With the booming of the new emerging market, automobile has become less expensive, and the internet has brought an open platform which makes it more reachable to families. China Automotive Technology Research Center estimated last year that automobile sales volume will reach 25.5 million in 2015 and 35 million in 2020 with average annual growth rate of 7%.

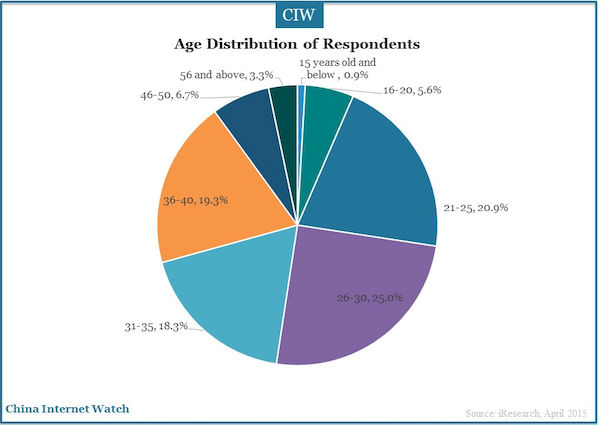

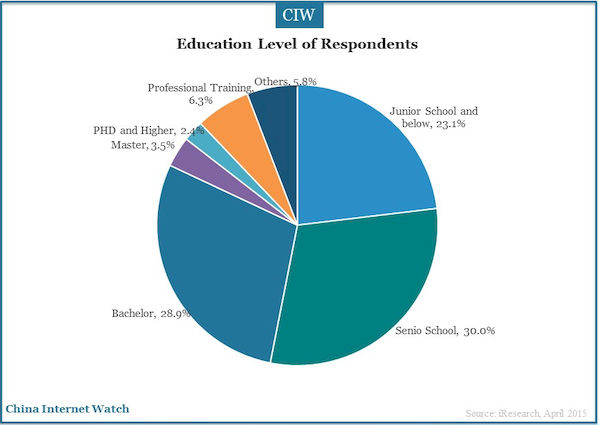

Tencent made a research on China’s automobile consumption after surveying 33,729 internet users, 83.5% of which are between 21 to 45 years old, 30% with high school degree, 34.8% with a bachelor degree or higher. The survey was made across over 20 provinces in all levels of city tiers.

According to the research, the number of car-owners in the second or third tier cities have similar purchase intentions as that in the first-tier cities; about 30% users plan to become car-owners in one year, especially in second and third tier cities. There is still a large potentially bigger automobile market in China.

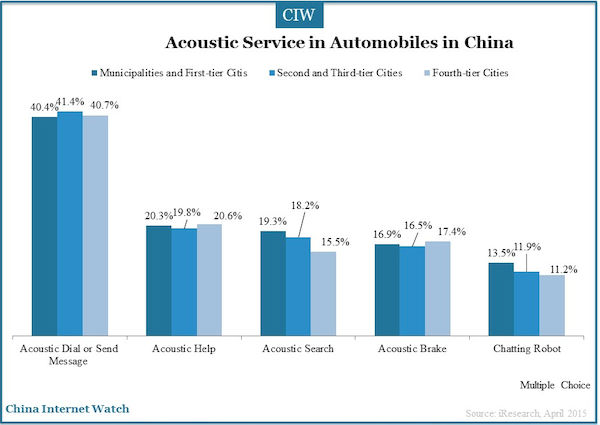

Convenient technical functions of automobiles are one of the several key factors that influence people’s purchase intention in China. There are several functions that automobiles may equip, interacting with smartphones, wonderful social network experience, navigation system, voice-ond so on.

