In H1 2015, the number of China mobile internet users reached 860 million, with 120 million increases compared with Q1 2015, which showed s high penetration rate of mobile music users according to data from TalkingData.

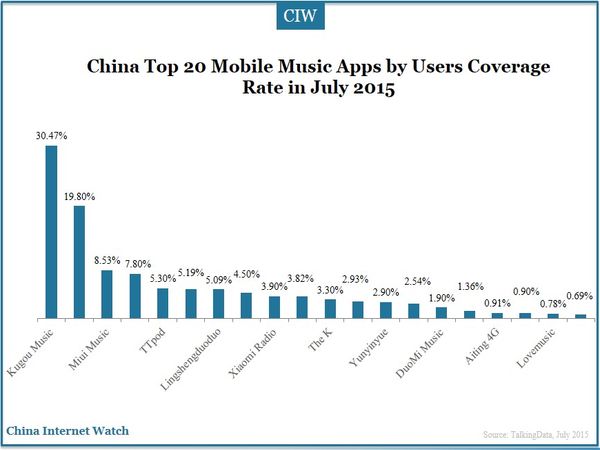

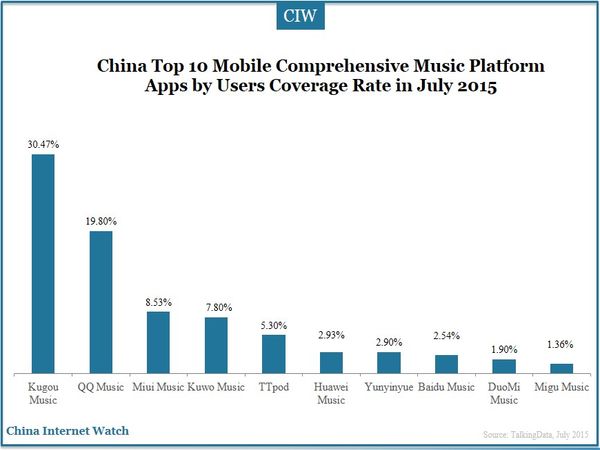

Among the top 20 mobile music apps, Kugou music ranked first with the coverage rate of 30.47%, followed by QQ Music (19.80%), Miui Music (8.53%), Kuwo Music (7.80%) and TTpod (5.30%).

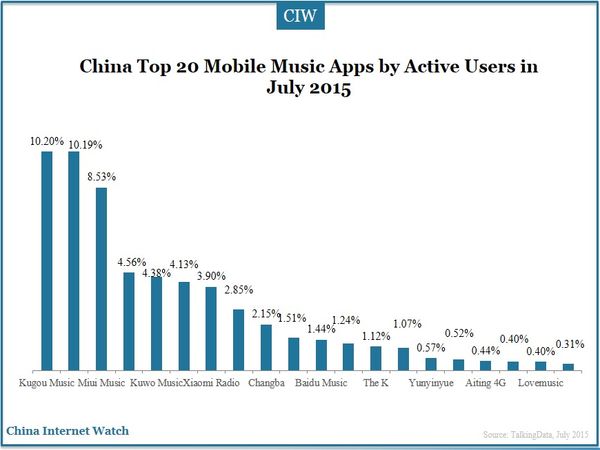

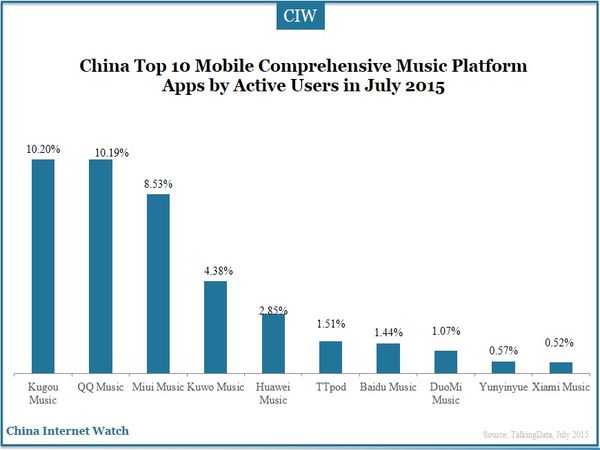

Among the top 20 mobile music apps by the number of active users, Kugou music took the lead position with active rate of 10.20%, followed by QQ music (10.19%) and Miui music (8.53%).

