China’s third-tier and fourth-tier cities account for 58% of the country’s smartphone market. China’s first-tier cities only account for 13% and second-tier cities 28%, which is out of expectation.

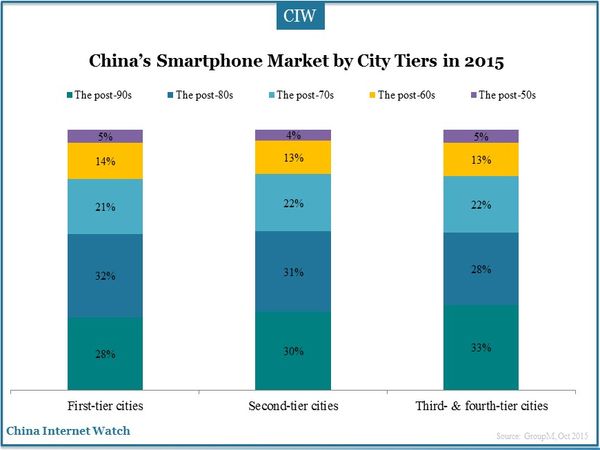

The post-80s and post-90s users combined account for about two-thirds of China’s smartphone market. The post-70s also have a large consumption needs of smartphones, which cannot be underestimated.

Differences exist in the purchase channels of smartphones. Consumers in China’s first-tier cities are more likely to buy phones on online B2C website. However, consumers in third-tier and fourth-tier cities are more inclined to buy through smartphone vendors’ websites or stores; the post-80s and post-90s prefer to buy on official websites or online shopping mall. The post-60s and 70s are more in favor of business offices, shopping malls and department stores to buy mobile phones.

Consumers in different tier cities have different concerns on smartphones when purchasing new sets. Consumers in first-tier cities value product evaluation reviews. Second-tier cities consumers are more concerned about related information on additional features and performance metrics. And, third-tier and fourth-tier cities consumers are more inclined to focus on price of smartphones.

Types of installed apps in smartphones have a significant discrepancy in different cities and people. Users in first-tier cities favor apps of business, health and sports while third-tier and fourth-tier cities prefer apps of music. The post-90s like social communication apps best, the post-80s download more apps on entertainment and navigation, and the post-70s prefer apps on lifestyle and tools.

Also read:China Top Smartphone Brands in H1 2015