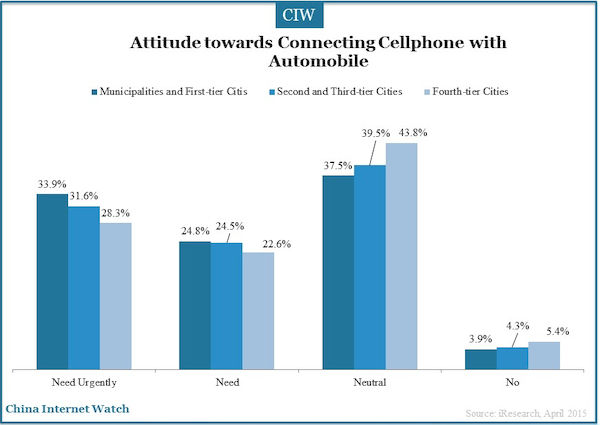

Most automobiles are not equipped with attractive interactivities with mobile phones although 58% car owners receive one to three calls when driving every day; even about 20% owners have four to six calls when driving. 95% internet users surveyed are open towards interactivities connectivity with mobile phones; and only 5% don’t need it at all.

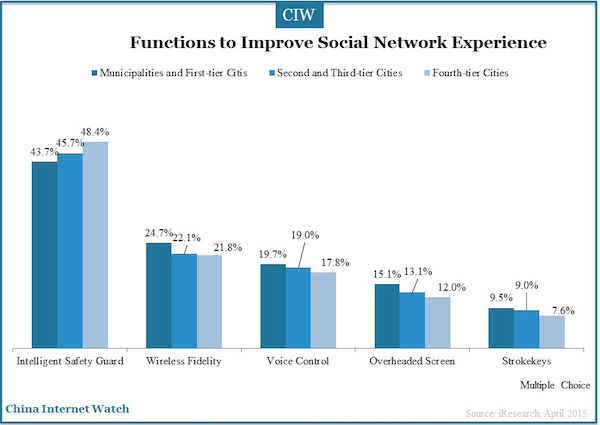

Some research shows that using mobile phones while driving may make drivers respond slower which may cause accidents. 40% users surveyed wish to enhance social network experience by improving intelligent safety. And many users require Wi-Fi equipped within the car, which is convenient for people to use navigation, receive payment if using Uber or Didi, a car calling app in China, or search for the road traffic with WeChat Traffic…

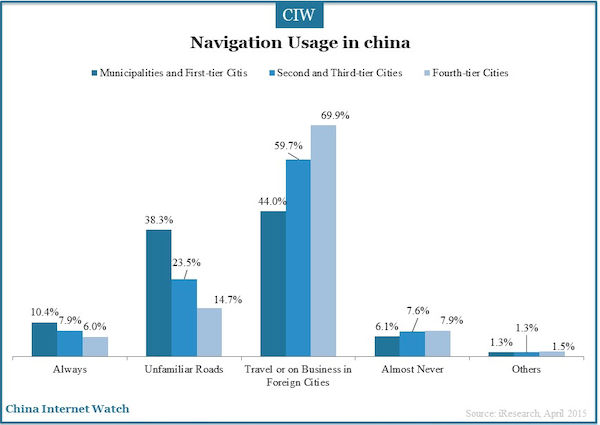

The navigation system is a necessary and important device inside the cars; nearly 70% users need navigation, especially during travel or on business trip in other strange cities. When using the navigation, users may find that it may locate inaccurately, waste power, show no road traffic, too many voice messages and sometimes can’t update in time. Solutions need to deal with those problems, where improving network experience may help in some means.

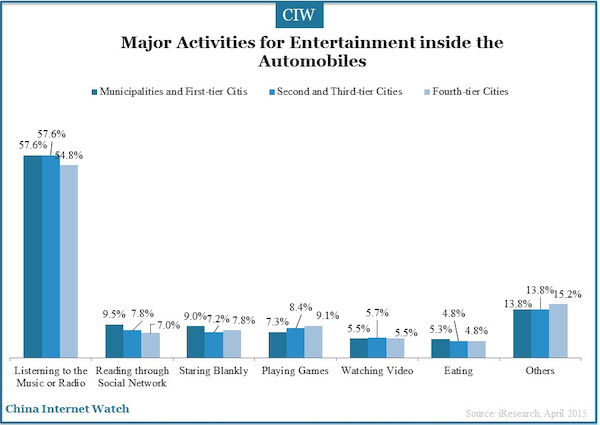

More than half of car owners like listening to the music or radio inside the cars; many are loyal listeners of some internet radio programs.