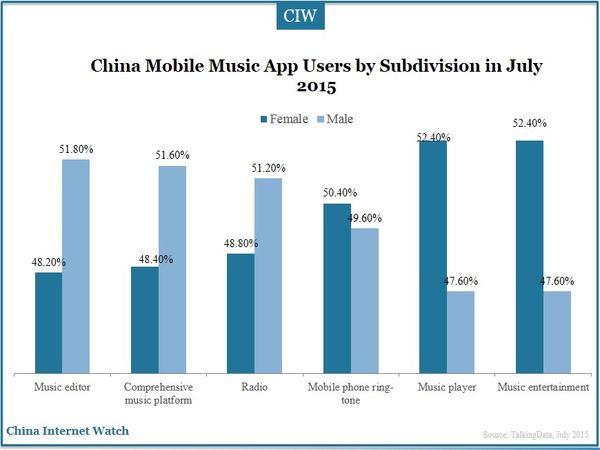

Female users accounted for 48.30% of the total mobile music app users in China, lower than that of male. Male users preferred music editing apps, comprehensive music platform and radio apps while female liked apps for music entertainment, music player and mobile phone ring-tones.

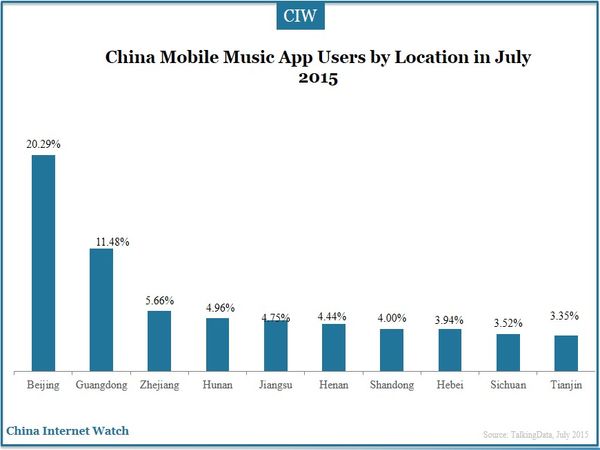

The location of mobile music app users had some relationship with the development level of regions. Beijing, with an overwhelming coverage rate of 20.20%, had the largest number of mobile music users, followed by Guangdong and Zhejiang province.The top 10 provinces and cities made up of 66.30% of the total market. First-tier cities and second-tier cities consisted of 15.40% and 32.30% of the total users respectively.

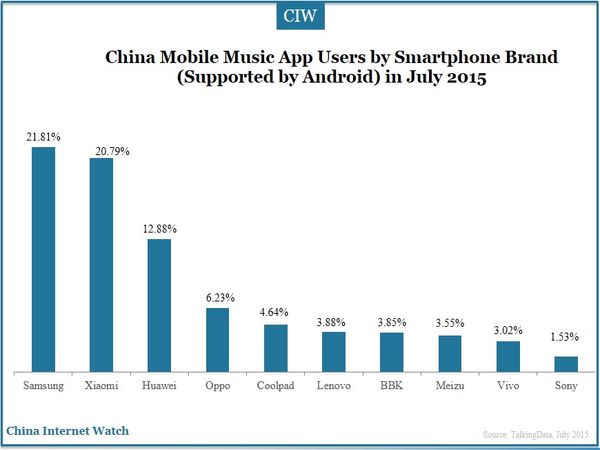

Among the top 10 smartphones supported by Android system for mobile music apps, Samsung and Xiaomi accounted for half the market, followed by Huawei 12.88%.

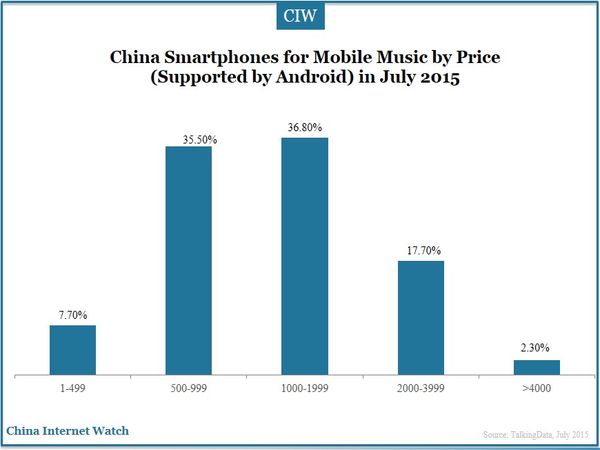

80.00% smartphones supported by Android for mobile music apps were below 1999 yuan. Smartphones between 1000 to 1999 yuan were the first choice of 36.80% users. 35.50% users bought handsets between 500 to 999 yuan and 17.70% used phones from 2000 to 3999 yuan. Only 2.30% users would buy phones over 4000 yuan.

