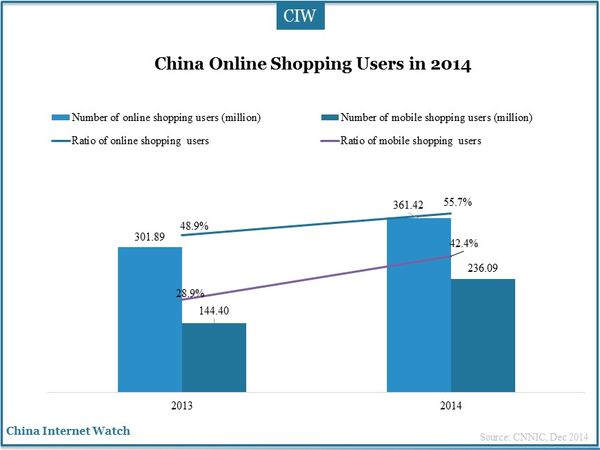

In 2014, China’s online shopping users reached 55.7% of the total internet users. In the mean time, mobile online shopping market was booming in China, with an annual growth rate of 63.5%, 3.2 times higher than the overall online shopping market.

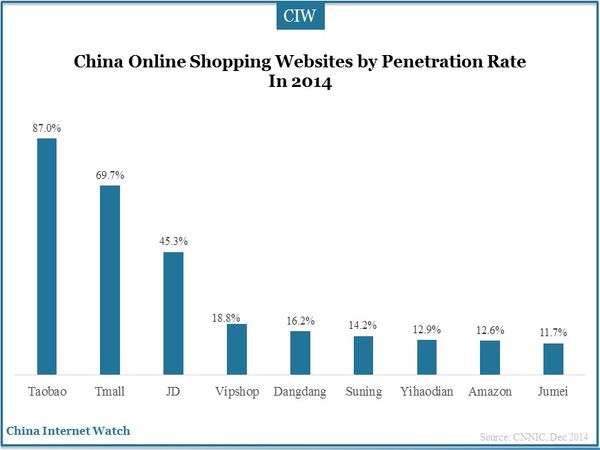

The booming of the mobile shopping market accelerated the strategic layout of companies. The configuration of Chinese online shopping market remain steady. Taobao, Tmall and Jingdong led the market with penetration rates of 87.0%, 69.7% and 45.3% respectively. After being listed on the market, Jumei, Jingdong, Alibaba would broaden their business across the world.

According to China Internet Information Center (CNNIC), about 361.42 million Chinese shopped online in 2014, compared with 301.89 million in 2013. Mobile shopping users increased to 236.09 million, 55.7% of the total.

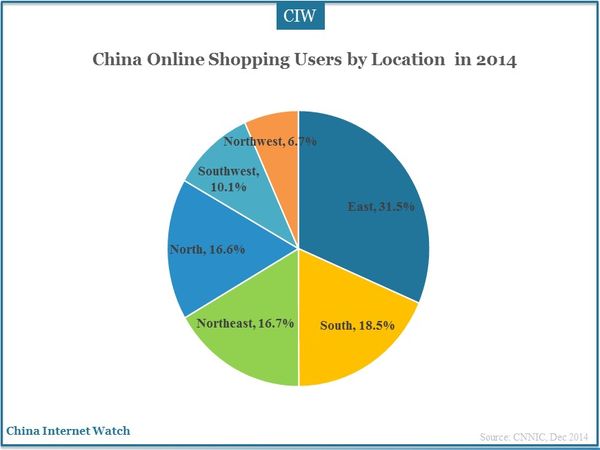

Almost one-third online shoppers were in the eastern region of China, followed by the southern (18.5%) and northeastern (16.7%). Users in the northwestern were the lowest.

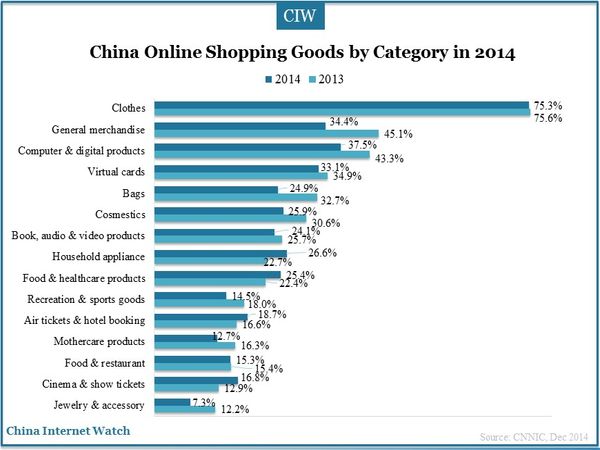

China’s online shopping market are more versatile compared with some western countries. China online users could buy both real and virtual goods online, some of which are even beyond many westerners’ imaginations. Clothes, computer and digital accessories, virtual cards and household appliance were main categories of online shopping in China.

