China Internet Stats, Trends, Insights

CIW »

About Social Media in China

Chinese social media landscape is very unique as compared with the rest of the world. Most of the world’s popular social media platforms, such as Facebook, Instagram, Twitter, Snap, can’t be accessed except LinkedIn.

Top Chinese Social Media Sites & Apps

The top trending Chinese social platforms in China are WeChat, Weibo, Xiaohongshu, Zhihu, Baidu Tieba (Post Bar), and TikTok (Douyin).

The most popular social media platforms by marketers and advertisers are WeChat, Weibo, and Douyin.

In fact, a good number of sites and mobile apps are integrated with social and networking features including e-commerce platforms like Taobao, online video platforms, and news apps such as Toutiao.

Tencent’s Social Media Apps

WeChat, an all-in-one mobile app with social media and networking features in Chats, WeChat Moments (networking), and WeChat Groups, is the largest social media in China. It started as an instant messenger and now includes multiple features such as social networking, payment, gaming, and content network.

QQ also started as a messenger, previously called OICQ, and is now integrated with social networking features as well. It is very popular among Generation Z in China.

Qzone is a social networking website, born as an extension on QQ platform, which was also created by Tencent in 2005. It allows users to write blogs, keep diaries, send photos, listen to music, and watch videos.

Other Top Social Media Apps

Weibo started like China’s Twitter and now it is very different. It remains a top social media platform in China. This is where the breaking news often surfaces. There were several players in Weibo market including Sina, Tencent, Netease, and Sohu; but, now just one.

TikTok, or Douyin, the leading short video platform owned by ByteDance, is also on top of marketers’ list in China for social media marketing. Its key competitor is Kwai (Kuaishou).

WeChat, Weibo, and TikTok are on many Chinese marketers’ top 3 list.

Zhihu, known as a community Q&A website or China’s Quora, was launched on January 26, 2011. Zhihu users are relatively more educated with higher incomes, comparing with other Q&A websites such as Baidu Zhidao.

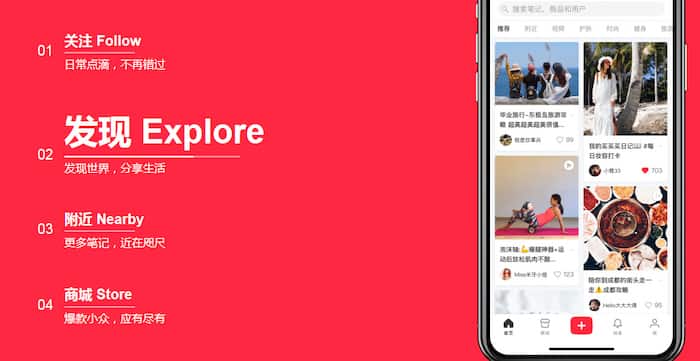

Xiaohongshu, a.k.a. RED, was created in 2013 as a social media and e-commerce platform. A large portion of its users are Generation Z. Its app allows users and influencers to post and share product reviews, travel blogs and lifestyle stories via short videos and photos.

You will find articles below on China’s social media landscape, usage, trends, statistics, and marketing insights.

Momo, founded in March 2011, is a free location-based online dating and social networking platform for smartphones; it’s popular for making friends with nearby strangers. And, it was well known as a tool for getting laid with strangers.

Tantan, another popular mobile dating app or China’s Tinder, has been acquired by Momo.

Transformation of China’s Social Media Platforms

China’s social media scene originated with the founding of the first online forum Shuguang (10qf.com) in 1994 and rose to prominence with the explosive growth of Sina Weibo users in 2012. Social media in China thrives today with a steady turnover rate of various forms of deep vertical or light entertainment platforms.

As older forms of social media fade out of view, new online media platforms begin to take the stage. Online video, music, and gaming have become the forms of social media with the most visible growth momentum in China today.

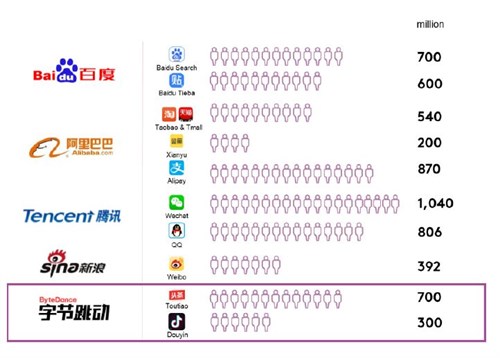

The traditionally BATS-led market (abbreviated from Baidu, Alibaba, Tencent, Sina –four of China’s largest social networks) has been shaken up by ByteDance, with its Direct Push technology (sending interest-based content to users) supported by algorithms and machine learning. The technology has achieved quick penetration, with short video platform Douyin (Tik Tok) and headline news platform Toutiao quickly gaining popularity.

