Chinese e-commerce market increased by 21.3% to 12.3 trillion yuan (US$1.93 trillion) in 2014, and would maintain steady and rapid growth in the next few years. The e-commerce market in 2018 is expected to reach 24.2 trillion yuan (US$3.80 trillion) according to Kantar Retail.

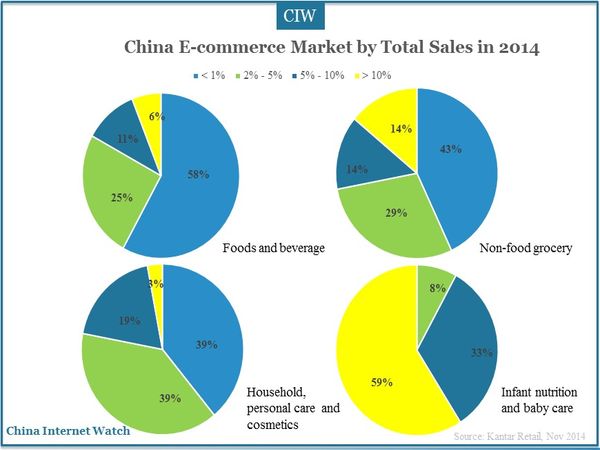

Foods and Beverage, non-Food Grocery, household, personal care and cosmetics, infant nutrition and baby care were major fast-moving consumer goods of China’s e-commerce. Household, personal care and cosmetics were relatively less reliable on electronic market: only 3% manufacturers had over 10% online revenues of total sales.

6% of foods and beverage manufacturers got over 10% of revenues from the online market. Non-Food grocery were relatively dependable on the online market that 14% gained over 10% their sales from the internet. Infant nutrition and baby care were most mature market: about 59% manufacturers gained over 10% of total sales from the online market.

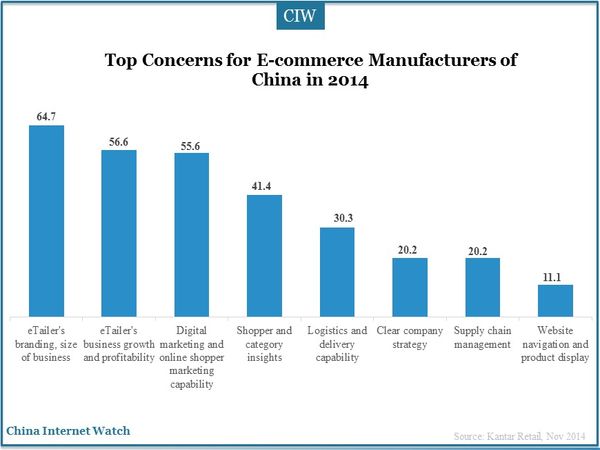

Size of business and branding, business growth and profitability, digital marketing and online shopper marketing capability were top three factors that influenced electronic manufacturers most, and followed by goods category insights, logistics and delivery capability. Digital marketing has been ever important for sales and revenues of companies.

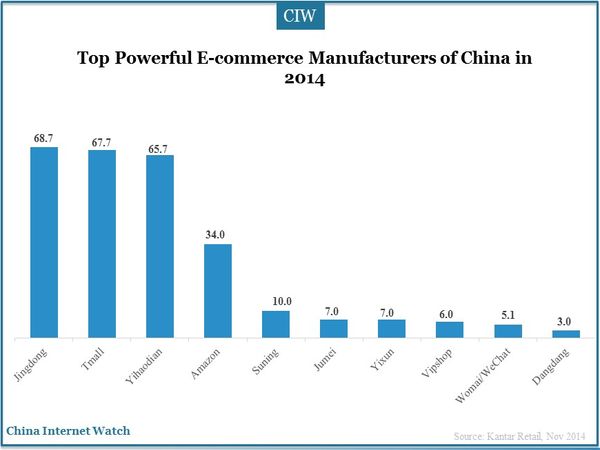

Among the top ten powerful e-commerce companies of China, Jingdong ranked first owing to increasing integrated good categories, leading logistics system and high-level website traffic. Tmall ranked second, which behaved well in platform operation and digital marketing by standing on shoulders of strong big data of Alibaba. Yihaodian followed which was recognized for specialized foods and grocery supply.

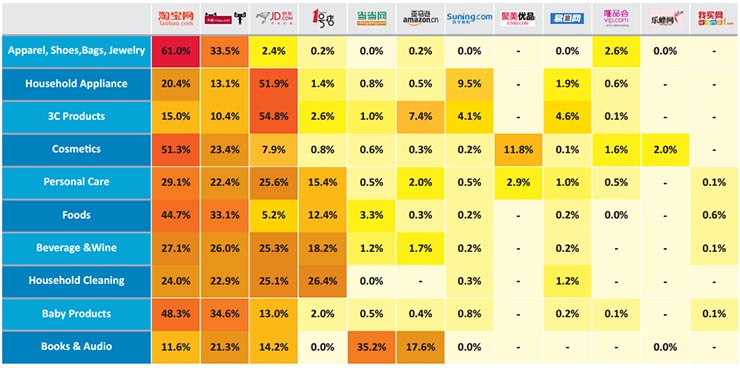

Different Chinese etailers have its own category priorities according to Kantar Retail report:

Also read: China Mobile Shopping in Counties Over $32.16B in 2014