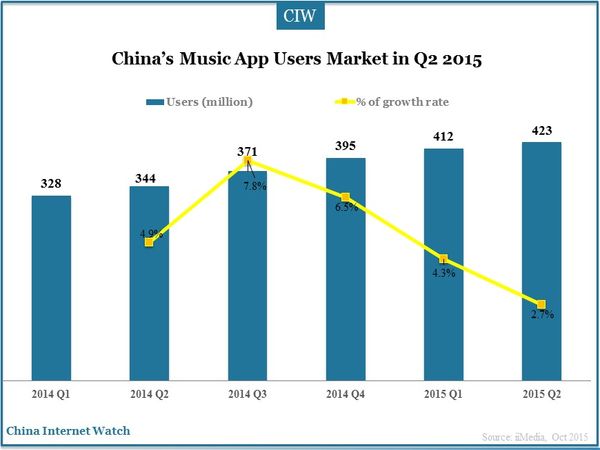

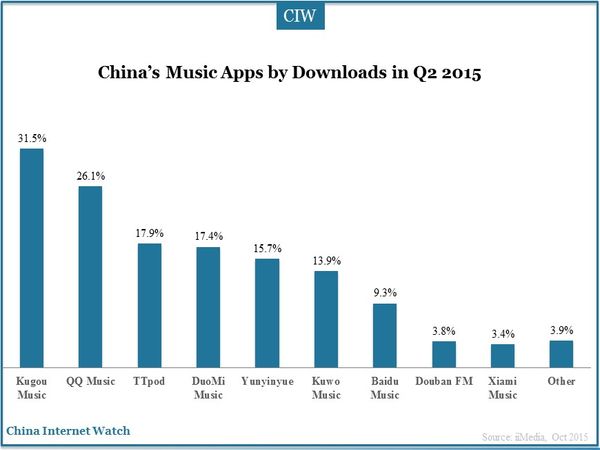

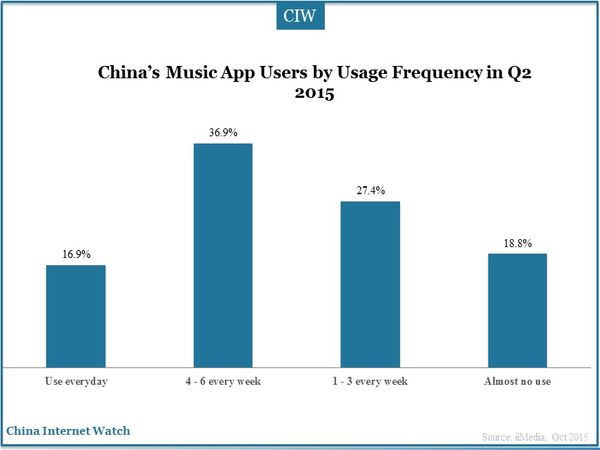

By Q2 2015, China’s music apps users reached 423 million with a growth rate of 2.7%. Kugou Music and QQ music win in music apps market with their high publicity and large song lists. Music apps are not used as frequently as news apps.

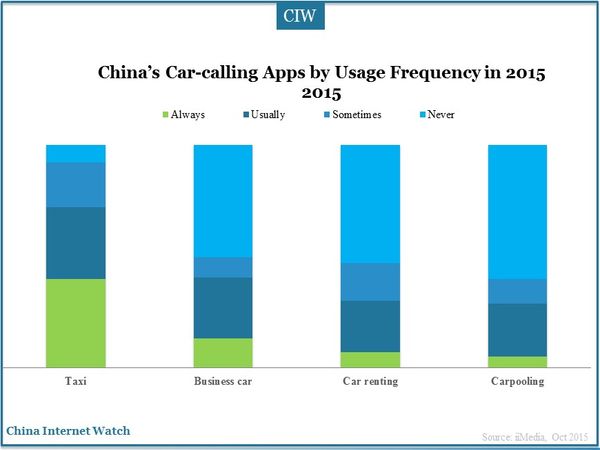

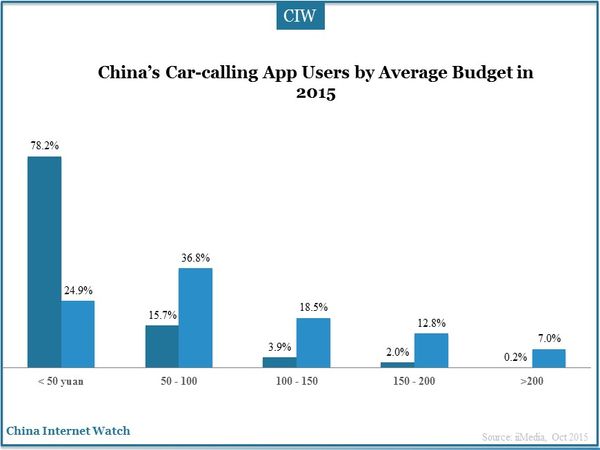

Taxi-calling apps are the most frequently used amongall car-calling apps for the lower cost. Users who prefer to get a better experience are more likely to use carpooling apps. The average fare of 78.2% taxi trips is less than 50 yuan (US$7.85) while only 24.9% of carpooling is less than 50 yuan. About 36.8% of carpooling costs is between 50 yuan to 100 yuan (US$15.70).

