iResearch released a report on Chinese electronic payment users in 2015, which shows data of China e-payment and its users.

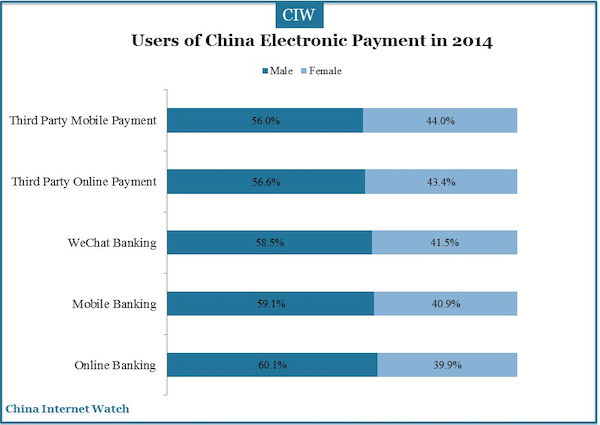

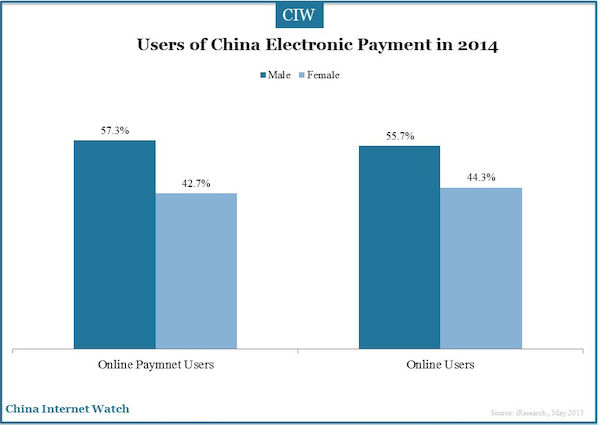

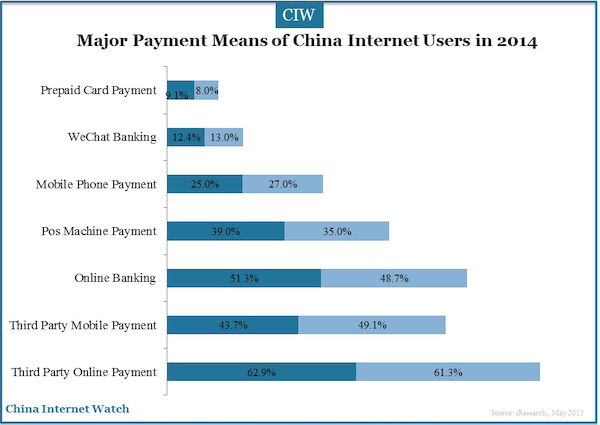

In 2014, male users of China e-payment account for up to 57.3%, while female users only account for 42.7%. The male ratio of online banking, mobile banking and WeChat banking account for more than half of the overall male proportion of electronic payments. While in the third-party online payment, third-party mobile payment, POS machine payments and prepaid cards payment, the ratio of female users is relatively high.

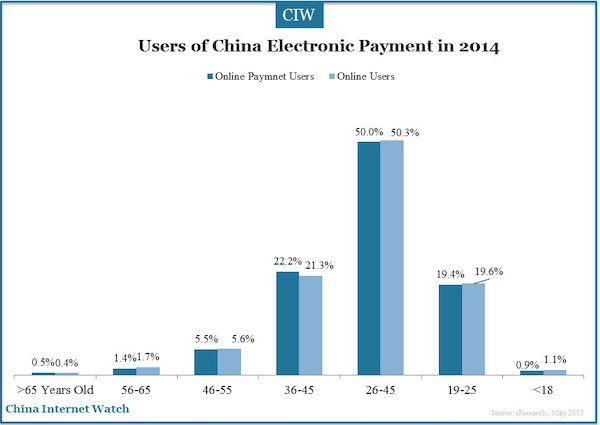

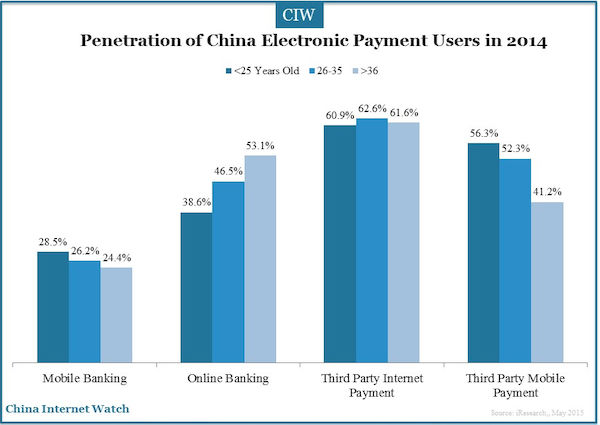

The ratios of China e-payment users and overall internet users are basically the same by ages. Users from 26 to 35 years old are the biggest age group, accounting for 50%. The penetration rate of online banking users increases with higher age groups; users above 36 years old are the biggest age group. At present, the penetration rate of mobile payment is higher, while in the future the situation may change.