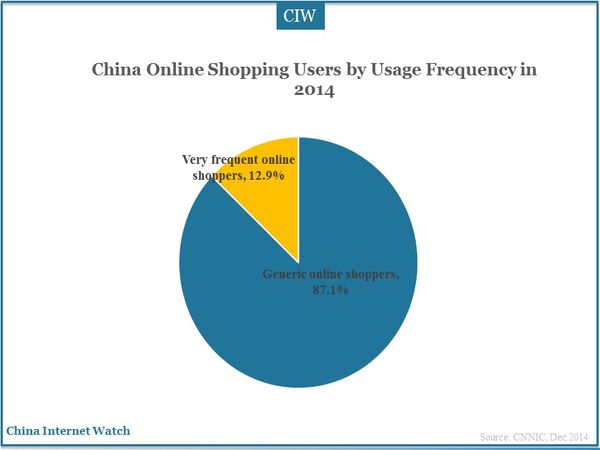

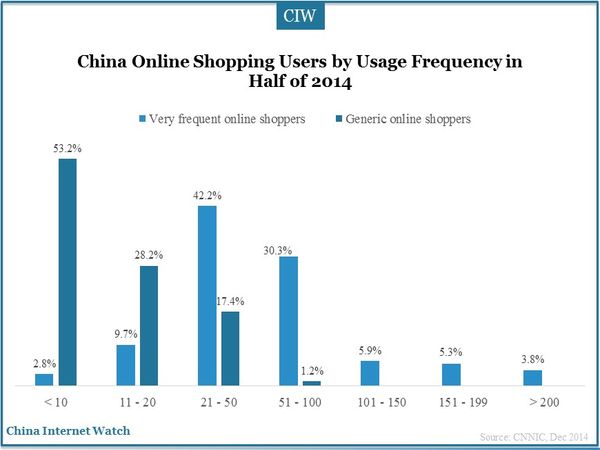

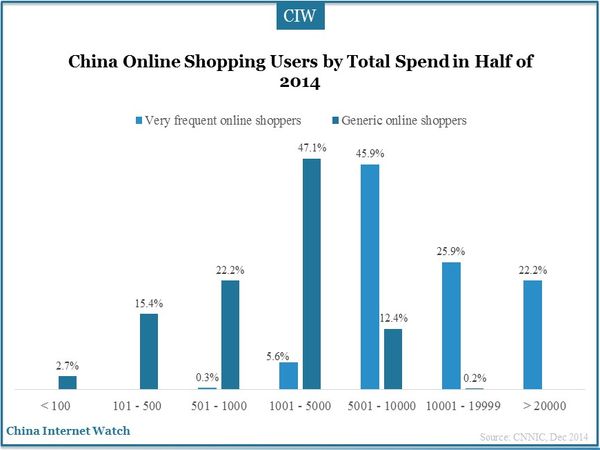

Based on shopping frequency and expenditure, China online shoppers could be divided into two groups, generic shoppers and frequent shoppers.

Very frequent online shoppers in China spent more than generic shoppers. The average expenditure in half year of 2014 by frequent shoppers reached 12,610 yuan (US$1,976.78), almost five times of 2,687 yuan (US$421.22) by the generic online shoppers.

