In 2014, the transaction value of Chinese mobile payment reached 6 trillion yuan (US$0.94 trillion), and is expected to exceed 9 trillion yuan (US$1.41 trillion) in 2015. The popularity of O2O and smartphones triggered deeper penetration of electronic payments.

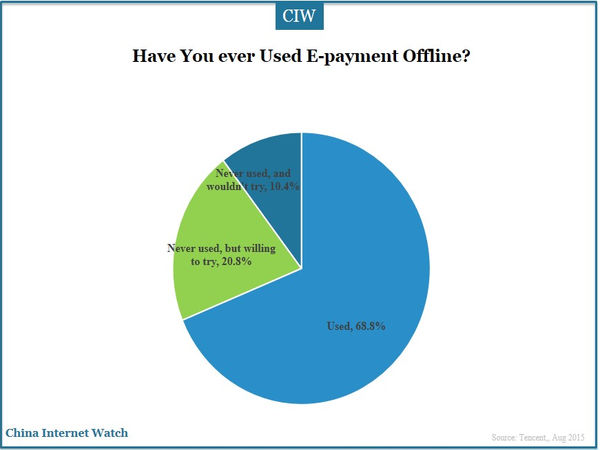

According to a survey by Tencent, 68.8% of respondents used e-payment offline. 20.8% said that although they had not yet, they were willing to try. Only 10.4% of users had not used before and were not willing to try.

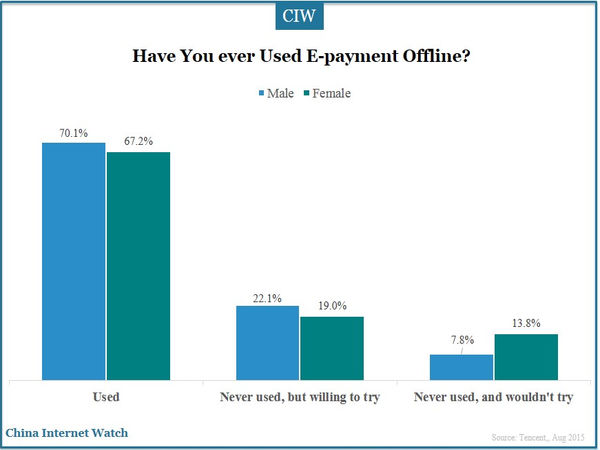

70.1% of male users used electronic payment offline, 22.1% said that although had not used, they were willing to try. In contrast, the corresponding proportion of female users was only 67.2% and 19%. Ratios of users who had not used e-payment before and would not have a try reached 13.8% among female, which was about 1.8 times more than the corresponding male users.

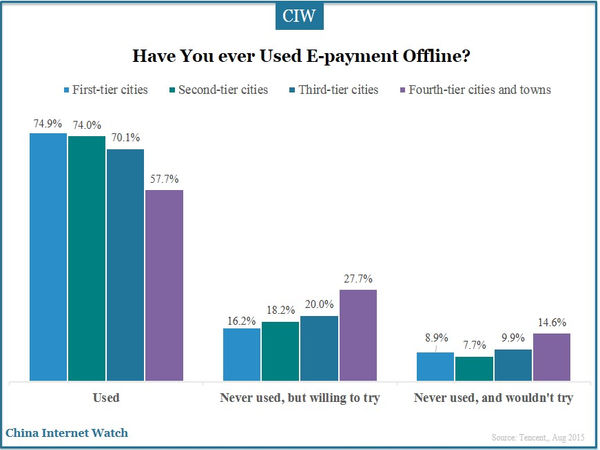

Usage of electronic payment in different level of cities had relations with the development level of cities. The more developed cities have more e-payment offline users.

ddd

ddd

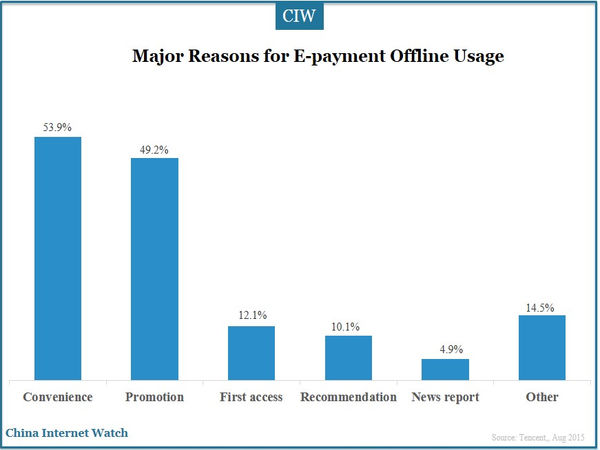

Convenience and preferential promotions were major two reasons for offline usage of e-payment. First trial and friends recommendations could also encourage the user’s next attempt at electronic payment offline while news media didn’t help much, only 4.9%.

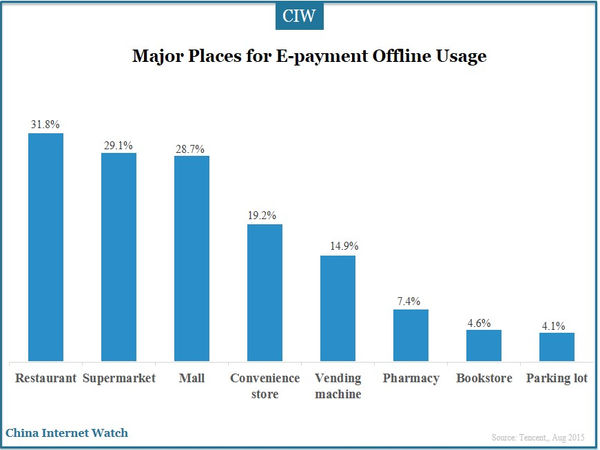

Restaurants, supermarkets and shopping malls were top three places of most common offline e-payment occasions. Restaurants took the lead, up to 31.8%, followed by supermarkets (29.1%) and shopping malls (28.7%). Convenience stores and vending machines were also frequent-used offline occasions of e-payment. In addition, pharmacies, bookstores, parking lots were the places where users used electronic payments, but their ratio did not exceed 10%.

