Affected by multiple factors, the advertising market in China in H1 2015 was mediocre which did not develop as expected.

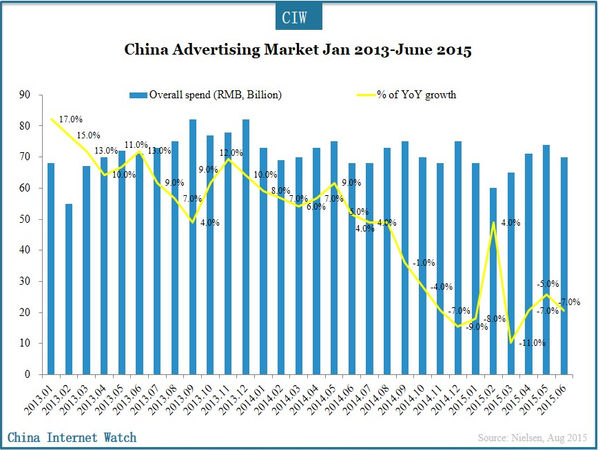

The overall advertising market in China in 2013 showed a growing trend, with a significant growth in the first half but slowed growth in the second half. In 2014, the slow growth trend continued. In H1 2015, China advertising market showed a decreasing trend apart from a slight increase in February 2015.

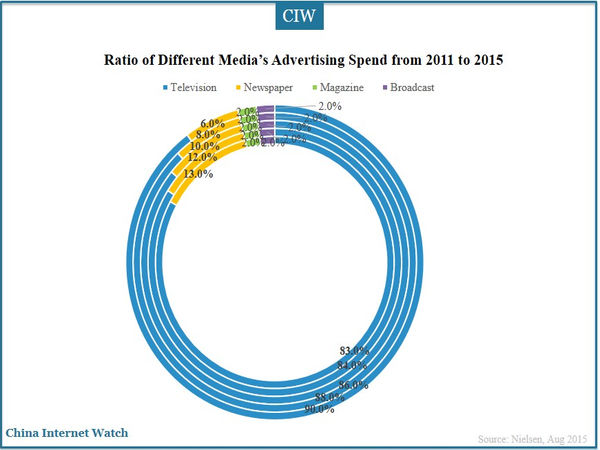

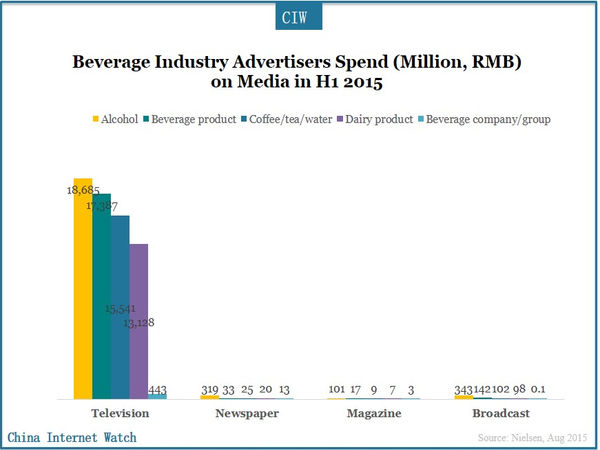

From different media types, magazine and broadcast advertising spends accounted for a relatively stable ratio. Newspaper advertising spends reduced slightly while TV advertising spends rose slightly. Television advertising still held an absolute leading position in the national advertising market.

