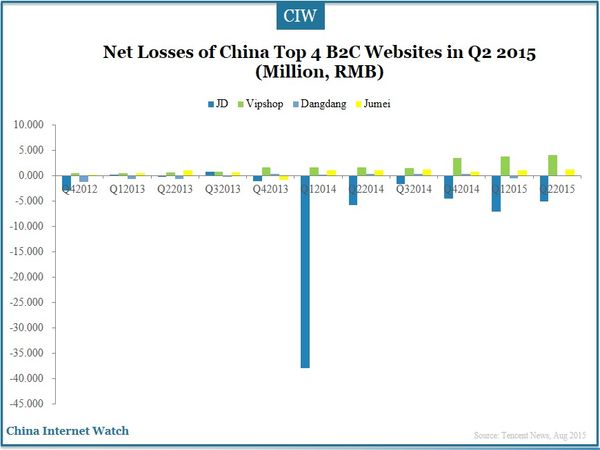

China’s top 4 B2C websites, JD, Jumei, Dangdang and Vipshop announced financial reports in Q2 2015, JD further inproved its business scale while suffering from greater losses. Jingdong lost over 1.8 billion yuan in the past year.

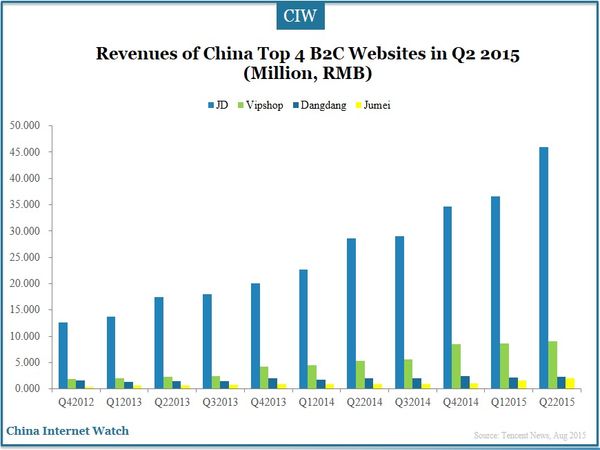

JD in Q2 2015 gained a revenue of 45.9 billion yuan (about US$7.4 billion), an increase of 61% year-over-year, mainly due to the increase of active users and orders; Vipshop totaled a net revenue of 9 billion (US$1.5 billion), 77.6% increase compared with 5.1 billion in the previous year; Jumei got a revenue of 1.963 billion yuan (US$308.1 million), 100% growth compared with US$154.4 million the same period last year; and Dangdang got a revenue of 2.312 billion yuan (US$373 million), a YoY increase of 29.8%, which was the slowest among the four companies.

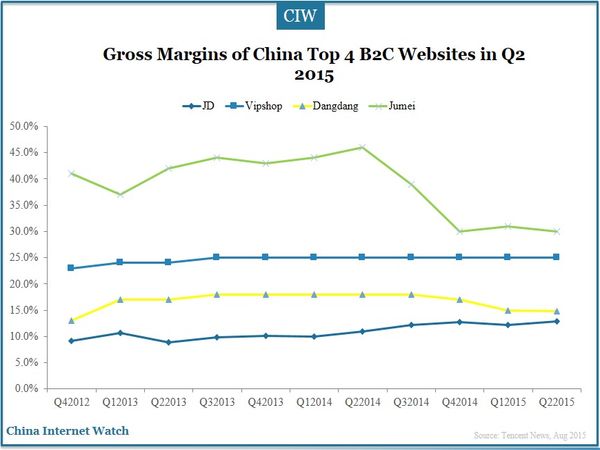

The gross profit of JD was 5.9 billion yuan (US$9.268 billion), with a rate of 12.9%, increasing 0.7 percent point compared with the previous quarter and 1.9 percent points compared with the same period last year; Vipshop gained a gross profit of 2.3 billion yuan (US$363 million), with a rate of 25% and 78.6% increase compared with the same period last year (US$204 million); Dangdang gained a gross profit of 340 million yuan (US$53.41 million), with a rate of 14.8%, lower than 18% in Q2 2014 and 15.2% in Q1 2015; and Jumei gained a gross profit of US$92.3 million, 29.1% rise compared with US$71.5 million a year earlier. The gross margin rate of Jumei was higher than the other three, but it has been long rumored that the high margin rate was affected by fake goods.

JD got a net loss of 510.4 million yuan (US$82.3 million), compared with 582.5 million yuan (US$91.5 million); the net profit of Vipshop was 399.3 million yuan (US$62.72 million), an increase of 147.2% compared with 161.5 million yuan of the same period last year (US$25.37 million); Dangdang lost 21.2 million yuan (US$3.4 million) in Q2; and Jumei gained a net profit of US$17.1 million, an YoY increase of 11%.

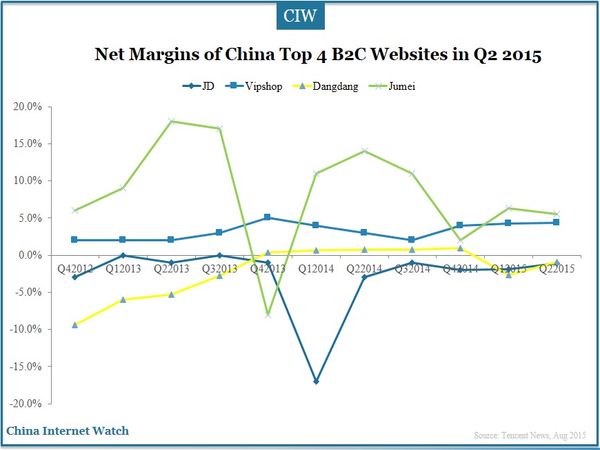

The net profit margin of JD was -1.1%, Dangdang -0.9%, Vipshop 4.4% and Jumei 5.5%.

Also read: China Mobile Shopping Market Value Exceeds RMB36 Bln in Q1 2015