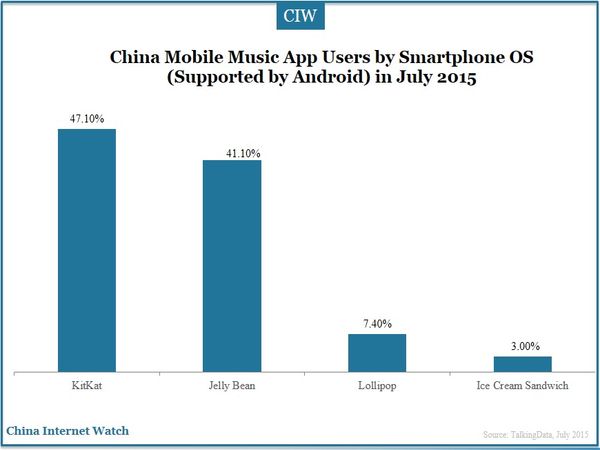

KitKat, Jelly Bean, Lollipop and Ice Cream Sandwich were different versions of Android OS. KitKat adoptions ranked first with ratio of 47.10%, followed by Jelly Bean (41.10%) and Lollipop (7.40%).

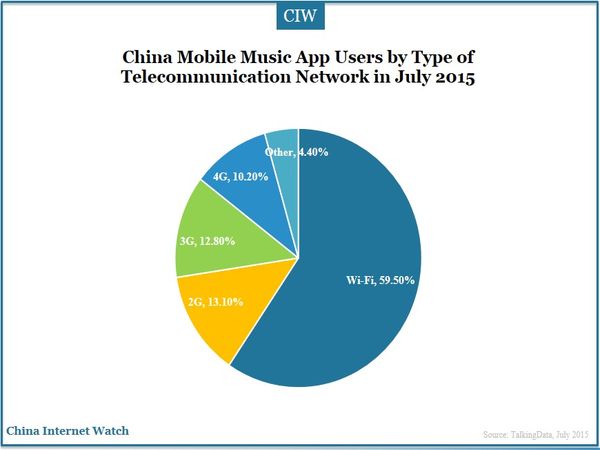

Wi-Fi became more and more influential among Chinese users. About 60.00% users would get access to the internet through Wi-Fi. Only 10.20% would utilize 4G network because of the high cost and incomplete coverage.

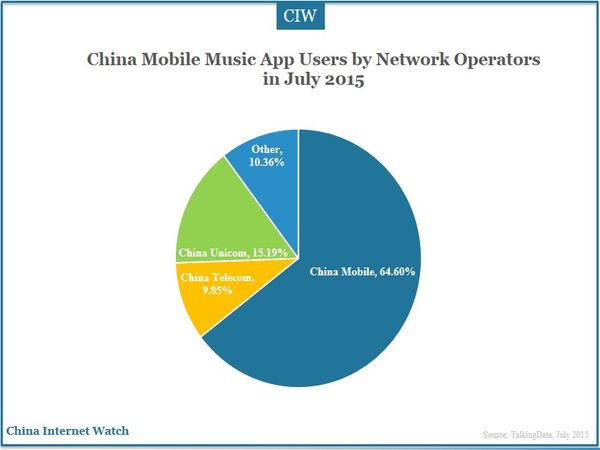

China Mobile, China Telecom and China Unicom made up of about 90.00% of Chinese network for mobile music app usage. 64.60% users gained access through China Mobile to the internet, which prevailed the sum of the others.

Comprehensive music platform apps referred to the apps that offered music, MV, lyric, radio, drama, cross-talks, variety shows and the others. Among the top 10 mobile music apps with highest coverage rate, Kugou music maintained the highest with 30.47%, followed by QQ music. All the others were lower than 10.00%. Kugou music, QQ music and Miui music were the most active mobile music apps, with ratios of 10.20%, 10.19% and 8.53% respectively.

