In Q2 2015, China’s online shopping market reached 872.54 billion yuan (US$136.77 billion), with a high level increase of 39.6%, which accounted for 12.3% of total retail value compared with 10% in 2014.

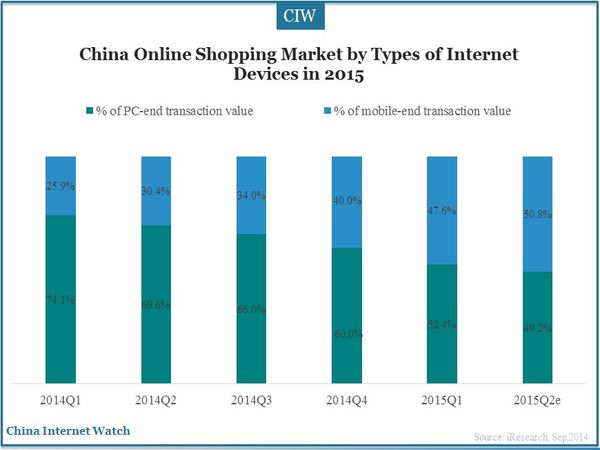

The transaction value of mobile shopping market exceeded 443.45 billion yuan (US$69.51 billion), an increase of 133.5% far higher than the overall growth of the online shopping market, which has become the main driving force for the rapid development of online shopping market in China.

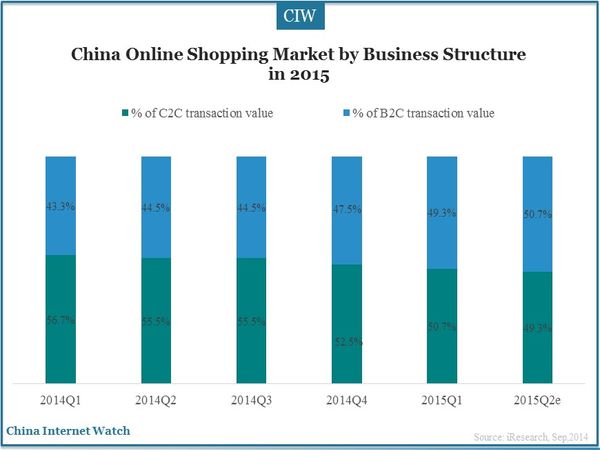

The transaction value of B2C market reached 442.13 billion yuan (US$69.31 billion) in Q2 2015, accounting for 50.7% of the overall online shopping value, 6.2 percentage points higher compared with Q2 2014. B2C market has been growing rapidly, this quarter China’s B2C online shopping market grew by 59.1%, much higher than C2C (24%). B2C has exceeded C2C to become the mainstream of China’s online shopping market.

From the use of different internet access devices, mobile shopping transaction value surpassed the PC-end turnover for the first time accounting for 50.8% of China’s online shopping market, an increase of 20 percentage points compared with the same period last year. In the future, mobile-end shopping would become major driving force of online shopping in China.

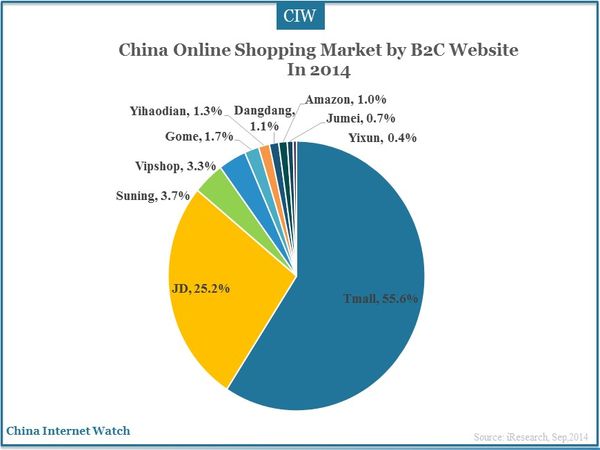

Tmall accounted for 55.6% of the total B2C online shopping market; Jingdong 25.2%, and the others totalled about 20% in Q2 2015.

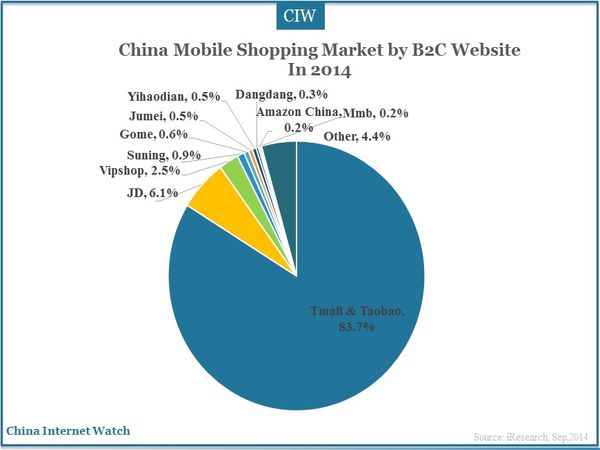

Alibaba’s mobile apps, such as Taobao and Tmall, made up 83.7% of China’s mobile shopping market share; Jingdong increased to 6.1%; and Vipshop ranked third with share of 2.5%.

Also read: China’s Mobile Market Analysis in Q2 2015