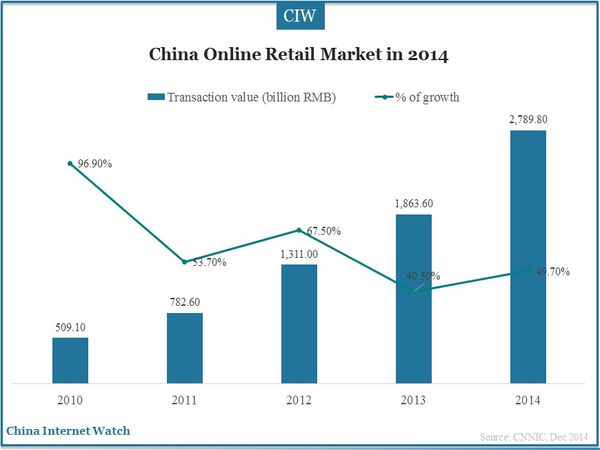

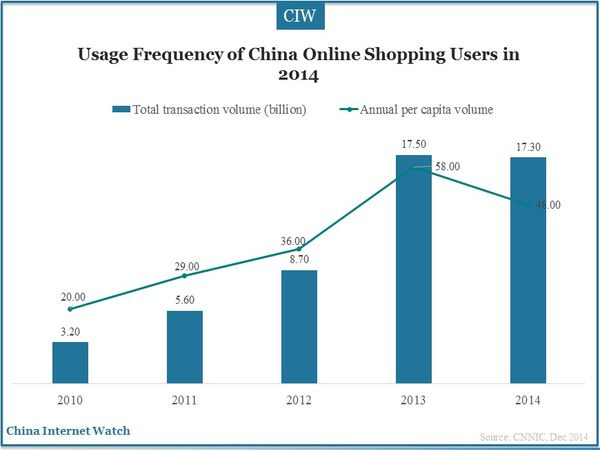

The omnipotent online shopping contributed 2,789.80 billion yuan (US$437.53 billion) to the total online retail, an increase of 49.7% compared with the same period last year, which was equal to 10.6% of China’s social consumer goods retail. China (US$41,151.50 billion) was the largest online shopping market in 2014, followed by the United States (US$3,056.50 billion).

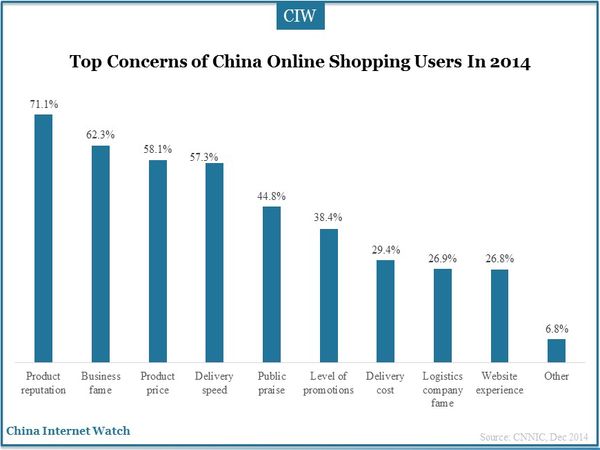

Featured as online shopping market, the displayed information couldn’t show realistic meaning and value of products; thus product reputation, business or company’s fame, together with price were top three influencing factors from the view of consumers. Delivery time was also one of the purchase decision factors.

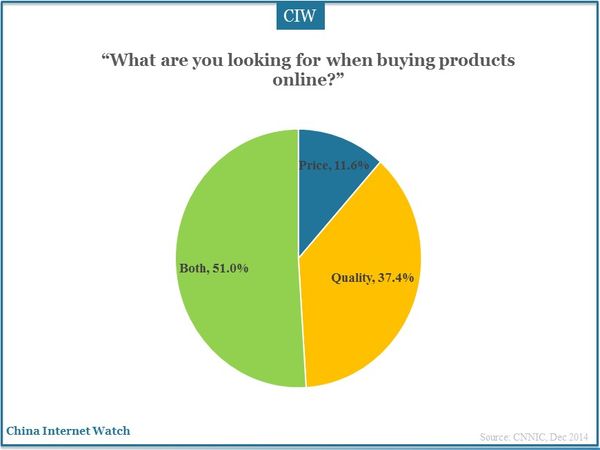

Affected by household income level, 11.6% showed they were willing sacrifice quality in shopping online, and 51% would consider quality and price both.