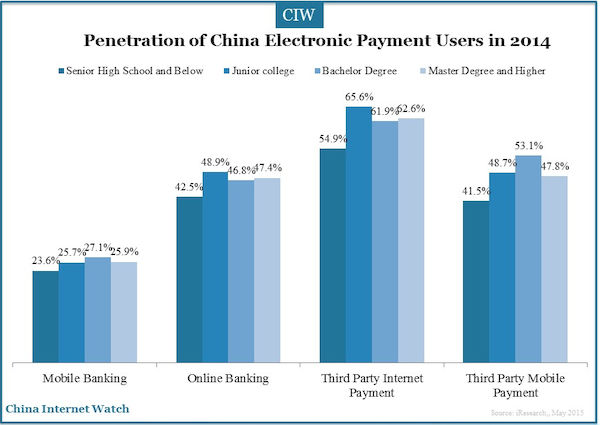

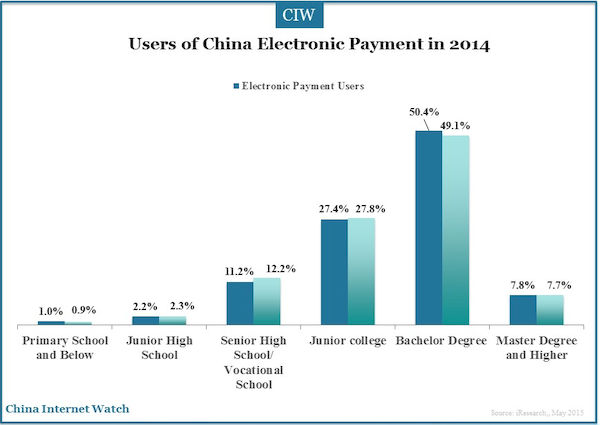

The ratios of China e-payment users and overall internet users are basically the same by education background. While the ratio of penetration tends to be higher among users with higher education background.

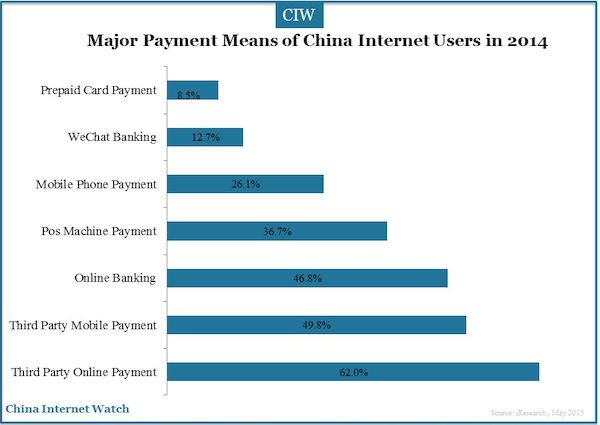

According to iResearch, male users of China’s electronic payment prefer to use electronic banking channels (online banking, mobile banking and WeChat banking), while Chinese women are more likely to use tools offered by third-party payments. In 2014, users of third-party internet payment account for over 60% of the overall payment users, then third-party mobile payment and online banking follow, with each accounting for about 50%.

Male users prefer electronic payment instruments offered by banks such as online banking (5.4% higher than female), mobile banking (relatively 2.0% higher than the female). While female users relatively prefer payment channels offered by third-party payments, such as third party internet payments (relatively 1.6% higher than the male), third-party mobile payments (2.6% higher than male).

iResearch believes that the reason the third-party payment and online banking users are more than POS machine payment users is that, electronic payment channels have less connections with the development level of local areas, the popularity of smart clients, and the internet also makes the payment of internet users migrate with electronic channels.