ByteDance’s model of “interest-based information streams” completely subverts the model of “using a search engine to find content” adopted by users during the web page era. In the process, when content is recommended to users, some previously undefined needs can be discovered.

Under the information stream model, users have a higher tolerance for ads, and Toutiao earned 6 billion yuan from its advertising business in 2016, and revenue soared to 15 billion yuan in 2017.

Although ByteDance has attracted wide attention, the market share of traditional giants such as Tencent should not be overlooked, especially WeChat and QQ, the instant messaging platforms they represent.

Dual-layer Social Media Ecosystem

Chinese social media today have evolved from its previous functionally oriented structure in the old landscape. The new “ecosystem” is based on user relationships and how platform content is generated. With regards to these differences, social media platforms could be generally categorized into the core and derivative social media, forming a new dual-layer social media ecosystem.

Core social media: For strengthening interpersonal relationships by helping users to better understand other users, core social media supports users with two-way communication. Exchanges frequently cover life experiences or other personal information, carried out on online platforms for networking, exploring interests, instant messaging, and news feed.

Derivative social media: To help platforms maintain/increase user engagement, thus grow traffic. Derivative social media supports users to obtain more personalized information that is filtered by the platform so that they can make better, more informed decisions.

When using derivative social media, users are more inclined to use a one-way communication mode, that is, obtaining information from content producers, such as KOLs (Key Opinion Leaders), public media, and even recommendations given by the platform itself based on algorithms, so as to acquire information that better fits with the user’s interests.

In a broad sense, derivative social media can be categorized into four major segments: online games, multimedia entertainment, knowledge & information, and e-commerce.

The matrix of core and derivative social media platforms

1.2 Core social media platforms: WeChat and Weibo

WeChat has been integrated into Chinese people’s daily life and is reshaping online relationships for users of all ages. As Tencent’s flagship social media platform, WeChat has the largest number of users and has been fully integrated into people’s daily lives. In 2017, 88% of users said WeChat was their most used app. WeChat supports relationship building between people. It is reported that 33% of users over 60 spend more than 80% of their mobile data on WeChat.

Sina Weibo has supported video-enabled, vertical categories, and MCN (multi-channel network) communication, which has not only enhanced relationships between ordinary and professional users but also increased platform engagement.

Vertical category orientation refers to Weibo’s strategy to carefully cultivate content, aiming to build up ecosystems in vertical categories for traffic and monetization. In 55 categories, there are 25 KOLs with over 10 billion impressions per month across various fields. Weibo has invited KOLs from 1200 MCN to open 16,000 accounts.

1.3 Derivative Social Media Platforms: from Douyin to Zhihu

Multimedia entertainment: companion-style content becomes the major product serving the “boredom economy”

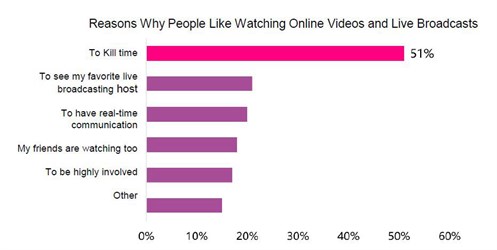

Video-based socializing satisfies the need of masses to kill time when feeling bored or lonely. According to the 41st report by CNNIC, the key reason why users like watching videos and live-streaming online is to kill time.

At the same time, these platforms generate social media posts, with users quickly sharing the content they consider interesting. Since this content comes from daily life and does not involve much thought, users generally do not sense the lapse of time during consumption.

In the meantime, users get satisfaction from “acquiring information” while enjoying the fun and recognition from “sharing information” with friends. Therefore, users quickly become addicted to these platforms.

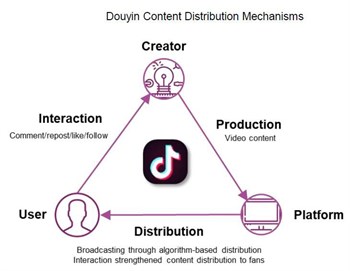

Douyin, for example, has built a content-based ecosystem and using algorithms to assist push messaging, it enables users with similar interests to expand their social networks via content sharing.