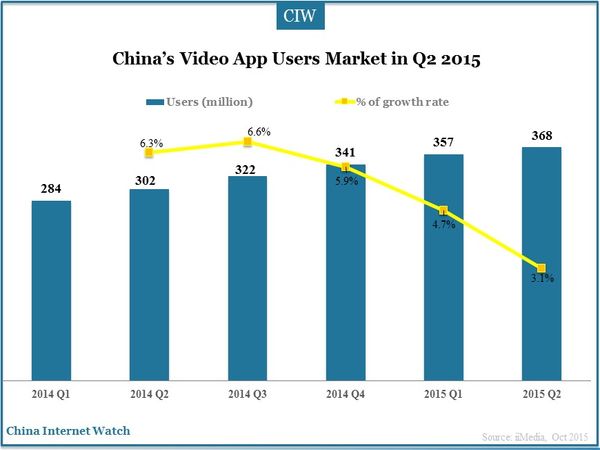

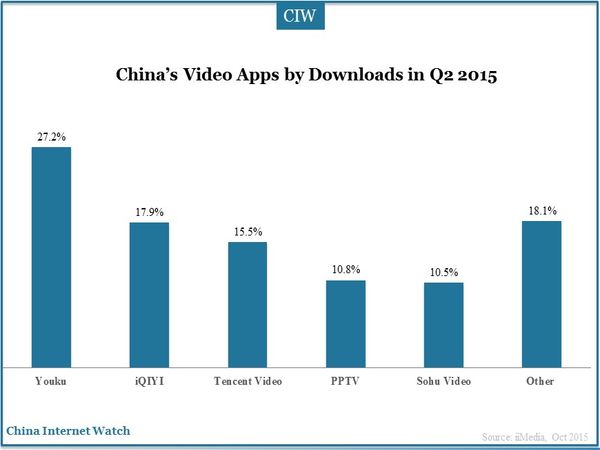

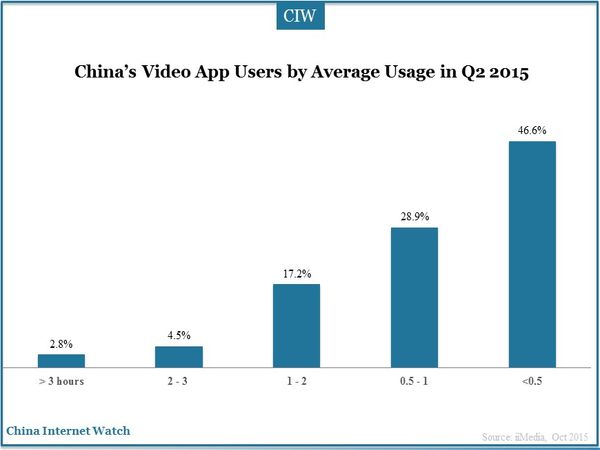

China mobile video app market is basically the same with the online market. Active users of music apps reachED 368 million with a growth rate of 3.1%. A matured online video market of Youku, iQIYI, Tencent Video, PPTV and Sohu Video has been established. Other apps in total accounted for only 18.1% of market share.

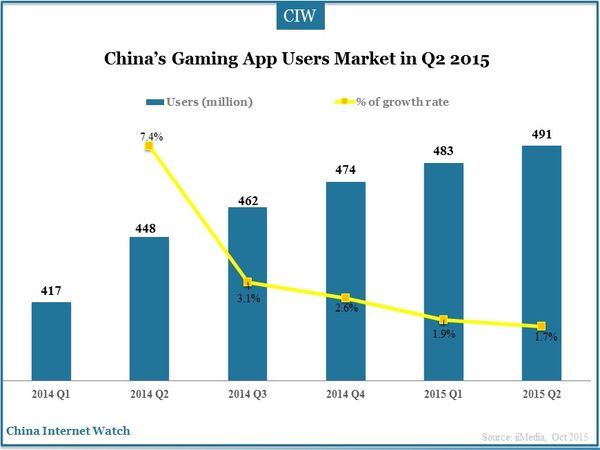

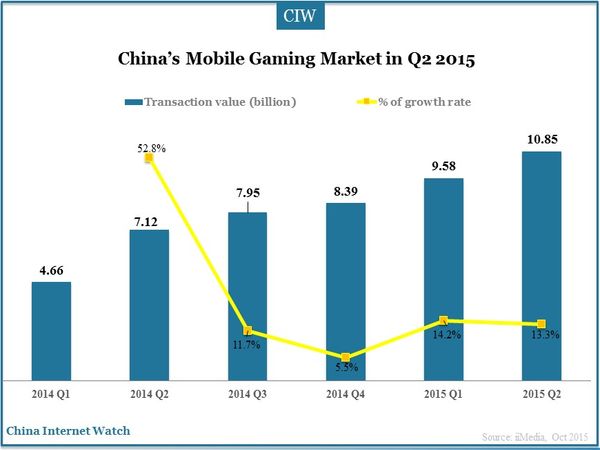

China’s mobile gaming users reached 10.85 billion yuan in Q2 2015, with 491 million users. Mobile apps couldn’t process too much storage and a majority of existing apps are puzzle games.

China’s app market still has a large room for development. At present, advertising and value-added services are the two most important profit channels for developers. However, the average usage period of apps is only ten months and about 85% apps are uninstalled within a month, especially social communication apps, which makes it hard for developers to gain profits. Developers should avoid invasion of users’ privacy and improve performance to attract more users.