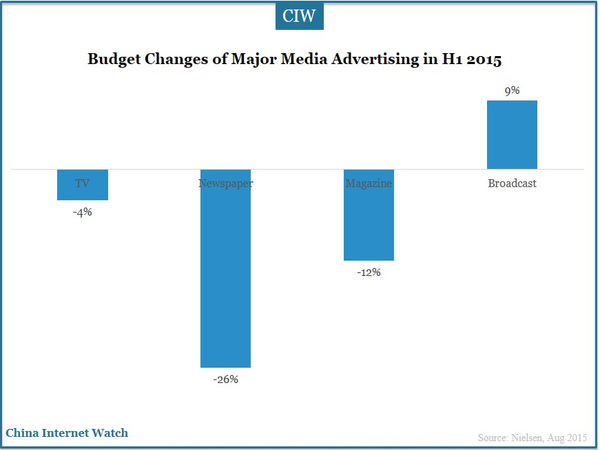

In H1 2015, the ratio of TV advertising decreased by 4% compared with the same period last year while radio advertising increased by 9% year over year. Influenced by the popularization of online advertising and mobile advertising, spend on print media advertising continued to show negative growth; and newspaper media advertising spends dropped to 26%.

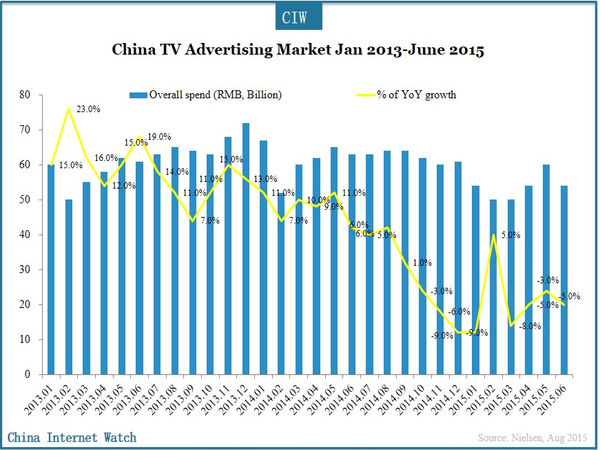

TV advertising market in China in 2013 showed a growing trend, with a significant growth in the first half but slowed growth in the second half. In 2014, the slow growth trend continued. In H1 2015, China TV advertising market showed a decreasing trend apart from a slight increase in February 2015.

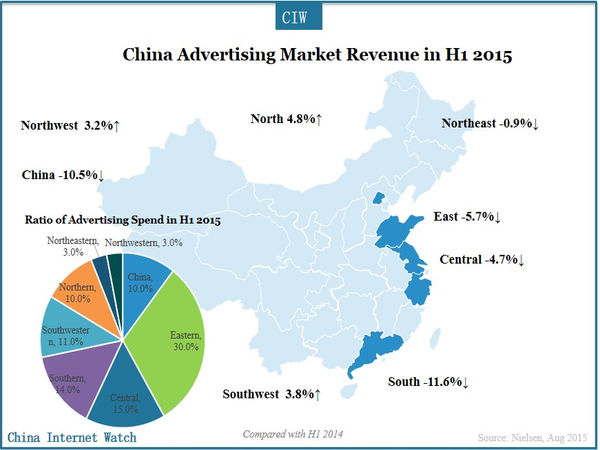

In H1 2015, the profit of China regional advertising market continued to grow; but overall revenue of domestic media decreased dramatically, an 10.5% decrease compared to last year.