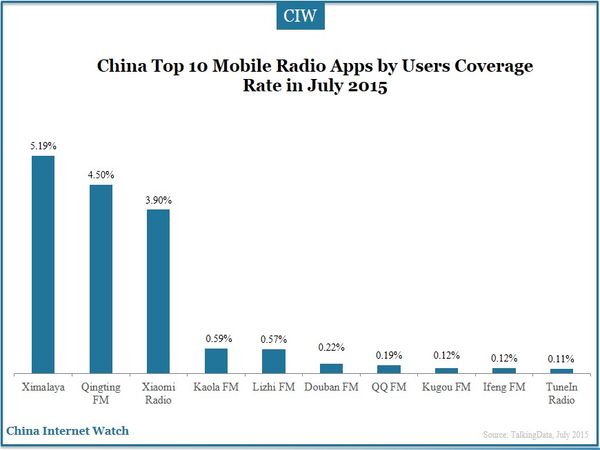

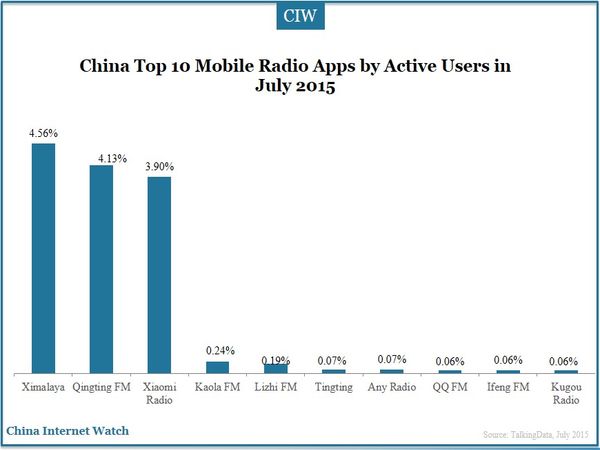

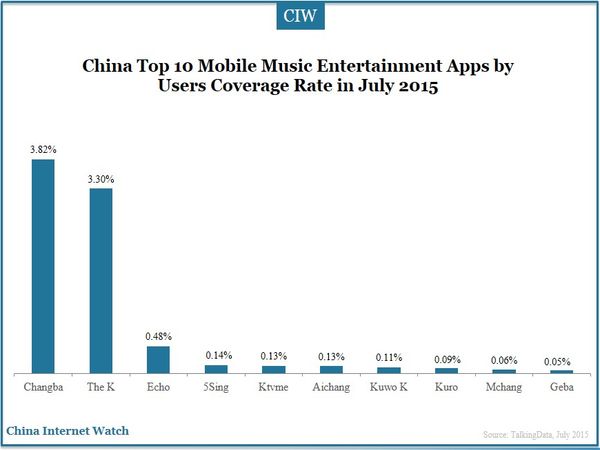

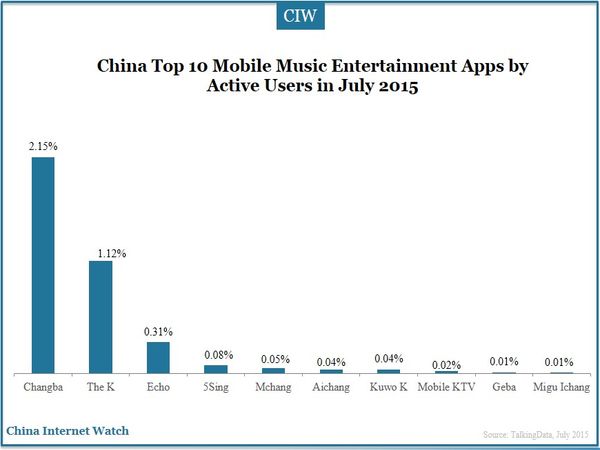

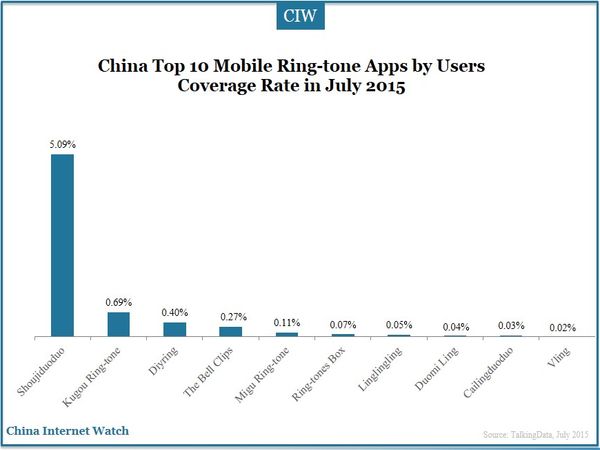

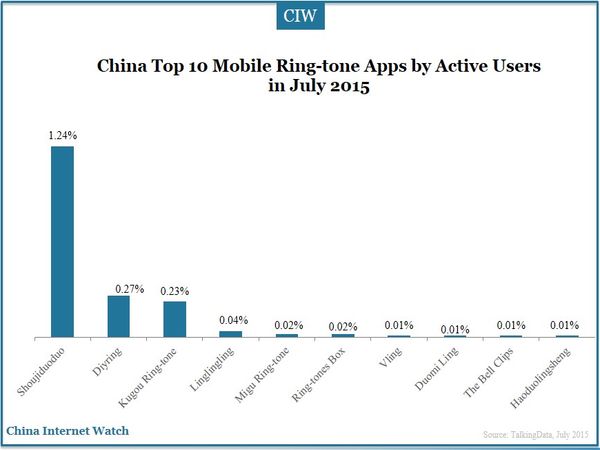

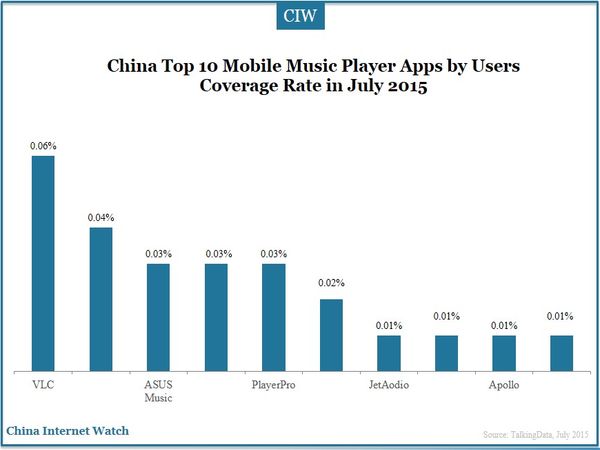

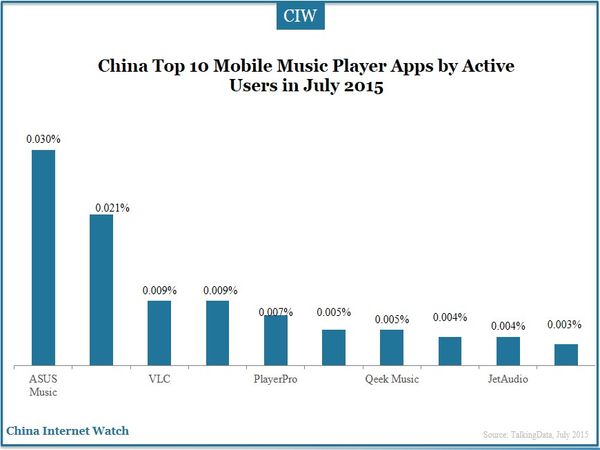

Mobile music apps referred to online radio that supported traditional radio service, original podcast, voice books and the like with widely covered themes and subjects. Ximalaya, Qingting FM and Xiaomi Radio took the first three positions in coverage and active users. The others were lower than 1.00%. See mobile music entertainment apps, mobile ring-tone apps and music player apps below.

Mobile music companies began competitions on copyright and tended to integrate in groups. Xiami Music and TTpod were acquired by Alibaba; Netease issued Yunyinyue; Himalaya FM acquired strategic investment from Yuewen Group, signing copyright cooperation agreement; and Changba gained D round of financing which promoted the layout of actual KTV.

Market structure has been changing. Original resources on the one hand integrated to large application companies, on the other hand cost uplift of copyright further compressed the living space of small and medium applications which might even be eliminated out of the market. Chinese mobile music industry didn’t set any defined shape, thus there was still a possibility that an app changed the market share in the future.

Also read: China Top 100 Mobile Apps in July 2015