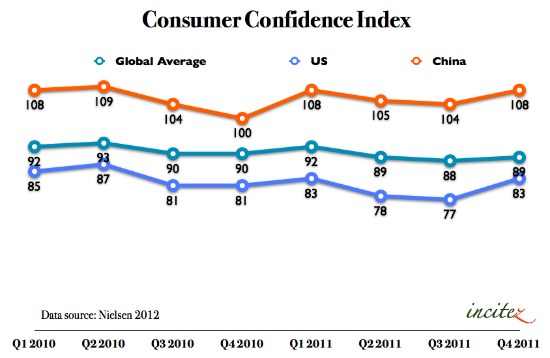

After Chinese confidence levels fell to 104 and 105 index points in Q2 and Q3, Chinese consumer confidence in Q4 returned to Q1 levels, ranked the sixth most optimistic country last quarter, according to Nielsen’s China Consumer Confidence Report.

China and the U.S. posted two of the strongest gains of 108 and 83 points respectively, while 60 percent of global markets measured posted confidence declines. Year-on-year, Chinese consumers spent more on out of home entertainment (+8), new technology purchases (+5), clothes (+5), dining out (+4) and vacations (+4) according to Nielsen.

At the end of last year, Chinese consumers topped global rankings for discretionary spend on out-of-home entertainment, technology spend and investing in the stock market and were the second biggest discretionary spenders on new clothes (after Russian consumers).

Rural consumers in China remained the most optimistic region with a four index point confidence gain 110 to 114, its highest level in the last three quarters and six points above the national average of 108. Consumer in rural areas enjoyed the highest confidence on employment (89%) and income (73%) prospects followed by consumers in lower tier cities.

Consumers in tier one were the most willing to spend (44%) compared to 33% a year ago, followed by consumers in tier two (43%).

Income, health and increasing food prices to be the top concerns for Chinese consumers nationwide. Differences in concerns prevailed across tier cities and rural areas. Income (72%) was the main concern for rural consumers, followed by health (32%) while in tiers 1 to 4 cities, consumers maintained similar concern levels for income and health.

According to Nielsen, total fast moving consumer goods (FMCG) sales for 2010 increased by 17 percent year-on-year, with non food FMCG sales accelerating at a faster pace than food sales. Other foods (mainly edible oil +24%), Personal Care (+23%) and Impulse Foods (19%) showed growth in 2011. FMCG sales increased 19 percent year on year in the latest quarter.