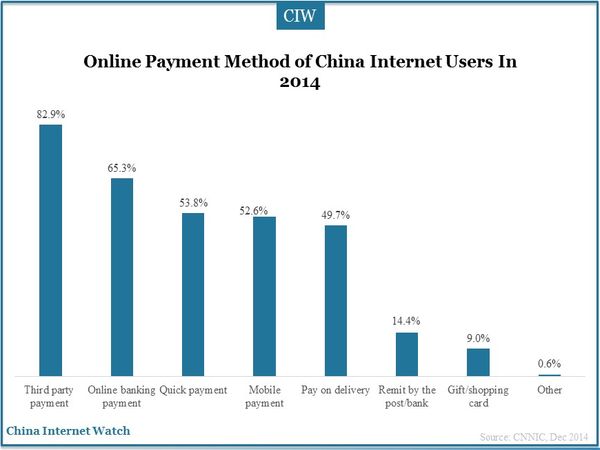

Payment channels for online shopping were diversified in China. Third party payment(eg.Alipay) was the mainstream channel, with penetration rate as high as 82.9%, and followed by online banking payment and quick payment.

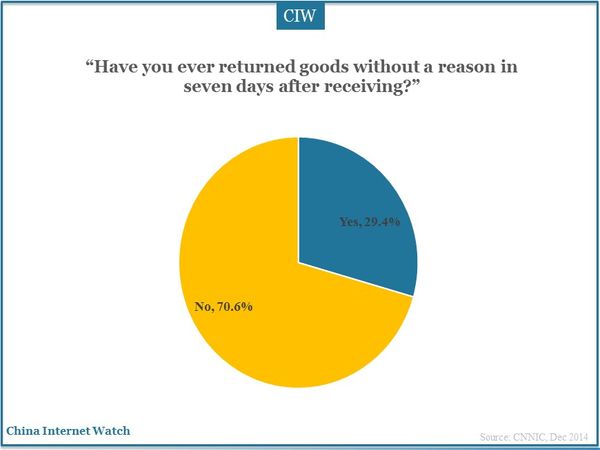

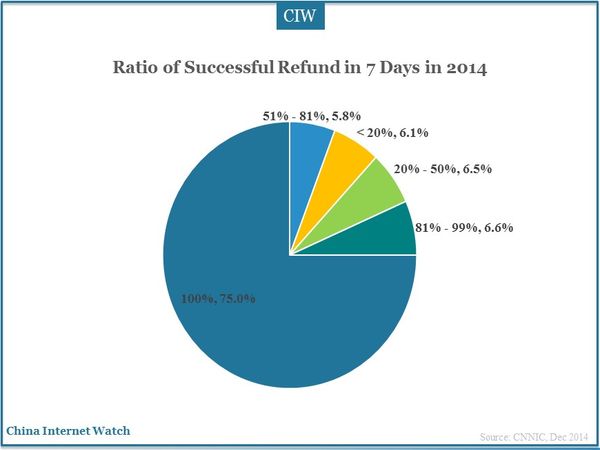

The Chinese government published corresponding regulations to protect consumers’ rights and interests, one of which with a large impact was the ‘7-day refund; no question asked’. 30% online shoppers once refunded goods, and 75% resolved the refund successfully.

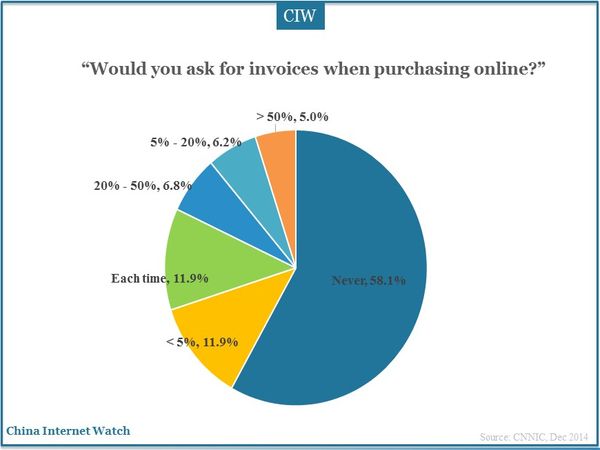

Invoice consciousness was not so strong in Chinese minds. During online shopping, only 11.9% asked for invoices each time, and 58.1% haven’t asked for any.