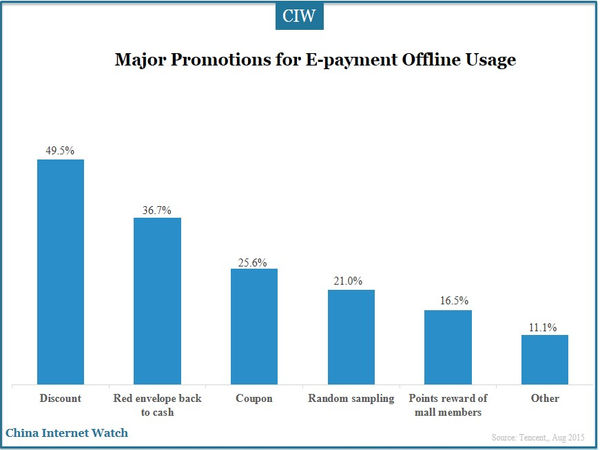

Preferential subsidies were one of the important means to encourage users to give up the wallet. About 50% users would turn to use mobile payment if there were discounts, and 36.7% would if the offline stores could give back cash activities through red envelopes on Alipay or WeChat. Coupons and samplings could also help to attract users, but their appeal was weaker than discounts and red envelopes, both the ratio of no more than 30%. Points reward to shopping mall members were less attractive compared with other promotions. Only 16.5% users were willing to use mobile payment for points reward.

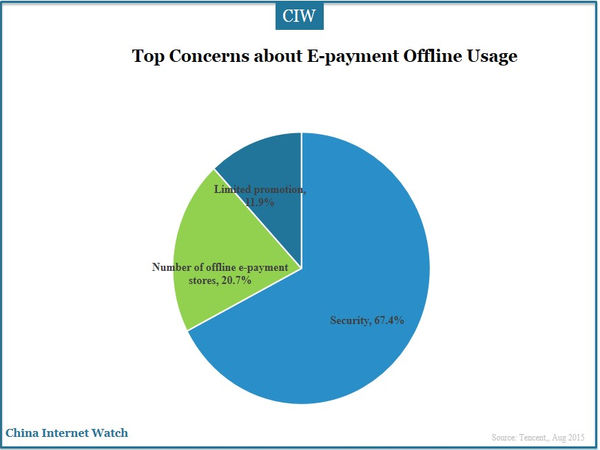

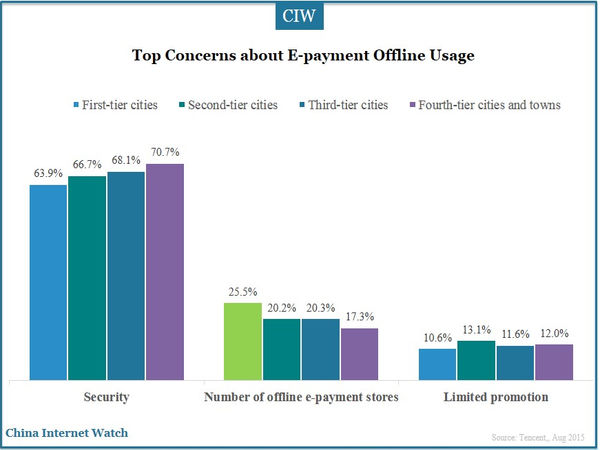

During the usage of offline mobile payment, transaction security problem was biggest concern among users. In addition, 20.7% of users worried about the availability of offline e-payments among off-line merchants. Only 11.9% of users concerned about the levels of promotions.

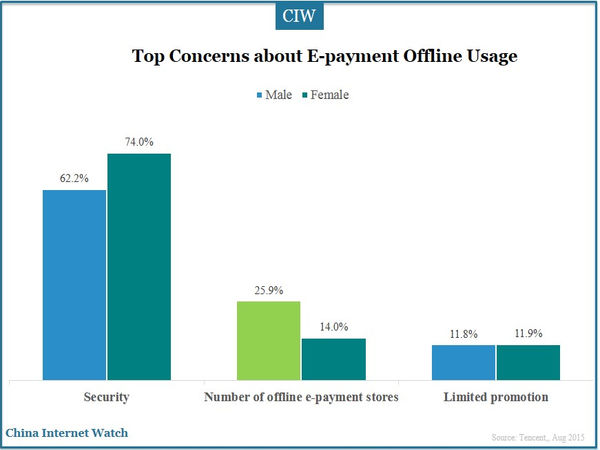

Male users were more worried about the number of stores that could support e-payment while female users were more concerned about the transaction security.

The higher development levels of urban areas, the lower the users are concerned about the transaction security. In first-tier cities, more users care oncerned the coverage of offline e-payment.

Flexible electronic payment was undoubtedly more convenient than the physical wallet, and multiple authentication technologies, such as fingerprint recognition and gesture unlock, also made it safer than the physical wallet. In theory, electronic payments have to replace the traditional means of payment; however, limited by the coverage, users of traditional habits and other factors, it’ll take time for offline e-payment to be the top choice of consumers’ payment.

Also read: China Mobile Internet Users Reached 740 Million in Q1 2015