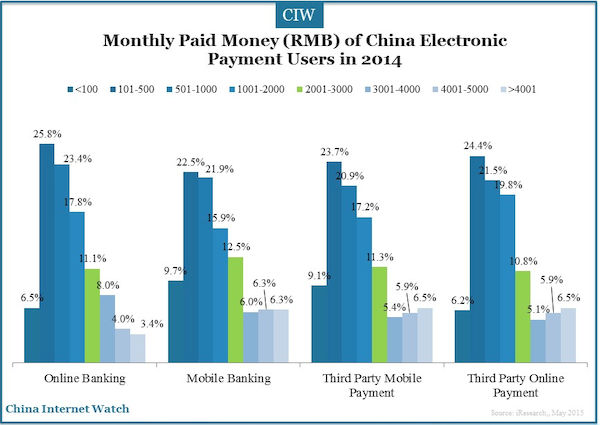

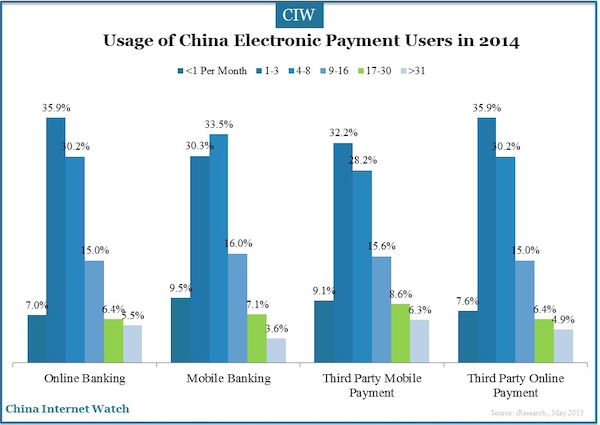

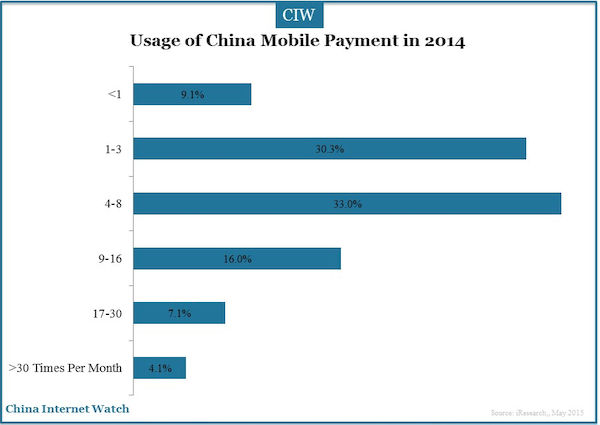

Users use a third-party payment gateways once or twice a week, and spend about 500 yuan per month. The average consumption is about RMB 100.

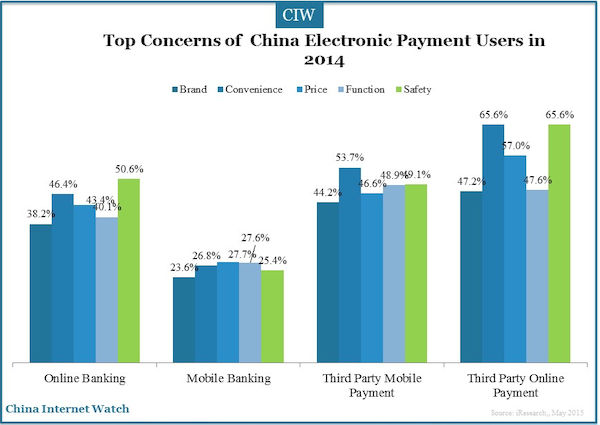

Several factors affect users acceptance of online payment, which are the brand of the company, security level, convenience level, price, and function. High security is the key factor users consider when they make payments online.