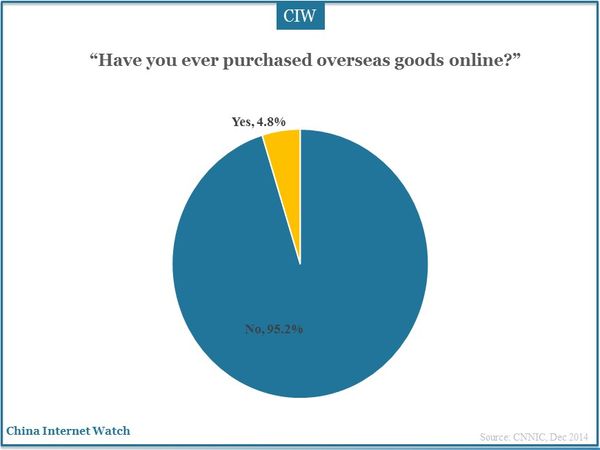

Online shopping for overseas goods gradually became a common practice of Chinese online shoppers. In 2014, only 4.8% admitted shopping for overseas goods; however, with many B2C companies realizing the potential, the group will grow in the future.

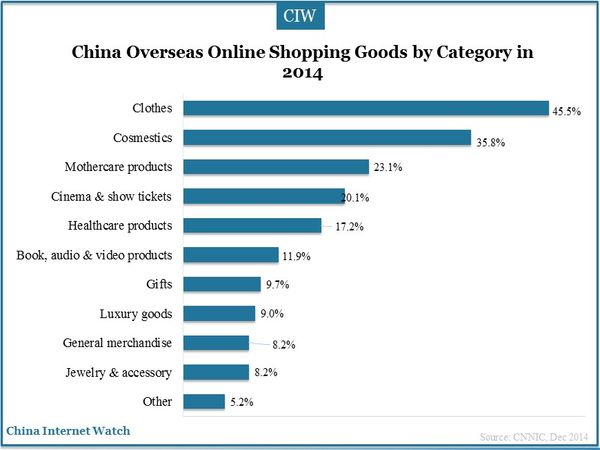

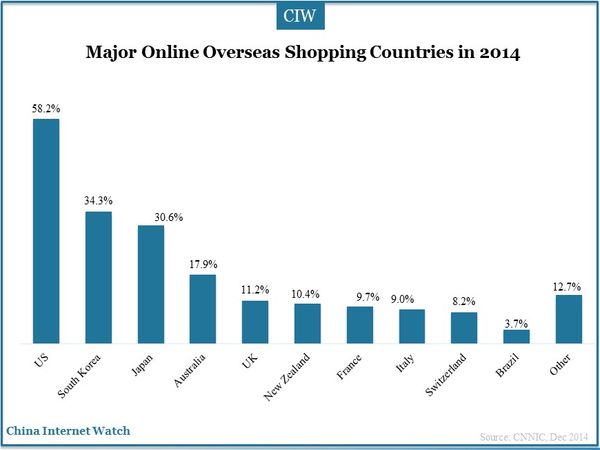

Clothes were first choices of 45.5% Chinese online shoppers shopping overseas. America, South Korea, and Japan were the hottest shopping destinations. The average order price of cross-border shoppers was higher than the overall online shopping. In 2014, the annual average spned of online cross-border shoppers was 4989 yuan (US$782.10), 64.1% of the overall.

