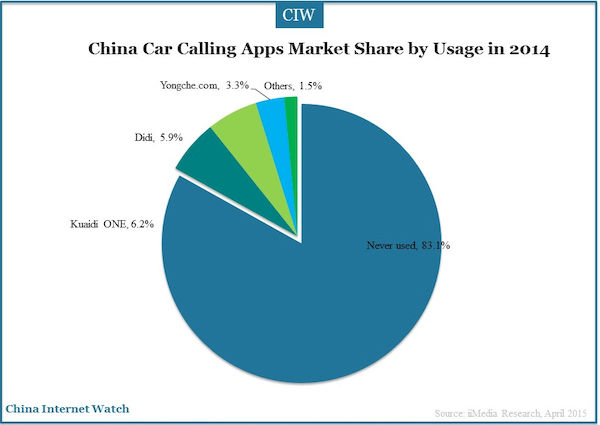

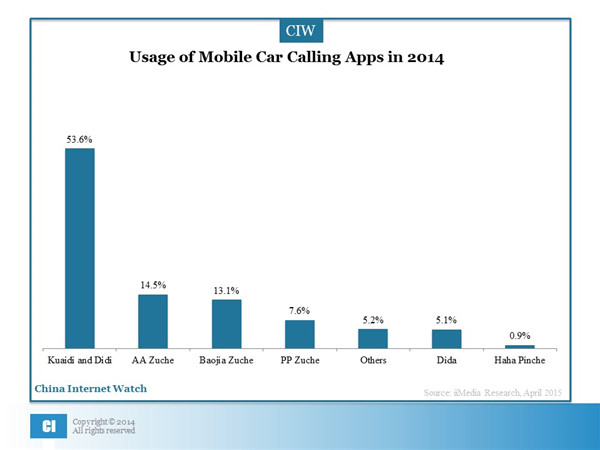

Kuaidi and Didi mobile car calling apps still rank first in China’s car calling market by usage rate according to iiMedia Research. Carpooling will become the next focus of competitions in China’s car calling market.

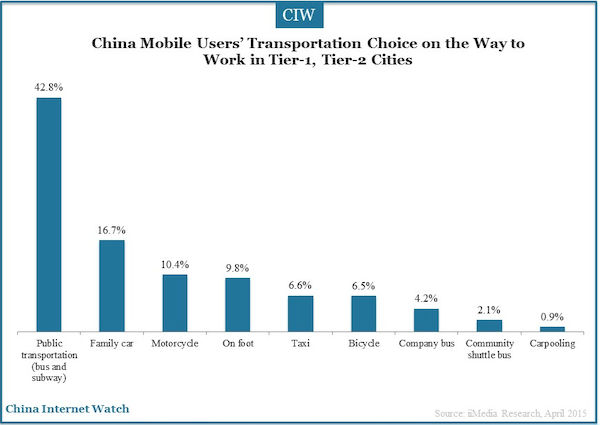

Public transportation is primary transportation in China’s first-tier and second-tier cities when mobile phone users go to work, which accounts for 42.8%. Public transportation system in first and second-tier cities is more sophisticated and less expensive, thus it is the main means to go to work among most mobile phone users.

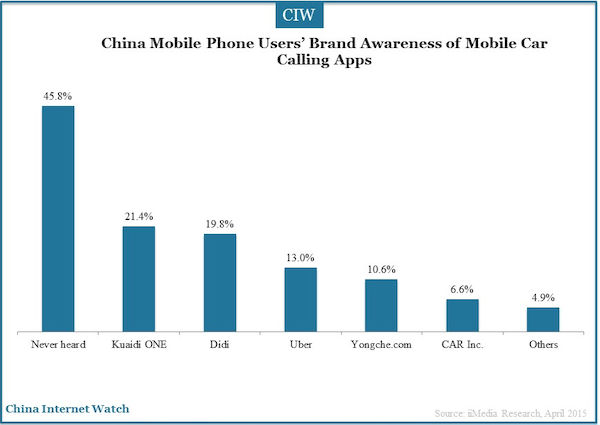

Brand awareness of Kuaidi ONE and Didi cars lead the market, but China’s mobile phone users’ overall awareness of the car calling mobile commerce has room for improvement. Uber ranks next to Kuaidi and Didi, accounting for 13.0%.