Other high-end functions, such as auto-braking, pneumatic suspension, self-adoptive cruising, supplemental steering, night-vision and so on, which help with safety, are expected according to the research. Driverless cars are also talked about, only 4% users know nothing about it; most people approved it is useful while the safety can’t be guaranteed.

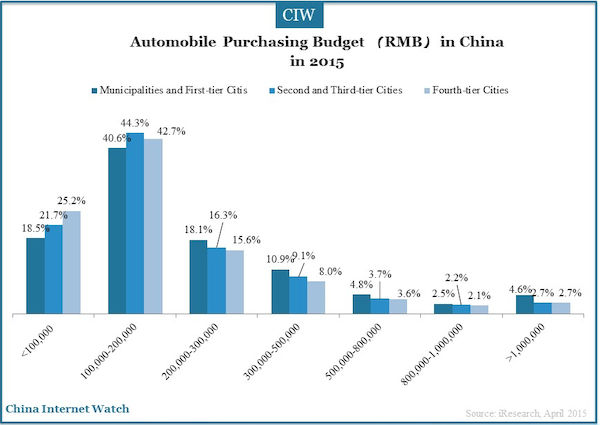

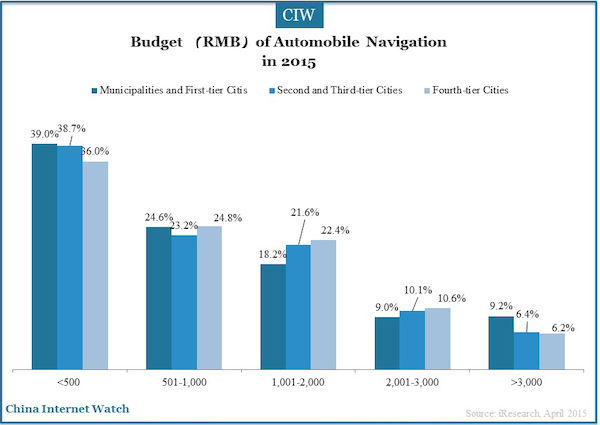

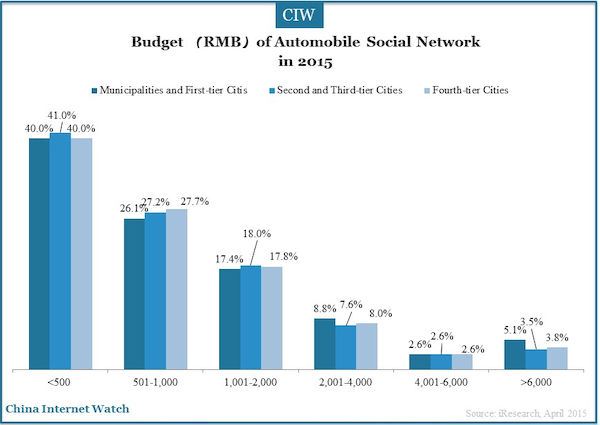

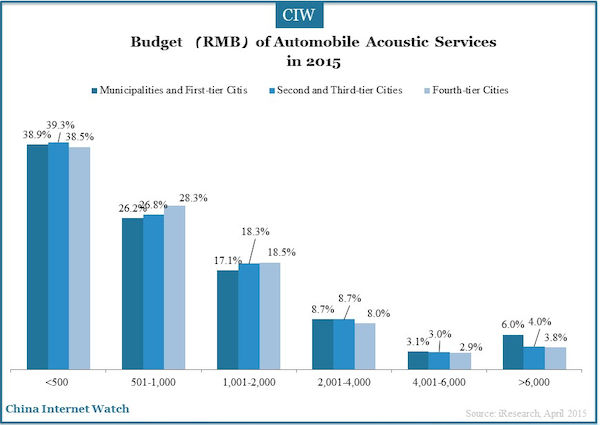

Automobile users in China’s first-, second- and third-tier, fourth-tier and county level cities almost have the same budget level for purchasing automobile devices.