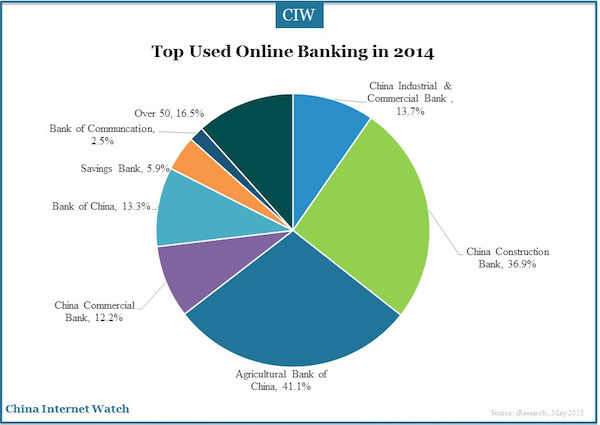

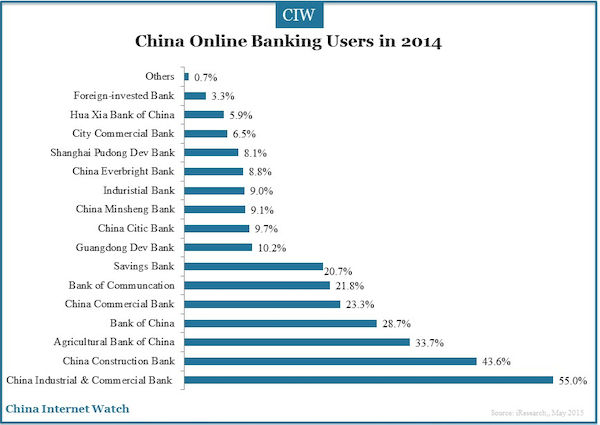

In 2014, China online banking users prefer to use online banking on ICBC, and over 50% of users have used China Construction Bank, Agricultural Bank of China and other five banks. The top several online banking users use more often is ICBC (25.6%), China Construction Bank (17.5%) and Agricultural Bank of China (11.4%).

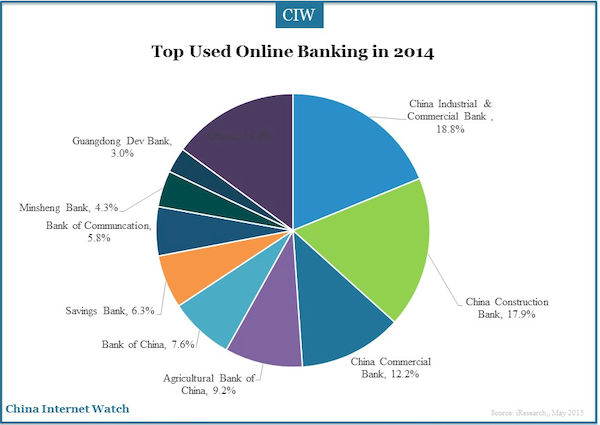

Mobile payment products are more diversified compared with online banking. China mobile banking users prefer to use online banking on ICBC (41.0%), and China Construction Bank (38.9%). The top several online banking that users use more often are ICBC (18.8%), China Construction Bank (17.9%) and Commercial Bank of China (12.2%).

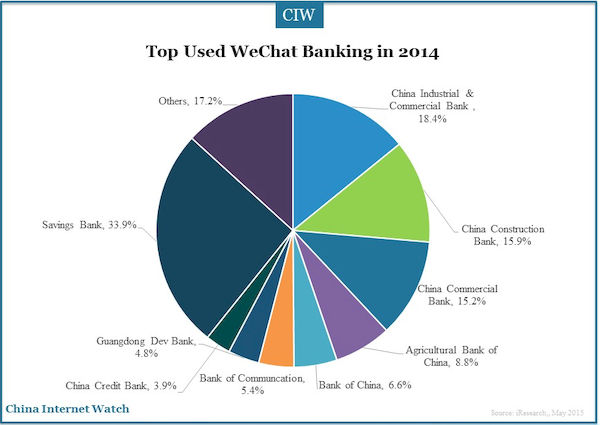

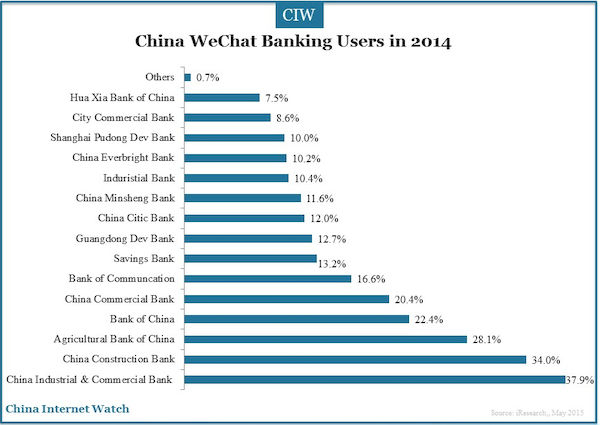

Apart from these common payment means, internet users also make payment through WeChat banking. China WeChat banking users prefer to use WeChat banking on ICBC (37.9%), China Construction Bank (34%) and China Commercial Bank (28.1%). The top several WeChat banking that users use more often is ICBC (18.4%), China Construction Bank (15.9%) and Commercial Bank of China (15.2%).