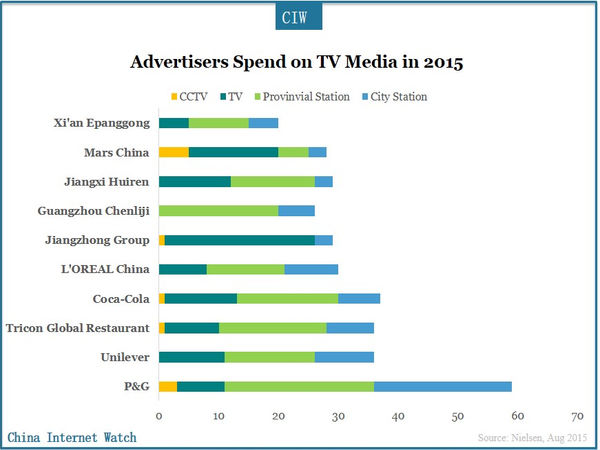

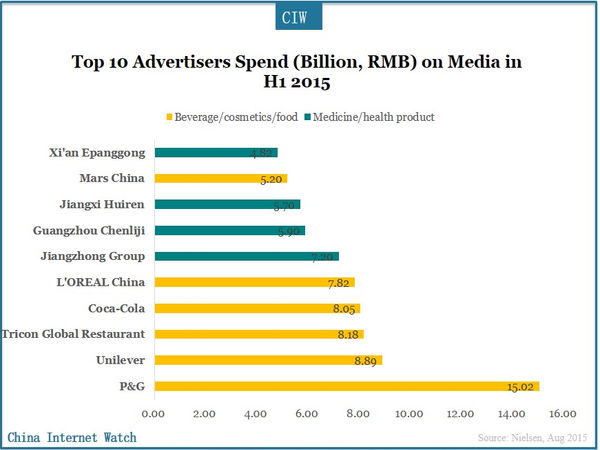

In the key television media advertising market, Procter & Gamble and Unilever reduced their spend on all levels of television advertising while the Jiangzhong Group, Guangzhou Chenliji Pharmaceutical and Jiangxi Huiren Pharmaceutical kept a substantial increase on TV advertising. The increase of Xi’an Epanggong Pharmaceutical spend on CCTV and local sateliite TV were more than 100%.

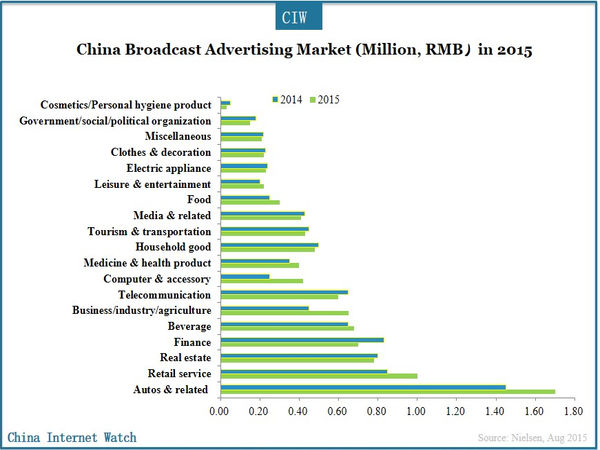

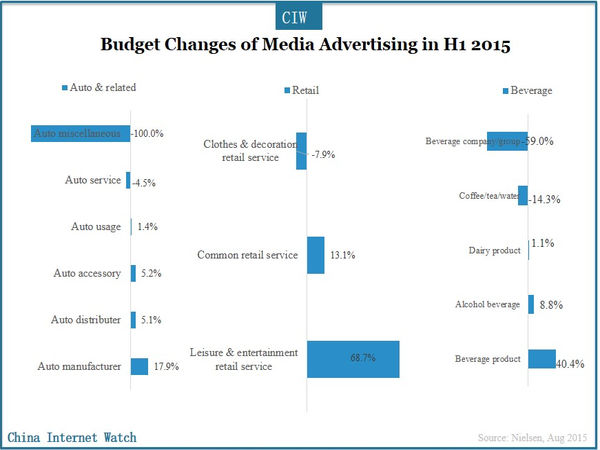

In China broadcast media market in H1 2015, the automotive and related products industry maintained rapid growth which led the market. Computers and accessories, media, and business/industrial/ agriculture market grew rapidly compared with the same period last year.

