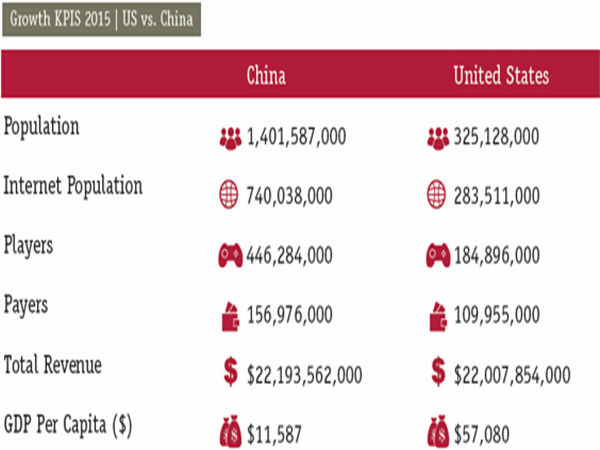

In 2015, Chinese online gaming market is expected to reach $22.2 billion (about 142 billion yuan), and officially surpass the U.S. as the world’s largest online gaming market according to data of TalkingData and Newzoo. Mobile gaming revenue of China in 2015 is estimated to reach $6.5 billion (about 41.6 billion yuan), surpassing Japan and the United States to become the world’s largest mobile gaming market.

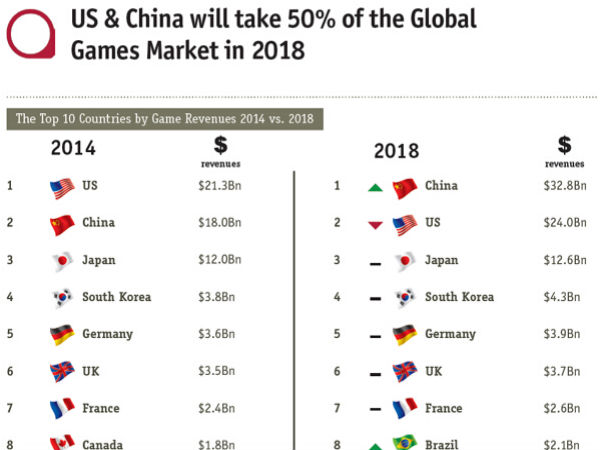

In 2014, the world’s top ten online gaming countries and regions by revenues are the United States, China, Japan, Korea, Germany, Britain France, Canada, Spain and Italy; and by 2018, China will reach the top; Brazil and Mexico will become the seventh and tenth respectively.

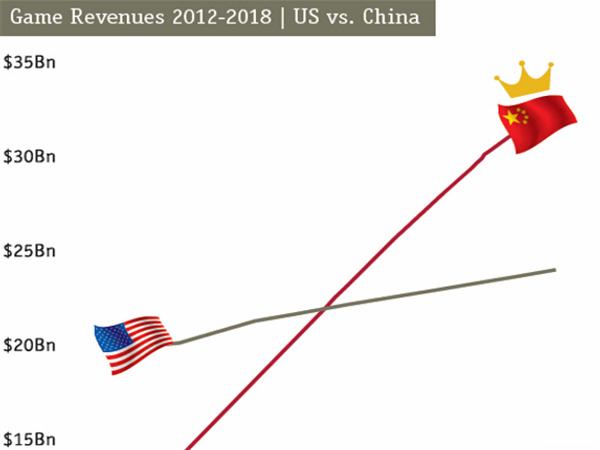

In 2013, China surpassed Japan to become the world’s second-largest online gaming market, following the United States. However, in only wo years, China will take the top spot and reach nearly 2 times that of Japanese online gaming market revenues. By 2016, the Chinese gaming market will increase to $26.2 billion (about 167.7 billion yuan) ahead of the U.S. $22.6 billion (144.6 billion yuan), and expected to reach $30 billion (about 192 billion yuan) in 2018.

Although the Chinese online gaming market represents a very big opportunity, the main revenue of current Chinese game industry still comes from local developers and local games. European and American developers may enter China indirectly during the process. For example, Tencent has been seeking for more developers from Europe and American.

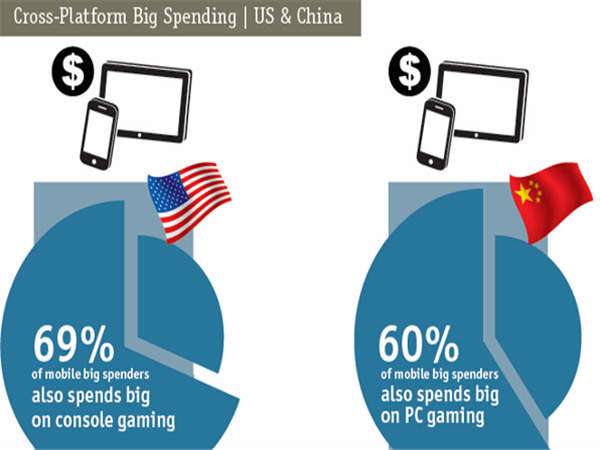

About 4.8% of American mobile gaming players would spend a lot on gaming, compared to 2.6% in China. In terms of demographics, the amounts of highest consumption players between the two countries are similar, but the ratio of women is slightly higher in China. In the U.S., the largest age level of high-spend users (48%) is male between 21 to 35 year-old; in China the largest age level of high-spend users (43%) is also between 21 to 35 years old.

In 2015, top 10 western publishers by Android revenues in China are Supercell, Mojang, Raleigh, PopCap and Gameloft. Top 10 Chinese publishers by Android revenues in China are Tencent, NetEase, Yingan Games, Happy Elements and iDreamsky.

In the Chinese online gaming market, the top 20 games revenues accounts for 74.2% of top 100 total revenues, compared to 61.3% in the U.S.. In 2015, the U.S. market is expected to reach 3.5% increase up to $22 billion in revenue. Despite the common misconception that the U.S. mobile gaming market has reached a saturation stage, the smartphones and tablet games will still maintain a 13.4% and 17.8% annual growth rates respectively and reach $6 billion in revenue (27% of total).

Also read: China Mobile Gaming Market in H1 2015