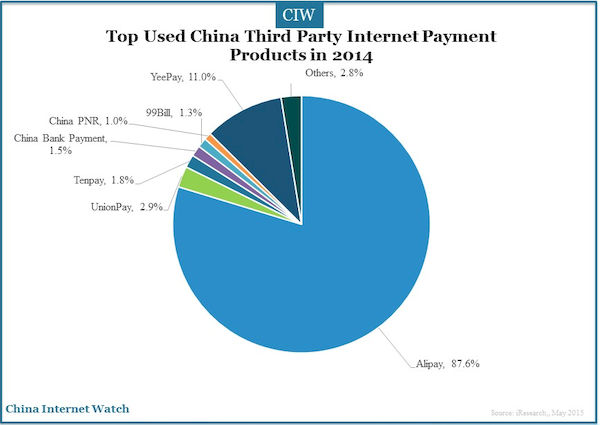

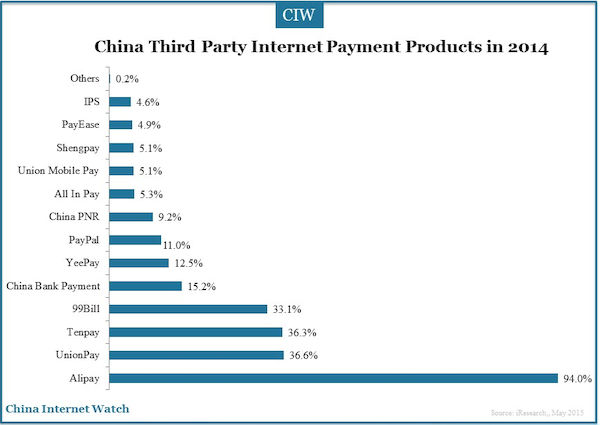

In 2014, China third party internet payment users use Alipay most frequently, with a usage of 94%, followed by China UnionPay (CUP) online (36.6%), Tenpay (36.3%) and 99Bill (33.1%). 87.6% of the users choose Alipay as the most preferred third-party internet payment product; and CUP online ranks second with only 2.9%.

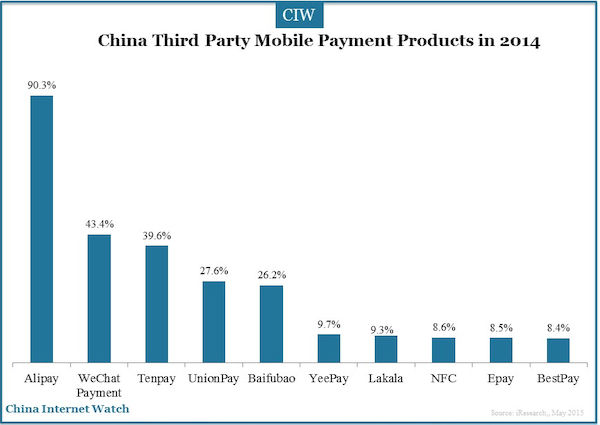

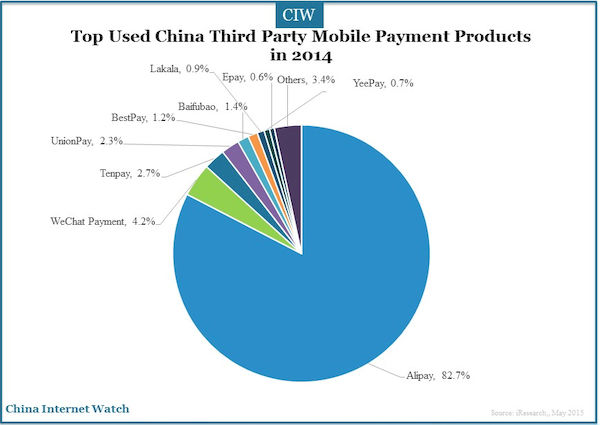

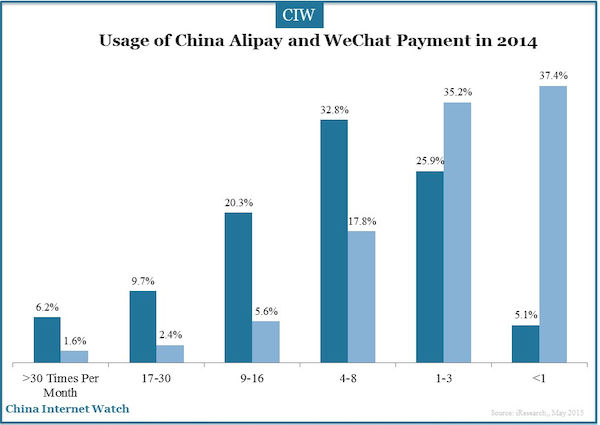

In 2014, people use Alipay more often than WeChat payment. Most WeChat payment users are new to it, and many of them are used to pay by Aipay. While Tencent still has a chance to have a promising future on the mobile payment market with its huge QQ and WeChat user base.

Also read: China Advertising Insights 2015