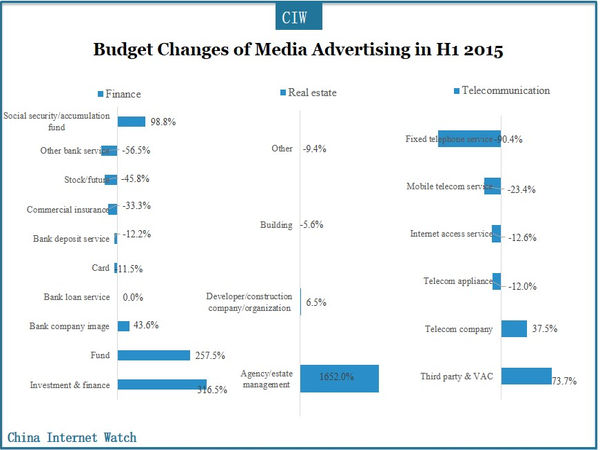

In sub-categories, real estate, fund, investment, wealth management, and funds market grew rapidly; and some third-party and value-added services, entertainment, and retail services advertising grew more than 50% YoY.

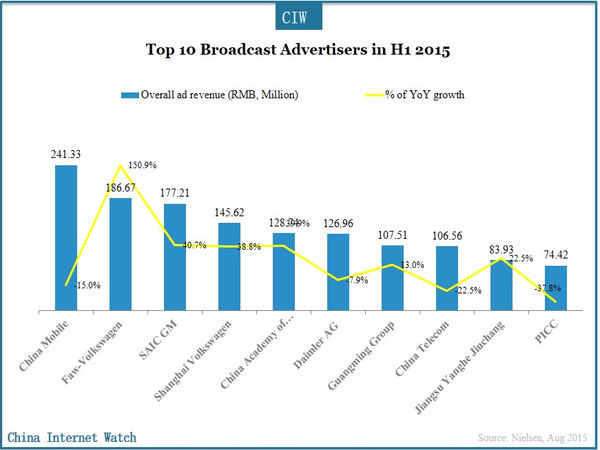

Among the top ten advertisers in H1 2015, most of them were in the automotive and related products industry, which still maintained a rapid growth trend. Furthermore, the top advertiser China Mobile lowered the advertising spends. China Telecom also had a certain level of decline in advertising spends, which might be a strategic plan of the companies.

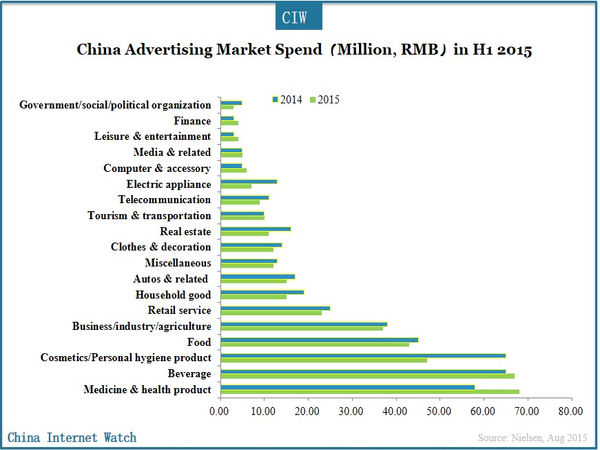

In H1 2015, medicines, F&B, and cosmetics industries continued their growth.

Many advertisers among top ten were from the FMCG industry. After P & G continuing to lower its advertising spend, other FMCG advertisers such as Unilever and L’Oreal also reduced the ad spend. Pharmaceutical industry advertisers increased spends on advertising compared with advertisers in other industries.

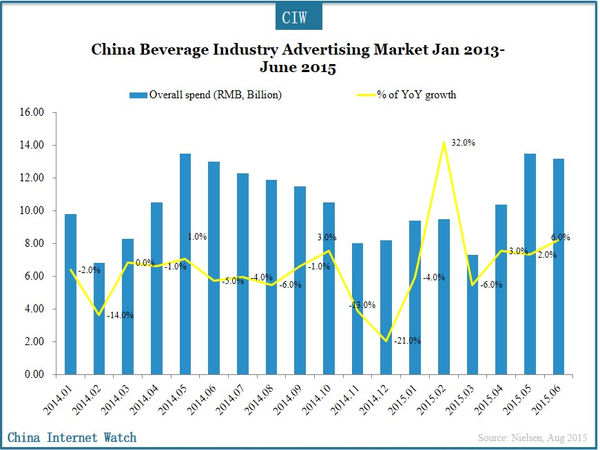

Beverage market advertisers continued to increase ad spend; especially in February Chinese New Year with 32% increase.