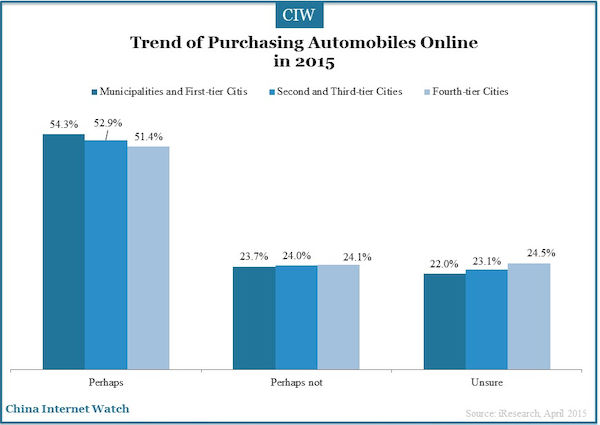

Over half of the respondents would consider purchasing cars online; about 60% prefer purchasing online if they can enjoy a lower price than in stores.

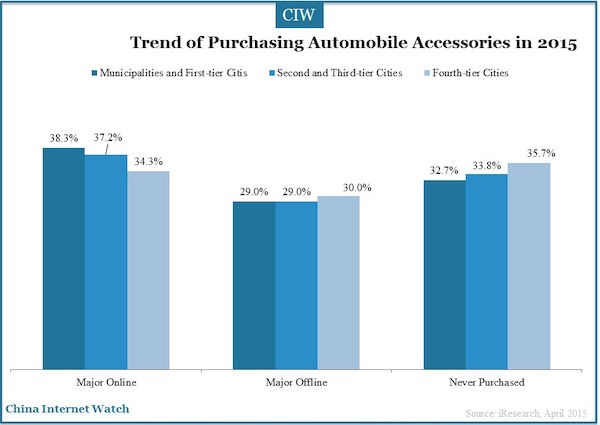

People who purchase automobile accessories online are higher than those who purchase offline. The trend may be more obvious in the future.

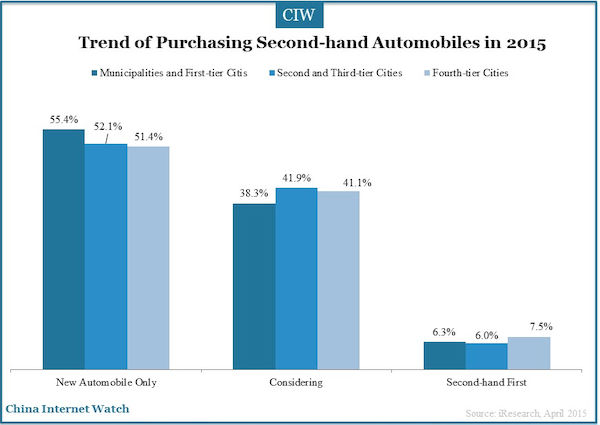

When purchasing cars, 40% users say they may consider purchasing new ones and second-hand ones at the same time; less than 10% users will give a priority to second-hand ones. Second-hand automobile market lacks mutual trust between buyers and sellers. 48.2% would choose to buy cars from acquaintances; and 59.3% respondents are afraid of facing undisclosed poor conditions of cars when they buy second-hand cars.

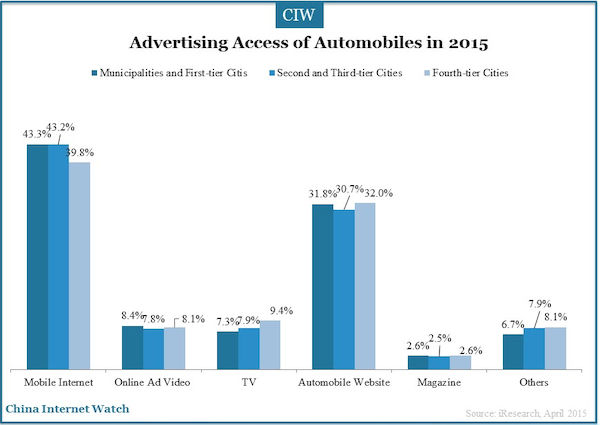

43.3% users obtain automobile information from the mobile internet; automobile vertical websites rank next important information channel. The internet becomes the major sources of automobile information.

Also read: Chinese Luxury Traveler Insights 2015