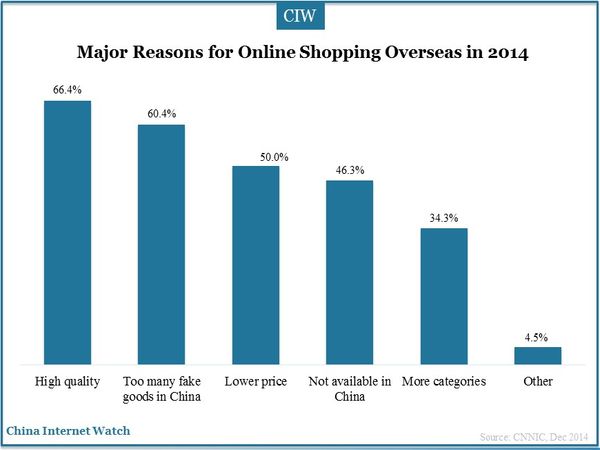

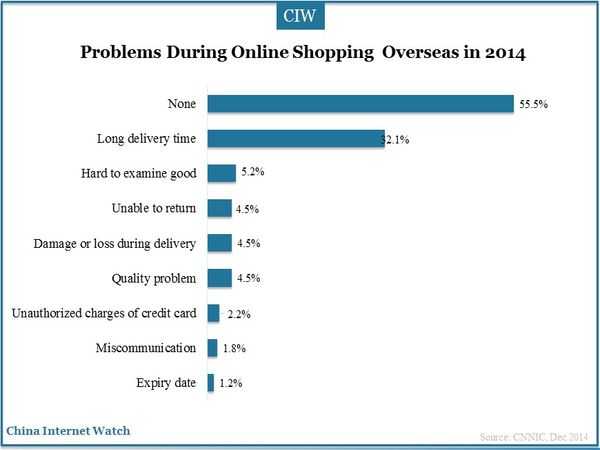

66.4% users chose to purchase overseas goods online due to the high quality in some foreign countries, and half due to lower prices. However, online shoppers sometimes faced problems such as long delivery time, damaged or loss of goods, hard to check and unable to refund or return.

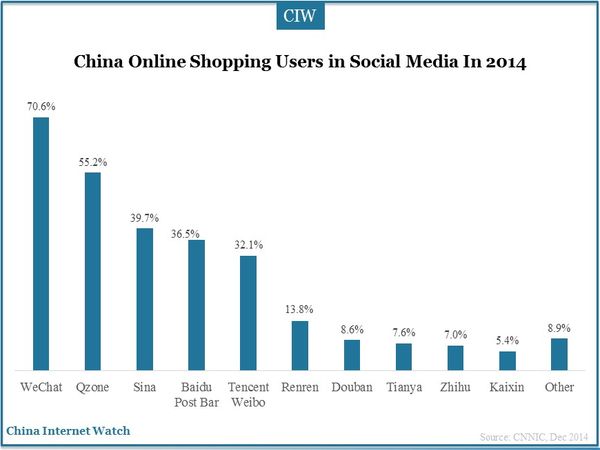

Social e-business wasn’t a new concept in China. As early as 2011, Chinese companies began the exploration in the social network and online shopping market. According to the research by CNNIC, online shoppers accounted for 70.6% of WeChat users, 55.2% of QQ users, and 36.5% of Sina Weibo users, which had a tremendous potential.

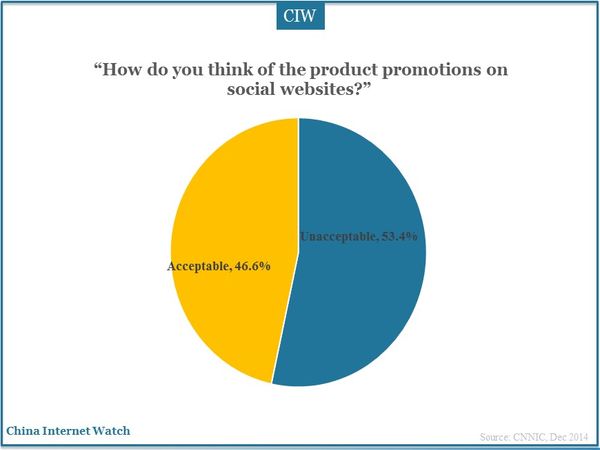

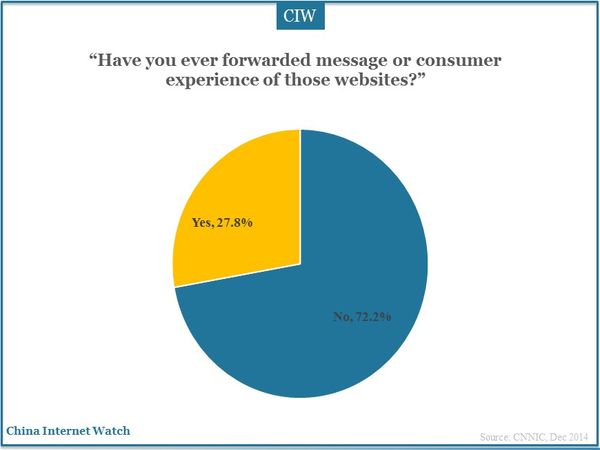

About 46.6% social networking users showed tolerance towards advertisements and marketing in social media. 27.8% users once forwarded messages and information of these websites, and 33.8% finally made orders following the promotion information.

China’s social media shopping had good genes and soil, with the continuous development of e-business market and acceleration of major companies, the proportion of this group and online overseas shoppers could be significantly increased.

Also read: China E-Payment Insights 2015