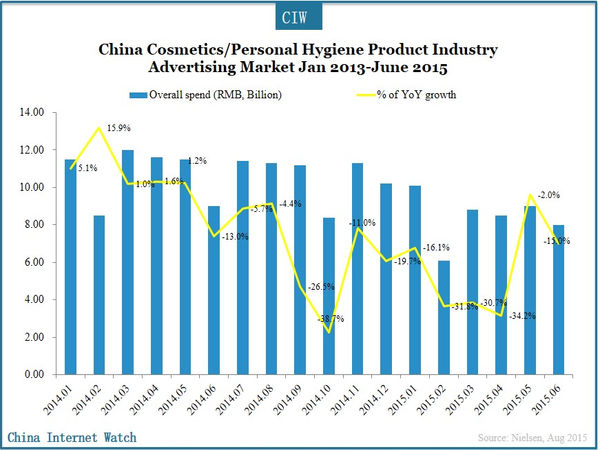

China’s cosmetics industry advertising market in 2014 overall showed a decreasing trend, and the advertising spends in the first half of 2015 continued to drop.

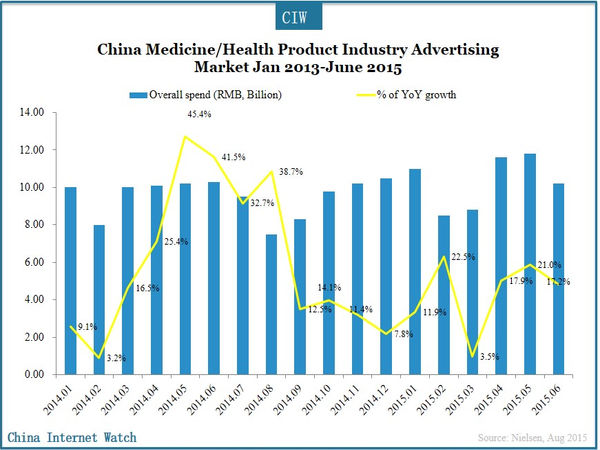

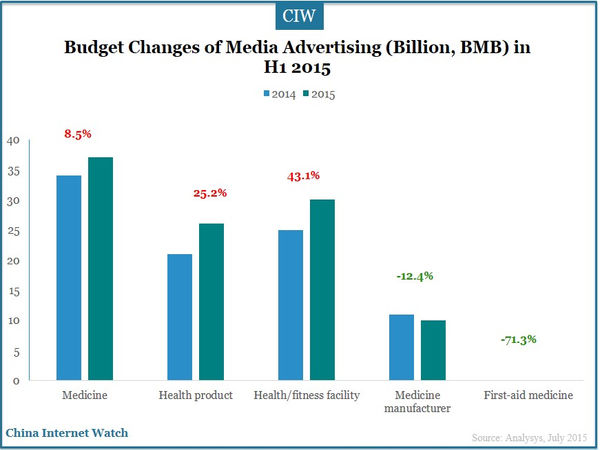

In pharmaceutical and healthcare products industry, health and fitness equipment, healthy food and beverage advertising market developed rapidly, which continued the growth in H1 2015 from 2014.

In H1 2015, the television media were still an important channel for advertising spend.

In H1 2015, advertising spend of the pharmaceutical industry ranked first in each sub-categories and maintained a relatively rapid growth; and healthy food/beverage and health / fitness facility also had a significant growth YoY. Medicine manufacturer and first-aid medicine with relatively small investment in advertising declined dramatically YoY.