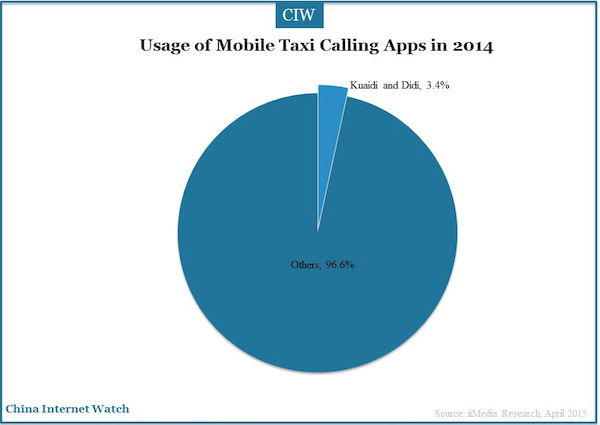

Nearly 20% Chinese mobile phone users surveyed used car calling mobile business app, and we can see that mobile car calling market has been developing gradually. China mobile car calling market began to detonate from the second half of 2014, and developed quickly driven by the capital. Under the background of car-purchasing restriction policy of some second and third-tier cities, China mobile car calling market prospect remains good.

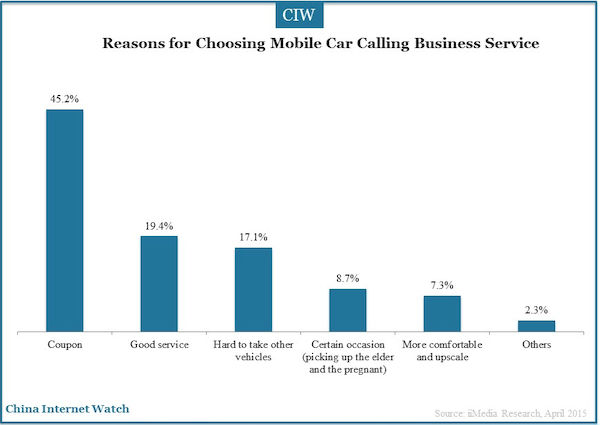

45.2% of Chinese mobile phone users used mobile car calling service after receiving promotion offers; and this proportion is far higher than other factors. Now the mobile car calling market is in the early development. Using marketing activities to gain a large number of new users has become a main tactic among car calling app companies.

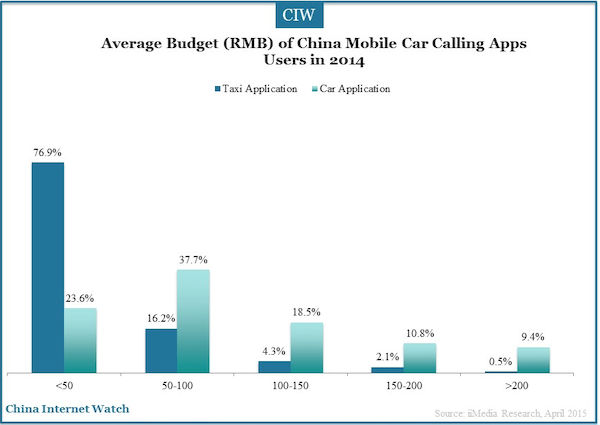

In 2014, the budget of 76.9% of Chinese taxi calling app users is under 50 yuan per trip while the budget of 37.7% of car calling applications users is between 50 to 100 yuan. .

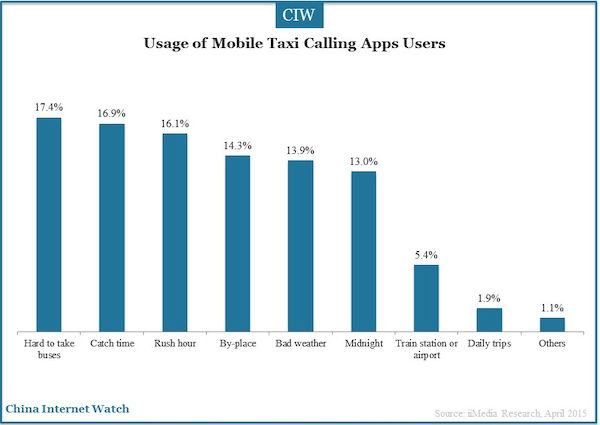

Users’ application usage scenarios distribution is relatively balanced. Taxi applications are a kind of high-frequency and broad-coverage applications, with a strong adhesive feature; once able to live with local travel information and users’ data, it will become the main way of O2O marketing in the future.

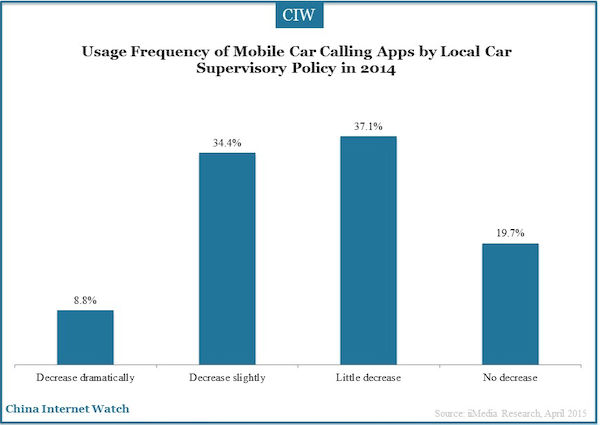

Although 37.1% users who used the mobile car application understood that the government took appropriate regulatory governance policies for mobile car market, the usage frequency has not changed much; 34.4% usage frequency decreased slightly. But overall, the appropriate government regulation of car calling mobile apps had little impact on the users’ intention to keep using this type of apps.

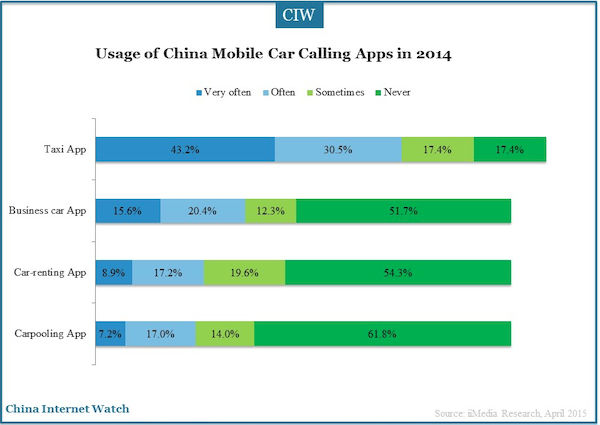

At the end of 2014, taxi calling apps were the used most frequently, accounting for 43.2%; and 30.5% used them often. The usage of business car calling apps increased slightly, accounting for 15.6%.

In 2015, taxi calling, private car calling, carpooling, car sharing and other sharing models will accumulate a large number of passengers’ locations, transport routes, usage time and other data on those mobile platforms. These data could go through deep integration with local life services after collated and excavated, and could form a marketing system with passenger routes.

After taxi and car, carpooling will be the next main battlefield of car calling applications. Although some of the participants entered the market, the market potential has not been fully tapped. After the merge of Kuaidi and Didi, they can expand their business lines and integrate existing resources. The carpooling market trends to bring into another wave of marketing craze in the next period.

Also read: Baidu’s Global Market Share Decreased to 7.52% in June 2015